The Texas Term Sheet — Simple Agreement for Future Equity (SAFE) is a legal document that outlines the terms and conditions of an investment in a startup company based in Texas. It is a popular financing tool utilized by both early-stage companies and investors to secure funding in a relatively simple and expedited manner. The Texas SAFE agreement is designed to provide flexibility and protection for both parties involved in the investment process. It eliminates the cumbersome and time-consuming negotiation of a traditional equity financing round, making it a preferred choice for startups looking for a streamlined investment process. There are different types of Texas SAFE agreements that cater to specific needs and circumstances. Some of these variations include: 1. pre-Roman SAFE: This type of agreement specifies the valuation of the company before the investment is made. The investor's stake in the company is determined by the valuation at the time of investment. 2. Post-Money SAFE: In this case, the valuation of the company is determined by the amount of investment made. The investor's ownership percentage is calculated based on the post-investment valuation. 3. Valuation Cap SAFE: This type of SAFE includes a maximum valuation at which the investor can convert their investment into equity. If the company's valuation exceeds this cap during a subsequent financing round, the investor benefits from a lower conversion price. 4. Discount Rate SAFE: The Texas SAFE agreement may also incorporate a discount rate, which allows the investor to convert their investment into equity at a prenegotiated discount rate. This incentivizes early-stage investors by giving them an advantage over later investors in future financing rounds. 5. Most Favored Nation (MFN) SAFE: This type of SAFE ensures that the investor receives the most favorable terms offered to any future investor. If the company offers better terms to a subsequent investor, the initial investor is entitled to the same improved terms. The Texas SAFE agreement also covers other important provisions, such as the company's conduct of business, intellectual property protection, and any restrictions or obligations imposed on the investor. It is crucial for both parties to carefully review and negotiate the terms of the agreement to ensure a fair and mutually beneficial investment relationship. In conclusion, the Texas Term Sheet — Simple Agreement for Future Equity (SAFE) is a versatile investment instrument that caters to the unique requirements of startups and investors in Texas. Its various types offer different benefits and protections, making it an attractive choice for those seeking a simplified investment process while safeguarding their interests.

