Title: Texas Retirement Plan for Outside Directors: A Comprehensive Overview Introduction: Texas Retirement Plan for Outside Directors is a specialized retirement program offered to external directors serving on the boards of various organizations within the state of Texas. This plan is designed to provide financial security and attractive retirement benefits to outside directors. In this article, we will delve into the details of the Texas Retirement Plan for Outside Directors, its features, eligibility criteria, and potential variations. 1. Key Features of Texas Retirement Plan for Outside Directors: The Texas Retirement Plan for Outside Directors offers a range of features to ensure a comfortable retirement for participating directors. Some key elements include: — Retirement Income: The plan provides a regular stream of retirement income based on a predetermined formula, taking into account factors like years of service, compensation, and other variables. — Vesting: Participant directors become fully vested in the plan after a specified period, usually a few years, ensuring the entitlement to receive the full range of benefits at retirement. — Optional Contribution: Depending on the organization's policies, outside directors may have the option to contribute a portion of their earnings towards the retirement plan to further enhance their benefits. — Investment Options: The plan typically offers multiple investment options, allowing directors to choose a strategy that aligns with their risk tolerance and financial goals. 2. Eligibility for Texas Retirement Plan for Outside Directors: Eligibility criteria for the Texas Retirement Plan for Outside Directors may vary slightly depending on the organization's rules. Generally, the following factors are considered when determining eligibility: — Tenure: Directors must serve a specific length of time to become eligible for the retirement plan, typically ranging from one to five years. — Compensation Threshold: Directors must meet certain compensation thresholds to qualify for the plan. This ensures that only high-ranking outside directors enjoy the benefits of the retirement program. — Terms of Appointment: Specific terms for the appointment of outside directors, such as attendance requirements, active participation in board activities, and adherence to ethical guidelines, may also influence eligibility. 3. Types of Texas Retirement Plan for Outside Directors: While the core principles remain consistent, there may be variations in the Texas Retirement Plan for Outside Directors across different organizations. Some notable variations include: — Defined Benefit (DB) Plans: This type of retirement plan guarantees a predetermined retirement income based on factors like years of service and compensation. It provides a stable income stream in retirement but typically requires more significant contributions from the organization. — Defined Contribution (DC) Plans: In this type of plan, the organization and/or participating directors make contributions to individual retirement accounts, such as 401(k) plans. The eventual retirement income depends on the account's performance and investment decisions made by the director. — Hybrid Plans: Hybrid plans combine elements of both DB and DC plans by offering a guaranteed benefit alongside an investment component. This allows directors to enjoy the stability of a pension while potentially benefiting from investment gains. Conclusion: The Texas Retirement Plan for Outside Directors serves as an attractive incentive for external directors serving on various boards in Texas. This well-structured retirement program ensures financial security during retirement by offering a range of features, eligibility criteria, and investment options. By understanding the plan's types and features, outside directors can make informed decisions about their participation, ensuring a fruitful retirement journey.

