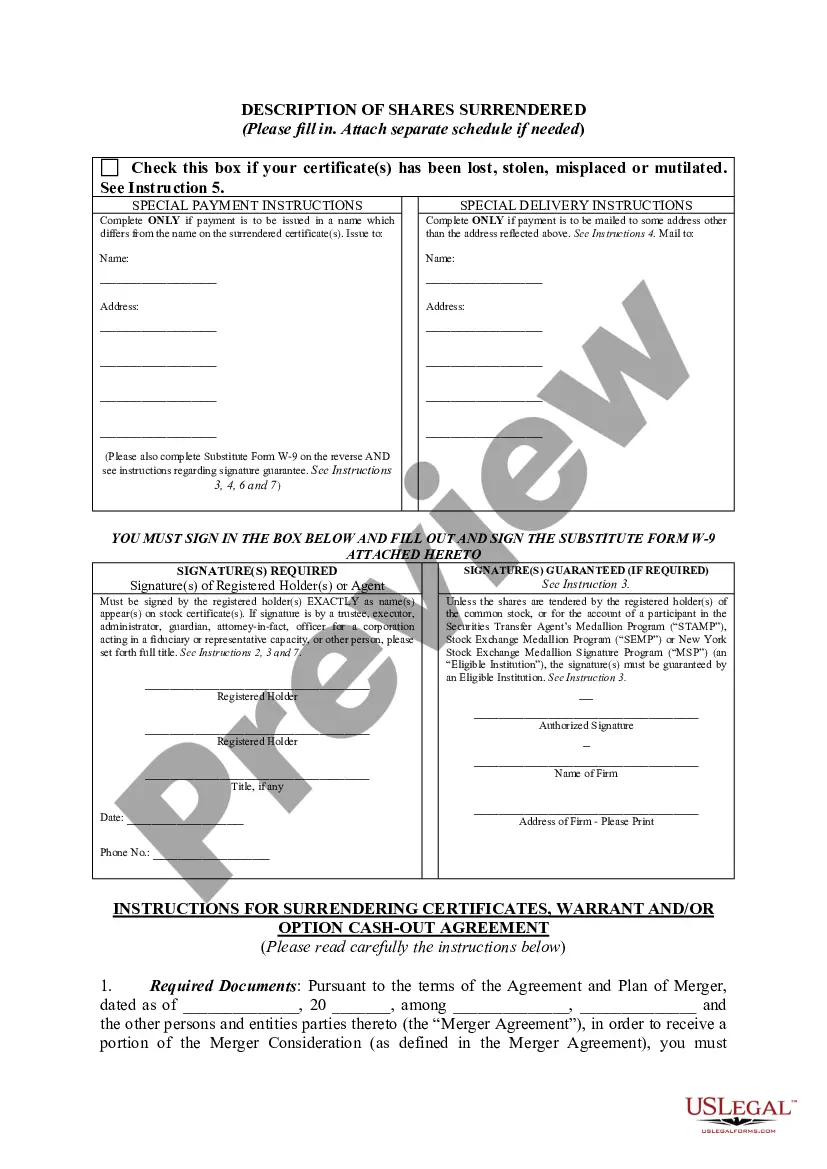

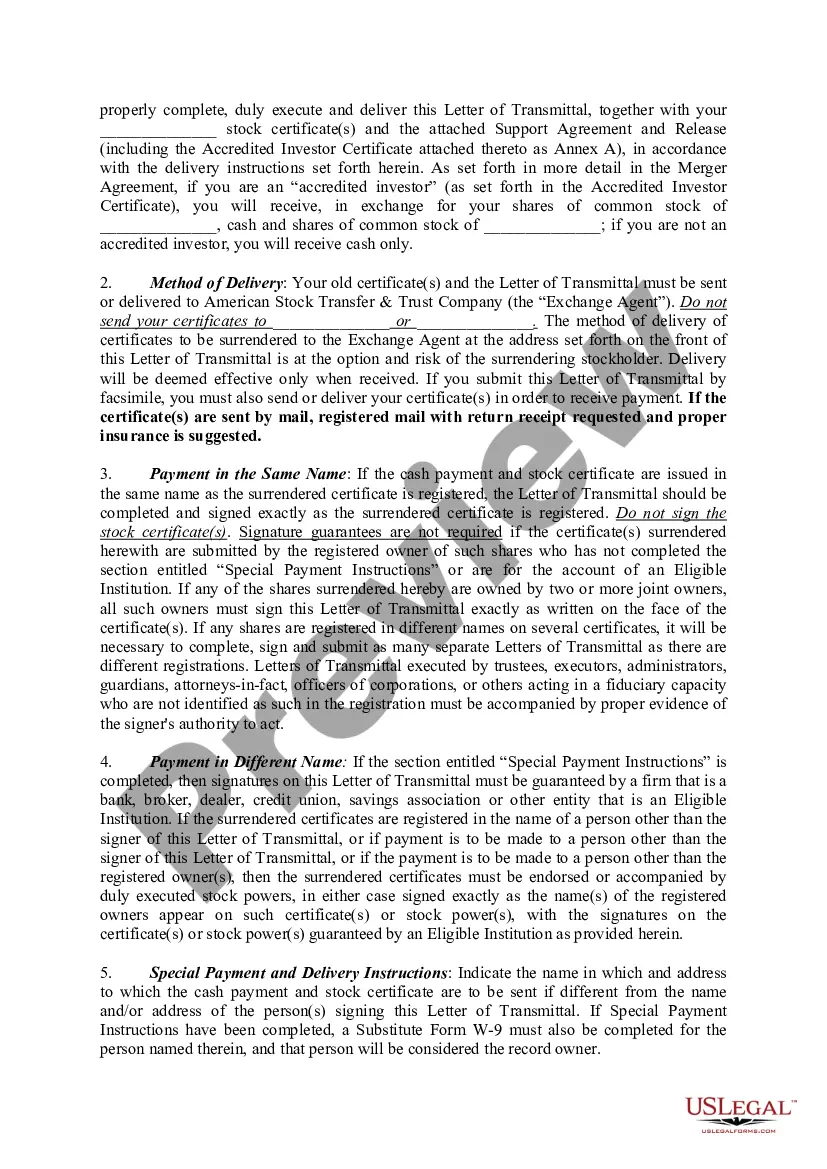

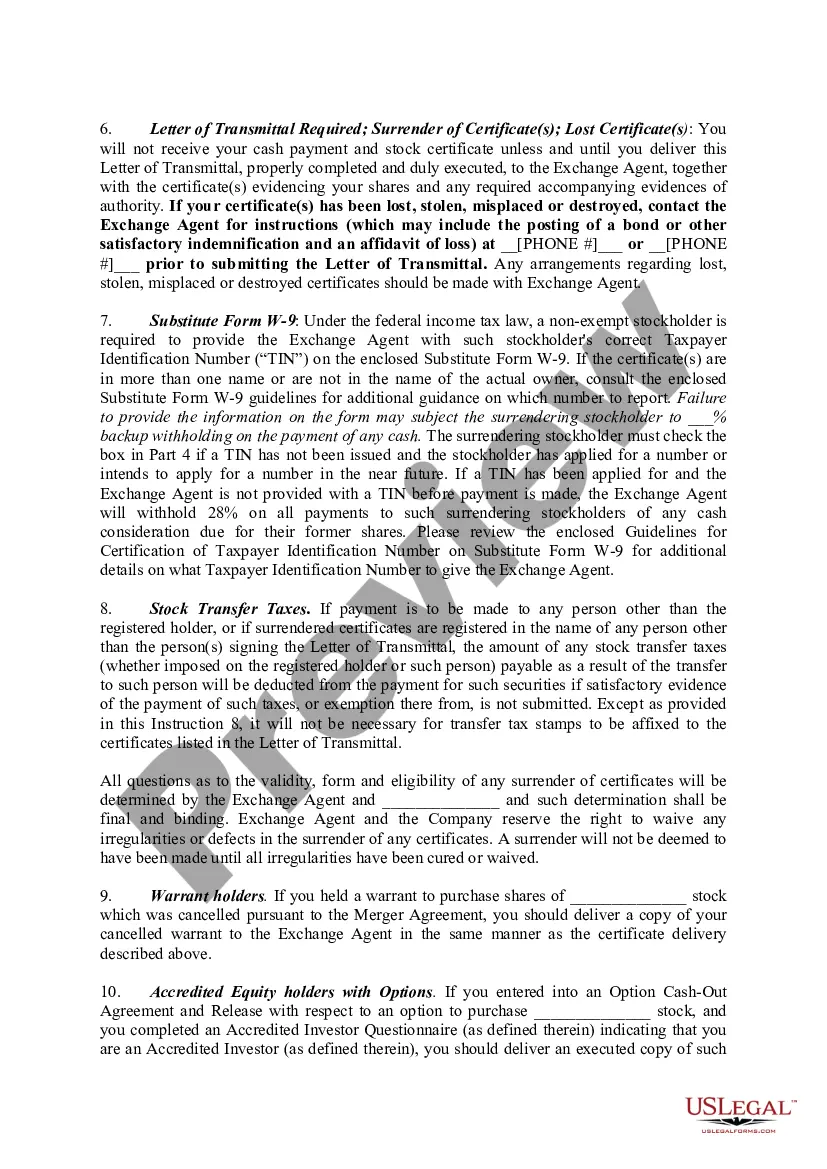

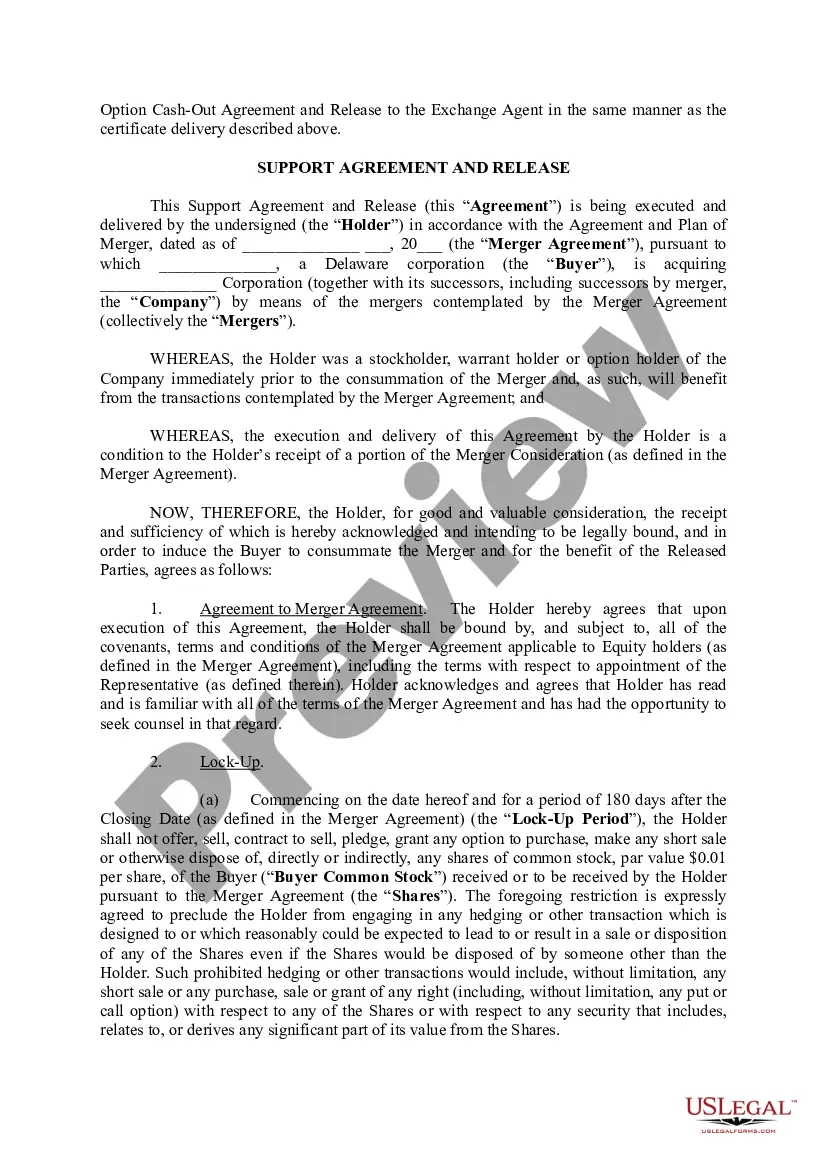

Title: Understanding the Types and Requirements of Texas Letter of Transmittal to Accompany Certificates of Common Stock Introduction: A Texas Letter of Transmittal to Accompany Certificates of Common Stock is a crucial legal document that facilitates the exchange of physical stock certificates in the State of Texas. This detailed description aims to provide an overview of the requirements, functions, and different types of Texas Letter of Transmittal to Accompany Certificates of Common Stock. 1. What is a Texas Letter of Transmittal to Accompany Certificates of Common Stock? A Texas Letter of Transmittal is a formal document required by the State of Texas to accompany the physical stock certificates during the transfer of ownership. It ensures a secure and transparent process, protecting the interests of both the shareholders and the companies involved. The letter outlines the instructions and required information needed to successfully transfer stock ownership. 