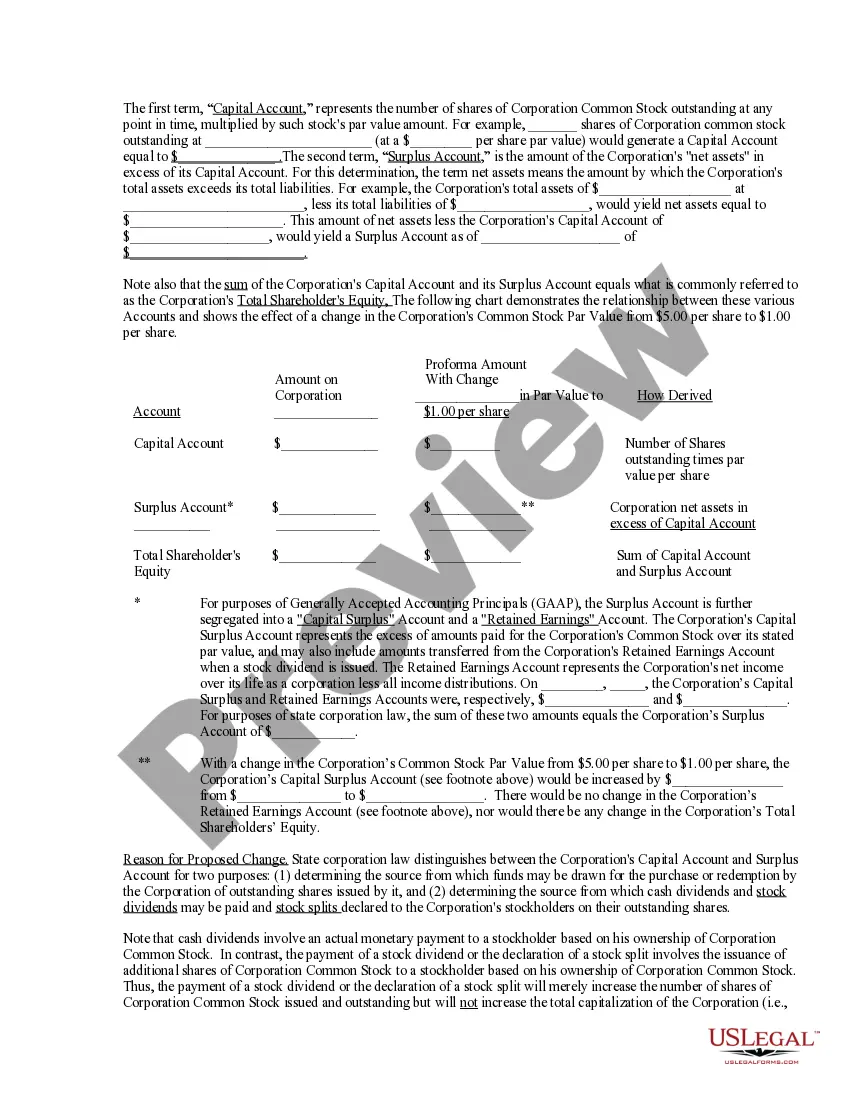

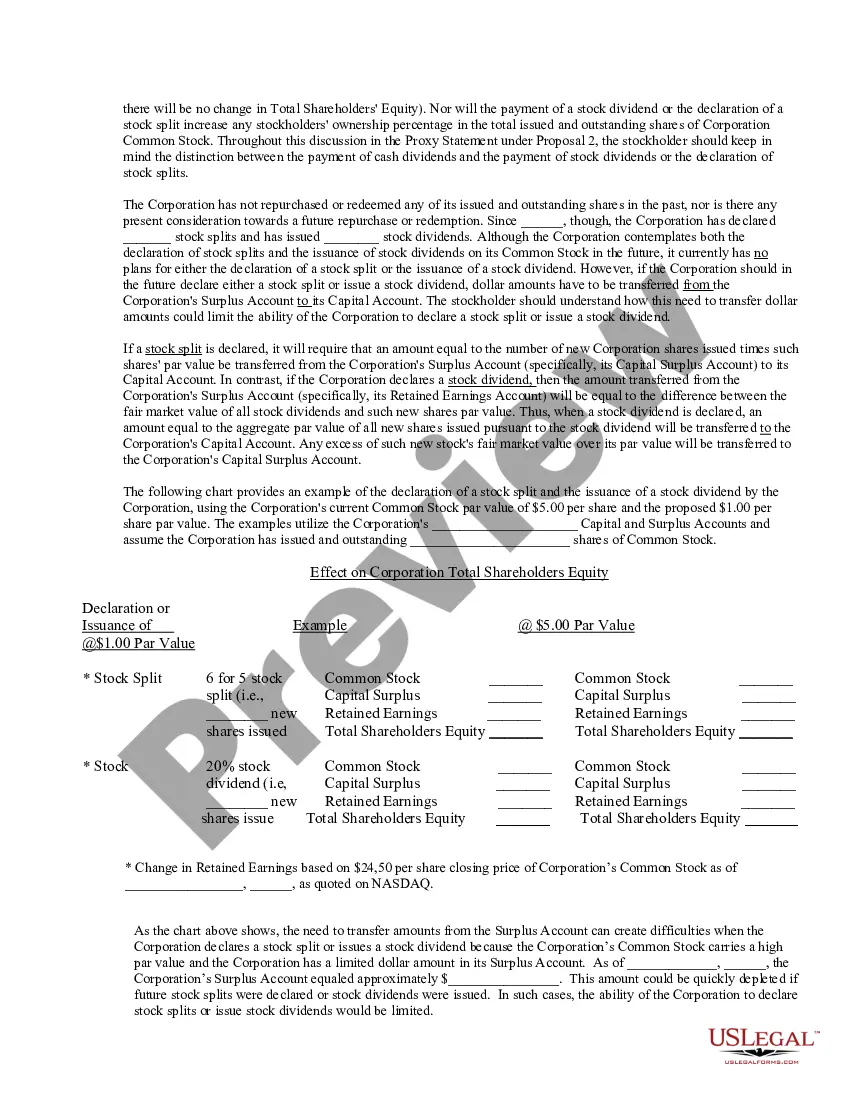

The Texas Amendment of Common Stock Par Value is a legal provision that allows a corporation registered in Texas to modify the par value of its common stock. Par value refers to the nominal or face value assigned to each share of stock, which serves as a baseline value for the stock. Amending the common stock par value in Texas can be crucial for corporations when they aim to adjust their capital structure or meet specific financial requirements. By increasing or decreasing the par value of their shares, companies can influence the value of their stock, affect shareholder rights, and ensure compliance with regulatory obligations. In Texas, there are various types of amendments related to common stock par value, including: 1. Increase of Par Value: A corporation may decide to increase the par value of its common stock to enhance the perceived value of the shares. This can be useful when attracting investors or reflecting improved financial performance. It is important to note that increasing par value usually requires shareholder approval and compliance with legal procedures. 2. Decrease of Par Value: On the other hand, a company may opt to reduce the par value of its common stock. This might be done to make the stock more affordable, facilitate stock splits, or accommodate a desire to realign the company's capital structure. Similar to increasing par value, decreasing par value typically involves obtaining shareholder consent and following legal procedures. 3. Elimination of Par Value: Texas also permits corporations to completely eliminate the par value of their common stock. This is known as "no-par value stock." Companies may choose this option to simplify their capital structure, remove restrictions related to par value, or streamline accounting processes. While eliminating par value can provide flexibility, it may require compliance with specific legal requirements and shareholder approval. It is crucial to note that any amendment to the par value of common stock in Texas must adhere to the guidelines set forth by the Texas Business Organizations Code (TBC) and the corporation's articles of incorporation. Compliance with these regulations ensures that the amendment is legally valid and protects the interests of shareholders. In