Texas Subscription Agreement

Description

How to fill out Subscription Agreement?

Are you within a placement that you need to have paperwork for sometimes organization or personal functions almost every day time? There are plenty of legal document layouts accessible on the Internet, but getting types you can rely isn`t effortless. US Legal Forms delivers a large number of type layouts, such as the Texas Subscription Agreement, which can be written to satisfy state and federal demands.

Should you be currently familiar with US Legal Forms web site and get an account, simply log in. Next, you may down load the Texas Subscription Agreement web template.

If you do not come with an bank account and want to begin using US Legal Forms, abide by these steps:

- Obtain the type you require and make sure it is for your appropriate city/region.

- Use the Preview option to examine the form.

- See the explanation to ensure that you have selected the appropriate type.

- In case the type isn`t what you`re searching for, use the Lookup discipline to get the type that meets your requirements and demands.

- Whenever you discover the appropriate type, click Acquire now.

- Choose the costs program you want, submit the required information to produce your bank account, and pay money for your order using your PayPal or charge card.

- Choose a handy paper formatting and down load your version.

Get every one of the document layouts you might have bought in the My Forms menu. You can obtain a extra version of Texas Subscription Agreement whenever, if needed. Just click on the required type to down load or print the document web template.

Use US Legal Forms, by far the most comprehensive collection of legal kinds, to save some time and prevent faults. The service delivers professionally made legal document layouts which you can use for a range of functions. Make an account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

