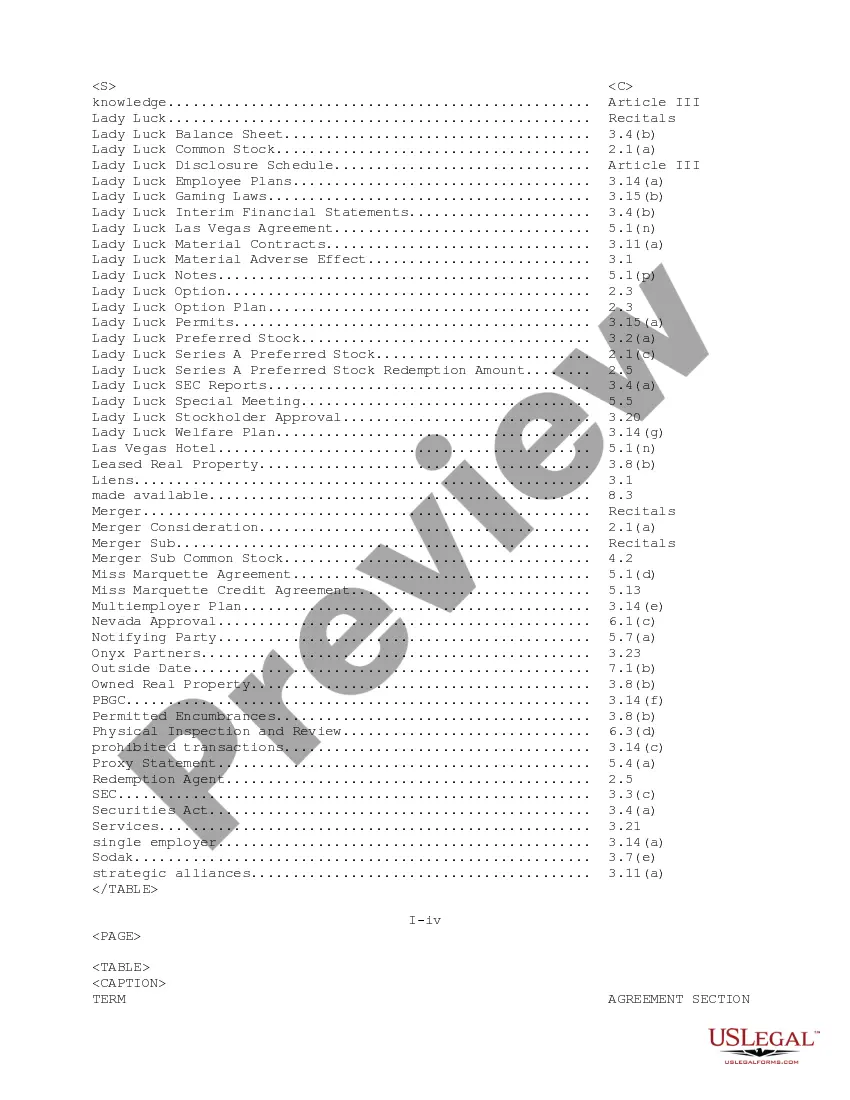

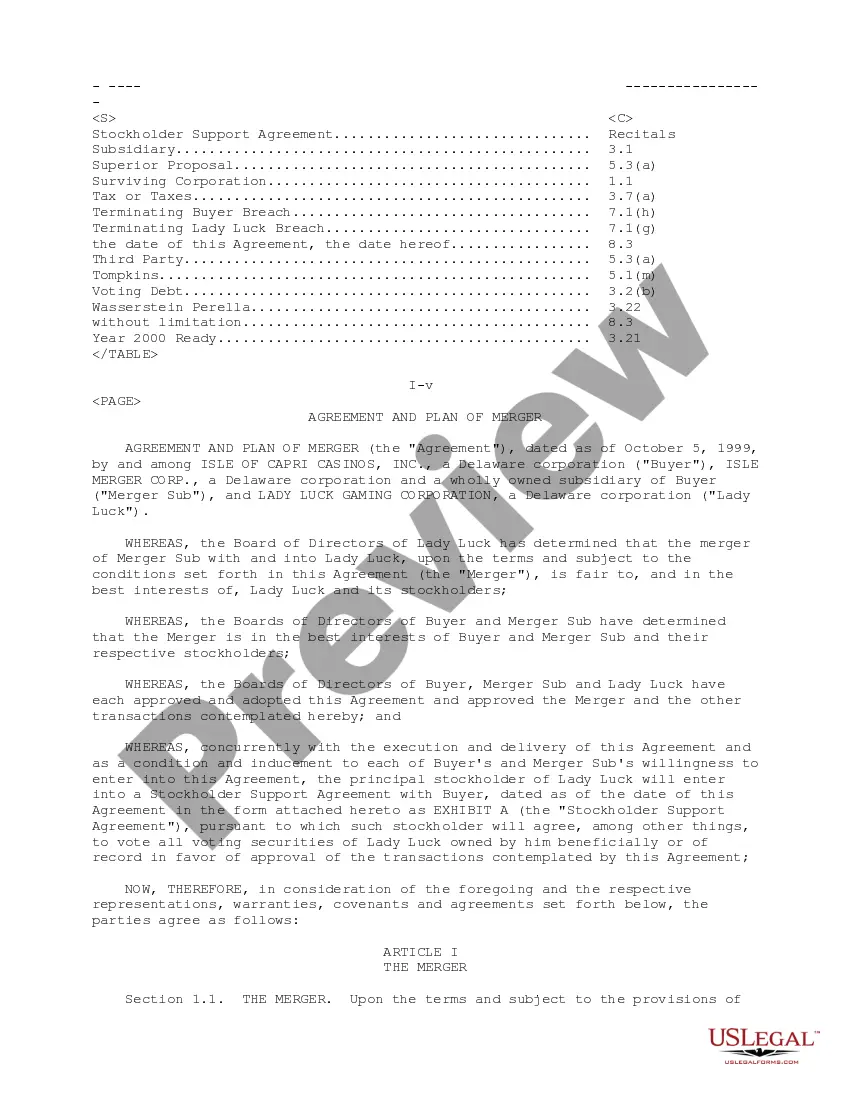

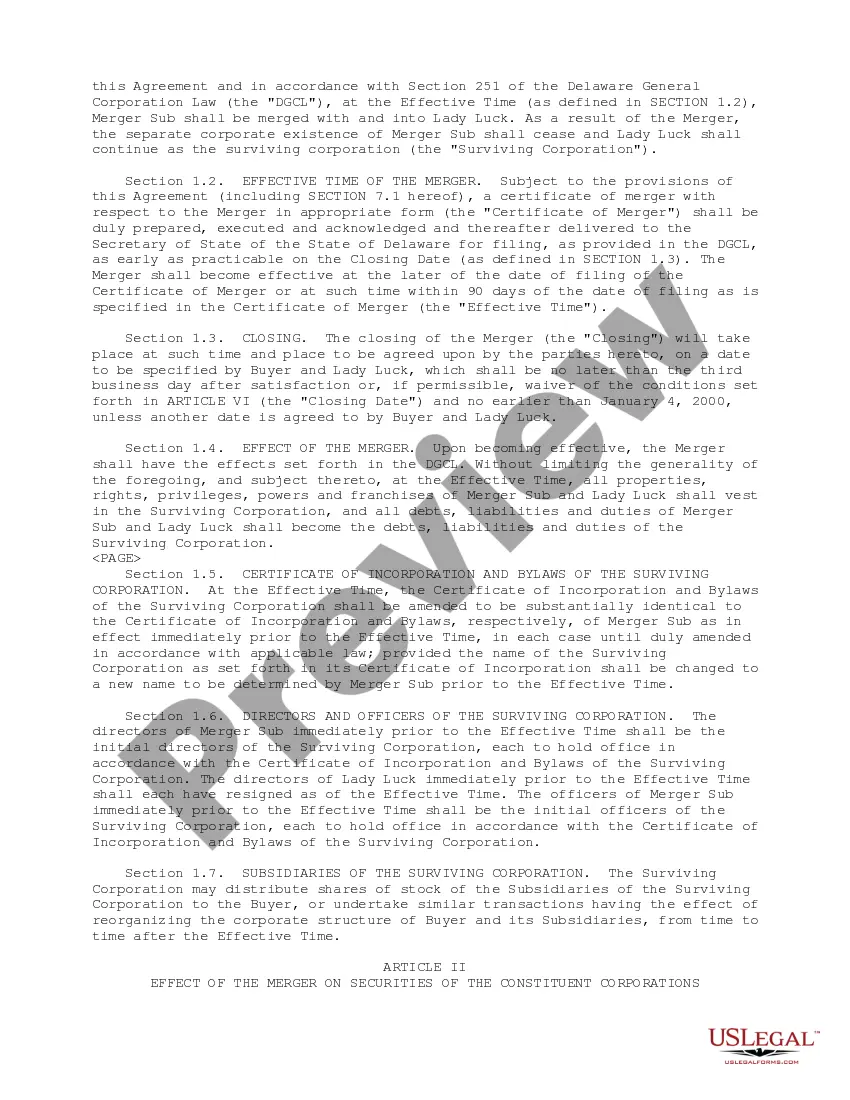

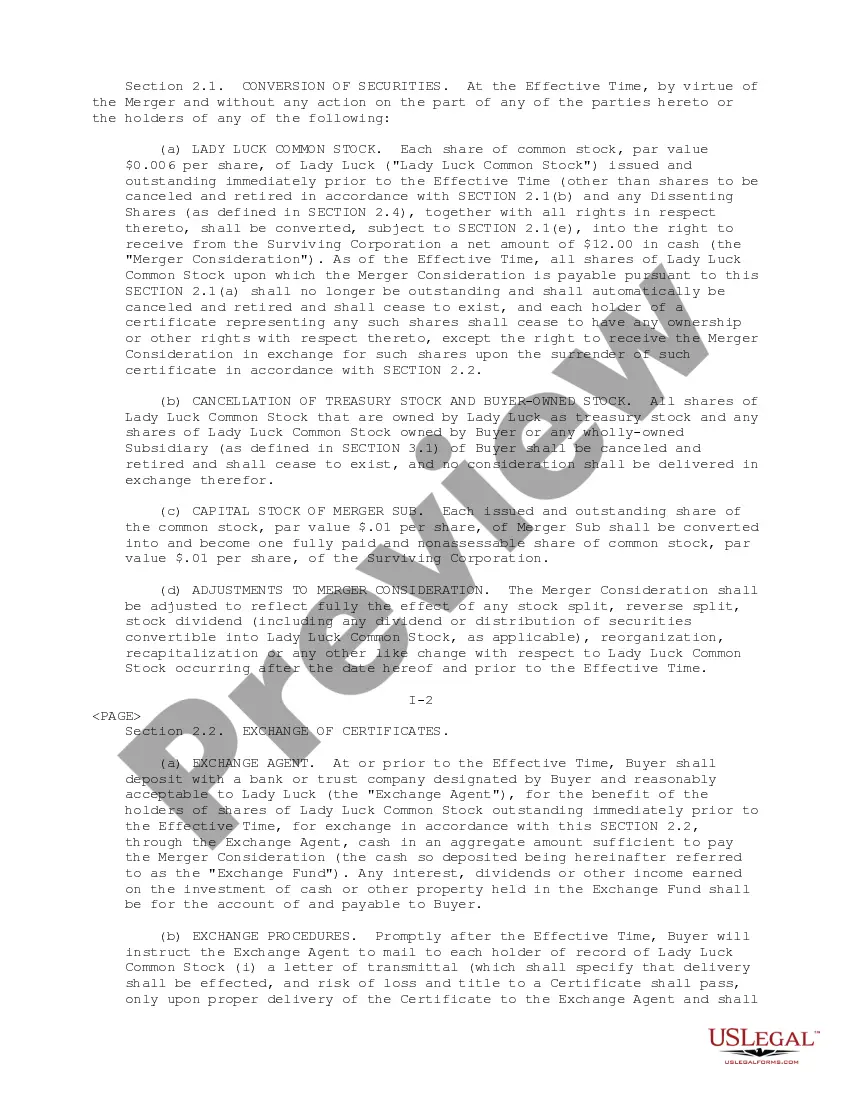

The Texas Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation is a legally binding document outlining the terms and conditions of a merger between the aforementioned companies. This merger aims to align their operations, resources, and expertise to create a stronger and more competitive entity in the gaming industry. Keywords: Texas Plan of Merger, Isle of Capri Casinos, Isle Merger Corporation, Lady Luck Gaming Corporation, merger, gaming industry. The Texas Plan of Merger involves a comprehensive process that requires careful consideration and evaluation of various aspects. It encompasses financial, legal, operational, and strategic elements to ensure a seamless integration and maximize the benefits derived from the consolidation. Several types of Texas Plan of Merger can be executed between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation, depending on the desired outcome and specific circumstances. These types may include: 1. Statutory Merger: This type of merger involves the absorption of