Texas Special Meeting Minutes of Shareholders

Description

How to fill out Special Meeting Minutes Of Shareholders?

You are able to spend hrs on the web searching for the lawful file design that fits the state and federal demands you want. US Legal Forms supplies 1000s of lawful kinds which are reviewed by pros. You can easily download or printing the Texas Special Meeting Minutes of Shareholders from our service.

If you already possess a US Legal Forms accounts, you can log in and click the Down load key. Next, you can full, modify, printing, or indication the Texas Special Meeting Minutes of Shareholders. Each lawful file design you purchase is yours forever. To acquire one more duplicate of any bought form, check out the My Forms tab and click the corresponding key.

If you are using the US Legal Forms website initially, adhere to the straightforward directions beneath:

- Very first, ensure that you have chosen the right file design to the county/city of your choosing. See the form information to ensure you have picked out the right form. If available, use the Review key to look throughout the file design as well.

- If you wish to find one more variation of the form, use the Lookup field to find the design that meets your needs and demands.

- Upon having found the design you desire, simply click Buy now to move forward.

- Pick the pricing strategy you desire, enter your references, and sign up for your account on US Legal Forms.

- Full the financial transaction. You can utilize your charge card or PayPal accounts to purchase the lawful form.

- Pick the formatting of the file and download it in your device.

- Make alterations in your file if needed. You are able to full, modify and indication and printing Texas Special Meeting Minutes of Shareholders.

Down load and printing 1000s of file templates using the US Legal Forms website, which offers the largest collection of lawful kinds. Use skilled and status-distinct templates to take on your organization or person demands.

Form popularity

FAQ

Minutes of general meeting Agenda item 1: Welcome, attendees and apologies. ... Agenda item 2: Proxy appointments. ... Agenda item 3: Minutes of previous meeting and matters arising. ... Agenda item 4: Business of the meeting. ... Agenda item 7: Special resolution/s (if relevant) ... Agenda item 9: Any other business.

Announce a Special Meeting ? Example Letters, Guides and Samples Indicate that this is a special (mandatory, emergency, etc.) meeting, and briefly explain its purpose. State clearly the date, time, and place. ... Explain how the reader should prepare for the meeting such as bringing specific reports or materials.

It helps to write out your meeting minutes as soon as the meeting concludes so you don't miss anything. 1 Be consistent. It helps to use a template every time you take meeting minutes. ... 2 Record it. ... 3 Make your notes viewable during the meeting. ... 4 Summarize. ... 5 Label comments with initials.

