Description: Texas Accredited Investor Representation Letter The Texas Accredited Investor Representation Letter is a legal document that serves as a declaration or affirmation from an individual or entity claiming to be an accredited investor in the state of Texas. Accredited investors are individuals or entities with a high net worth or certain levels of income, as defined by the Texas Securities Act and the U.S. Securities and Exchange Commission (SEC). Keywords: Texas, Accredited Investor, Representation Letter, Legal Document, Declaration, Affirmation, State of Texas, Texas Securities Act, U.S. Securities and Exchange Commission, SEC, High Net Worth, Income, Investment Types of Texas Accredited Investor Representation Letters: 1. Individual Texas Accredited Investor Representation Letter: This type of representation letter is used by individual investors who meet the criteria set by the Texas Securities Act and SEC to qualify as accredited investors based on their net worth or income. 2. Entity Texas Accredited Investor Representation Letter: This variation of the representation letter is utilized by entities such as corporations, partnerships, limited liability companies, or trusts to assert their status as accredited investors in Texas. Entities must meet specific financial thresholds to qualify. 3. Texas Accredited Investor Representation Letter for Investment Funds: Investment funds or entities actively engaged in managing funds can use this representation letter to demonstrate their accreditation status, reflecting the eligibility of their potential investors to participate in certain investment opportunities. 4. Real Estate Texas Accredited Investor Representation Letter: Specifically designed for real estate investments, this letter is employed by individuals or entities interested in real estate projects or ventures in Texas. It confirms the accredited investor status of the involved party, complying with state and federal regulations. 5. Start-up Funding Texas Accredited Investor Representation Letter: This type of representation letter is geared towards start-up companies seeking funding from accredited investors in Texas. It allows the start-up to verify the accredited investor status of potential investors and demonstrate their compliance with securities laws. 6. Texas Accredited Investor Representation Letter for Private Placements: Private placement offerings are typically limited to accredited investors. This representation letter verifies an individual's or entity's eligibility in participating in privately offered securities. In conclusion, the Texas Accredited Investor Representation Letter is a crucial legal document used by individuals, entities, investment funds, start-ups, and real estate ventures to declare their accredited investor status and comply with Texas Securities Act and SEC regulations. It ensures the eligibility of investors to participate in various investment opportunities, providing transparency and legal compliance.

Texas Accredited Investor Representation Letter

Description

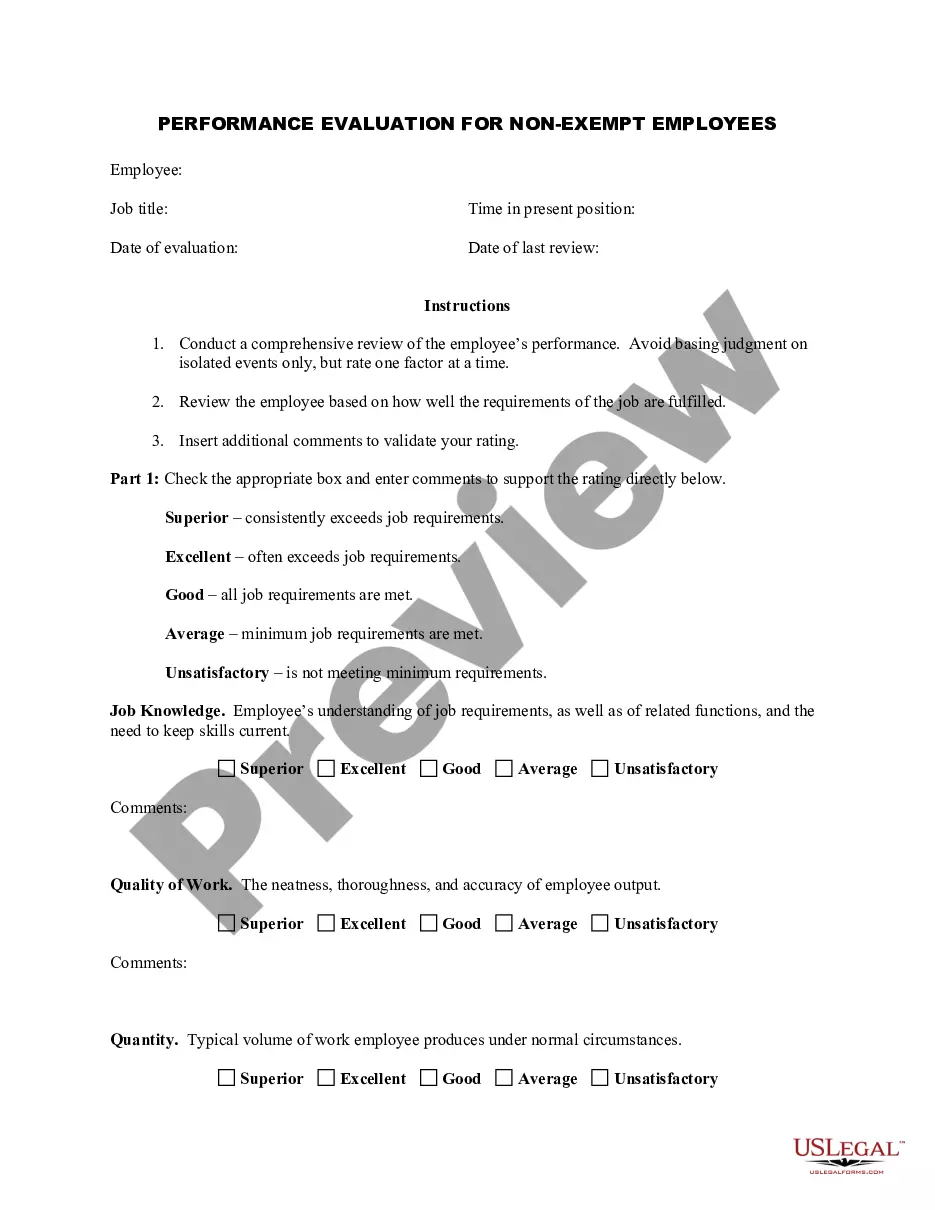

How to fill out Texas Accredited Investor Representation Letter?

You are able to commit hrs on-line searching for the legitimate record web template that meets the state and federal needs you will need. US Legal Forms gives a large number of legitimate types which can be reviewed by experts. It is simple to obtain or print the Texas Accredited Investor Representation Letter from our assistance.

If you currently have a US Legal Forms profile, it is possible to log in and click the Obtain key. Following that, it is possible to complete, change, print, or indication the Texas Accredited Investor Representation Letter. Each legitimate record web template you purchase is the one you have forever. To have another version of any obtained form, go to the My Forms tab and click the related key.

If you are using the US Legal Forms internet site for the first time, keep to the straightforward directions below:

- First, be sure that you have selected the proper record web template to the area/city of your choice. Read the form outline to make sure you have picked out the appropriate form. If offered, make use of the Review key to search throughout the record web template as well.

- If you want to get another version of the form, make use of the Look for discipline to obtain the web template that suits you and needs.

- After you have identified the web template you need, click Acquire now to proceed.

- Pick the pricing strategy you need, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your charge card or PayPal profile to cover the legitimate form.

- Pick the file format of the record and obtain it for your device.

- Make alterations for your record if needed. You are able to complete, change and indication and print Texas Accredited Investor Representation Letter.

Obtain and print a large number of record themes while using US Legal Forms Internet site, that offers the greatest selection of legitimate types. Use specialist and status-distinct themes to tackle your small business or person needs.