The Texas Form of Revolving Promissory Note is a legally binding document that establishes a revolving credit arrangement between a lender and a borrower in the state of Texas. This type of promissory note provides the borrower with the flexibility to borrow, repay, and borrow again up to a pre-approved credit limit, making it ideal for businesses or individuals with fluctuating financing needs. The Texas Form of Revolving Promissory Note typically includes essential information such as the names and addresses of both parties involved, the principal amount being borrowed, the interest rate, repayment terms, and any applicable fees or penalties. This document serves as evidence of the borrower's promise to repay the debt according to the agreed-upon terms. One type of Texas Form of Revolving Promissory Note is the Unsecured Revolving Promissory Note, where the borrower does not provide any collateral to secure the loan. This type of note relies solely on the borrower's creditworthiness and repayment history, making it a more flexible option for those who do not possess significant assets or are not willing to pledge collateral. Another type is the Secured Revolving Promissory Note, where the borrower offers specific assets as collateral to secure the loan. This collateral can be in the form of real estate, equipment, inventory, or other valuable assets. A secured revolving note provides an added layer of protection for the lender, as they can seize and sell the collateral in case of default, reducing their risk. Borrowers seeking a Texas Form of Revolving Promissory Note should ensure they fully understand the terms and conditions stated in the document before signing. The interest rate, repayment schedule, late fees, and any additional charges should be carefully reviewed to avoid any misunderstandings or potential financial difficulties in the future. In conclusion, the Texas Form of Revolving Promissory Note is a versatile financial instrument that provides borrowers with ongoing access to credit within predetermined limits. Whether it's an unsecured or secured option, this type of note allows for flexible borrowing while maintaining legal obligations. Proper consideration and understanding of the terms are essential for both parties to ensure a mutually beneficial and secure financial arrangement.

