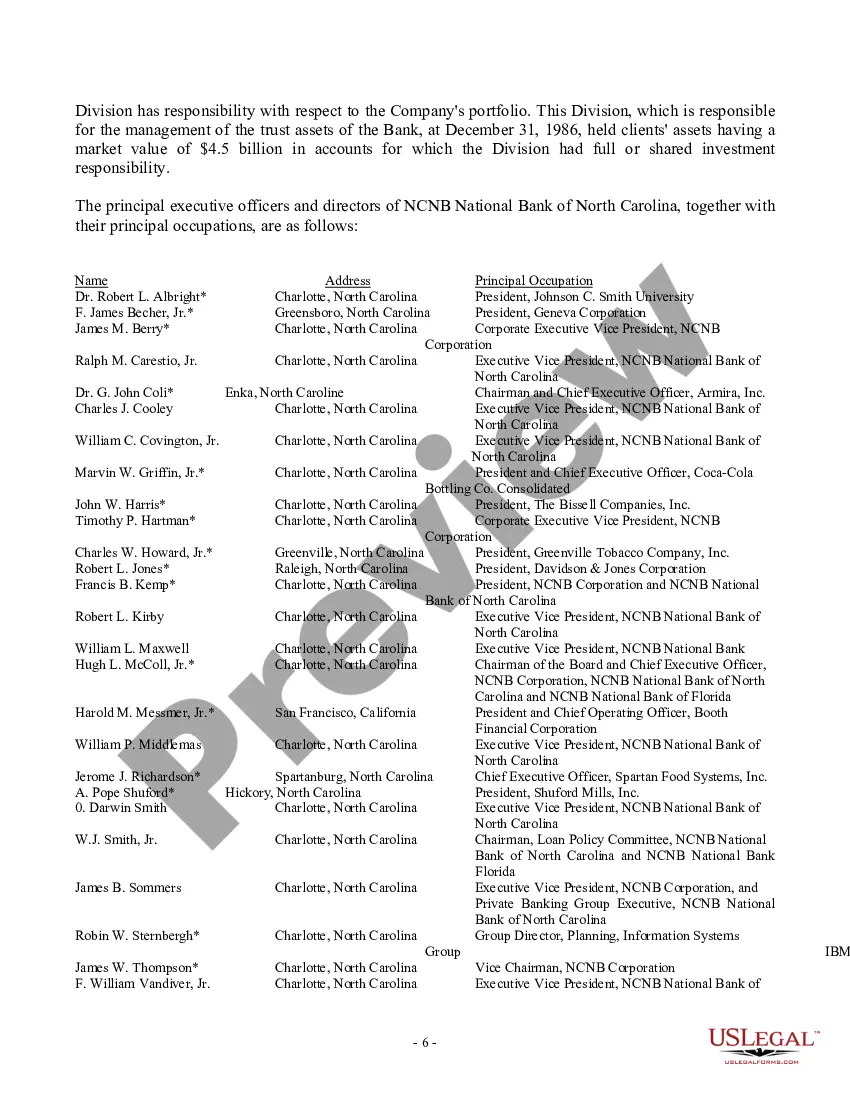

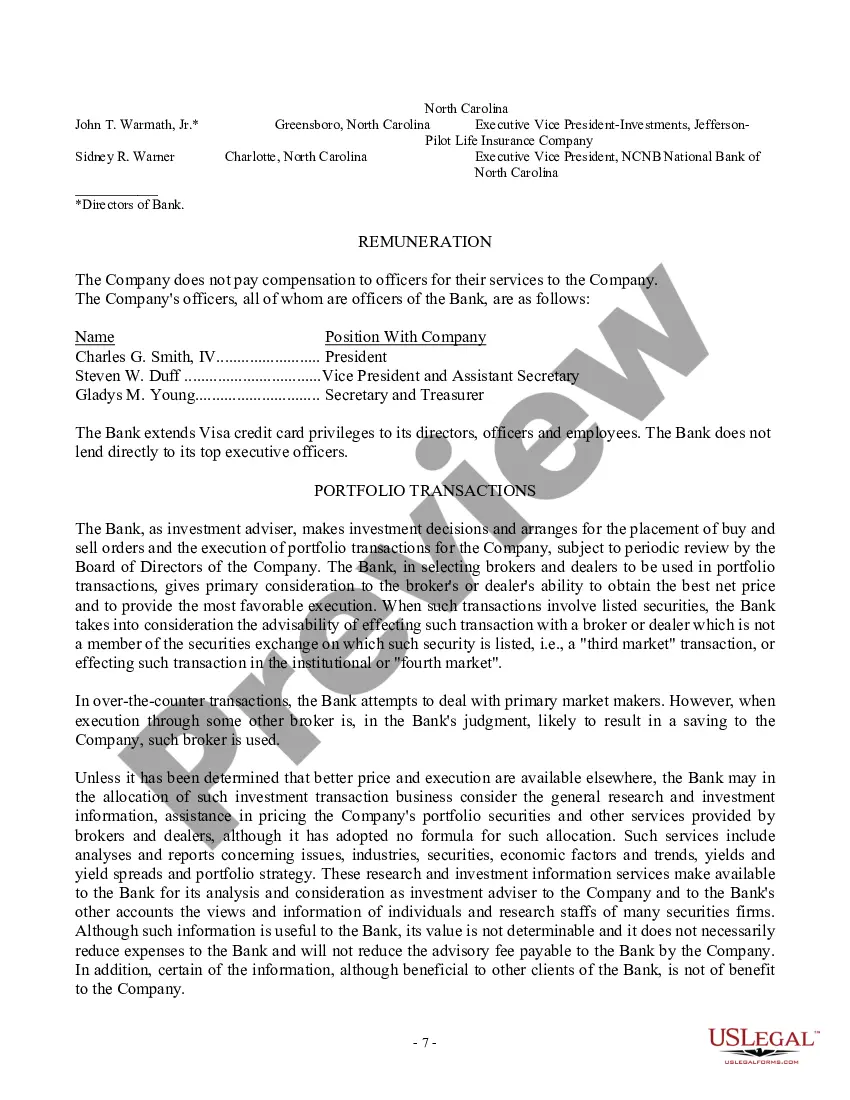

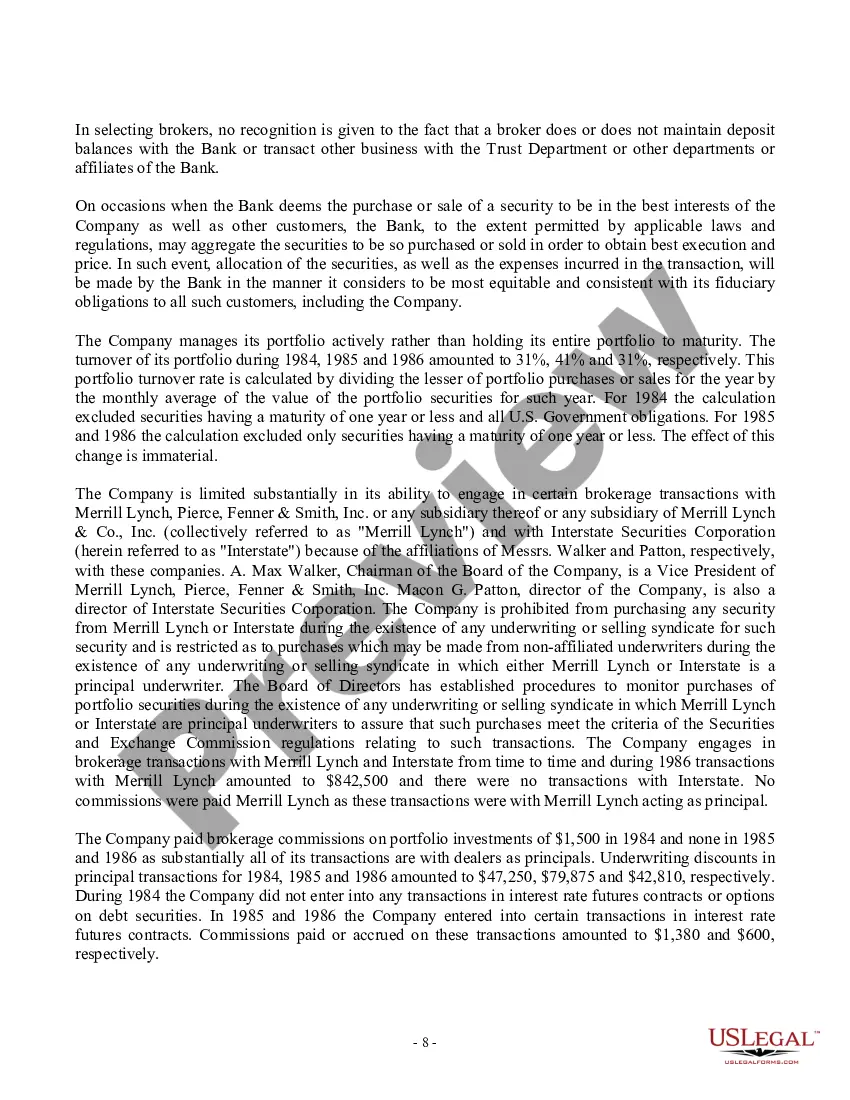

A proxy statement is a document that provides shareholders with important information regarding a company's annual meeting and the matters that will be voted on during the meeting. In this particular context, we will discuss the Texas Proxy Statement for Hatteras Income Securities, Inc., which includes a copy of the advisory agreement. The Texas Proxy Statement for Hatteras Income Securities, Inc. is a legally required document that is distributed to shareholders to provide them with detailed information about the company's upcoming annual meeting of shareholders. It is a key tool for shareholders to make informed decisions on matters that will be presented at the meeting. This proxy statement outlines the proposals that will be voted on during the annual meeting, such as the election of directors, approval of auditors, executive compensation, and any other significant issues impacting the company. It also provides information about the background and qualifications of the candidates nominated for director positions, including details about their experience and expertise. Additionally, the Texas Proxy Statement includes a copy of the advisory agreement. This agreement outlines the terms and conditions under which an advisory firm will provide services to Hatteras Income Securities, Inc. It details the scope of the advisory services, compensation arrangements, potential conflicts of interest, and