This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

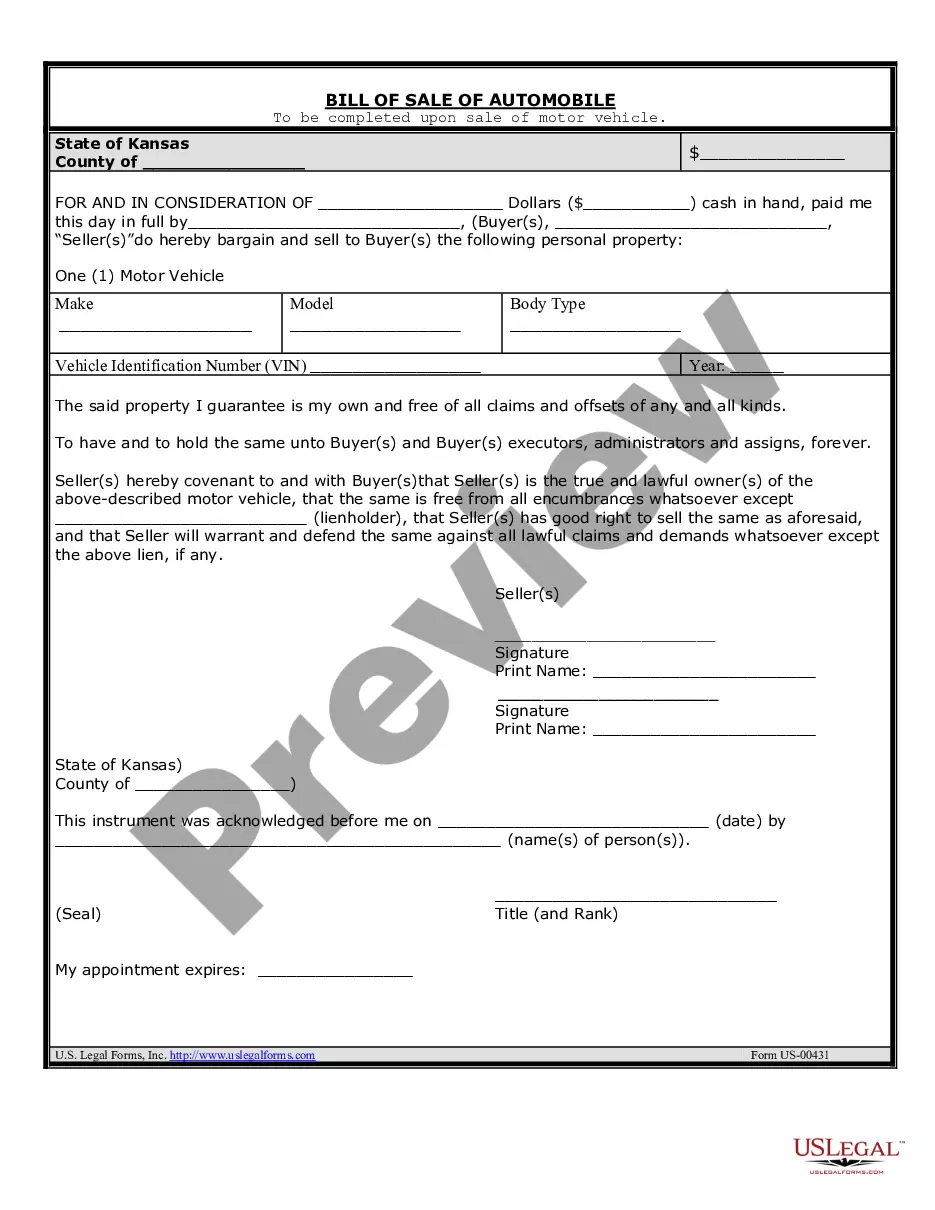

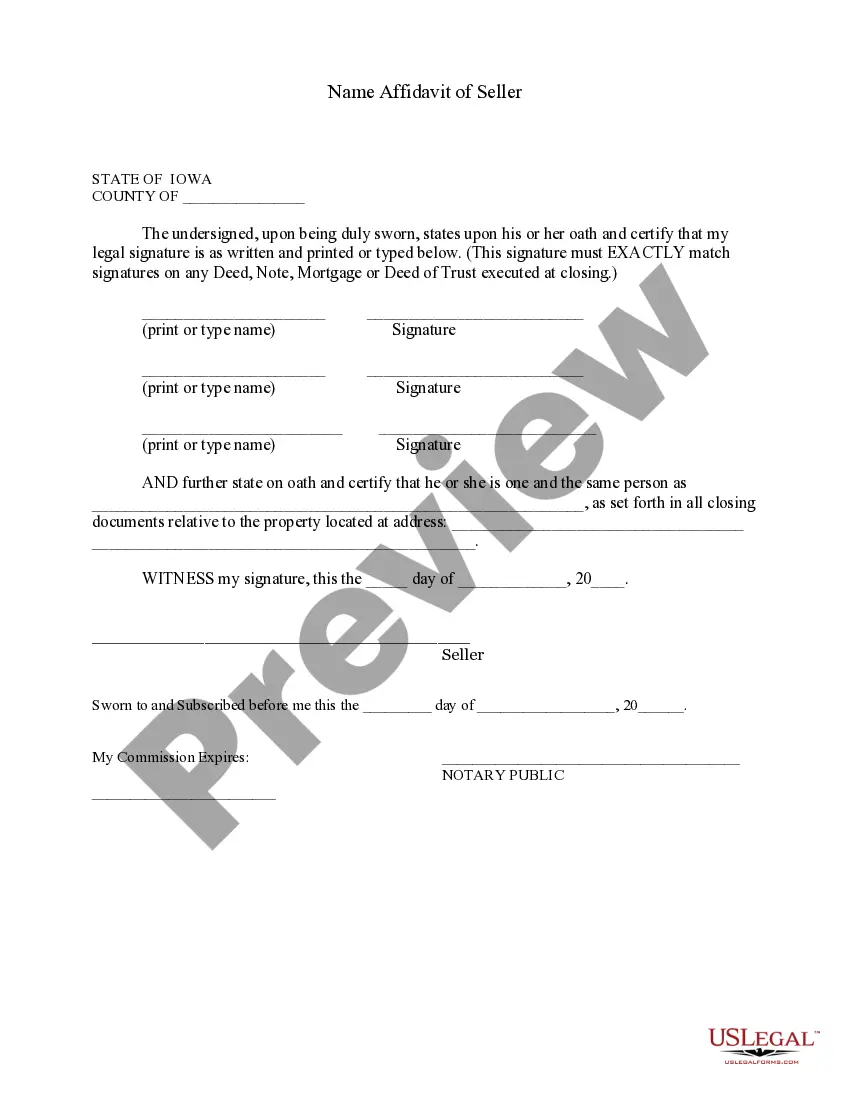

Note: The preview only shows the 1st page of the document.

The Texas Guide to Complying with the Red Flags Rule under FCRA and FACT is a comprehensive resource designed to assist businesses and organizations operating in the state of Texas in understanding and implementing the necessary measures to comply with the Red Flags Rule under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT). This guide includes various types of information and guidance, tailored specifically for businesses in different sectors and industries. One important aspect covered in the Texas Guide is defining what red flags are and why they are significant for businesses. It explains how red flags can indicate potential identity theft or fraudulent activity, and provides a list of common red flags that businesses should be aware of. The guide also emphasizes the importance of having a robust identity theft prevention program in place to detect and respond to red flags appropriately. Furthermore, the Texas Guide provides detailed instructions on developing and implementing an effective identity theft prevention program. It outlines the required components of such a program, including policies and procedures for identifying red flags, detecting suspicious activity, and responding appropriately. The guide offers practical examples and best practices to help businesses tailor their programs to their specific needs and risks, acknowledging that different industries may face unique challenges and red flag indicators. Moreover, the Texas Guide highlights the significance of employee training in recognizing red flags and reporting suspicious activity promptly. It emphasizes the need for ongoing training to keep employees updated on evolving identity theft techniques and red flag indicators. The guide offers resources and templates to assist businesses in creating effective training programs for their employees. Lastly, the Texas Guide to Complying with the Red Flags Rule under FCRA and FACT addresses the requirements for periodic review and updates of the identity theft prevention program. It advises businesses to stay informed about changes in identity theft techniques, new red flags, and updates to relevant laws and regulations. The guide encourages businesses to regularly reassess their program's effectiveness and make necessary adjustments to ensure continued compliance. In summary, the Texas Guide to Complying with the Red Flags Rule under FCRA and FACT provides businesses with comprehensive and practical guidance on developing and maintaining effective identity theft prevention programs. By utilizing this guide, businesses in Texas can stay proactive in detecting and addressing potential red flags, safeguarding