Texas Form of Revolving Promissory Note

Description

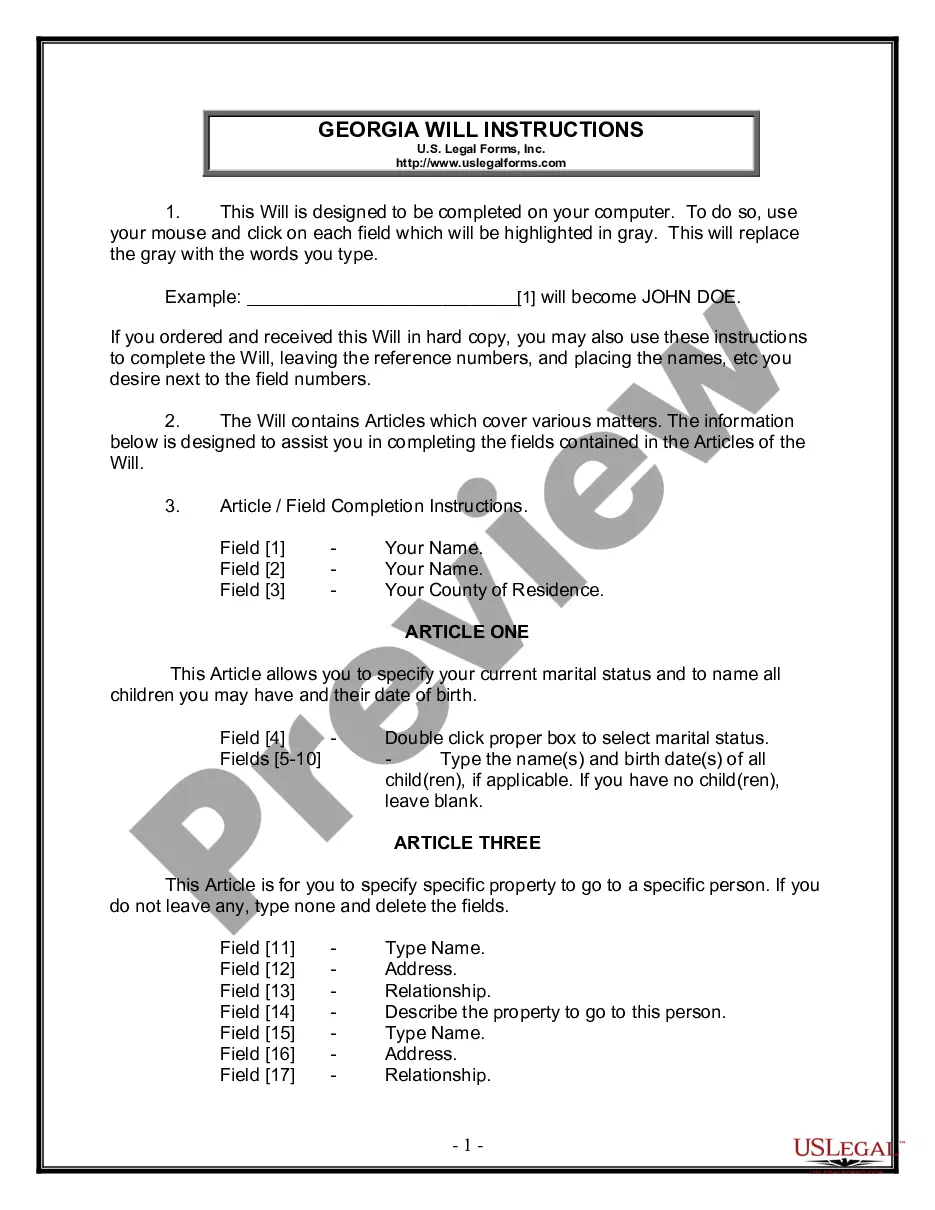

How to fill out Texas Form Of Revolving Promissory Note?

Choosing the best legal papers web template can be quite a struggle. Needless to say, there are a variety of web templates available online, but how would you discover the legal kind you need? Take advantage of the US Legal Forms web site. The assistance delivers a large number of web templates, including the Texas Form of Revolving Promissory Note, that you can use for enterprise and private demands. All the varieties are examined by specialists and satisfy federal and state specifications.

If you are already listed, log in in your account and click the Download option to find the Texas Form of Revolving Promissory Note. Make use of account to look throughout the legal varieties you might have ordered formerly. Check out the My Forms tab of your own account and get another backup of the papers you need.

If you are a new consumer of US Legal Forms, listed below are straightforward recommendations for you to comply with:

- Initial, be sure you have chosen the right kind for your town/region. You may check out the form using the Review option and read the form explanation to guarantee it is the best for you.

- In the event the kind fails to satisfy your preferences, use the Seach field to get the proper kind.

- Once you are positive that the form is proper, select the Buy now option to find the kind.

- Choose the pricing program you desire and enter in the needed information. Build your account and buy an order using your PayPal account or Visa or Mastercard.

- Opt for the submit file format and download the legal papers web template in your gadget.

- Complete, modify and produce and indicator the attained Texas Form of Revolving Promissory Note.

US Legal Forms is definitely the largest local library of legal varieties in which you will find numerous papers web templates. Take advantage of the service to download professionally-created papers that comply with express specifications.

Form popularity

FAQ

A promissory note is a form of debt that companies and individuals sometimes use, like loans, to raise money. The issuer, through the notes, promises to return the buyer's funds (principal) and to make fixed interest payments to the buyer in exchange for borrowing the money.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A Promissory Note is a contract between a borrower and a lender. In the note, the borrower promises to repay the loan ing to the terms of agreement specified within the note. If the borrower fails to repay the loan ing to the agreed terms, the borrower may be liable for breach of note.

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

Texas Secured Promissory Note The date of inception of the note. The names and addresses of all the parties involved as well as the information of the witness that gives the document validity. The loan amount and the details of how and when payment will occur.

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

There are three types of promissory notes: unsecured, secured and demand.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.