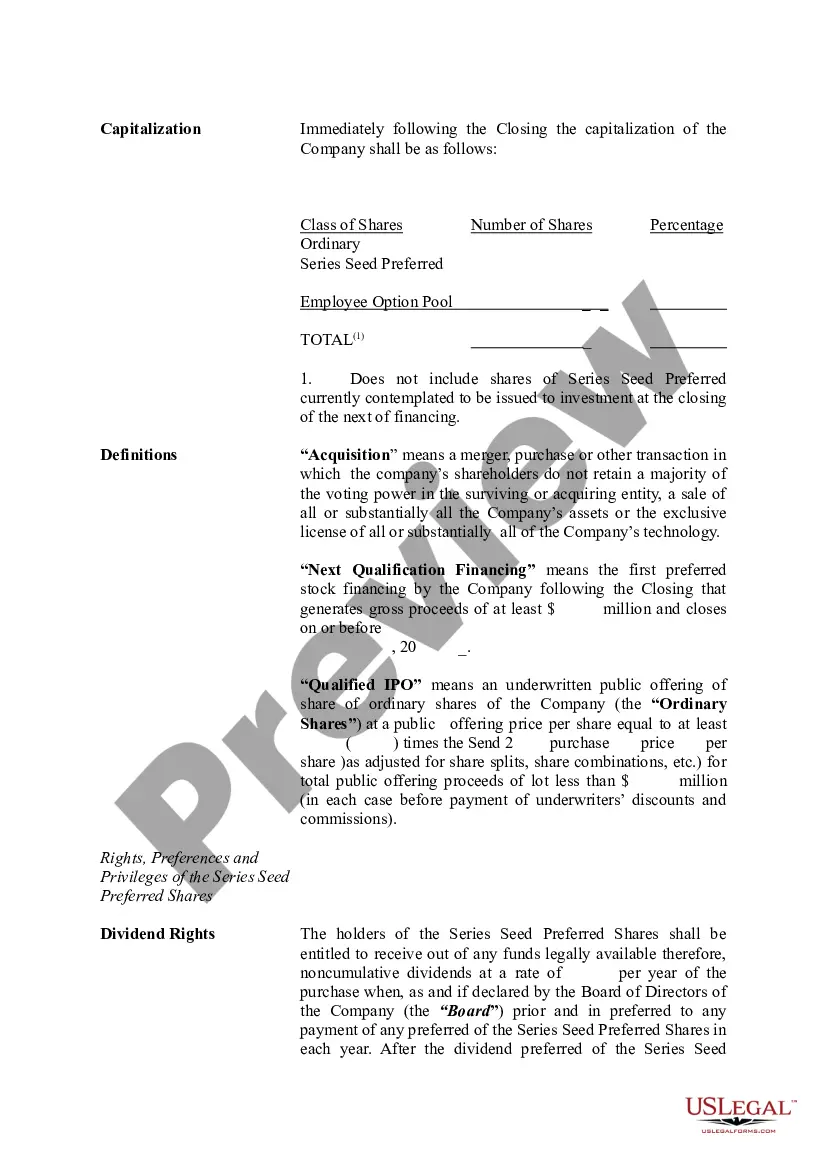

Texas Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

US Legal Forms - one of several greatest libraries of legal varieties in the United States - gives a variety of legal file layouts you can acquire or printing. While using site, you can find a huge number of varieties for company and person uses, categorized by classes, suggests, or key phrases.You will find the most recent variations of varieties such as the Texas Term Sheet - Series Seed Preferred Share for Company within minutes.

If you have a monthly subscription, log in and acquire Texas Term Sheet - Series Seed Preferred Share for Company in the US Legal Forms collection. The Download option will show up on every single kind you perspective. You gain access to all earlier delivered electronically varieties within the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, here are simple instructions to get you started:

- Ensure you have chosen the best kind for your area/region. Click on the Review option to examine the form`s content. Look at the kind information to actually have chosen the proper kind.

- If the kind does not suit your specifications, utilize the Search discipline near the top of the display to discover the the one that does.

- In case you are pleased with the shape, verify your decision by clicking the Get now option. Then, opt for the rates strategy you want and offer your references to register for an account.

- Procedure the transaction. Utilize your bank card or PayPal account to finish the transaction.

- Find the structure and acquire the shape in your gadget.