other relevant provisions that govern the relationship between the advisory firm and the company. It is worth noting that there may be different types of Texas Proxy Statements for Hatteras Income Securities, Inc. depending on the specific annual meeting and the agenda items being presented. For example, there could be separate proxy statements issued when there are special meetings, mergers, acquisitions, or significant changes in the company's corporate structure. In summary, the Texas Proxy Statement for Hatteras Income Securities, Inc. is a critical document that provides shareholders with vital information about the company's annual meeting agendas and enables them to participate in the decision-making process. The inclusion of the advisory agreement ensures transparency and allows shareholders to understand the terms of the company's relationship with the advisory firm.

Texas Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement

Description

How to fill out Texas Proxy Statement - Hatteras Income Securities, Inc. With Copy Of Advisory Agreement?

You can invest hours on the Internet searching for the legitimate file template that meets the federal and state needs you require. US Legal Forms offers a large number of legitimate types that are evaluated by experts. You can actually download or print out the Texas Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement from my services.

If you have a US Legal Forms accounts, you may log in and click on the Obtain button. Following that, you may complete, revise, print out, or sign the Texas Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement. Every single legitimate file template you get is the one you have forever. To obtain one more backup for any bought develop, check out the My Forms tab and click on the related button.

If you use the US Legal Forms web site the first time, stick to the simple recommendations listed below:

- Very first, be sure that you have chosen the best file template to the area/area of your liking. Look at the develop description to ensure you have picked out the appropriate develop. If available, use the Review button to search with the file template too.

- If you want to discover one more version from the develop, use the Look for discipline to obtain the template that meets your needs and needs.

- When you have discovered the template you desire, click Get now to move forward.

- Find the pricing strategy you desire, type your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You may use your Visa or Mastercard or PayPal accounts to cover the legitimate develop.

- Find the formatting from the file and download it to the gadget.

- Make changes to the file if required. You can complete, revise and sign and print out Texas Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement.

Obtain and print out a large number of file templates utilizing the US Legal Forms web site, that provides the most important collection of legitimate types. Use expert and state-certain templates to handle your organization or personal requirements.