one or more companies into another entity. In this case, Isle Merger Corporation could merge with Isle of Capri Casinos, Inc., or vice versa, while ensuring the creation of a new entity or continuation of one of the existing entities. 2. Acquisition Merger: This form of merger involves taking over the operations and assets of another company. In this scenario, Isle of Capri Casinos, Inc., or Isle Merger Corporation could acquire Lady Luck Gaming Corporation, leading to the consolidation of their operations under a single corporate structure. 3. Consolidation Merger: This type of merger involves the formation of an entirely new entity, combining the resources and operations of all parties involved. In this case, Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation could form a new corporation, enabling a fresh start and enhanced market positioning. The Texas Plan of Merger outlines the terms of the agreement, including the exchange ratio for the stockholders, the allocation of assets and liabilities, the governance structure of the merged entity, and any additional considerations such as non-compete clauses or employee retention programs. Overall, the Texas Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation represents a strategic move to leverage their collective strengths, expand their market presence, and drive long-term growth in the dynamic and competitive gaming industry.

Texas Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation

Description

How to fill out Texas Plan Of Merger Between Isle Of Capri Casinos, Inc., Isle Merger Corporation And Lady Luck Gaming Corporation?

Are you inside a position where you need papers for possibly company or person reasons almost every time? There are plenty of legitimate document web templates available online, but getting kinds you can rely isn`t straightforward. US Legal Forms provides 1000s of kind web templates, like the Texas Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation, which can be created in order to meet federal and state requirements.

When you are presently familiar with US Legal Forms website and get a free account, basically log in. After that, you are able to download the Texas Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation template.

Unless you come with an profile and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you require and ensure it is for that proper city/area.

- Utilize the Preview key to analyze the shape.

- Look at the description to actually have selected the proper kind.

- In case the kind isn`t what you are searching for, take advantage of the Research industry to obtain the kind that fits your needs and requirements.

- Whenever you get the proper kind, click Acquire now.

- Choose the rates program you would like, fill in the necessary info to generate your bank account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Decide on a handy document structure and download your backup.

Get every one of the document web templates you have purchased in the My Forms menu. You can obtain a more backup of Texas Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation whenever, if necessary. Just click the required kind to download or print out the document template.

Use US Legal Forms, one of the most considerable variety of legitimate types, to conserve time as well as avoid mistakes. The service provides professionally made legitimate document web templates which you can use for a range of reasons. Create a free account on US Legal Forms and initiate creating your lifestyle a little easier.