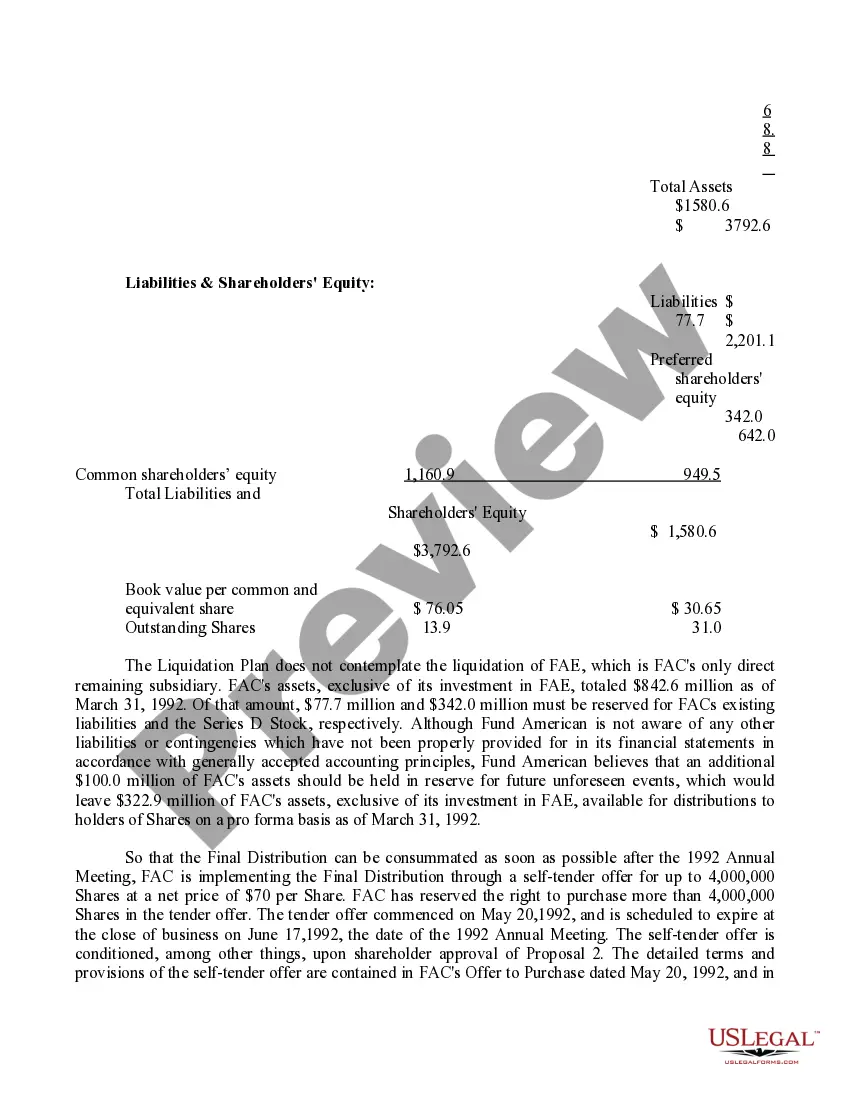

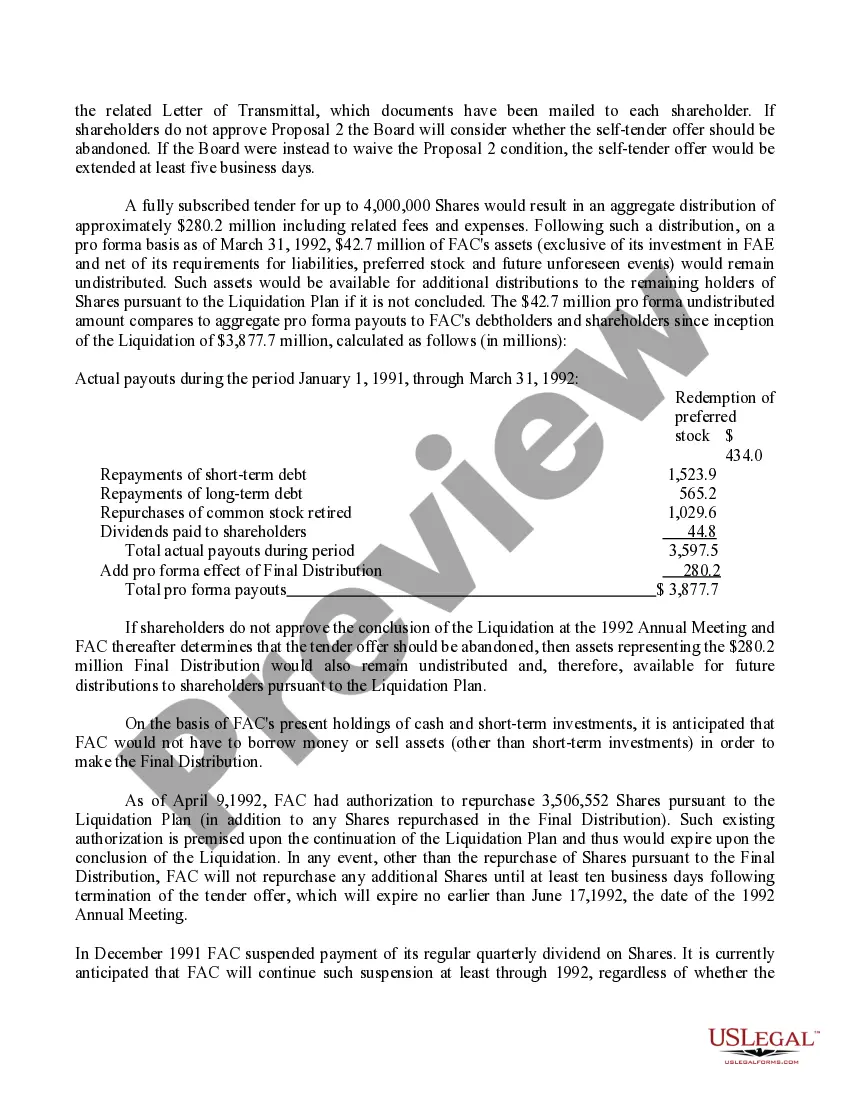

Texas Proposal - Conclusion of the Liquidation with exhibit

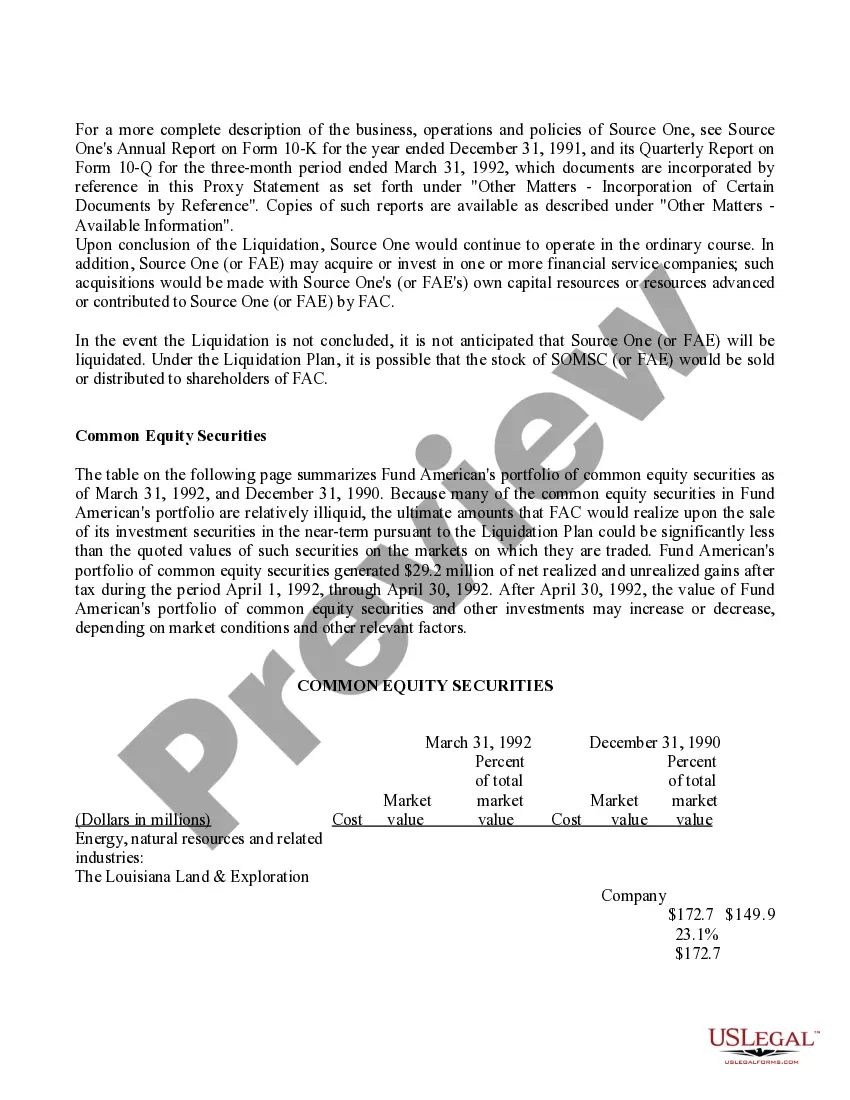

Description

How to fill out Proposal - Conclusion Of The Liquidation With Exhibit?

Finding the right legitimate record web template could be a struggle. Naturally, there are a variety of templates available online, but how will you get the legitimate form you need? Utilize the US Legal Forms website. The assistance provides a huge number of templates, for example the Texas Proposal - Conclusion of the Liquidation with exhibit, that can be used for organization and personal requirements. All the forms are examined by professionals and fulfill federal and state demands.

If you are currently listed, log in to your accounts and click the Acquire key to find the Texas Proposal - Conclusion of the Liquidation with exhibit. Use your accounts to search throughout the legitimate forms you may have bought previously. Visit the My Forms tab of the accounts and acquire an additional duplicate of the record you need.

If you are a fresh user of US Legal Forms, allow me to share easy recommendations that you can follow:

- Initially, be sure you have chosen the appropriate form to your town/region. You are able to look through the form while using Preview key and look at the form description to make sure this is the best for you.

- If the form will not fulfill your preferences, make use of the Seach field to discover the appropriate form.

- When you are certain that the form would work, select the Acquire now key to find the form.

- Opt for the pricing program you would like and enter in the needed info. Design your accounts and purchase an order utilizing your PayPal accounts or charge card.

- Choose the file structure and down load the legitimate record web template to your gadget.

- Complete, change and printing and signal the acquired Texas Proposal - Conclusion of the Liquidation with exhibit.

US Legal Forms will be the largest local library of legitimate forms that you can see different record templates. Utilize the service to down load appropriately-manufactured files that follow state demands.