A Texas Stock Option Agreement is a legal document that outlines the terms and conditions of stock options granted by Key Ironic Corporation, a company based in Texas, to its employees or other individuals. Stock options are a form of compensation that provide the recipient with the right to purchase a specific number of company stocks at a predetermined price within a specified time frame. The Texas Stock Option Agreement of Key Ironic Corporation is designed to ensure that both parties understand their rights and obligations regarding the stock options. It typically includes detailed information such as the names of the parties involved, the grant date of the options, the exercise price, vesting schedule, and expiration date. The agreement may also specify the conditions under which the options can be exercised, such as the occurrence of certain events or the achievement of certain performance targets by the company or the recipient. Additionally, it may outline any restrictions or limitations on the transferability or sale of the stock options. Key Ironic Corporation may offer different types of stock option agreements to its employees or executives, depending on their positions, roles, and level of responsibility within the company. Some possible variations of the Texas Stock Option Agreement by Key Ironic Corporation may include: 1. Employee Stock Option Agreement: This type of agreement is typically offered to regular employees of the company and provides them with the opportunity to acquire company stocks as part of their overall compensation package. 2. Executive Stock Option Agreement: Executives or high-ranking employees may be offered this type of agreement, which may offer more favorable terms and benefits compared to employee stock option agreements. Executives often receive larger option grants to align their interests with the company's performance and long-term goals. 3. Non-Qualified Stock Option (NO) Agreement: A non-qualified stock option agreement does not qualify for special tax treatment and is subject to ordinary income tax rates upon exercise. This type of agreement may be offered to employees or executives who do not meet certain criteria set by the Internal Revenue Service (IRS) for qualified stock options. 4. Incentive Stock Option (ISO) Agreement: This type of agreement qualifies for special tax treatment under the Internal Revenue Code and may be offered to employees who meet specific IRS requirements. SOS typically offer tax advantages, such as potential capital gains tax treatment upon the sale of the stock acquired through exercise. In summary, the Texas Stock Option Agreement of Key Ironic Corporation is a legal document that ensures clarity and transparency regarding stock options granted by the company. With various types of agreements tailored to different recipients, Key Ironic Corporation strives to incentivize and reward its employees or executives in alignment with their roles and responsibilities within the organization.

Texas Stock Option Agreement of Key Tronic Corporation

Description

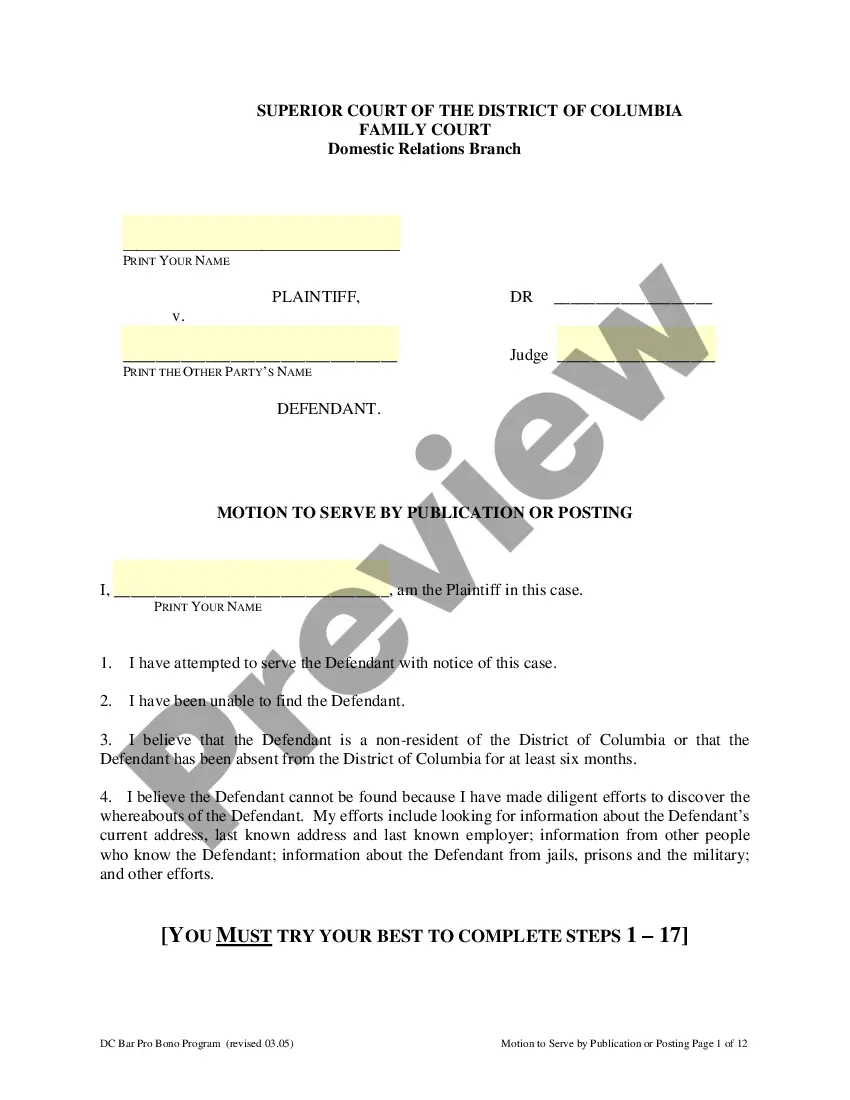

How to fill out Texas Stock Option Agreement Of Key Tronic Corporation?

US Legal Forms - one of many largest libraries of lawful kinds in the United States - gives a wide range of lawful papers layouts you can acquire or print out. Making use of the internet site, you can find thousands of kinds for enterprise and individual purposes, categorized by types, states, or key phrases.You can get the newest models of kinds such as the Texas Stock Option Agreement of Key Tronic Corporation within minutes.

If you have a registration, log in and acquire Texas Stock Option Agreement of Key Tronic Corporation in the US Legal Forms library. The Obtain option will appear on every develop you perspective. You get access to all earlier acquired kinds within the My Forms tab of your respective profile.

If you want to use US Legal Forms the first time, listed below are straightforward guidelines to get you started:

- Make sure you have selected the proper develop to your metropolis/county. Go through the Preview option to examine the form`s information. See the develop outline to actually have selected the correct develop.

- If the develop doesn`t satisfy your requirements, take advantage of the Lookup discipline near the top of the display to discover the the one that does.

- In case you are pleased with the shape, confirm your decision by simply clicking the Get now option. Then, select the costs prepare you prefer and offer your credentials to register for the profile.

- Procedure the financial transaction. Make use of your Visa or Mastercard or PayPal profile to complete the financial transaction.

- Find the format and acquire the shape on your own device.

- Make adjustments. Complete, change and print out and sign the acquired Texas Stock Option Agreement of Key Tronic Corporation.

Every design you added to your bank account lacks an expiration date and is yours forever. So, in order to acquire or print out an additional duplicate, just proceed to the My Forms area and then click on the develop you require.

Obtain access to the Texas Stock Option Agreement of Key Tronic Corporation with US Legal Forms, the most extensive library of lawful papers layouts. Use thousands of expert and status-specific layouts that meet up with your company or individual demands and requirements.