The Texas Gust Series Seed Term Sheet is a legal document that outlines the specific terms and conditions related to an investment in a startup company based in Texas. This term sheet serves as a framework for negotiations between startup founders and potential investors, providing both parties with a clear understanding of the expectations and obligations associated with the investment. The Texas Gust Series Seed Term Sheet includes various key provisions, such as the valuation of the startup, the amount of funding to be provided by the investor, and the type of securities to be issued in exchange for the investment. It also specifies the rights and preferences of the investor, such as liquidation preferences, anti-dilution protection, and board representation. Moreover, this term sheet may contain provisions related to company governance, including voting rights, protective provisions, and information rights. It typically outlines the terms of the investment, including the use of funds, milestones, and any conditions that need to be met before subsequent funding rounds. Additionally, it is important to note that there may be different types of Texas Gust Series Seed Term Sheets. These variations can depend on factors such as the stage of the startup, the industry it operates in, and the specific preferences of the investor. Some examples of different types of Texas Gust Series Seed Term Sheets include: 1. Early-stage term sheet: This type of term sheet is typically used for startups in the early stages of their development, where they may not have a well-established track record or significant revenue. The terms in this type of term sheet may focus more on the potential of the business rather than its current financials. 2. Growth-stage term sheet: This term sheet is suitable for startups that have already demonstrated some market traction and growth but require additional funding to accelerate their expansion. The terms in this type of term sheet may include provisions related to scaling the business, market penetration, and capturing a larger market share. 3. Industry-specific term sheet: In certain cases, the Texas Gust Series Seed Term Sheet may cater to specific industries or sectors, such as fintech, healthcare, or artificial intelligence. The terms in these term sheets may include industry-specific clauses, regulatory considerations, or technical requirements relevant to the startup's niche. In conclusion, the Texas Gust Series Seed Term Sheet is an essential legal document that outlines the terms and conditions of an investment in a Texas-based startup. It plays a crucial role in ensuring transparency, protecting the rights of both the startup founders and the investors, and facilitating a successful investment deal.

Texas Gust Series Seed Term Sheet

Description

How to fill out Texas Gust Series Seed Term Sheet?

US Legal Forms - one of many biggest libraries of legitimate varieties in America - offers a wide range of legitimate document layouts you are able to acquire or print out. Using the internet site, you can get a large number of varieties for organization and person uses, categorized by types, says, or keywords.You will find the most recent versions of varieties like the Texas Gust Series Seed Term Sheet in seconds.

If you already possess a subscription, log in and acquire Texas Gust Series Seed Term Sheet through the US Legal Forms library. The Acquire button will show up on every develop you see. You have accessibility to all previously acquired varieties inside the My Forms tab of your own profile.

If you wish to use US Legal Forms the very first time, allow me to share simple directions to help you started off:

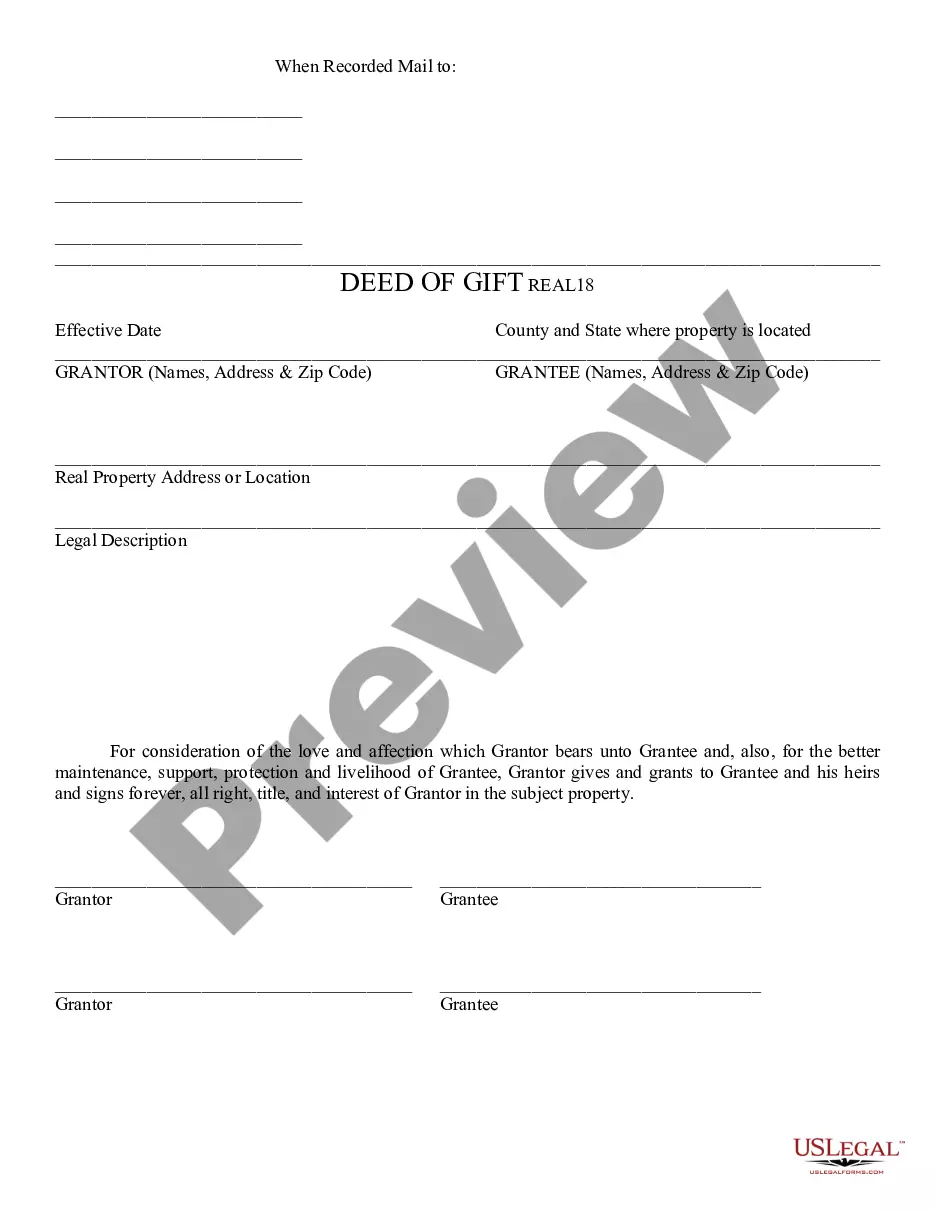

- Be sure you have picked the best develop for your metropolis/area. Click the Review button to analyze the form`s content material. Browse the develop explanation to actually have selected the proper develop.

- In case the develop doesn`t fit your requirements, take advantage of the Look for discipline near the top of the display screen to find the one which does.

- When you are satisfied with the form, verify your selection by visiting the Buy now button. Then, select the pricing program you like and provide your qualifications to register on an profile.

- Process the purchase. Make use of your bank card or PayPal profile to complete the purchase.

- Select the file format and acquire the form on the system.

- Make adjustments. Fill out, edit and print out and indicator the acquired Texas Gust Series Seed Term Sheet.

Every single template you added to your bank account lacks an expiry date and is your own permanently. So, if you would like acquire or print out one more backup, just proceed to the My Forms area and then click in the develop you will need.

Gain access to the Texas Gust Series Seed Term Sheet with US Legal Forms, the most substantial library of legitimate document layouts. Use a large number of skilled and condition-certain layouts that meet your small business or person requires and requirements.