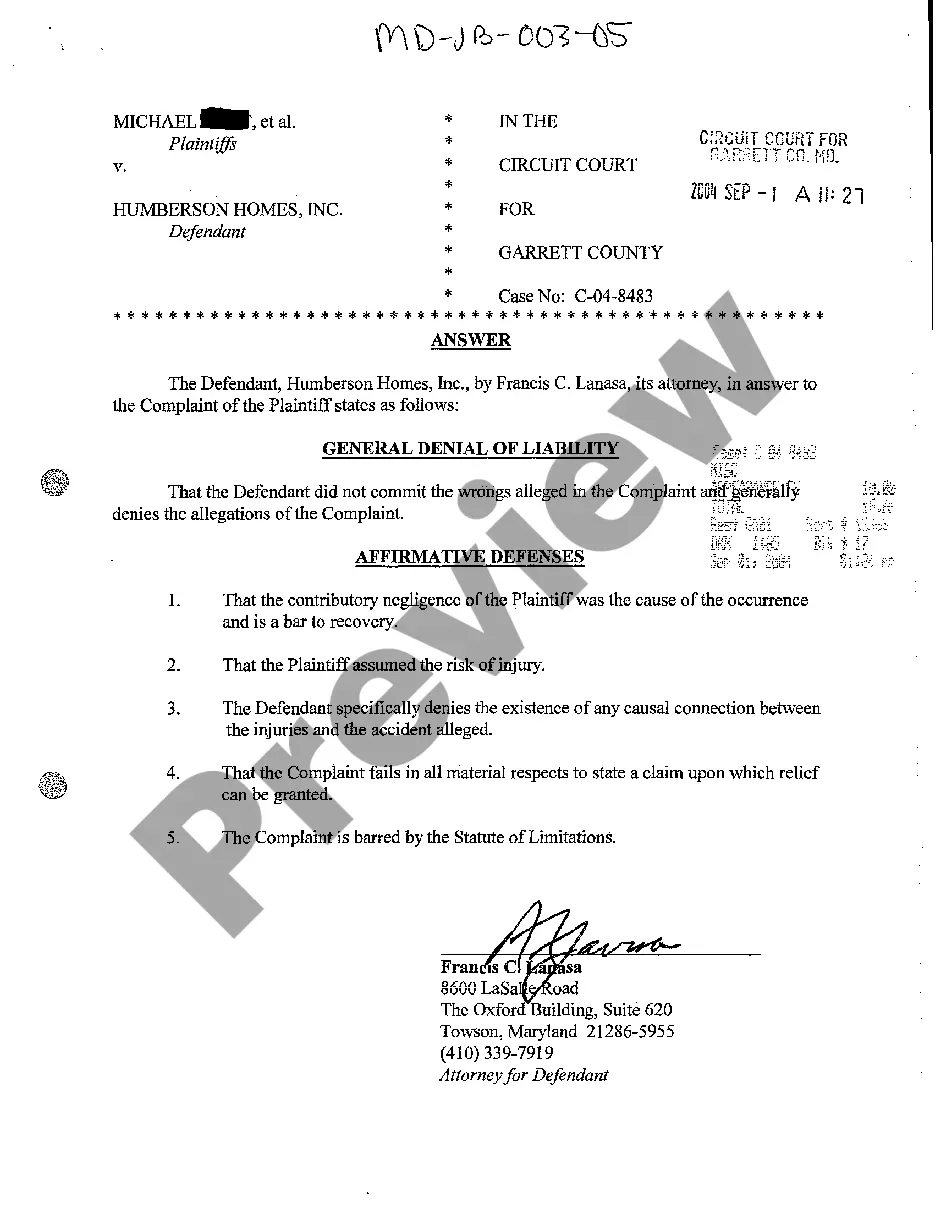

A Texas Participation Agreement is a legal document that outlines the terms and conditions of an agreement between Variable Insurance Products Fund, III (VIP Fund III) and Lincoln Life and Annuity Company of New York (Lincoln Life). This agreement is specific to the state of Texas and governs the participation of Lincoln Life in the investment activities of VIP Fund III. Keywords: Texas, Participation Agreement, Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York. The Texas Participation Agreement between VIP Fund III and Lincoln Life serves as a framework for their collaboration in the realm of variable insurance products. It details the responsibilities, obligations, and rights of each party involved. This agreement ensures that both VIP Fund III and Lincoln Life comply with the laws and regulations of Texas. There may be different types of Texas Participation Agreements between VIP Fund III and Lincoln Life, each serving a specific purpose or addressing different aspects of their partnership. Some examples include: 1. Investment Participation Agreement: This type of agreement outlines the terms and conditions regarding Lincoln Life's participation in the investment activities of VIP Fund III. It establishes the investment strategies, asset allocation, and risk management guidelines that both parties should adhere to. Additionally, it may specify the obligations of each party in terms of reporting, fund allocation, and decision-making processes. 2. Distribution Participation Agreement: In this type of agreement, VIP Fund III and Lincoln Life establish the terms and conditions for the distribution of variable insurance products in Texas. It covers topics such as sales commissions, marketing support, licensing requirements, and product pricing. The agreement may also define the responsibilities of each party in terms of customer servicing, complaints handling, and regulatory compliance. 3. Administrative Participation Agreement: An administrative participation agreement focuses on the administrative aspects of the collaboration between VIP Fund III and Lincoln Life. It may cover areas such as record-keeping, financial reporting, tax compliance, and regulatory filings. This type of agreement ensures that both parties have a clear understanding of their administrative duties and responsibilities. It is important to note that the specific types of Texas Participation Agreements between VIP Fund III and Lincoln Life may vary depending on the nature and scope of their collaboration, as well as the regulatory requirements of the state of Texas. Each agreement is tailored to meet the unique needs and objectives of the parties involved, while ensuring compliance with applicable laws and regulations.

