The Texas Approval of Senior Management Executive Incentive Plan is a performance-based reward system designed to motivate and compensate top-level executives in Texas-based companies. It is crucial for companies to obtain formal approval from the relevant authorities before implementing such plans. This arrangement aims to align the interests of executives with the long-term success of the organization and maintain their commitment to driving financial growth, innovation, and optimal performance. The Texas Approval of Senior Management Executive Incentive Plan ensures that eligible executives are granted performance-based bonuses, stock options, restricted stock units (RSS), and other financial incentives based on predefined criteria. These incentives are directly linked to key performance indicators (KPIs), such as revenue growth, profitability, industry-specific benchmarks, market share, customer satisfaction, and cost reduction. The approval process requires companies to thoroughly outline the plan's structure, performance metrics, eligibility criteria, potential payouts, and a detailed explanation of how it aligns with the company's overall strategy and goals. Additionally, the plan must comply with all relevant state and federal regulations, ensuring transparency and fairness in compensation schemes. There might be different types of Texas Approval of Senior Management Executive Incentive Plans, including: 1. Annual Incentive Plan: This plan offers executives short-term incentives, such as performance-based cash bonuses, to reward their annual achievements. The formula for calculating bonuses may vary based on the executive's position and the company's financial performance. 2. Long-Term Incentive Plan: This plan focuses on rewarding executives based on sustained performance over an extended period. It often includes stock options, RSS, or performance shares, which vest over time and encourage executives to contribute to the company's long-term success. 3. Equity-Based Incentive Plan: This type of plan grants executives equity shares or options, which provide a sense of ownership and align their interests with the company's shareholders. These incentives motivate executives to maximize stock value and drive sustainable growth. 4. Performance Share Plan: This plan links executive compensation with the company's performance relative to predefined benchmarks. It provides executives with shares or cash awards based on achieving specific financial goals, strategic targets, or industry-specific metrics. 5. Bonus Pool Plan: This plan pools a portion of the executive's bonuses and redistributes them among other key employees based on their individual or team performances. It promotes collaboration, teamwork, and a sense of shared success within the organization. The Texas Approval of Senior Management Executive Incentive Plan encourages companies to set ambitious yet realistic goals, ensuring that executive compensation is directly tied to exceptional performance. By obtaining proper authorization, companies can implement these plans in a transparent and accountable manner, attracting and retaining top talent while driving organizational growth and shareholder value.

