A Texas Security Agreement is a legally binding document that outlines the terms and conditions for borrowing funds and granting a security interest in assets. This agreement is typically entered into between a borrower and a lender in Texas. It helps protect the lender's rights and ensures that they have collateral to recover their funds in case of default by the borrower. The following are key elements and types of Texas Security Agreements relevant to borrowing of funds and granting of security interest in assets: 1. Scope and Parties: The Texas Security Agreement specifies the parties involved, including the borrower and the lender, along with their contact details and addresses. It outlines the assets that will serve as collateral to secure the borrowing. 2. Description of Assets: The agreement provides a detailed description of the assets that will be subject to the security interest. These include physical assets like machinery, equipment, inventory, and real estate, as well as intangible assets such as patents, trademarks, copyrights, and accounts receivable. 3. Granting of Security Interest: This section establishes the borrower's consent to grant the lender a security interest in the identified assets. It outlines the priority of the security interest and the lender's rights in case of default. 4. Borrower's Representations and Warranties: The Texas Security Agreement typically includes representations and warranties by the borrower to the lender, such as the legality of the assets, their ownership, and the absence of any conflicting security interests. 5. Conditions Precedent: This section outlines specific conditions that must be fulfilled before the borrower can obtain the funds, such as execution of additional documents or providing certain financial statements. 6. Events of Default: The agreement details the events that would constitute a default by the borrower, such as failure to make timely payments, violation of covenants, or bankruptcy. It outlines the consequences of default, including acceleration of the debt and the lender's remedies. 7. Governing Law and Jurisdiction: This section clarifies that the agreement is governed by Texas law and designates the courts or arbitration for dispute resolution. Types of Texas Security Agreements: 1. Real Estate Security Agreement: This type of agreement is used when real property is used as collateral, such as land, buildings, or other structures. 2. Chattel Security Agreement: This agreement applies when movable assets, such as machinery, equipment, or inventory, are used as collateral. 3. Intellectual Property Security Agreement: When intangible assets like patents, trademarks, or copyrights are used as collateral, this agreement is employed. 4. Accounts Receivable Security Agreement: This agreement is used when the borrower pledges their accounts receivable as collateral. In conclusion, a Texas Security Agreement is a crucial legal document that governs the borrowing of funds and granting of security interest in assets. It ensures the lender's protection and outlines the borrower's obligations. Various types of agreements are used depending on the nature of the assets being used as collateral.

Texas Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

How to fill out Texas Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

Are you currently in the place that you will need documents for either enterprise or specific reasons almost every working day? There are a variety of legal papers layouts accessible on the Internet, but finding kinds you can depend on is not easy. US Legal Forms gives a large number of develop layouts, such as the Texas Security Agreement regarding borrowing of funds and granting of security interest in assets, which can be created to meet state and federal requirements.

In case you are previously familiar with US Legal Forms web site and possess an account, basically log in. Afterward, you are able to obtain the Texas Security Agreement regarding borrowing of funds and granting of security interest in assets template.

Should you not come with an bank account and want to start using US Legal Forms, adopt these measures:

- Find the develop you need and make sure it is to the proper area/area.

