Title: Understanding the Texas Proposed Amendment to Articles Eliminating Certain Preemptive Rights: Exploring their Types and Impact Introduction: The state of Texas is currently considering a proposed amendment to articles aimed at eliminating specific preemptive rights. This comprehensive guide provides a detailed explanation of what this amendment entails, highlighting its various types and potential implications. By incorporating relevant keywords, we aim to shed light on the subject effectively. 1. Definition of Preemptive Rights: Preemptive rights, commonly referred to as subscription rights or pre-emption rights, are a shareholder's privilege to maintain their proportional ownership in a company by purchasing additional shares when new shares are issued. 2. Overview of the Proposed Amendment: The Texas Proposed Amendment to Articles Eliminating Certain Preemptive Rights is a legislative measure aimed at altering the current regulations concerning preemptive rights in business entities. The amendment seeks to restrict or remove these rights to make changes to the existing shareholder landscape. 3. Types of Texas Proposed Amendment: While the specific types of the Texas Proposed Amendment may vary, depending on the legislative language, the following are some common variations: a. Complete Elimination of Preemptive Rights: One type involves the complete removal of preemptive rights. This means that shareholders would no longer have the automatic privilege to purchase additional shares during future issuance, effectively cancelling their preemptive rights altogether. b. Partial Limitation on Preemptive Rights: Another type could propose limitations on preemptive rights by setting conditions or thresholds that must be met for shareholders to exercise these rights. c. Replacement of Preemptive Rights with Alternative Mechanisms: A potential variation of the Texas Proposed Amendment might seek to substitute preemptive rights with alternative mechanisms, such as rights offerings or rights offerings with additional incentives. 4. The Rationale Behind the Proposed Amendment: The primary reasons driving this proposed amendment include: a. Simplifying Capital Raising Processes: By eliminating or modifying preemptive rights, the amendment aims to streamline the capital-raising processes for companies and reduce administrative burdens associated with offering shares to existing shareholders. b. Encouraging Investment and Flexibility: Proponents of the amendment argue that removing or limiting preemptive rights could foster investment opportunities by offering companies greater flexibility to attract new investors, potentially leading to enhanced growth and expansion. 5. Impact of the Proposed Amendment: The Texas Proposed Amendment, if implemented, could have several significant consequences, including: a. Dilution Risk for Existing Shareholders: Without preemptive rights, current shareholders may face increased risks of dilution, as they won't have the automatic right to maintain their proportional ownership when new shares are issued. b. Enhanced Capital-Raising Opportunities: Companies may benefit from greater flexibility and faster capital-raising processes, as they can offer shares without requiring equal allocation to existing shareholders. c. Potential Effect on Market Stability: Removing preemptive rights might lead to changes in shareholder dynamics and market volatility, as control and ownership proportions could shift more rapidly if certain shareholders opt not to participate or gain a larger stake through the elimination of others' preemptive rights. Conclusion: Understanding the Texas Proposed Amendment to Articles Eliminating Certain Preemptive Rights is crucial for all stakeholders involved in the state's business landscape. By weighing the potential advantages and disadvantages, it is essential to strike a balance that fosters both investor protection and capital-raising facilitation.

