Texas Recapitalization Agreement is a legal document designed to restructure and recapitalize companies located in the state of Texas, USA. It provides a framework for companies to undergo financial restructuring and inject fresh capital into their operations in order to improve or restore their financial health. This agreement is often utilized by struggling companies that are facing significant financial challenges, such as a cash shortage, excessive debt, or declining profitability. By entering into a recapitalization agreement, these companies aim to strengthen their balance sheets, enhance their cash flow, and ultimately regain their competitiveness in the market. There can be several types of Texas Recapitalization Agreements, depending on the specific needs and circumstances of the company involved: 1. Debt Recapitalization Agreement: This type of agreement focuses on restructuring the company's existing debt obligations. It may involve negotiations with creditors to modify repayment terms, extend maturities, reduce interest rates, or even write off a portion of the debt. By reducing the burden of debt, the company can regain financial stability and improve its ability to invest in growth opportunities. 2. Equity Recapitalization Agreement: In this case, the agreement aims to inject fresh equity capital into the company. This can be achieved through various means, such as issuing new shares, attracting new investors, or securing additional funding from existing shareholders. By strengthening its equity base, the company can enhance its financial resources, expand its operations, or undertake strategic initiatives to revive profitability. 3. Asset Recapitalization Agreement: This agreement focuses on restructuring the company's assets to improve its financial position. It may involve selling non-core assets, restructuring or refinancing existing assets, or even acquiring new assets to diversify the company's revenue streams. By optimizing its asset portfolio, the company can increase its value, generate cash, and improve its financial performance. 4. Operational Recapitalization Agreement: This type of agreement concentrates on improving the company's operational efficiency and effectiveness. It may involve implementing cost-cutting measures, streamlining processes, enhancing productivity, or introducing new management practices. By improving its operations, the company can reduce expenses, increase profitability, and create a solid foundation for future growth. Overall, Texas Recapitalization Agreement offers struggling companies in Texas a chance to restructure their finances, attract fresh capital, and revitalize their businesses. It allows them to overcome financial difficulties, strengthen their market position, and pursue long-term sustainability.