2. Types of Texas Letter of Transmittal to Accompany Certificates of Common Stock: a) Standard Letter of Transmittal: This type of letter is typically used for regular stock transfers. It includes essential details such as the shareholder's name and information, the number of shares being transferred, and any special instructions or requests. b) Tax-Deferred Exchange Letter of Transmittal: If stockholders engage in a tax-deferred exchange, this specialized letter is necessitated. It includes additional information related to the exchange, such as the applicable tax laws, new stock details, and any required supporting documentation. c) Estate Planning Letter of Transmittal: In cases of stock transfers due to estate planning, this specific letter type is utilized. It contains information about the transferor's estate, executor details, and formalities required to comply with legal obligations. 3. Required Information: The Texas Letter of Transmittal to Accompany Certificates of Common Stock typically requests the following key details: a) Shareholder Information: Name, contact details, and Social Security or Tax ID number. b) Certificate Details: Unique stock certificate numbers being transferred. c) Signature: A valid signature of the shareholder or authorized representative. d) Instructions: Clear guidelines on how to complete the transfer, including the desired method for receiving new certificates or funds. Conclusion: The Texas Letter of Transmittal to Accompany Certificates of Common Stock is a crucial document for stock transfers in the State of Texas. It ensures compliance with legal requirements while safeguarding the interests of shareholders and companies. With different types of letters available to accommodate specific scenarios, individuals must understand the relevant type of letter to use for their specific stock transfer needs. Adhering to the instructions and providing accurate information will facilitate a smooth stock transfer process.