- Make modifications. Fill up, modify and printing and indication the delivered electronically Texas Term Sheet - Series Seed Preferred Share for Company.

Each template you put into your bank account lacks an expiration time and it is yours eternally. So, if you would like acquire or printing yet another version, just check out the My Forms segment and click about the kind you will need.

Obtain access to the Texas Term Sheet - Series Seed Preferred Share for Company with US Legal Forms, by far the most comprehensive collection of legal file layouts. Use a huge number of expert and condition-particular layouts that fulfill your organization or person requires and specifications.

Form popularity

FAQ

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

Series A Preferred Stock is the class of stock that is issued to investors in a Series A round. The stock is preferred because it contains certain rights superior to the company's common stock, commonly liquidation preference, anti-dilution protection, and control rights.

Series A funding is different from seed funding in a few key ways. First, seed funding is typically used to finance a startups initial costs, such as product development and market research. Series A funding, on the other hand, is used to finance a company's early-stage growth.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

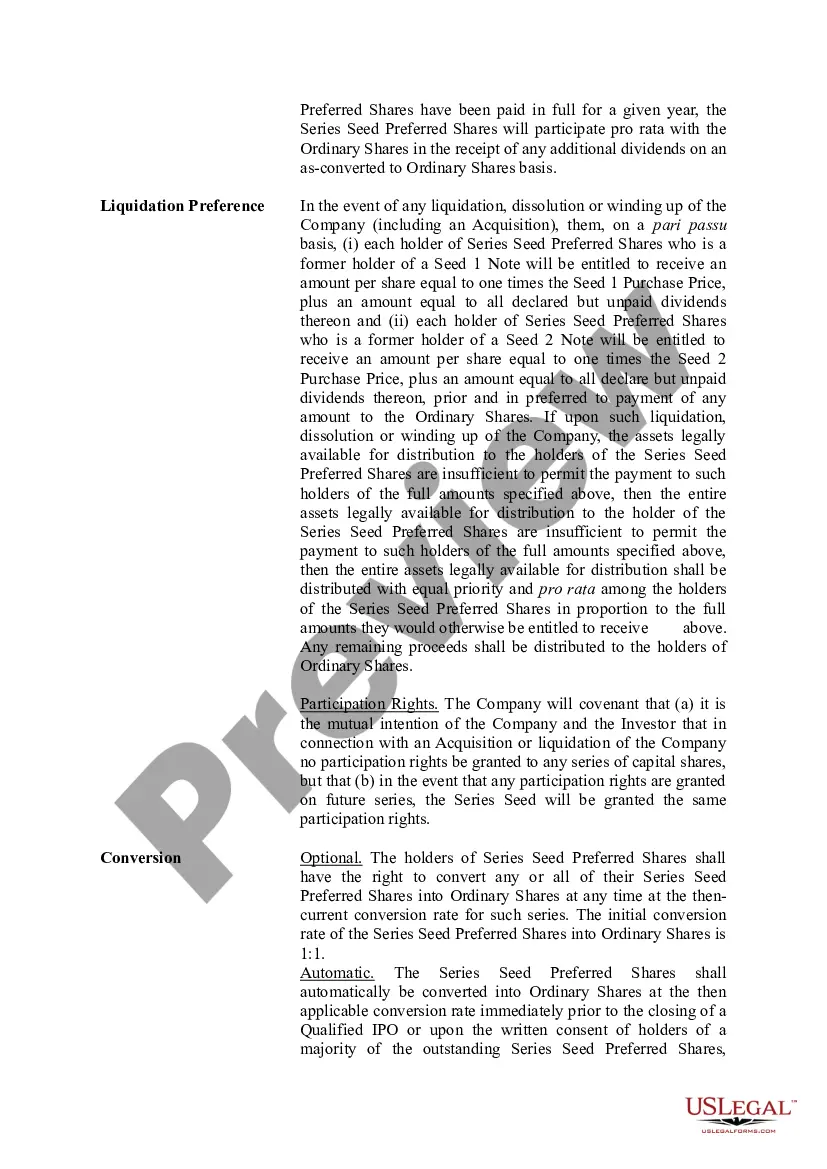

Common Series Seed terms include: Preferred Stock. Preferred stock is a class of stock with certain preferences and rights that are superior to the rights of the common stock that is issued to the founders. Series Seed will generally be issued as preferred stock. Liquidation Preference.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.