their customers' personal information, and complying with legal obligations to combat identity theft.The Texas Guide to Complying with the Red Flags Rule under FCRA and FACT is a comprehensive resource designed to assist businesses and organizations operating in the state of Texas in understanding and implementing the necessary measures to comply with the Red Flags Rule under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT). This guide includes various types of information and guidance, tailored specifically for businesses in different sectors and industries. One important aspect covered in the Texas Guide is defining what red flags are and why they are significant for businesses. It explains how red flags can indicate potential identity theft or fraudulent activity, and provides a list of common red flags that businesses should be aware of. The guide also emphasizes the importance of having a robust identity theft prevention program in place to detect and respond to red flags appropriately. Furthermore, the Texas Guide provides detailed instructions on developing and implementing an effective identity theft prevention program. It outlines the required components of such a program, including policies and procedures for identifying red flags, detecting suspicious activity, and responding appropriately. The guide offers practical examples and best practices to help businesses tailor their programs to their specific needs and risks, acknowledging that different industries may face unique challenges and red flag indicators. Moreover, the Texas Guide highlights the significance of employee training in recognizing red flags and reporting suspicious activity promptly. It emphasizes the need for ongoing training to keep employees updated on evolving identity theft techniques and red flag indicators. The guide offers resources and templates to assist businesses in creating effective training programs for their employees. Lastly, the Texas Guide to Complying with the Red Flags Rule under FCRA and FACT addresses the requirements for periodic review and updates of the identity theft prevention program. It advises businesses to stay informed about changes in identity theft techniques, new red flags, and updates to relevant laws and regulations. The guide encourages businesses to regularly reassess their program's effectiveness and make necessary adjustments to ensure continued compliance. In summary, the Texas Guide to Complying with the Red Flags Rule under FCRA and FACT provides businesses with comprehensive and practical guidance on developing and maintaining effective identity theft prevention programs. By utilizing this guide, businesses in Texas can stay proactive in detecting and addressing potential red flags, safeguarding their customers' personal information, and complying with legal obligations to combat identity theft.