Texas Complex Will - Income Trust for Spouse

Description

How to fill out Complex Will - Income Trust For Spouse?

Have you been in a placement the place you will need documents for possibly enterprise or individual uses just about every day? There are plenty of legal file themes available online, but discovering ones you can trust isn`t simple. US Legal Forms provides a huge number of kind themes, just like the Texas Complex Will - Income Trust for Spouse, that are written to meet federal and state needs.

When you are presently knowledgeable about US Legal Forms site and get your account, merely log in. Following that, you are able to acquire the Texas Complex Will - Income Trust for Spouse design.

Should you not offer an bank account and need to begin to use US Legal Forms, follow these steps:

- Find the kind you want and ensure it is for that correct city/area.

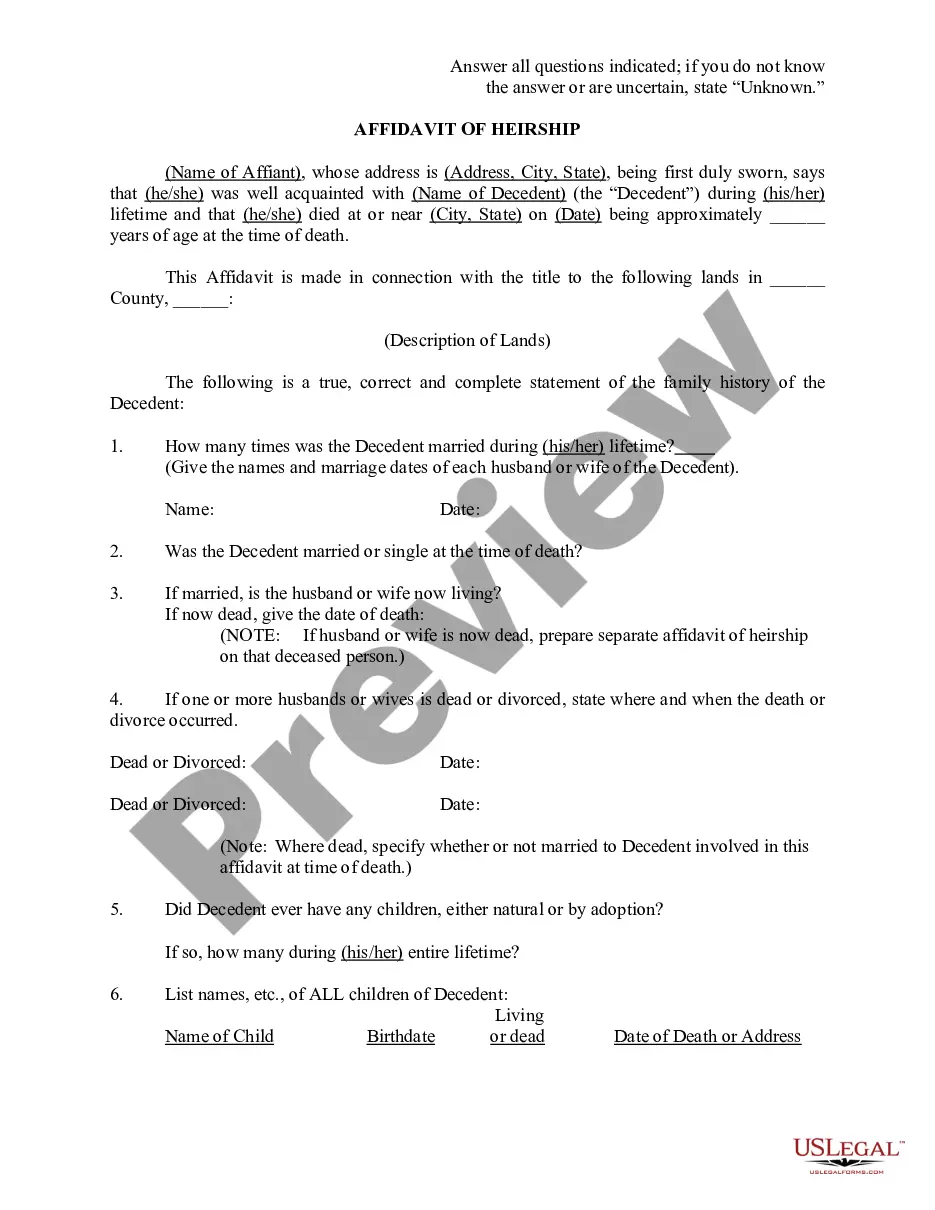

- Take advantage of the Preview option to examine the form.

- See the information to ensure that you have selected the proper kind.

- When the kind isn`t what you`re trying to find, make use of the Search industry to get the kind that fits your needs and needs.

- When you discover the correct kind, click Acquire now.

- Pick the pricing program you desire, submit the necessary information to make your account, and pay money for your order with your PayPal or charge card.

- Choose a handy data file file format and acquire your version.

Get every one of the file themes you have bought in the My Forms food selection. You can obtain a extra version of Texas Complex Will - Income Trust for Spouse at any time, if necessary. Just select the needed kind to acquire or printing the file design.

Use US Legal Forms, the most comprehensive collection of legal forms, in order to save efforts and prevent mistakes. The support provides professionally produced legal file themes which you can use for an array of uses. Create your account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

A spousal trust created in your will can protect your spouse's (and your children's) eventual inheritance, while also ensuring your assets are distributed the way you had intended.

In the event of divorce, a disadvantage of a SLAT is that the separated non-donor spouse will continue to benefit from the trust as a beneficiary while the donor spouse loses the indirect access in the same way that they would if the non-donor spouse passed away while they were still married.

There are a variety of ways that money can be left to your children, including wills, trusts, or by naming them beneficiaries of retirement plans, life insurance, and 529 plans. The best ways to leave your children money are through estate planning tools, such as wills and trusts.

Intestate Succession: Spouses and Children Stepchildren do not receive a part of your intestate estate as per the succession plan of Texas. Because the state doesn't view anyone related to you solely through marriage as an automatic heir, a stepchild's claim to your estate is null and void.

A marital trust is also beneficial since it can provide income to the surviving spouse, tax free. However, the grantor may set a limit on how much can be withdrawn from the trust over time.

A marital trust is a legal entity established to pass assets to a surviving spouse or children/grandchildren. When a spouse dies, their assets are moved into the trust. A general power of appointment, an estate trust, and a QTIP trust are three types of marital trusts.

Assets held in trust are generally not considered community or separate property. Instead, income and distributions from trusts are generally the only aspect of a trust that need characterization in a divorce.

You name a lifetime beneficiary, typically your spouse, who receives income from the trust for their lifetime. Whatever is left once the spouse dies goes to the "remainder beneficiary." Your spouse will have limited access to the principal but will receive steady income at least quarterly.