Texas Share Exchange Agreement is a legally binding contract that governs the exchange of nonvoting shares of capital stock among shareholders in the state of Texas. This agreement outlines the terms, conditions, and procedures for shareholders who wish to participate in the exchange of their shares. The Texas Share Exchange Agreement is specifically designed for shareholders who hold nonvoting shares of capital stock in a company. These nonvoting shares do not grant voting rights to the shareholders but entitle them to certain economic benefits, such as dividends and distributions. When shareholders decide to exchange their nonvoting shares, this agreement ensures a fair and transparent process. It outlines the valuation methodology that will be used to determine the exchange ratio between the nonvoting shares and the new shares being issued. Typically, this valuation is based on the market value of the company, as determined by a qualified independent appraiser. There are different types of Texas Share Exchange Agreements regarding shareholders issued exchangeable nonvoting shares of capital stock, including: 1. Single-Party Exchange Agreement: This type of agreement involves only one shareholder who wishes to exchange their nonvoting shares for other shares. It outlines the details of the exchange process, including the number of shares to be exchanged, the valuation methodology, and any restrictions or conditions. 2. Multi-Party Exchange Agreement: In cases where multiple shareholders are involved in the exchange, a multi-party exchange agreement is utilized. This agreement outlines the roles and responsibilities of each shareholder, as well as the overall process for exchanging the nonvoting shares. 3. Cross-Border Exchange Agreement: This type of agreement is relevant when shareholders from different jurisdictions wish to exchange their nonvoting shares. It addresses any legal and regulatory considerations and ensures compliance with both Texas state laws and the laws of other jurisdictions involved. Furthermore, the Texas Share Exchange Agreement may also include provisions regarding the transferability of the exchanged shares, the treatment of fractional shares, rights and obligations of the new shareholders, and any other pertinent matters. In summary, the Texas Share Exchange Agreement is a comprehensive document that regulates the exchange of nonvoting shares of capital stock among shareholders. It provides a framework for a fair and transparent process, and it effectively protects the interests of shareholders involved in the exchange.

Texas Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

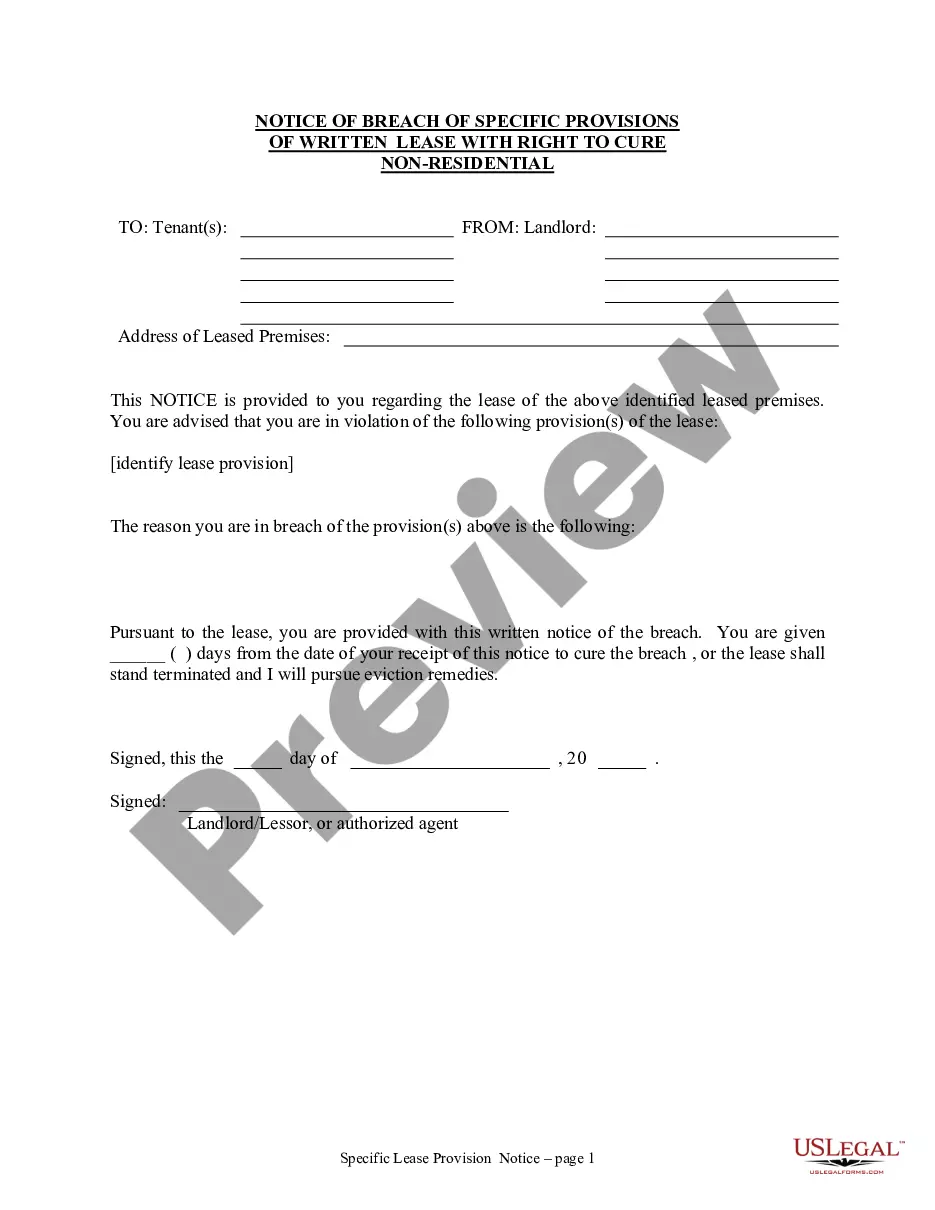

How to fill out Texas Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

If you have to comprehensive, obtain, or print authorized papers layouts, use US Legal Forms, the biggest selection of authorized forms, that can be found on-line. Take advantage of the site`s basic and handy lookup to find the files you will need. A variety of layouts for organization and individual purposes are categorized by categories and suggests, or search phrases. Use US Legal Forms to find the Texas Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock in a number of mouse clicks.

In case you are already a US Legal Forms client, log in to the profile and click the Download option to have the Texas Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock. You can also gain access to forms you formerly acquired inside the My Forms tab of the profile.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for your correct town/land.

- Step 2. Use the Review solution to look through the form`s articles. Never forget to read through the information.

- Step 3. In case you are not satisfied using the form, use the Research industry near the top of the display screen to get other variations from the authorized form format.

- Step 4. Upon having located the form you will need, select the Buy now option. Pick the prices plan you prefer and put your credentials to sign up for the profile.

- Step 5. Method the purchase. You can utilize your charge card or PayPal profile to accomplish the purchase.

- Step 6. Choose the formatting from the authorized form and obtain it on the gadget.

- Step 7. Complete, modify and print or indication the Texas Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

Every single authorized papers format you buy is the one you have permanently. You might have acces to every single form you acquired with your acccount. Click on the My Forms area and pick a form to print or obtain yet again.

Be competitive and obtain, and print the Texas Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock with US Legal Forms. There are thousands of expert and status-certain forms you can use for your personal organization or individual needs.