A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Miranda Warning Texas

Description

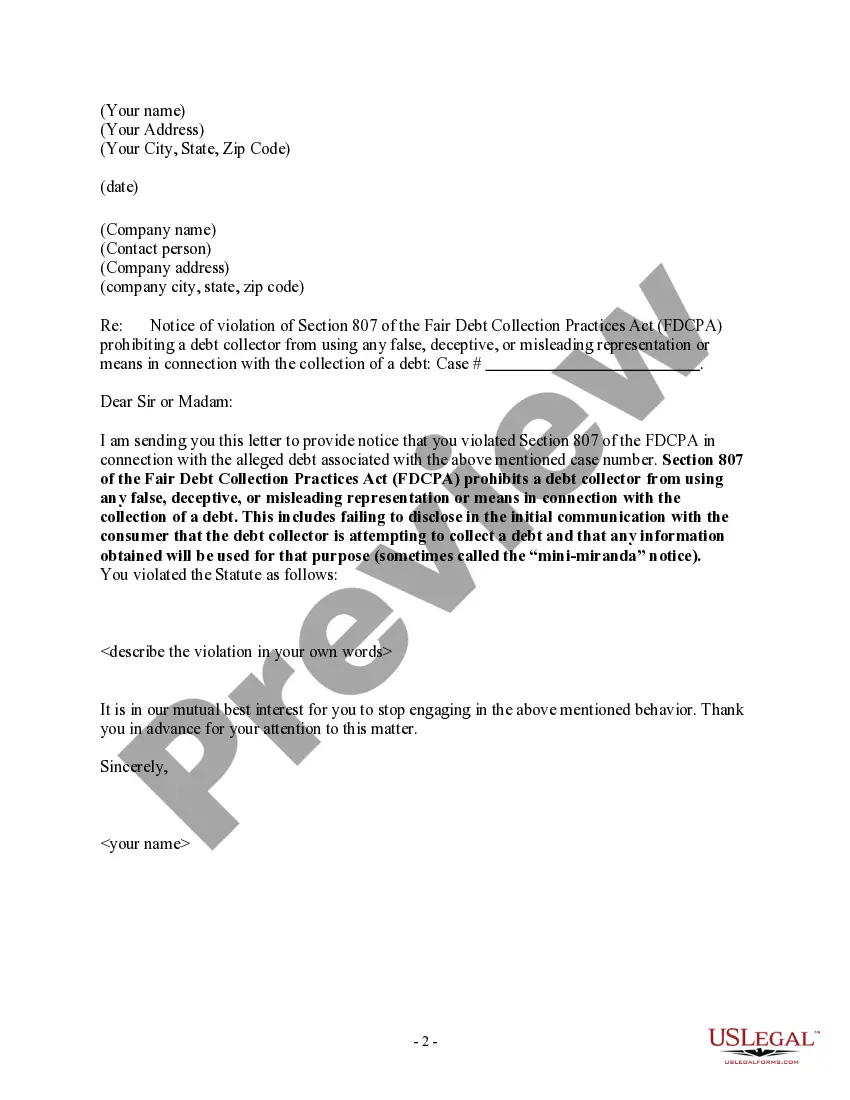

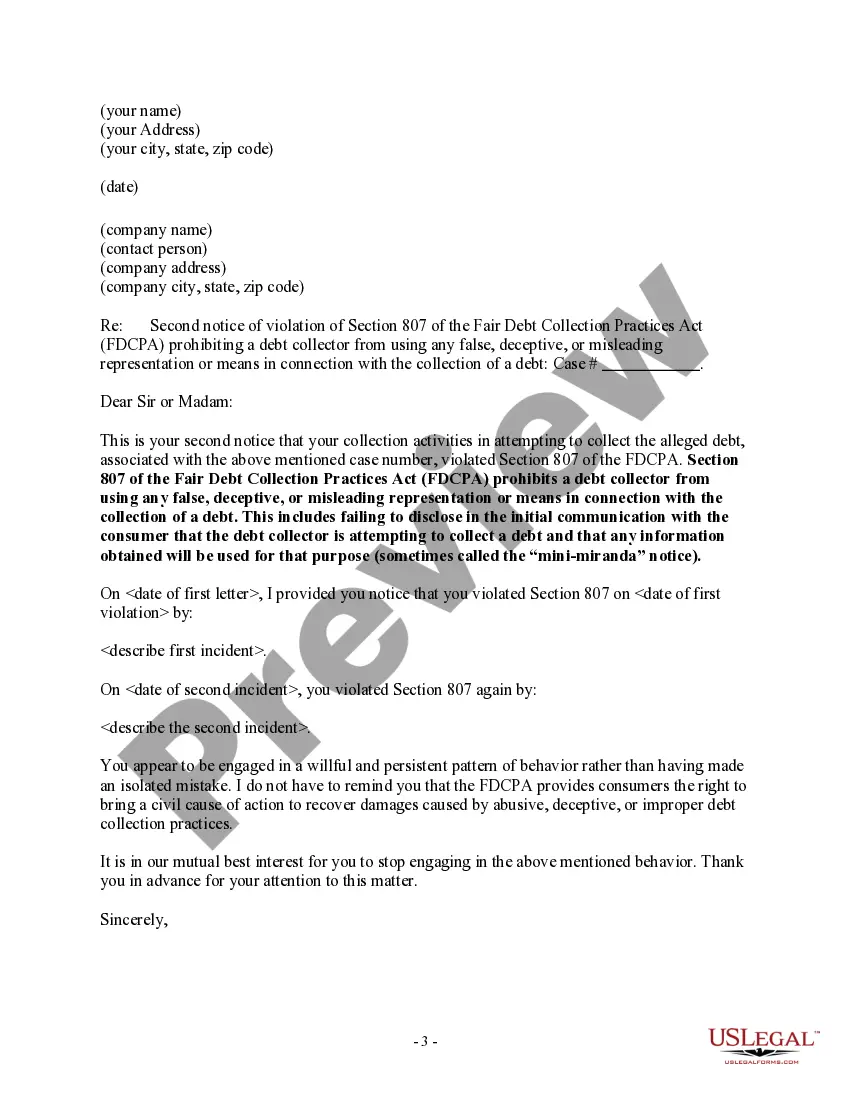

How to fill out Texas Notice To Debt Collector - Failure To Provide Mini-Miranda?

If you wish to total, obtain, or produce lawful papers templates, use US Legal Forms, the greatest collection of lawful kinds, which can be found on the web. Utilize the site`s simple and easy hassle-free lookup to get the papers you will need. Numerous templates for organization and person uses are categorized by categories and says, or key phrases. Use US Legal Forms to get the Texas Notice to Debt Collector - Failure to Provide Mini-Miranda in a handful of clicks.

When you are currently a US Legal Forms client, log in for your account and then click the Obtain option to find the Texas Notice to Debt Collector - Failure to Provide Mini-Miranda. You may also entry kinds you earlier delivered electronically in the My Forms tab of your account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the shape to the appropriate metropolis/nation.

- Step 2. Make use of the Review choice to examine the form`s content. Never forget to see the information.

- Step 3. When you are unsatisfied with the type, use the Research industry near the top of the display to discover other versions of your lawful type web template.

- Step 4. When you have identified the shape you will need, select the Purchase now option. Opt for the prices plan you favor and put your credentials to sign up to have an account.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Pick the formatting of your lawful type and obtain it on your own device.

- Step 7. Complete, modify and produce or indicator the Texas Notice to Debt Collector - Failure to Provide Mini-Miranda.

Every lawful papers web template you purchase is yours eternally. You might have acces to every type you delivered electronically within your acccount. Select the My Forms segment and decide on a type to produce or obtain once more.

Contend and obtain, and produce the Texas Notice to Debt Collector - Failure to Provide Mini-Miranda with US Legal Forms. There are millions of professional and state-distinct kinds you may use for the organization or person requires.

Form popularity

FAQ

The Basic Law: The first notice from the debt collector to the debtor must include a warning known as the "Mini-Miranda Warning," which must state that the communication is from a debt collector and that any information obtained may be used to collect the debt.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

Under the FDCPA, debt collectors are required to identify themselves when they attempt to collect a debt as well as note that any information you give them will be used in an attempt to collect the debt. They also must give you the name of their company or agency.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

When a debt collector contacts you, they have to identify themselves as a collector and tell you they're trying to collect on a debt. This is sometimes called a "Mini Miranda requirement. This requirement was created to prevent unfair questioning and practices in the debt collection process.