Texas Proposed amendment to articles eliminating certain preemptive rights

Description

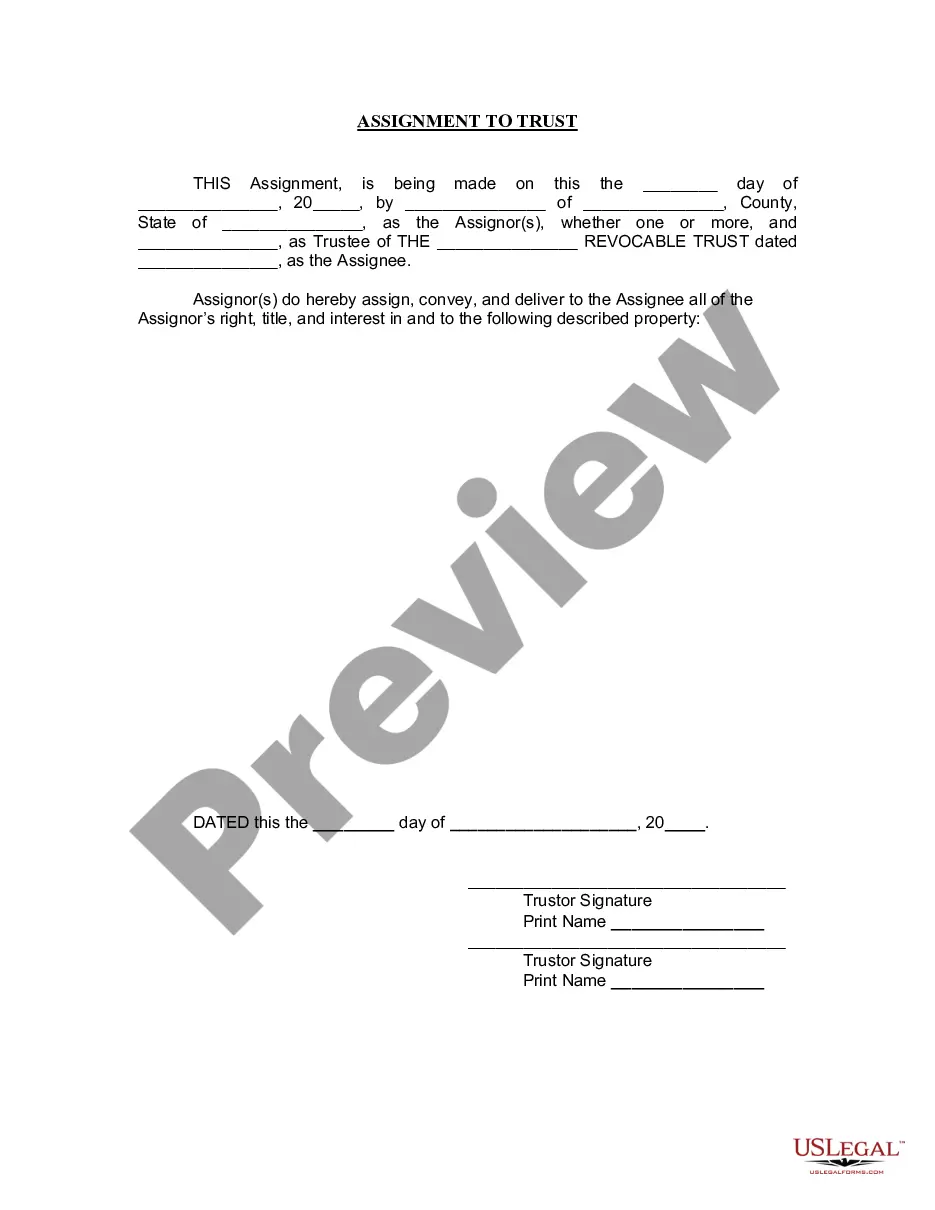

How to fill out Texas Proposed Amendment To Articles Eliminating Certain Preemptive Rights?

Are you currently in a placement in which you will need paperwork for sometimes business or individual functions almost every day? There are plenty of lawful file templates available on the Internet, but getting ones you can trust isn`t straightforward. US Legal Forms delivers a huge number of type templates, like the Texas Proposed amendment to articles eliminating certain preemptive rights, which can be published to satisfy state and federal specifications.

In case you are already knowledgeable about US Legal Forms site and get a merchant account, basically log in. Next, you can down load the Texas Proposed amendment to articles eliminating certain preemptive rights design.

Should you not offer an accounts and would like to start using US Legal Forms, adopt these measures:

- Get the type you will need and ensure it is to the appropriate city/region.

- Take advantage of the Review key to review the shape.

- See the description to ensure that you have chosen the correct type.

- In the event the type isn`t what you`re searching for, take advantage of the Search field to find the type that fits your needs and specifications.

- If you find the appropriate type, just click Acquire now.

- Pick the rates prepare you would like, fill in the specified details to produce your bank account, and buy the transaction with your PayPal or credit card.

- Select a hassle-free document file format and down load your duplicate.

Get every one of the file templates you possess purchased in the My Forms food selection. You can get a more duplicate of Texas Proposed amendment to articles eliminating certain preemptive rights whenever, if required. Just select the needed type to down load or produce the file design.

Use US Legal Forms, one of the most comprehensive variety of lawful forms, to conserve time and stay away from errors. The support delivers professionally produced lawful file templates that you can use for a variety of functions. Generate a merchant account on US Legal Forms and begin producing your daily life a little easier.