Texas Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York

Description

How to fill out Texas Participation Agreement Between Variable Insurance Products Fund, III, Lincoln Life And Annuity Company Of New York?

US Legal Forms - one of many largest libraries of lawful types in the States - gives a wide array of lawful record templates you may down load or print out. Utilizing the site, you will get 1000s of types for business and person uses, sorted by categories, says, or search phrases.You can find the most up-to-date versions of types just like the Texas Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York within minutes.

If you have a registration, log in and down load Texas Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York from your US Legal Forms collection. The Download button will appear on every single type you see. You get access to all earlier delivered electronically types in the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, here are easy guidelines to obtain started:

- Make sure you have picked the proper type for your area/state. Select the Preview button to review the form`s information. Look at the type explanation to ensure that you have selected the right type.

- When the type doesn`t match your specifications, use the Lookup industry at the top of the monitor to find the one who does.

- In case you are happy with the form, validate your selection by clicking the Buy now button. Then, choose the pricing strategy you prefer and provide your credentials to sign up for the accounts.

- Approach the purchase. Make use of Visa or Mastercard or PayPal accounts to complete the purchase.

- Choose the format and down load the form in your gadget.

- Make modifications. Fill out, change and print out and indicator the delivered electronically Texas Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York.

Each design you included with your bank account does not have an expiration time and is your own forever. So, if you wish to down load or print out yet another copy, just go to the My Forms segment and click on about the type you will need.

Obtain access to the Texas Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York with US Legal Forms, by far the most substantial collection of lawful record templates. Use 1000s of professional and express-specific templates that meet your business or person requires and specifications.

Form popularity

FAQ

Long-Term Care Customer Service: 888-503-8110. Variable Annuities (Prudential): 800-457-7617. Licensing and Commissions: 844-768-6777. LBL Home Office (for non-service related questions): 888-674-3667.

Third, variable annuities let you receive periodic income payments for a specified period or the rest of your life (or the life of your spouse). This process of turning your investment into a stream of periodic income payments is known as annuitization. Variable Annuities | Investor.gov Investor.gov ? insurance-products ? varia... Investor.gov ? insurance-products ? varia...

While variable annuities have greater potential for earnings, since their interest rate rises and falls with their underlying investments, they can lose money. They are also riddled with fees, which can cut into profits. Fixed annuities typically earn at a lower, stable rate. Variable Annuity: Definition, How It Works, and vs. Fixed Annuity Investopedia ? ... ? Annuities Investopedia ? ... ? Annuities

A variable annuity is a contract between you and an insurance company, under which the insurer agrees to make periodic pay- ments to you, beginning either immediately or at some future date. You purchase a variable annuity contract by making either a single purchase payment or a series of purchase payments.

Variable Annuity Disadvantages There are two big disadvantages to variable annuities that you should take into account when comparing annuity plans?the possibility of market loss and high management fees and account charges. You may also have IRS penalties and tax implications to consider. Pros and Cons of a Variable Annuity: What You Should Know canvasannuity.com ? blog ? variable-annuities-pr... canvasannuity.com ? blog ? variable-annuities-pr...

With variable annuities you assign a beneficiary, who would receive a specified amount of money if you pass away. This is typically the remaining value of the annuity or the sum of your premiums, minus any withdrawals. This is a bit different from a variable life insurance policy, which has a lifelong death benefit.

For example, a 65-year-old man who invests $50,000 in an immediate annuity could receive about $247 per month for life. A 70-year-old man who invests $50,000 could receive $286 per month, in part because his life expectancy is shorter. And second, that you might get even more if interest rates rise by then. 5 Things You Should Know About Annuities - AARP aarp.org ? retirement-savings ? info-2020 aarp.org ? retirement-savings ? info-2020

If I complete the form I received in the mail, how long will it take to get a check? It may take up to eight weeks once all required documentation is received. However, if you are the beneficiary claiming funds, it may take longer and additional documentation may be requested at a later date.