Texas is the second-largest state in the United States, known for its vast landscapes, diverse culture, and vibrant economy. As such, it attracts a multitude of businesses, investors, and individuals seeking opportunities. However, Texas's dynamic economy also means that it can be prone to bankruptcy cases and legal proceedings, such as Chapter 7 or 13 filings. One crucial aspect of these bankruptcy cases is the Texas List of Creditors Holding 20 Largest Secured Claims, which helps determine the distribution of assets to the creditors. The Texas List of Creditors Holding 20 Largest Secured Claims is a vital document that provides detailed information about the creditors with the largest claims on the debtor's assets. This list is typically not required for Chapter 7 or 13 bankruptcy cases, as the focus in those chapters is on the liquidation or repayment plans rather than secured claims. Form 4 is the specific form used for submitting the Texas List of Creditors Holding 20 Largest Secured Claims post-2005. It is crucial to accurately complete this form by providing the necessary information about the creditor's name, contact details, amount of secured claim, and the collateral securing the claim. In Texas, there might be different types of Texas List of Creditors Holding 20 Largest Secured Claims, depending on the nature of the bankruptcy case or the type of assets involved. These variations could include: 1. Real Estate Secured Claims: This type of secured claim arises when the creditor has a lien on the debtor's real estate property, such as a mortgage or home equity loan. The creditor's claim will be secured by the property itself and listed accordingly. 2. Vehicle Secured Claims: In cases where the debtor has secured a loan using a vehicle, such as a car or a recreational vehicle, the creditor will have a claim on that specific asset. These secured claims will be outlined in the Texas List of Creditors Holding 20 Largest Secured Claims. 3. Equipment or Machinery Secured Claims: Businesses often secure loans to purchase or lease equipment, machinery, or other assets necessary for their operations. If a debtor in Texas has such secured debts, they will be included in the List of Creditors Holding 20 Largest Secured Claims, indicating the creditor's claim on the equipment or machinery. 4. Other Personal Property Secured Claims: Debts secured by personal property, besides real estate, vehicles, or specific equipment, will fall under this category. It could include claims related to jewelry, electronics, or valuable assets securing the debt. The Texas List of Creditors Holding 20 Largest Secured Claims is an essential tool in bankruptcy cases, allowing the court, debtors, and creditors to determine the priority and value of secured claims. Accurately completing Form 4 post-2005 is crucial to ensure a fair and equitable distribution of the debtor's assets. It provides transparency regarding the creditors and their claims, fostering a structured process within the Texas bankruptcy system.

Texas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

How to fill out Texas List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

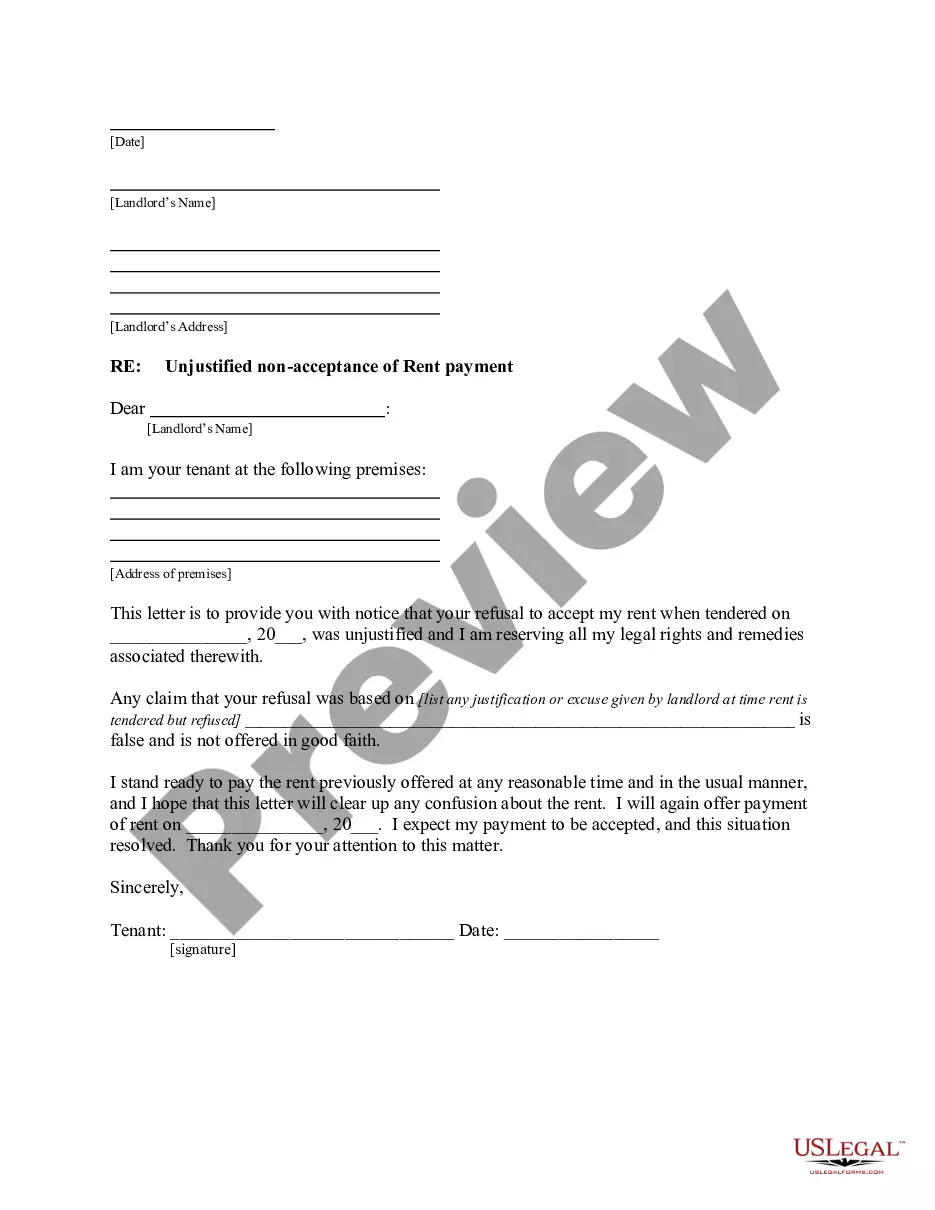

You can spend hours on-line looking for the legal papers template that meets the federal and state needs you require. US Legal Forms supplies a large number of legal varieties which are analyzed by experts. You can easily download or produce the Texas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 from my services.

If you already have a US Legal Forms profile, you are able to log in and then click the Download option. Following that, you are able to full, revise, produce, or indicator the Texas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005. Each legal papers template you get is yours eternally. To have another copy of the bought develop, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms internet site the very first time, adhere to the straightforward recommendations listed below:

- Initially, make certain you have selected the correct papers template for your state/metropolis that you pick. See the develop explanation to make sure you have picked the appropriate develop. If offered, use the Preview option to search throughout the papers template also.

- If you would like find another version in the develop, use the Research field to obtain the template that fits your needs and needs.

- Once you have discovered the template you desire, click Get now to proceed.

- Pick the costs plan you desire, enter your references, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal profile to fund the legal develop.

- Pick the formatting in the papers and download it to your gadget.

- Make adjustments to your papers if required. You can full, revise and indicator and produce Texas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

Download and produce a large number of papers themes making use of the US Legal Forms web site, which provides the most important collection of legal varieties. Use expert and express-specific themes to handle your organization or specific demands.