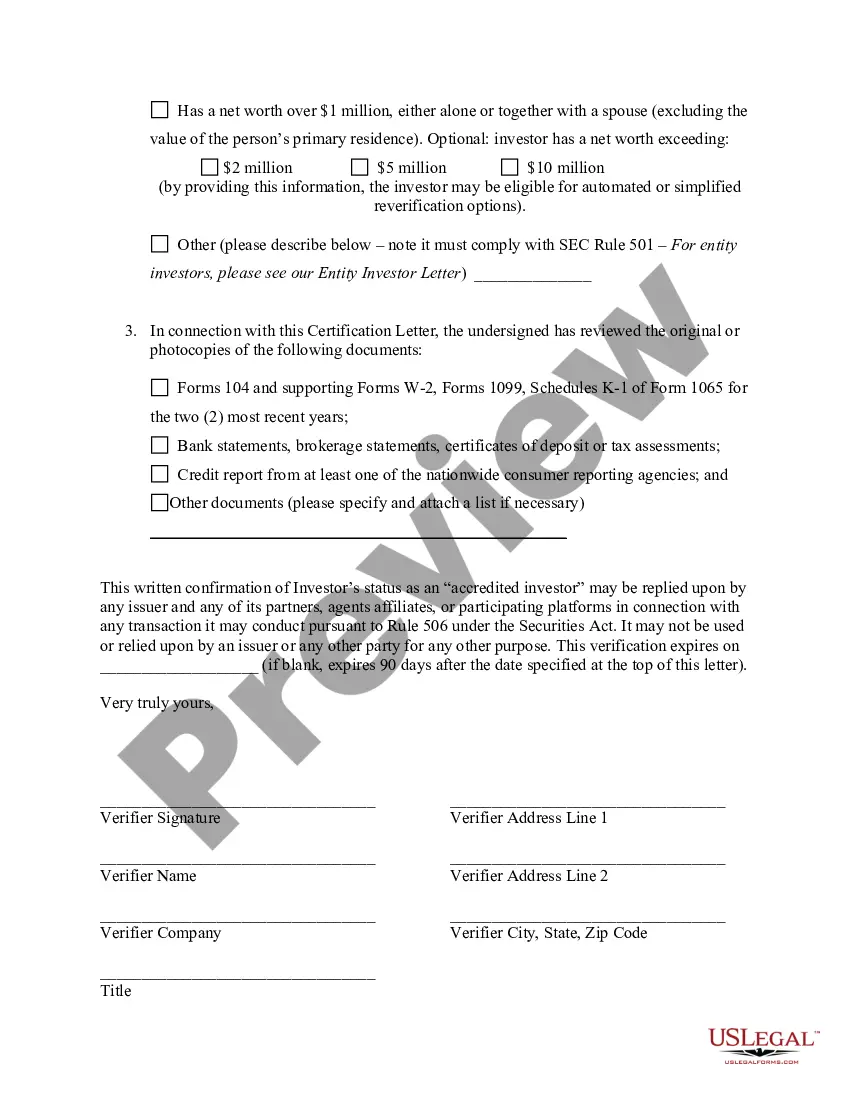

Texas Accredited Investor Verification Letter — Individual Investor: A Comprehensive Overview The Texas Accredited Investor Verification Letter is a crucial document used to confirm an individual's status as an accredited investor within the state of Texas. It serves as evidence that the individual meets the specific criteria set by the Texas State Securities Board to participate in certain investment opportunities that are limited to accredited investors. The letter serves as an official declaration and validation of an individual's net worth, income, or professional credentials, which are fundamental factors in determining their eligibility as an accredited investor. The verification process helps protect both investors and investment opportunities by ensuring compliance with state regulations and safeguarding against potential fraud. Keywords: Texas, Accredited Investor Verification Letter, individual investor, criteria, net worth, income, professional credentials, investment opportunities, compliance, fraud protection. Types of Texas Accredited Investor Verification Letters — Individual Investor: 1. Texas Net Worth Verification Letter: This type of verification letter focuses on an individual's net worth and requires the provision of detailed financial statements, including assets, liabilities, and net worth calculations. The individual must meet specific net worth thresholds, such as having a net worth exceeding $1 million, excluding the value of their primary residence. 2. Texas Income Verification Letter: This verification letter concentrates on an individual's annual income and necessitates the submission of income documentation, such as tax returns, salary statements, or other forms of income verification. To qualify as an accredited investor, the individual must demonstrate a consistent income level surpassing certain thresholds, typically $200,000 per year for an individual or $300,000 for a couple. 3. Texas Professional Credentials Verification Letter: In certain cases, an individual may qualify as an accredited investor based on their specific professional credentials, expertise, or industry experience. This verification letter involves providing relevant documentation, such as licenses, certifications, or professional memberships, to validate the individual's eligibility as an accredited investor. Keywords: Texas, Accredited Investor Verification Letter, types, net worth verification, income verification, professional credentials' verification, thresholds, financial statements, income documentation, tax returns, licensed professionals, certifications, industry experience. In conclusion, the Texas Accredited Investor Verification Letter is a crucial document for individual investors seeking access to exclusive investment opportunities within the state. By providing detailed information regarding an individual's net worth, income, or professional credentials, this letter serves as an official validation of their eligibility as an accredited investor, promoting compliance with state regulations and safeguarding against potential fraud.

Texas Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Texas Accredited Investor Veri?cation Letter - Individual Investor?

Discovering the right authorized record template can be quite a battle. Naturally, there are plenty of themes available on the Internet, but how do you obtain the authorized kind you need? Utilize the US Legal Forms web site. The services gives 1000s of themes, including the Texas Accredited Investor Veri?cation Letter - Individual Investor, which can be used for enterprise and personal requirements. Every one of the varieties are checked out by pros and meet up with state and federal needs.

When you are already signed up, log in to the account and then click the Download switch to obtain the Texas Accredited Investor Veri?cation Letter - Individual Investor. Make use of account to check with the authorized varieties you may have purchased previously. Visit the My Forms tab of your own account and get yet another copy of the record you need.

When you are a whole new consumer of US Legal Forms, listed below are straightforward directions for you to stick to:

- Very first, ensure you have selected the proper kind for your personal town/area. You are able to look over the shape using the Review switch and read the shape outline to guarantee it is the best for you.

- In case the kind does not meet up with your requirements, utilize the Seach area to obtain the correct kind.

- Once you are sure that the shape is acceptable, click on the Acquire now switch to obtain the kind.

- Opt for the prices strategy you want and enter in the essential info. Build your account and buy the transaction with your PayPal account or Visa or Mastercard.

- Pick the file file format and obtain the authorized record template to the gadget.

- Total, edit and produce and indicator the acquired Texas Accredited Investor Veri?cation Letter - Individual Investor.

US Legal Forms is definitely the largest local library of authorized varieties that you can see a variety of record themes. Utilize the service to obtain professionally-created papers that stick to express needs.