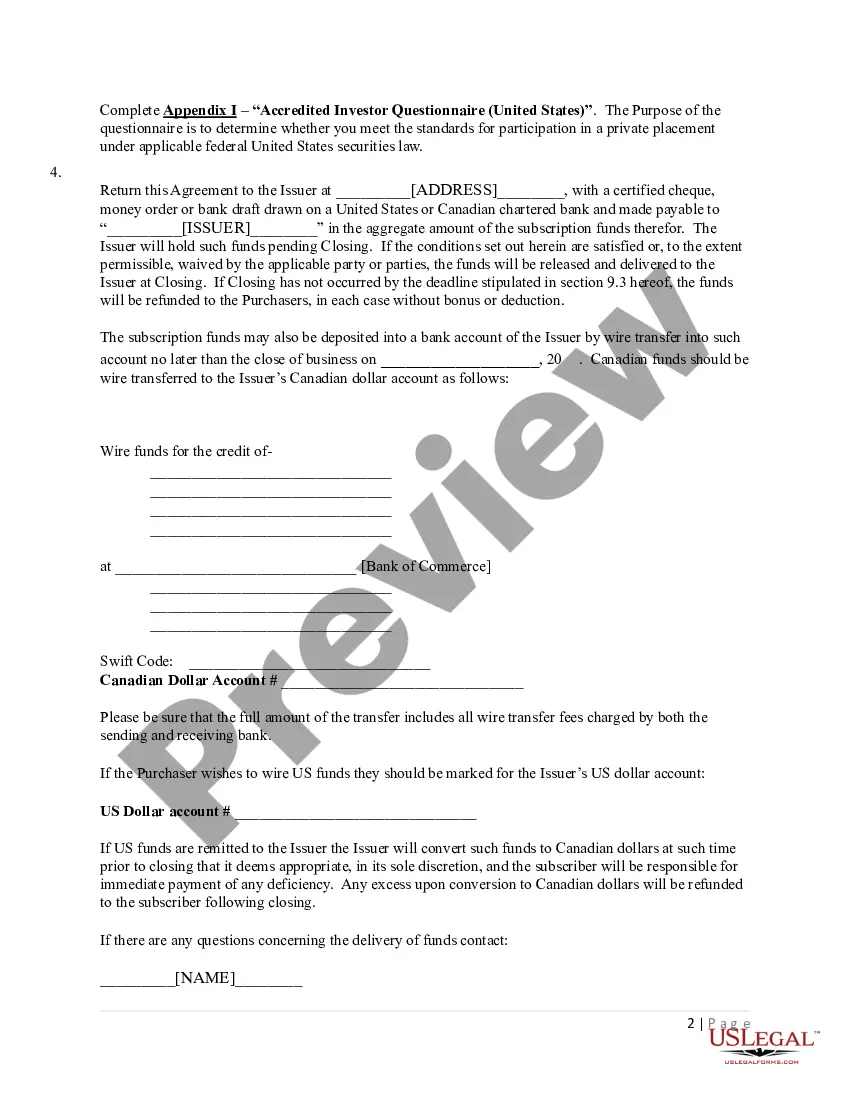

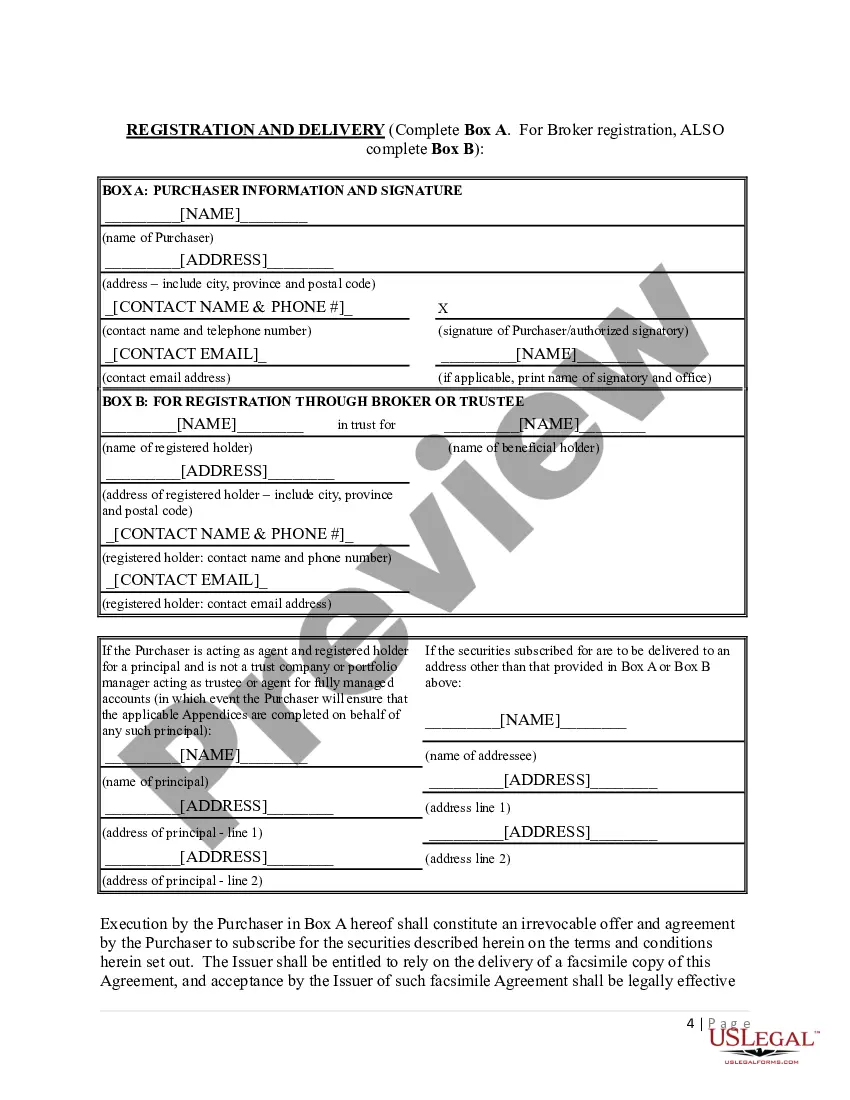

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Hear this out loud PauseAlso known as a subscription agreement. The purchase agreement is the principal agreement between the issuer and the investor, or between the issuer and the initial purchasers, in a private placement of debt or equity securities.

