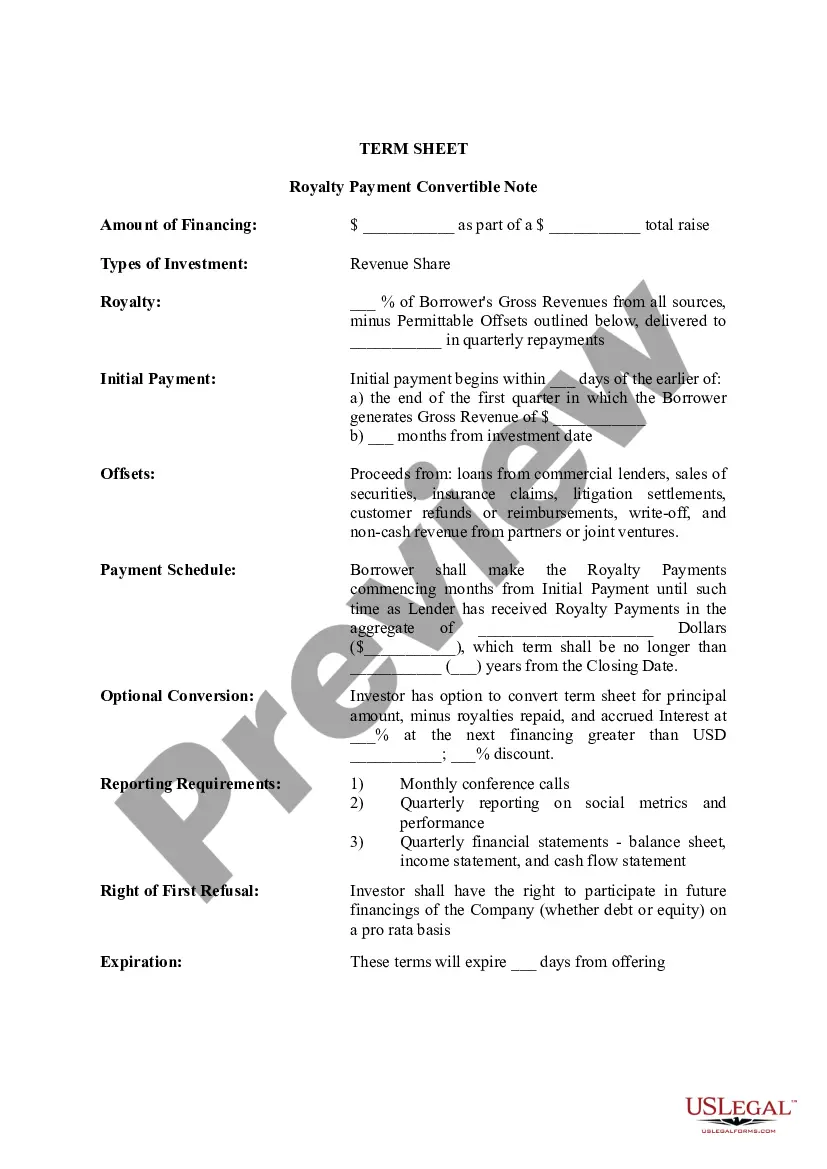

Texas Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

If you have to full, down load, or printing lawful papers web templates, use US Legal Forms, the most important selection of lawful types, which can be found online. Utilize the site`s easy and hassle-free research to obtain the papers you want. Various web templates for enterprise and person uses are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Texas Term Sheet - Royalty Payment Convertible Note with a handful of mouse clicks.

In case you are previously a US Legal Forms client, log in to your accounts and click the Acquire switch to obtain the Texas Term Sheet - Royalty Payment Convertible Note. You can even gain access to types you in the past downloaded within the My Forms tab of your own accounts.

Should you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the proper metropolis/region.

- Step 2. Make use of the Review choice to look over the form`s information. Do not forget about to learn the description.

- Step 3. In case you are not satisfied together with the develop, make use of the Lookup industry towards the top of the display to discover other variations of your lawful develop design.

- Step 4. When you have discovered the form you want, click the Purchase now switch. Pick the prices program you like and put your qualifications to register to have an accounts.

- Step 5. Process the financial transaction. You can use your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the format of your lawful develop and down load it on your system.

- Step 7. Total, modify and printing or indication the Texas Term Sheet - Royalty Payment Convertible Note.

Each lawful papers design you get is your own property forever. You might have acces to each develop you downloaded inside your acccount. Click the My Forms portion and choose a develop to printing or down load once more.

Compete and down load, and printing the Texas Term Sheet - Royalty Payment Convertible Note with US Legal Forms. There are millions of skilled and condition-particular types you can utilize to your enterprise or person needs.

Form popularity

FAQ

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Discount. The discount rate, typically 15% to 25% percent, gets applied to the per-share price of the new investor. For example, let's say your convertible note had a 20% discount and the new investors are paying $1 per share. The convertible note investor will convert at $0.80 per share.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

In recent years, SAFEs have become the most common convertible instrument due to their relative simplicity. Like convertible notes, SAFEs convert into stock in a future priced round. Unlike convertible notes, they are not debt and do not require the company to pay back the investment with interest.

Calculating post-money valuation Post-money valuation = Pre-money valuation + Size of investment. ... Share price = New investment amount / # of new shares received. ... Post-money valuation / total # of shares post-investment = New investment amount / # of new shares received.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.