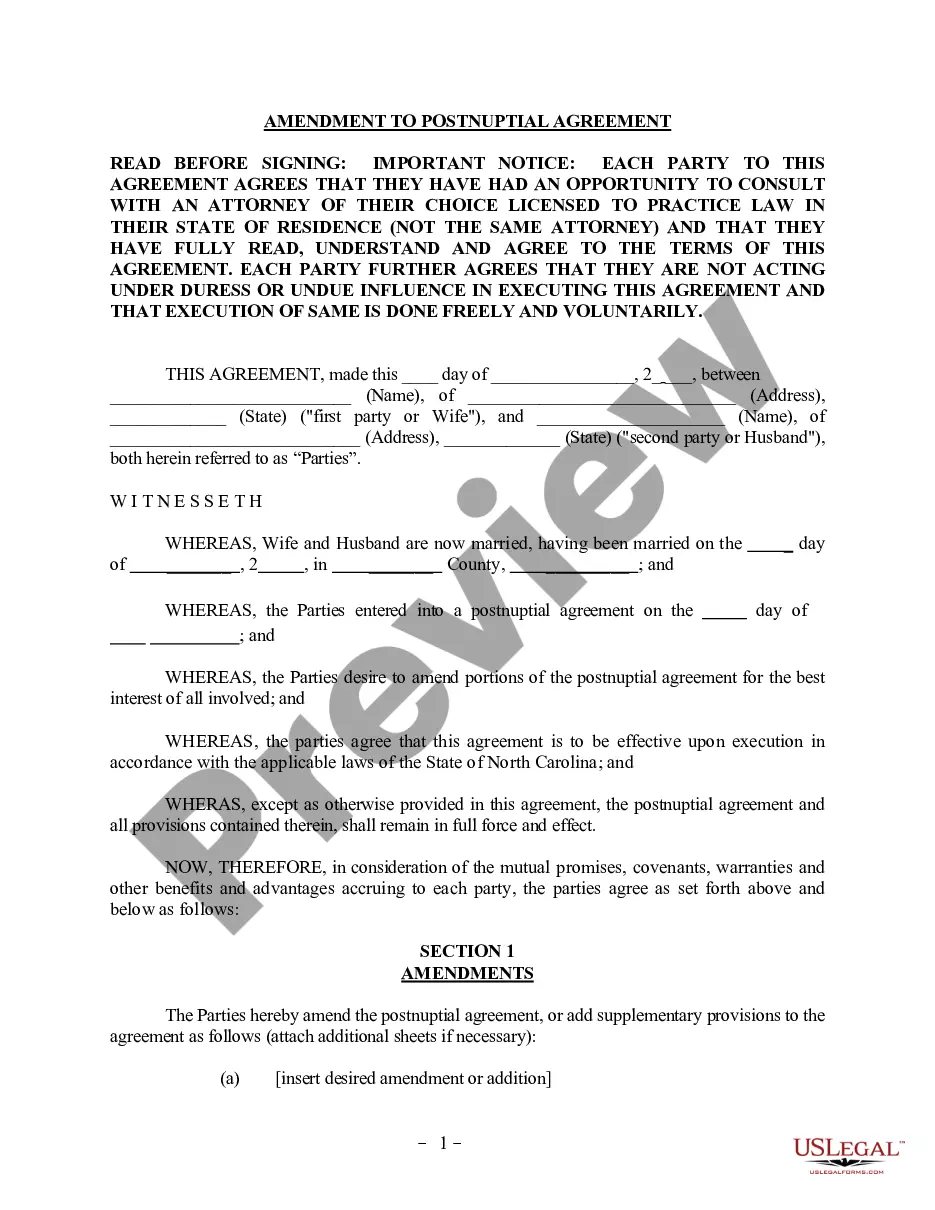

- Make use of the Preview button to review the form.

- Look at the explanation to actually have chosen the right develop.

- In the event the develop is not what you are searching for, utilize the Search discipline to get the develop that meets your needs and requirements.

- When you discover the proper develop, click on Purchase now.

- Choose the rates plan you need, fill out the necessary information to generate your account, and pay money for the transaction with your PayPal or bank card.

- Decide on a handy document structure and obtain your version.

Locate each of the papers layouts you possess bought in the My Forms food list. You can aquire a extra version of Texas Security Agreement regarding borrowing of funds and granting of security interest in assets whenever, if required. Just click on the essential develop to obtain or print out the papers template.

Use US Legal Forms, the most extensive assortment of legal forms, to save lots of time as well as steer clear of errors. The services gives professionally created legal papers layouts which you can use for an array of reasons. Produce an account on US Legal Forms and commence making your daily life easier.