summary, the Texas Amendment of Common Stock Par Value enables corporations to adjust the par value of their common stock to meet their financial needs, regulatory requirements, or strategic objectives. Whether it involves increasing, decreasing, or eliminating par value, companies must navigate the legal framework to ensure proper execution and maintain transparency with their shareholders.

Texas Amendment of common stock par value

Description

How to fill out Texas Amendment Of Common Stock Par Value?

Discovering the right legal file design can be a battle. Of course, there are a variety of layouts available on the net, but how would you discover the legal kind you require? Use the US Legal Forms internet site. The services provides 1000s of layouts, such as the Texas Amendment of common stock par value, that you can use for business and personal needs. Every one of the kinds are inspected by pros and satisfy state and federal requirements.

If you are previously authorized, log in in your accounts and click on the Acquire option to get the Texas Amendment of common stock par value. Use your accounts to appear throughout the legal kinds you have acquired in the past. Go to the My Forms tab of your accounts and obtain an additional duplicate in the file you require.

If you are a brand new end user of US Legal Forms, here are simple instructions for you to comply with:

- Very first, make sure you have chosen the correct kind for your personal town/county. It is possible to look through the form using the Review option and study the form information to guarantee this is basically the best for you.

- In case the kind is not going to satisfy your needs, utilize the Seach industry to get the correct kind.

- When you are sure that the form would work, go through the Buy now option to get the kind.

- Choose the rates plan you desire and enter the necessary details. Design your accounts and pay for the order with your PayPal accounts or credit card.

- Pick the document formatting and acquire the legal file design in your system.

- Total, edit and produce and signal the acquired Texas Amendment of common stock par value.

US Legal Forms will be the biggest collection of legal kinds that you can see numerous file layouts. Use the service to acquire expertly-made paperwork that comply with status requirements.