Title: Exploring the Texas Lease Agreement for Office Building Between Ryan South bank II, LLC and Mind spring Enterprises, Inc. Introduction: The Texas Lease Agreement plays a significant role in establishing the terms and conditions of a lease agreement between Ryan South bank II, LLC and Mind spring Enterprises, Inc. In this article, we will dive into the specifics of this agreement, focusing on its purpose, key elements, and potential variations that may exist of this lease type. Key Terms: 1. Lease Agreement: A legal contract outlining the rights and responsibilities of both the lessor (Ryan South bank II, LLC) and the lessee (Mind spring Enterprises, Inc.) for the leasing of an office building in Texas. 2. Office Building: A commercial property specifically designed and intended for office spaces. 3. Lessor: Ryan South bank II, LLC — The owner or landlord providing the office building for lease. 4. Lessee: Mind spring Enterprises, Inc. — The tenant or renter acquiring the lease rights to occupy and use the office building. Elements Covered by the Texas Lease Agreement: 1. Parties and Property Details: — Identification of both the lessor (Ryan South bank II, LLC) and lessee (Mind spring Enterprises, Inc.), including their respective legal names and contact information. — Detailed description and address of the office building being leased. 2. Lease Terms and Duration: — Start and end dates of the lease agreement. — Renewal or termination conditions, including any notice periods required. — Any provisions regarding lease renewal or extension options. 3. Rent and Payment Schedule: — Stipulated rent amount and frequency of payment. — Description of rent payment methods— - Policies concerning late fees, security deposits, and rent escalation clauses. 4. Maintenance and Repairs: — Responsibilities and obligations of the lessor and lessee regarding property maintenance and repairs. — Outlining who is responsible for specific repairs, such as structural or cosmetic issues. — Ensuring compliance with relevant laws regarding building maintenance and safety. 5. Alterations and Improvements: — Guidelines for any alterations, renovations, or improvements to the office building. — Specifications on seeking prior written consent from the lessor before undertaking any modifications. Types of Texas Lease Agreements: 1. Triple Net Lease Agreement: This agreement requires the lessee to cover additional expenses such as property taxes, insurance, and maintenance costs, in addition to the base rent. 2. Gross Lease Agreement: In contrast to the triple net lease, this agreement places the responsibility of taxes, insurance, and maintenance costs solely on the lessor, with the lessee paying a fixed monthly rent. Conclusion: The Texas Lease Agreement for an office building between Ryan South bank II, LLC and Mind spring Enterprises, Inc. establishes a binding relationship and comprehensive guidelines for both parties involved. By ensuring clarity on crucial aspects of the lease, such as rent, duration, and maintenance, this agreement serves as a foundation for a smooth landlord-tenant relationship.

Texas Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc.

