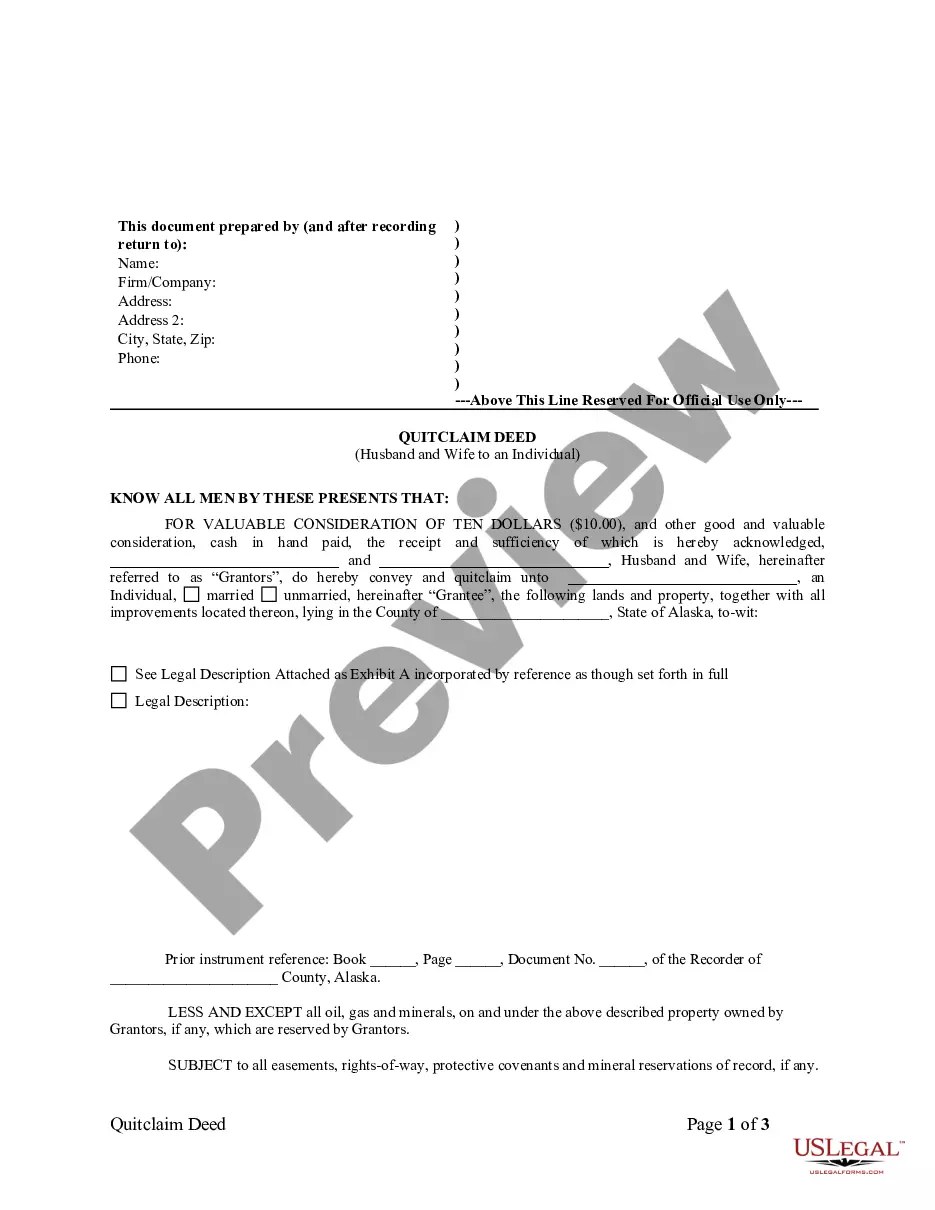

Texas Employee Payroll Records Checklist is a comprehensive document used by employers in Texas to ensure compliance with state regulations regarding payroll record keeping. It serves as a guideline for maintaining and organizing employee payroll records in a consistent and efficient manner. The checklist includes various requirements and vital information that must be documented accurately and retained for specific durations. The Texas Employee Payroll Records Checklist assists employers in meeting their responsibilities for record keeping, making it easier to track and manage payroll information. This checklist acts as a reference tool to ensure that all necessary documents are properly maintained and readily available for audits, inquiries, or other employment-related purposes. Some key components covered in the Texas Employee Payroll Records Checklist include: 1. Employee Information: — Full Nam— - Social Security Number (SSN) — Addres— - Date of Birth - Hire Date 2. Payroll Records: — Pay period start and end date— - Regular and overtime hours worked — Wages paid (hourly, salary, commission, etc.) — Bonuses, incentives, or any other additional compensation — Deductions (taxes, insurance, retirement contributions, etc.) — Net pay received 3. Time Records— - Clock-in and clock-out times — Break and meal periods 4. Earnings Statements: — Detailed pay stubs showing earnings and deductions — Year-to-date (YTD) totals for wages, taxes, etc. 5. Taxes and Withholding: — Federal Income Tax (FITwithholdingin— - Social Security and Medicare (FICA) taxes — State income tawithholdingin— - Local taxes (if applicable) 6. Benefits and Deductions: — Health insurance premium— - Retirement plan contributions — Flexible SpendinAccountFASAMASSASAs) or Health Savings Accounts (Has) — Wage garnishments or other court-ordered deductions 7. Leave and Time-Off Records: — Vacation, sick leave, or any other paid time off (PTO) — Family and Medical Leave Act (FMLA) documentation 8. Employment Contracts and Agreements: — Offer letter— - Employment contracts - Non-disclosure or non-compete agreements Different types of Texas Employee Payroll Records Checklists may exist depending on the nature and size of the business. Some industries might require additional information specific to their operations or have separate checklists for different categories of employees (full-time, part-time, independent contractors, etc.). It is crucial for employers to adapt the checklist and maintain records as per the relevant legal regulations and industry standards. By utilizing the Texas Employee Payroll Records Checklist, employers ensure compliance with Texas state laws and regulatory requirements. This thorough record keeping practice not only safeguards employers from potential legal issues but also helps in maintaining transparent communication and fostering positive employer-employee relationships.

Texas Employee Payroll Records Checklist

Description

How to fill out Texas Employee Payroll Records Checklist?

Finding the right legal papers format might be a have difficulties. Of course, there are a lot of web templates available on the Internet, but how do you obtain the legal develop you will need? Make use of the US Legal Forms web site. The assistance provides a large number of web templates, such as the Texas Employee Payroll Records Checklist, which can be used for organization and private requirements. Each of the kinds are examined by specialists and satisfy federal and state specifications.