Texas Recapitalization Agreement

Description

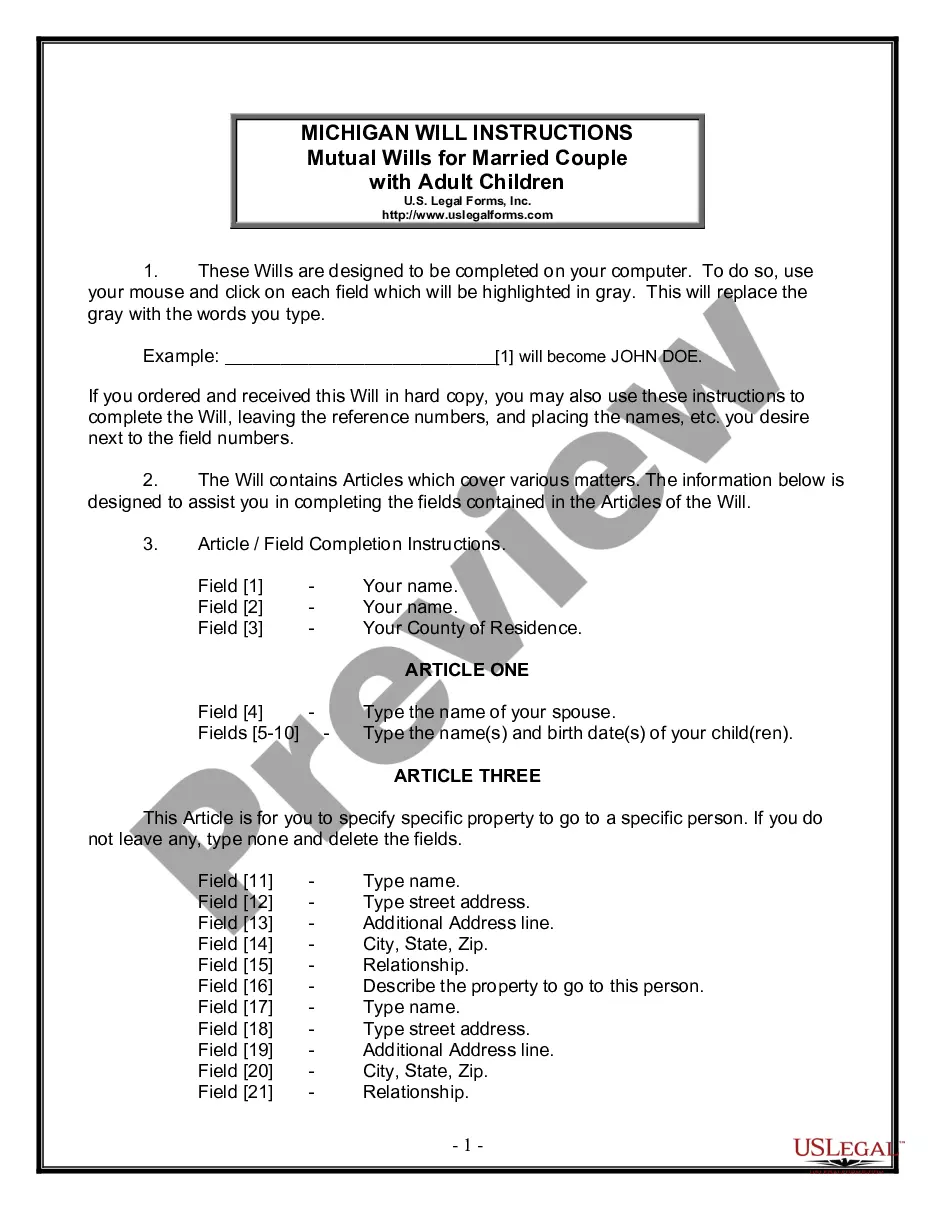

How to fill out Texas Recapitalization Agreement?

Choosing the best legal document web template can be quite a battle. Of course, there are a variety of templates available on the net, but how do you find the legal kind you will need? Use the US Legal Forms site. The service provides a huge number of templates, including the Texas Recapitalization Agreement, that can be used for company and private demands. All the kinds are examined by specialists and meet up with federal and state demands.

In case you are already listed, log in to your account and then click the Download option to get the Texas Recapitalization Agreement. Make use of your account to check from the legal kinds you may have acquired earlier. Go to the My Forms tab of your own account and obtain one more copy in the document you will need.

In case you are a whole new user of US Legal Forms, listed below are easy recommendations that you can follow:

- Initially, make certain you have chosen the appropriate kind for your city/area. You can examine the shape using the Preview option and read the shape information to guarantee this is the best for you.

- If the kind is not going to meet up with your requirements, take advantage of the Seach discipline to find the right kind.

- When you are sure that the shape is acceptable, go through the Acquire now option to get the kind.

- Choose the costs prepare you would like and enter in the necessary info. Create your account and pay money for an order using your PayPal account or bank card.

- Choose the submit formatting and obtain the legal document web template to your system.

- Full, change and print out and indication the attained Texas Recapitalization Agreement.

US Legal Forms is definitely the greatest collection of legal kinds where you can see different document templates. Use the company to obtain expertly-made files that follow state demands.

Form popularity

FAQ

Leveraged recapitalization, leveraged buyouts, nationalization, and equity recapitalization are various types of recapitalization. One may also use this process as an opening route in private equity.

Recapitalization is the restructuring of a company's debt and equity ratio. The purpose of recapitalization is to stabilize a company's capital structure. Some of the reasons a company may consider recapitalization include a drop in its share price, to defend against a hostile takeover, or bankruptcy.

Equity Recapitalization The move can benefit companies that have a high debt-to-equity ratio. A high debt-to-equity ratio puts an additional burden on a company, as it must pay interest on its debt securities. Higher debt levels also increase a company's risk level, making it less attractive to investors.

Leveraged recapitalizations have a similar structure to that employed in leveraged buyouts (LBO), to the extent that they significantly increase financial leverage. But unlike LBOs, they may remain publicly traded.

Cons of Majority Recapitalization Here are a few potential drawbacks to keep in mind: Dilution of Ownership: By selling a majority stake, existing shareholders dilute their share of the company's equity into a minority position (or sell entirely), weakening their influence over decision-making.