Description

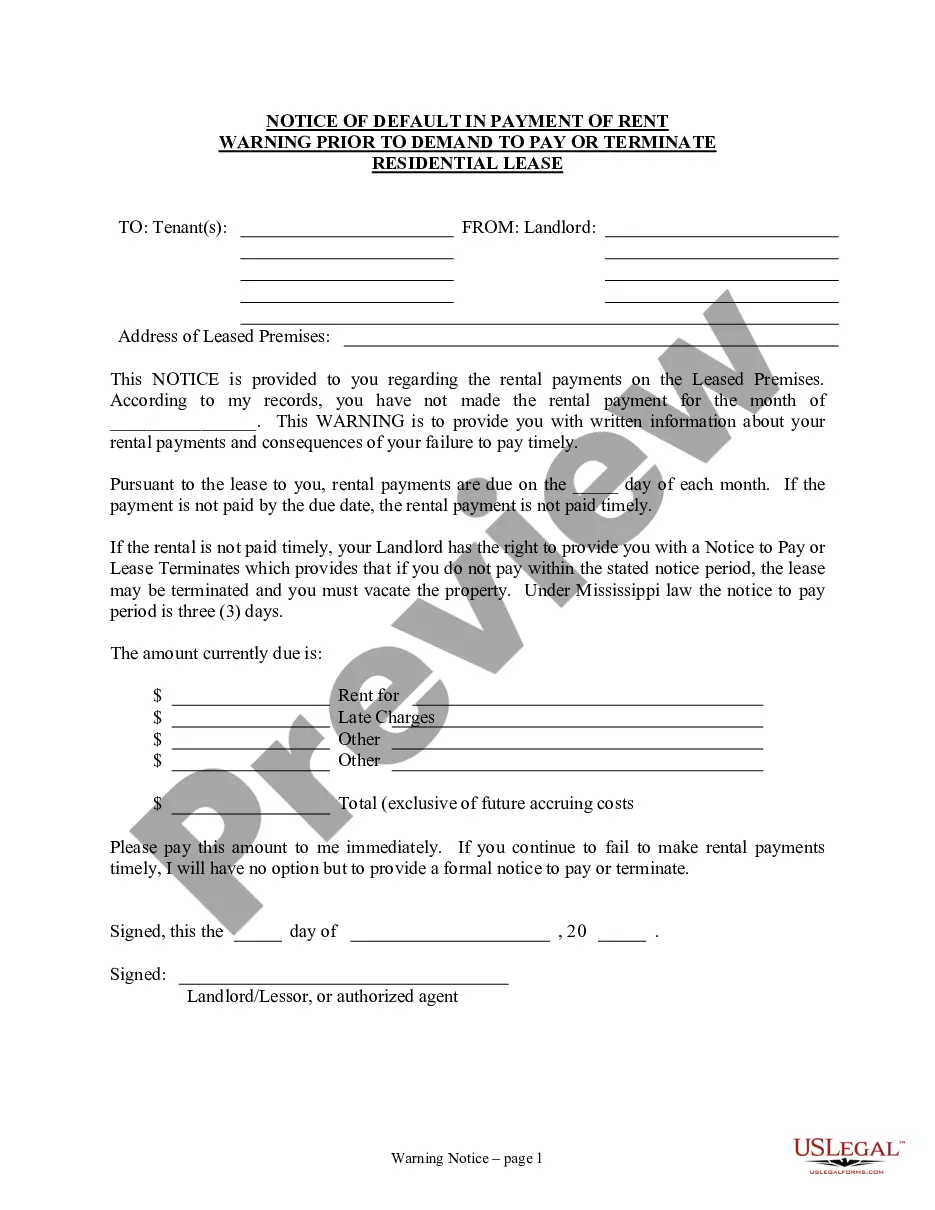

How to fill out Texas Lease Agreement Regarding Lease Of Office Building Between Ryan Southbank II, LLC And Mindspring Enterprises, Inc.?

Are you presently in the place the place you require files for possibly enterprise or personal reasons virtually every day? There are plenty of legitimate document web templates available on the net, but getting ones you can trust is not effortless. US Legal Forms delivers thousands of develop web templates, like the Texas Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc., which can be composed in order to meet state and federal requirements.

If you are previously acquainted with US Legal Forms site and get a free account, simply log in. Following that, you may acquire the Texas Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc. design.

If you do not provide an account and need to begin using US Legal Forms, adopt these measures:

- Find the develop you want and make sure it is to the proper city/state.

- Make use of the Preview key to review the shape.

- Read the description to ensure that you have selected the proper develop.

- In case the develop is not what you are seeking, utilize the Lookup field to obtain the develop that meets your needs and requirements.

- Once you find the proper develop, simply click Get now.

- Choose the rates prepare you want, submit the desired information to create your money, and buy the transaction with your PayPal or bank card.

- Pick a convenient document formatting and acquire your backup.

Find all the document web templates you possess purchased in the My Forms menu. You may get a additional backup of Texas Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc. anytime, if possible. Just go through the essential develop to acquire or print out the document design.

Use US Legal Forms, by far the most substantial selection of legitimate types, to save time as well as steer clear of mistakes. The service delivers professionally produced legitimate document web templates that you can use for a selection of reasons. Generate a free account on US Legal Forms and initiate generating your lifestyle easier.