Texas Approval of senior management executive incentive plan

Description

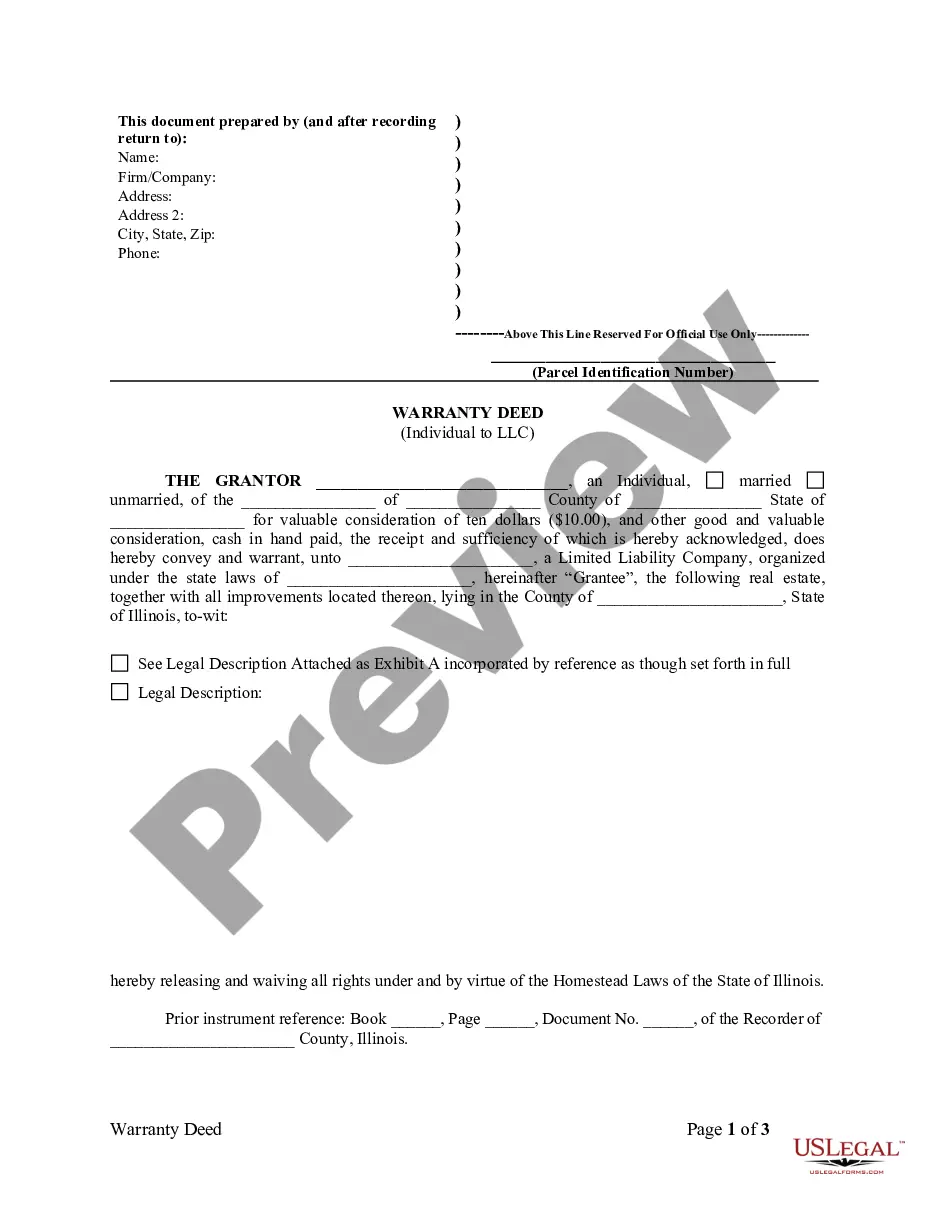

How to fill out Approval Of Senior Management Executive Incentive Plan?

US Legal Forms - one of many largest libraries of authorized forms in America - offers a variety of authorized record layouts you are able to obtain or printing. Using the website, you can get a large number of forms for enterprise and specific purposes, sorted by types, claims, or key phrases.You will find the most recent types of forms such as the Texas Approval of senior management executive incentive plan within minutes.

If you have a monthly subscription, log in and obtain Texas Approval of senior management executive incentive plan through the US Legal Forms local library. The Download option will show up on each type you perspective. You have access to all earlier downloaded forms within the My Forms tab of your respective bank account.

If you would like use US Legal Forms for the first time, listed here are basic instructions to obtain began:

- Be sure you have picked out the right type for your personal metropolis/area. Click on the Review option to analyze the form`s content. Read the type outline to actually have chosen the correct type.

- In the event the type does not fit your needs, take advantage of the Research field near the top of the monitor to discover the the one that does.

- If you are pleased with the form, affirm your selection by clicking on the Purchase now option. Then, pick the pricing program you favor and offer your credentials to register on an bank account.

- Approach the financial transaction. Make use of bank card or PayPal bank account to accomplish the financial transaction.

- Find the format and obtain the form in your system.

- Make modifications. Complete, modify and printing and sign the downloaded Texas Approval of senior management executive incentive plan.

Each and every design you included with your account does not have an expiration time and it is the one you have eternally. So, if you would like obtain or printing yet another duplicate, just go to the My Forms section and then click around the type you want.

Obtain access to the Texas Approval of senior management executive incentive plan with US Legal Forms, by far the most extensive local library of authorized record layouts. Use a large number of professional and express-particular layouts that satisfy your organization or specific needs and needs.

Form popularity

FAQ

An Executive Bonus Plan, also referred to as Section 162 Plan, is a non-qualified plan used by employers to provide special compensation to key executives. The employers' contribution to an executive bonus plan is considered salary to the executive and is therefore subject to taxation.

Executive bonus plans are often popular with top-level employees, but they also provide benefits to your company. In some cases, they can be a more tax-efficient way to reward top talent. They give employees additional compensation with a lower current cost to the employer than some other types of benefits.

A typical executive compensation package has financial and non-financial components. They are salary, benefits, bonuses and equity. Commonly, an executive would get more amount of equity than a normal worker and a normal worker quite often wouldn't get any equity in a private company.

An employee bonus plan provides compensation beyond annual salary to employees as an incentive or reward for reaching certain predetermined individual or team goals. The purpose of bonus plans is to provide recognition for employees who go above and beyond normal work obligations.

term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

What Is an Annual Incentive Plan? An annual incentive plan is a plan for compensation that is earned and paid based upon the achievement of performance goals over a one-year period. These plans motivate performance and align executives' work with the company's short-term performance goals.

As a rule of thumb, the base salary constitutes 30% of total compensation, the annual incentive another 20%, the benefits about 10% and long-term incentives or the wealth creation portion of the compensation about 40%.

Payout Opportunity A Participant's payout target amount under the Plan is determined by pay grade as follows: The range of incentive opportunity for a Plan Participant is 0% to 200% of the Participant's total value target. This means the maximum payout that a Participant can receive from this Plan is 200%.