Texas Retirement Plan for Outside Directors

Description

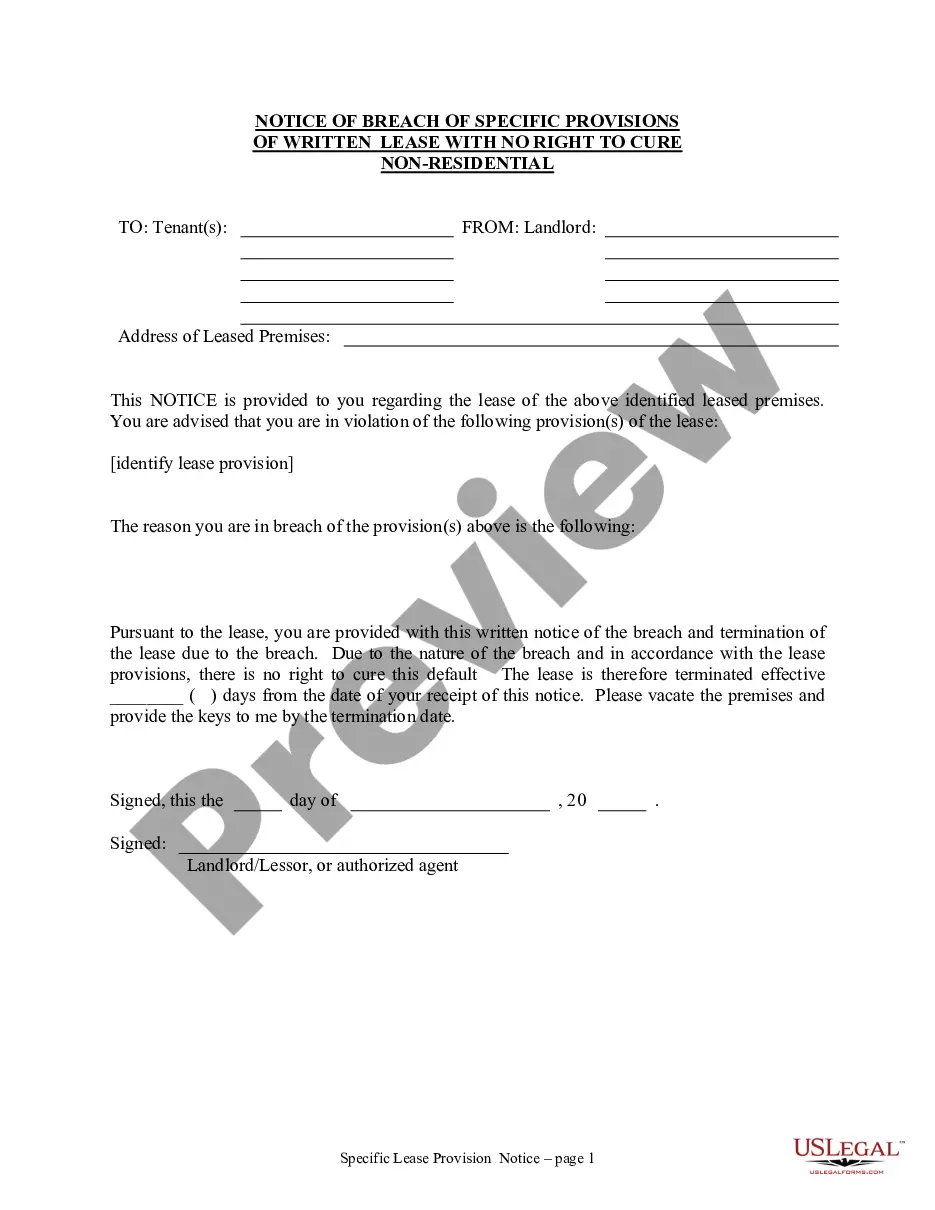

How to fill out Texas Retirement Plan For Outside Directors?

Finding the right legitimate papers design might be a battle. Naturally, there are plenty of web templates available on the Internet, but how will you discover the legitimate kind you want? Make use of the US Legal Forms website. The service gives a large number of web templates, such as the Texas Retirement Plan for Outside Directors, which can be used for company and private requirements. Each of the kinds are inspected by professionals and meet up with federal and state requirements.

If you are already listed, log in for your account and click the Download option to have the Texas Retirement Plan for Outside Directors. Use your account to appear through the legitimate kinds you might have purchased earlier. Visit the My Forms tab of your respective account and get another copy in the papers you want.

If you are a fresh customer of US Legal Forms, listed here are easy directions that you should comply with:

- Very first, be sure you have selected the right kind for your personal metropolis/area. You are able to look through the form making use of the Preview option and study the form information to guarantee it is the best for you.

- In the event the kind will not meet up with your preferences, use the Seach field to get the right kind.

- Once you are sure that the form is acceptable, select the Get now option to have the kind.

- Select the costs program you would like and enter in the required details. Create your account and pay money for an order making use of your PayPal account or bank card.

- Select the document file format and obtain the legitimate papers design for your product.

- Total, edit and print and sign the obtained Texas Retirement Plan for Outside Directors.

US Legal Forms will be the biggest local library of legitimate kinds that you can discover various papers web templates. Make use of the service to obtain skillfully-manufactured documents that comply with express requirements.

Form popularity

FAQ

Pension: TRS Retirement Your monthly TRS contributions, as well as contributions from the state and your employer, help fund your future TRS retirement. Upon retirement, you would receive a monthly annuity for life. There are no automatic increases to your annuity once you have retired.

Throughout their careers with the state, employees contribute a percentage of their salaries to the ERS Retirement Trust Fund. The state also contributes to the Retirement Trust Fund on employees' behalf. ERS invests the money in the Trust Fund to increase its value.

Texas public education employees who are employed in membership-eligible positions are required to participate in TRS and are automatically enrolled in TRS on their first day of employment. However, some higher education employees may choose to participate in ORP instead.

Normal Age Retirement Age 65 with five or more years of service credit, or. At least age 62, meet the Rule of 80 (combined age and years of service credit equal at least 80), and have at least five years of service credit.

Along with contributions you make to TRS throughout your career as an active member, the Texas Legislature and school districts also make contributions to help fund your benefits. As a member, you can count on a strong team to manage your contributions before and after retirement.

The State of Texas retirement plan is mandatory for most state agency employees and provides a lifetime annuity when they retire. In addition to mandatory participation in State of Texas retirement, eligible state agency employees are encouraged to contribute to personal retirement savings.

The State of Texas contributes 6.8% of your salary each year to the retirement system. If you've been part of TRS long enough, you qualify for a fixed annuity payout for life when you retire.

THERE IS NO RULE OF 90 FOR FULL RETIREMENT. This is a very commonly believed provision, but no employee has to meet a Rule of 90 for standard retirement benefits.