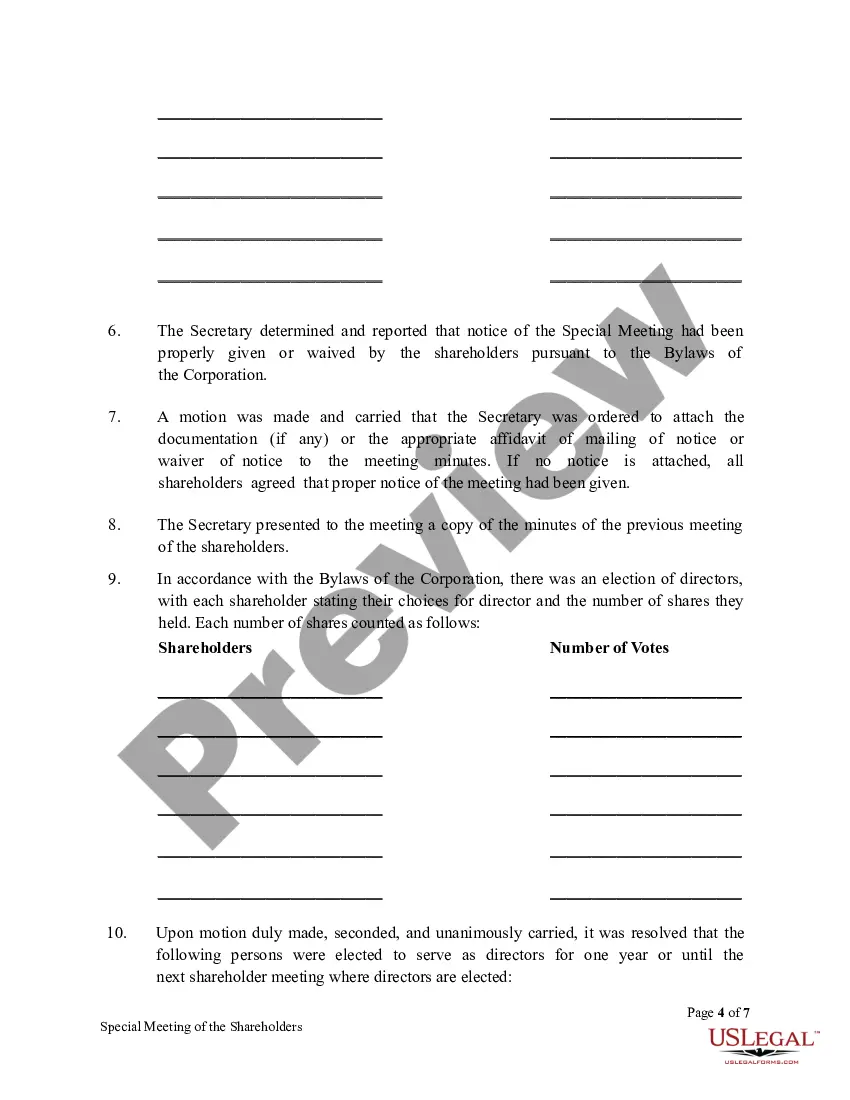

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation ...

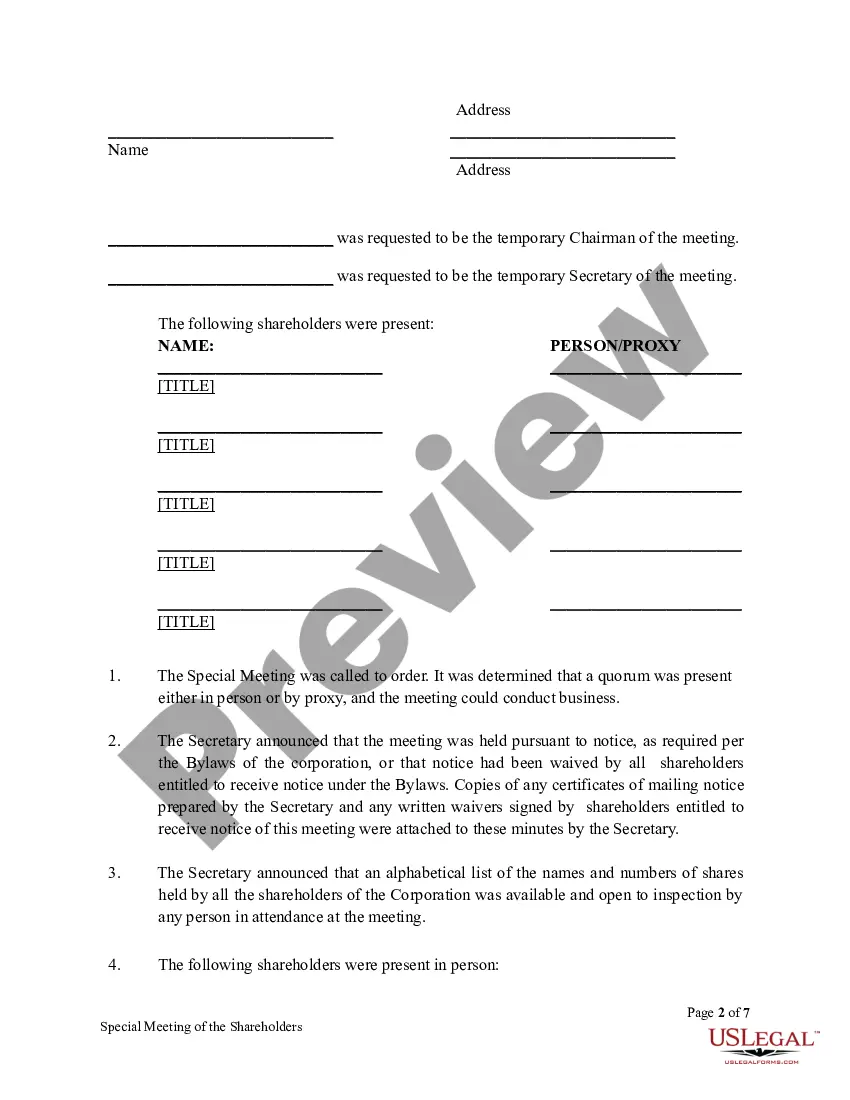

What should be recorded in meeting minutes? The minutes should include corporation details like the name of the corporation and the names of the chairperson and secretary of the meeting. The meeting place and time should also be found somewhere in the minutes, along with the names of the shareholders.

Personal observations or judgmental comments should not be included in meeting minutes. All statements should be as neutral as possible. Avoid writing down everything everyone said. Minutes should be concise and summarize the major points of what happened at the meeting.

2. What Should Be Included in Meeting Minutes? Date and time of the meeting. Names of the meeting participants and those unable to attend (e.g., ?regrets?) Acceptance or corrections/amendments to previous meeting minutes. Decisions made about each agenda item, for example: Actions taken or agreed to be taken. Next steps.

Our meeting experts compiled 7 best practices that apply to all sorts of teams and scenarios. 1 Date and time of the meeting. ... 2 Names of the participants. ... 3 Purpose of the meeting. ... 4 Agenda items and topics discussed. ... 5 Key decisions and action items. ... 6 Next meeting date and place. ... 7 Documents to be included in the report.