Title: Texas Executive Director Loan Plan with Copy of Promissory Note by Hathaway Instruments, Inc. Keywords: Texas Executive Director Loan Plan, Promissory Note, Hathaway Instruments, Inc., loan types, detailed description Introduction: The Texas Executive Director Loan Plan by Hathaway Instruments, Inc. is a unique financial offering designed to cater to the specific needs of executive directors residing in the state of Texas. This comprehensive plan includes a Promissory Note, providing a legally binding agreement between the borrower and Hathaway Instruments, Inc. Here, we will delve into the details of this loan plan and shed light on its different types. 1. Texas Executive Director Loan Plan: The Texas Executive Director Loan Plan is an exclusive program developed by Hathaway Instruments, Inc. that caters specifically to executive directors in Texas. It aims to provide financial support to these professionals by offering competitive loan options tailored to their unique financial requirements. 2. Hathaway Instruments, Inc.: Hathaway Instruments, Inc. is a reputable financial institution committed to assisting executive directors with their financial needs. With years of experience in the industry, Hathaway Instruments, Inc. offers personalized loan solutions, ensuring that executive directors can access funds for various purposes, such as business expansion, further education, debt consolidation, or personal expenses. 3. Promissory Note: Part of the Texas Executive Director Loan Plan is the Promissory Note, a legal document that outlines the terms and conditions of the loan between the borrower and Hathaway Instruments, Inc. This document acts as proof of the borrower's agreement to repay the loan amount along with any accrued interest, within a specified timeframe. Types of Texas Executive Director Loan Plan: a. Executive Director Business Expansion Loan: This loan type focuses on assisting executive directors in expanding their existing businesses or starting new ventures. It provides financial capital to executive directors seeking funding for business acquisitions, equipment purchases, marketing campaigns, or any other operational needs. With competitive interest rates and flexible repayment options, this loan type is designed to support the growth and development of executive directors' businesses. b. Executive Director Education Loan: The Executive Director Education Loan is targeted at executive directors seeking further education or professional development opportunities. This loan type provides financial assistance for executive directors pursuing advanced degrees, attending conferences or seminars, or acquiring new skills to enhance their professional abilities. Hathaway Instruments, Inc. understands the importance of continuous learning and supports executive directors in their quest for knowledge. c. Executive Director Personal Loan: The Executive Director Personal Loan is designed to cater to the personal financial needs of executive directors. Whether it's funding home renovations, planning a vacation, managing unexpected medical expenses, or consolidating high-interest debts, this loan type provides executive directors with the flexibility to meet their individual financial requirements efficiently and responsibly. Conclusion: The Texas Executive Director Loan Plan, accompanied by the Promissory Note, is a comprehensive financial offering by Hathaway Instruments, Inc. designed explicitly for executive directors in Texas. With different loan types available to suit the diverse needs of executive directors, Hathaway Instruments, Inc. aims to provide financial support and enhance executive directors' professional and personal lives through competitive interest rates, flexible terms, and outstanding customer service.