Texas Letter of Transmittal to Accompany Certificates of Common Stock

Description

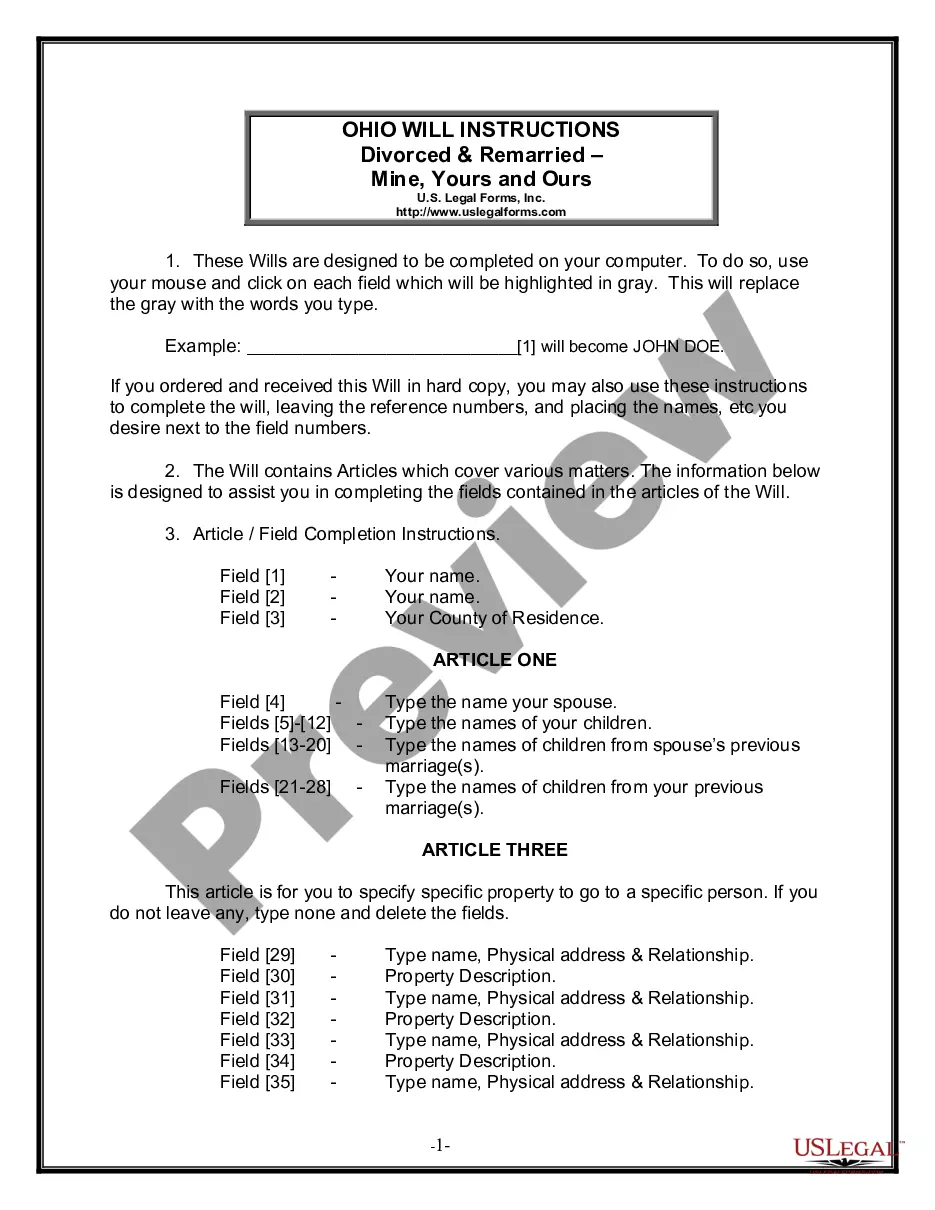

How to fill out Texas Letter Of Transmittal To Accompany Certificates Of Common Stock?

Discovering the right legitimate record web template could be a have difficulties. Obviously, there are a variety of web templates available online, but how do you find the legitimate kind you require? Make use of the US Legal Forms website. The service offers a large number of web templates, like the Texas Letter of Transmittal to Accompany Certificates of Common Stock, which can be used for company and personal demands. Every one of the varieties are checked out by specialists and meet federal and state demands.

When you are already listed, log in to the account and click the Down load option to have the Texas Letter of Transmittal to Accompany Certificates of Common Stock. Utilize your account to appear through the legitimate varieties you possess acquired in the past. Visit the My Forms tab of your own account and get one more copy of the record you require.

When you are a brand new customer of US Legal Forms, allow me to share easy directions that you can adhere to:

- Initial, make certain you have selected the right kind for your personal town/county. You may examine the form making use of the Preview option and study the form explanation to make certain it is the best for you.

- In the event the kind is not going to meet your preferences, take advantage of the Seach area to discover the appropriate kind.

- Once you are certain the form is proper, select the Buy now option to have the kind.

- Pick the pricing program you need and enter the necessary information. Build your account and buy your order with your PayPal account or Visa or Mastercard.

- Choose the submit structure and download the legitimate record web template to the gadget.

- Full, change and print and indicator the acquired Texas Letter of Transmittal to Accompany Certificates of Common Stock.

US Legal Forms is definitely the greatest library of legitimate varieties in which you will find numerous record web templates. Make use of the service to download appropriately-produced documents that adhere to status demands.

Form popularity