Hear this out loud PauseA subscription contract can be defined as regular or continuous use of a certain service or product by paying a certain amount. In this type of contract, the buyer has the right to demand a product or service from the other party for a certain period or continuously by paying a certain amount.

Hear this out loud PauseA limited partnership is when private investors or partners own the company. Under the subscription agreement, the terms are set for the company to sell a certain number of shares in return for a predetermined amount from the private investor.

Hear this out loud PauseThe Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

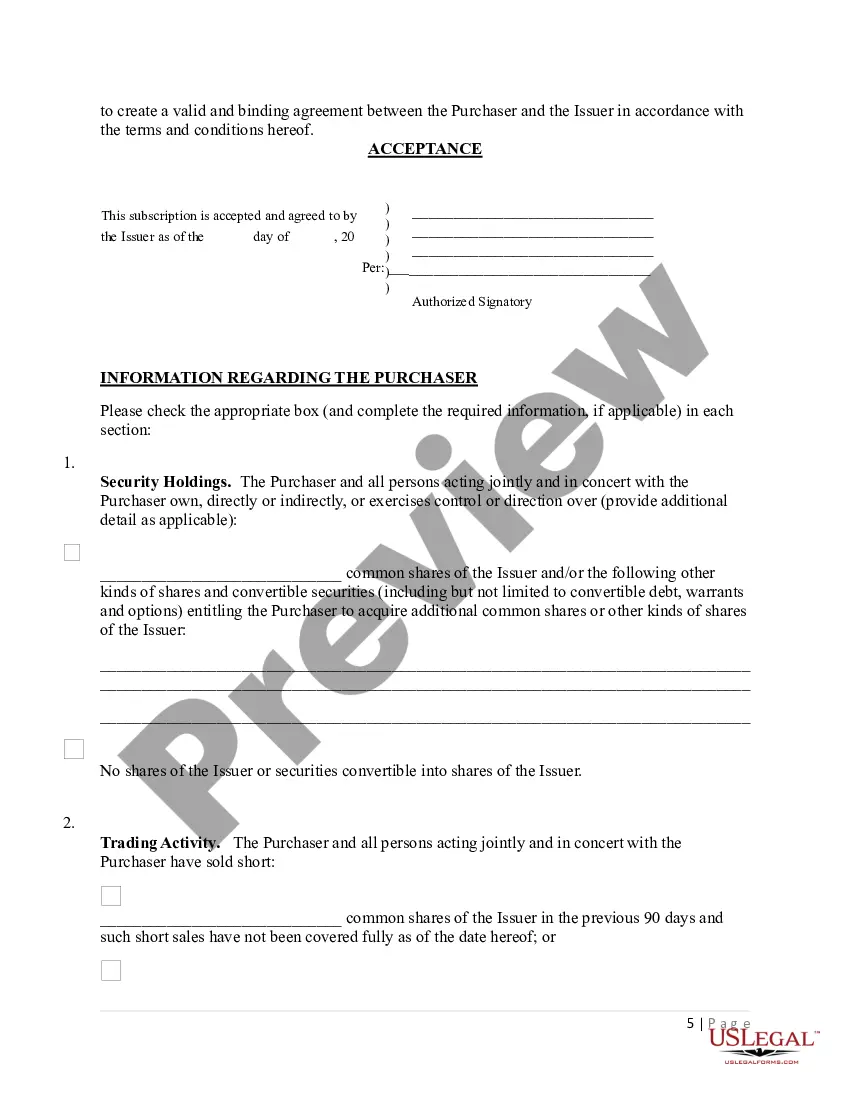

Subscription agreements are legal contracts that allow an investor to buy shares, bonds, or units of a company as a subscriber and shareholder with limited partnerships (LP) or private placement rights. Share subscription agreements are a type of subscription agreement that involves purchasing shares specifically.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.