Texas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

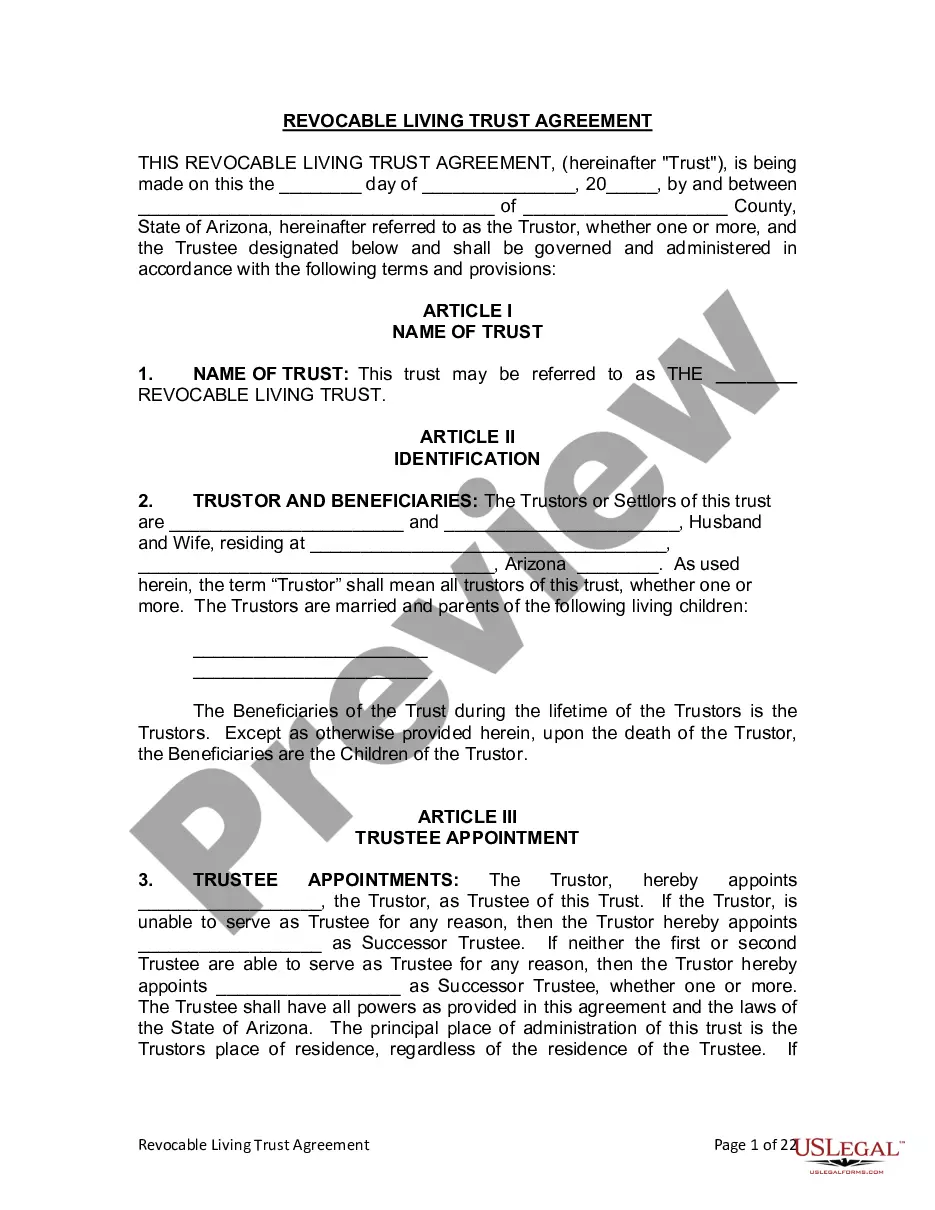

How to fill out Texas Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

If you wish to complete, acquire, or produce lawful papers themes, use US Legal Forms, the largest assortment of lawful kinds, which can be found on the Internet. Use the site`s basic and practical lookup to obtain the files you need. Different themes for business and personal reasons are sorted by types and claims, or search phrases. Use US Legal Forms to obtain the Texas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. within a few mouse clicks.

In case you are previously a US Legal Forms consumer, log in in your account and click on the Down load switch to have the Texas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.. Also you can accessibility kinds you in the past downloaded in the My Forms tab of your account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for your proper area/region.

- Step 2. Take advantage of the Review method to check out the form`s information. Never forget about to learn the explanation.

- Step 3. In case you are unsatisfied using the form, utilize the Search discipline at the top of the display to get other models from the lawful form web template.

- Step 4. Once you have located the form you need, go through the Buy now switch. Select the prices program you choose and add your accreditations to register on an account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal account to finish the purchase.

- Step 6. Choose the format from the lawful form and acquire it in your product.

- Step 7. Complete, revise and produce or indication the Texas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc..

Each and every lawful papers web template you get is your own forever. You have acces to every single form you downloaded in your acccount. Click the My Forms area and select a form to produce or acquire yet again.

Contend and acquire, and produce the Texas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. with US Legal Forms. There are thousands of skilled and status-distinct kinds you can use for your personal business or personal needs.

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

A promissory note must be containing an unconditional promise to pay. it must contain a consideration in monetary terms only. the parties must be certain. a promissory note should be payable either on demand or at a certain date.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A Family Member Promissory Note is a promise of payment from one family member (Borrower) to another family member (Lender). This promise specifies the payment of the sum of money plus any interest that may accrue on the loan over a stipulated period.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A promissory note typically states that a borrower promises to repay a lender a certain amount of money by a specific date. These notes are legally binding and may include loan terms?like the principal amount, interest rate and payment schedule.

A promissory note is a documented promise to repay borrowed money. Promissory notes are binding legal documents used to protect both the lender and the borrower. The promissory note is paper evidence of the debt that the borrower has incurred.

A promissory note cannot be valid unless it contains details about the nature of credit, the means to repay it along with the duration given for the repayment, the signatures of all parties, the conditions agreed in the sanction of the loan, the rate of interest and all related terms.