FAQ

In order to cash in the stock, you need to fill out the transfer form on the back of the certificate and have it notarized. Once complete, send the notarized certificate to the transfer agent, who will register the stock to you as owner.

A stock certificate is a physical piece of paper that represents a shareholder's ownership in a company. Stock certificates include information such as the number of shares owned, the date of purchase, an identification number, usually a corporate seal, and signatures.

How to complete a stock transfer form in 10 Steps 1 Consideration money. ... 2 Full name of Undertaking. ... 3 Full description of Security. ... 4 Number or amount of Shares, Stock or other security. ... 5 Name(s) and address of registered holder(s) ... 6 Signature(s) ... 7 Name(s) and address of person(s) receiving the shares. Stock transfer form J30 template and guide - Inform Direct informdirect.co.uk ? shares ? how-to-compl... informdirect.co.uk ? shares ? how-to-compl...

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal. Using stock certificates to help your business grow | .com ? articles ? using-stock-certif... .com ? articles ? using-stock-certif...

Key information on a share certificate includes: Certificate number. Company name and registration number. Shareholder name and address. Number of shares owned. Class of shares. Issue date of shares. Amount paid (or treated as paid) on the shares. Share Certificate: Definition, How They Work, and Key Information investopedia.com ? terms ? share-certificate investopedia.com ? terms ? share-certificate

In the Stock Transfer Ledger, the names of the shareholders can be listed along with important information such as their places of residence, the time that they gained ownership within the corporation, the number of shares issued, the amount paid for the shares, and the stock certificate number that was distributed (if ... Sample Stock Transfer Ledger | Harvard Business Services Harvard Business Services ? blog ? sample-stock-tr... Harvard Business Services ? blog ? sample-stock-tr...

What is a Letter of Transmittal? A Letter of Transmittal is a form generally used for an exchange of stock and/or cash payment.

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.