If you are currently signed up, log in to your account and click the Download key to have the Texas Employee Payroll Records Checklist. Make use of your account to search through the legal kinds you might have purchased in the past. Proceed to the My Forms tab of your own account and obtain one more duplicate from the papers you will need.

If you are a new user of US Legal Forms, listed below are straightforward recommendations that you can comply with:

- Initially, make certain you have selected the appropriate develop for your area/area. You may look over the form making use of the Review key and look at the form explanation to make certain this is basically the right one for you.

- If the develop is not going to satisfy your needs, use the Seach discipline to find the appropriate develop.

- Once you are certain the form would work, click the Acquire now key to have the develop.

- Pick the pricing strategy you want and enter in the essential info. Build your account and pay for an order using your PayPal account or charge card.

- Select the submit formatting and obtain the legal papers format to your system.

- Full, modify and produce and signal the acquired Texas Employee Payroll Records Checklist.

US Legal Forms may be the greatest collection of legal kinds where you can discover various papers web templates. Make use of the service to obtain skillfully-made papers that comply with status specifications.

Form popularity

FAQ

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...

Generally, here are the documents you should include in each employee's payroll record:General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.

You're legally required to keep some employment records for 7 years, such as: employee details including information about pay, leave and hours of work. reimbursements of work-related expenses. workers compensation insurance for each employee.

Payroll records is a blanket term that applies to all documentation associated with paying employees, from hiring documents and direct deposit authorization forms to paystubs. This includes anything that documents total hours worked, their pay rate, tax deductions, employee benefits, etc.

Types of Employee RecordsBasic Information. This category includes personal information such as the employee's full name, social security number, address, and birth date.Hiring Documents.Job Performance and Development.Employment-Related Agreements.Compensation.Termination and Post-Employment Information.

Employers have to keep time and wages records for 7 years. Time and wages records have to be: readily accessible to a Fair Work Inspector (FWI) legible....Best practice tipWeekly time and wage records.Employment records - general employer and employee details.Rosters or Rosters.Timesheets.

Payroll records are the combined documents pertaining to payroll that businesses must maintain for each individual that they employ. This includes pay rates, total compensation, tax deductions, hours worked, benefit contributions and more.

What to Include in an Employee Files ChecklistJob description.Job application and/or resume.Job offer.IRS Form W-4.Receipt or signed acknowledgment of employee handbook.Performance evaluations.Forms relating to employee benefits.Forms providing emergency contacts.More items...?

Generally, here are the documents you should include in each employee's payroll record:General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.

Examples of items that should not be included in the personnel file are: Pre-employment records (with the exception of the application and resume) Monthly attendance transaction documents. Whistleblower complaints, notes generated from informal discrimination complaint investigations, Ombuds, or Campus Climate.