Simple Agreement For Future Equity Tax Treatment

Description simple agreement for future equity

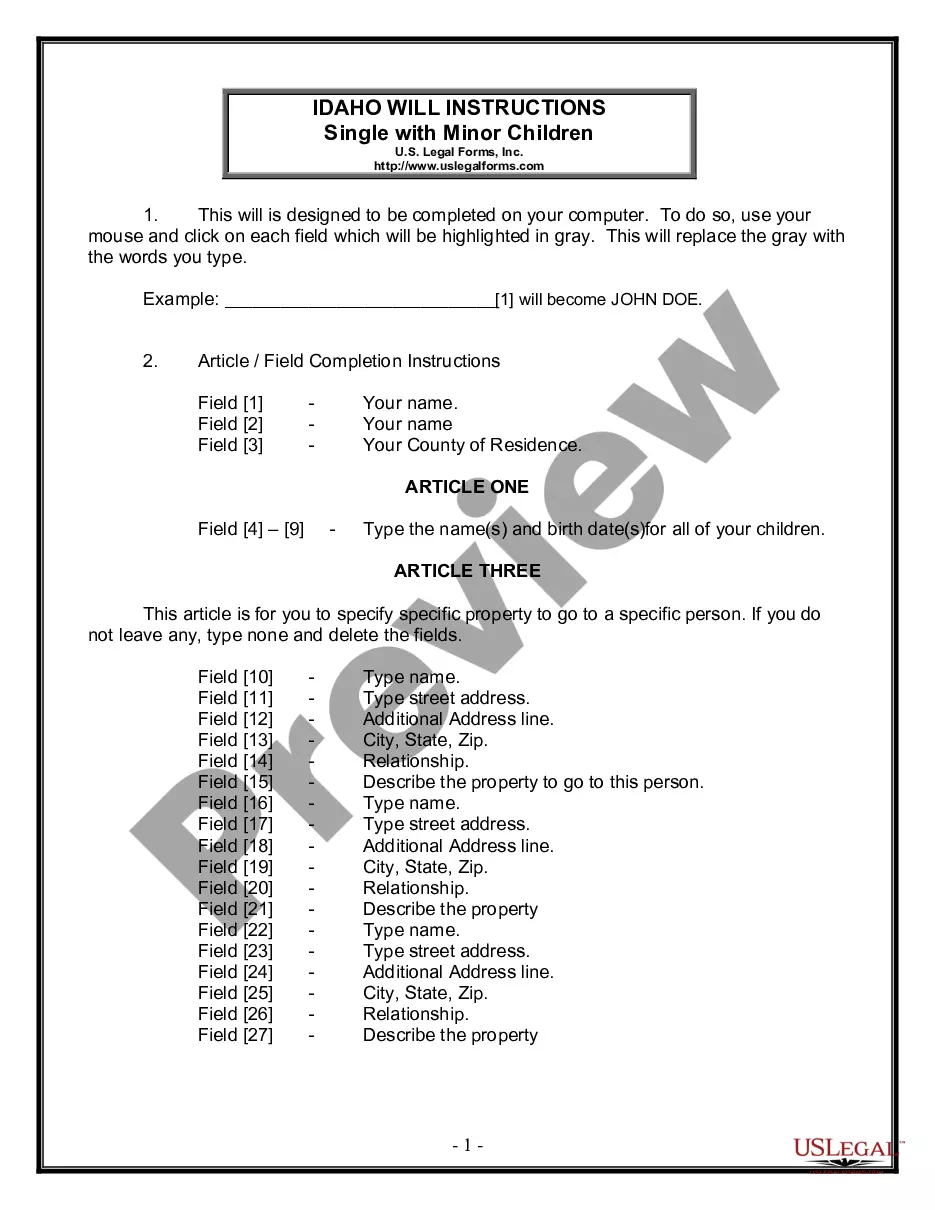

How to fill out Texas Term Sheet - Simple Agreement For Future Equity (SAFE)?

You can spend several hours on the Internet searching for the legal papers template that fits the federal and state needs you want. US Legal Forms provides a large number of legal kinds which are analyzed by professionals. It is simple to download or print the Texas Term Sheet - Simple Agreement for Future Equity (SAFE) from my service.

If you already have a US Legal Forms account, it is possible to log in and click on the Obtain switch. Next, it is possible to complete, modify, print, or signal the Texas Term Sheet - Simple Agreement for Future Equity (SAFE). Every legal papers template you purchase is yours for a long time. To get one more backup of any acquired type, proceed to the My Forms tab and click on the related switch.

If you use the US Legal Forms internet site the first time, keep to the easy directions beneath:

- First, ensure that you have selected the correct papers template for your state/metropolis of your choosing. Browse the type information to ensure you have picked out the appropriate type. If readily available, make use of the Preview switch to appear from the papers template as well.

- In order to locate one more version in the type, make use of the Look for field to obtain the template that fits your needs and needs.

- When you have found the template you need, simply click Get now to carry on.

- Pick the costs plan you need, type in your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can utilize your credit card or PayPal account to cover the legal type.

- Pick the file format in the papers and download it in your gadget.

- Make changes in your papers if necessary. You can complete, modify and signal and print Texas Term Sheet - Simple Agreement for Future Equity (SAFE).

Obtain and print a large number of papers web templates utilizing the US Legal Forms web site, that offers the greatest variety of legal kinds. Use skilled and status-particular web templates to handle your company or individual needs.

Form popularity

FAQ

A SAFE is an agreement to provide you a future equity stake based on the amount you invested if?and only if?a triggering event occurs, such as an additional round of financing or the sale of the company.

A SAFE note is a security that is going to convert to stock at a future point, usually at a pre-negotiated price cap. Let's look at an example. A person might invest in a SAFE note with a $10 million cap. If the company is bought for $100 million, that's great news.

Term sheets are also often used for SAFE or convertible note rounds, but are used less frequently than for priced rounds because of the relative simplicity of SAFE and convertible note legal documents.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A safe (Simple Agreement for Future Equity) term sheet is a type of investment instrument used in early-stage startup funding. It allows investors to provide capital to a startup in exchange for the right to receive equity at a later date.

In a Liquidity Event, a safe holder is entitled to receive a portion of the proceeds equal to the greater of (1) a return of its Purchase Amount and (2) the as-converted proceeds it is entitled to in connection with a Liquidity Event (i.e., the proceeds it would be entitled to had its Purchase Amount been converted ...

A SAFE note term sheet is a legal document that aligns early-stage startup funding interests by outlining the key investment agreement terms for entrepreneurs.

Is a SAFE Note a Loan? No, a SAFE note is not a loan or debt, it is accounted for an equity on the balance sheet. Unlike convertible debt - or pretty much any debt, it does not have an interest rate nor does it have a maturity date.