Texas Window Contractor Agreement - Self-Employed

Description

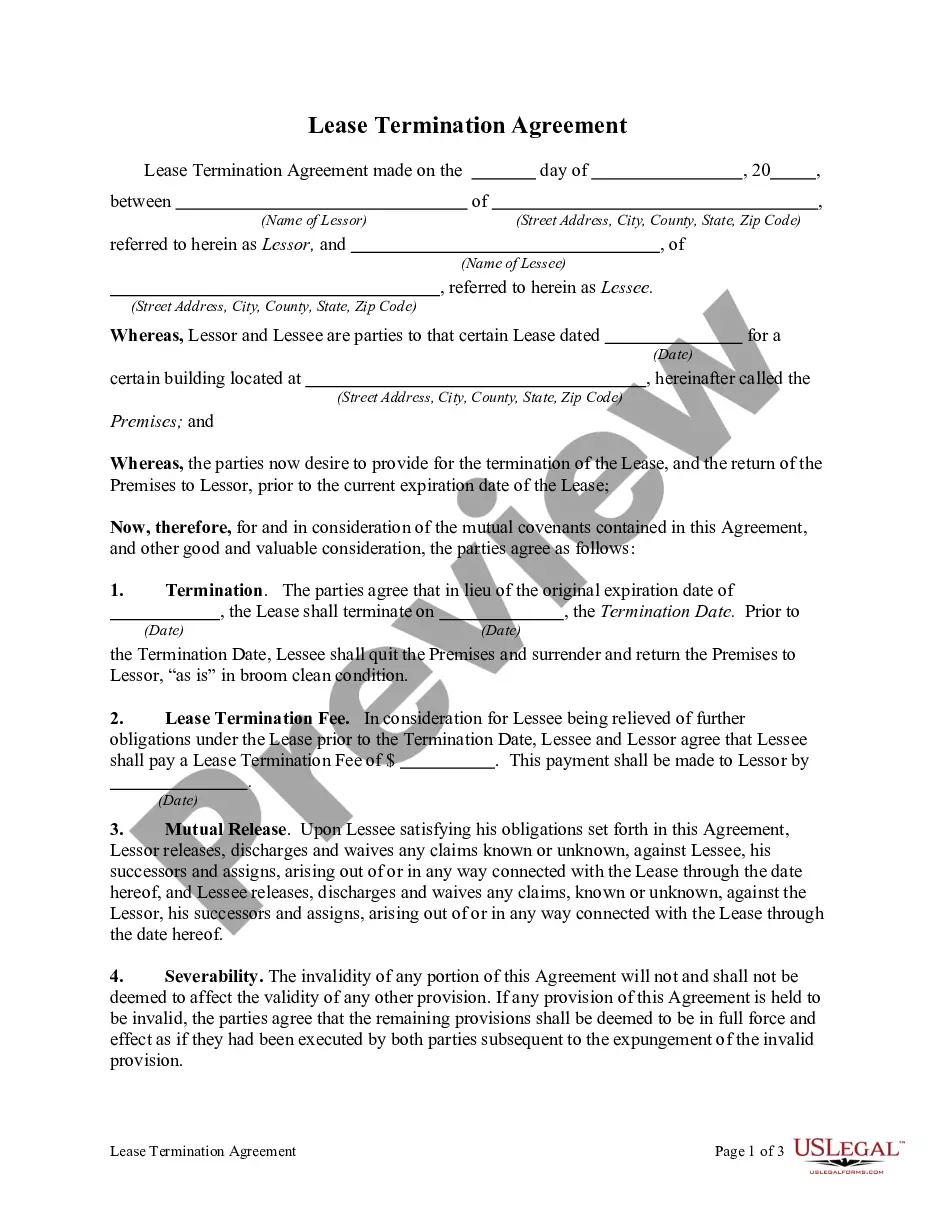

How to fill out Texas Window Contractor Agreement - Self-Employed?

If you need to full, acquire, or print legal record web templates, use US Legal Forms, the greatest collection of legal forms, that can be found on the web. Take advantage of the site`s basic and handy lookup to find the files you require. Numerous web templates for company and personal functions are sorted by groups and says, or keywords. Use US Legal Forms to find the Texas Window Contractor Agreement - Self-Employed within a number of click throughs.

In case you are already a US Legal Forms consumer, log in in your bank account and click on the Obtain option to have the Texas Window Contractor Agreement - Self-Employed. You can even access forms you previously saved inside the My Forms tab of your bank account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape for the right metropolis/nation.

- Step 2. Utilize the Preview choice to check out the form`s articles. Never overlook to read through the outline.

- Step 3. In case you are unhappy with the kind, make use of the Lookup discipline towards the top of the monitor to locate other versions in the legal kind template.

- Step 4. Once you have found the shape you require, select the Purchase now option. Select the costs program you favor and put your credentials to sign up on an bank account.

- Step 5. Approach the financial transaction. You should use your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Choose the formatting in the legal kind and acquire it on the product.

- Step 7. Complete, revise and print or indication the Texas Window Contractor Agreement - Self-Employed.

Each legal record template you get is your own for a long time. You may have acces to every kind you saved with your acccount. Click on the My Forms section and select a kind to print or acquire once again.

Contend and acquire, and print the Texas Window Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and express-specific forms you may use for your company or personal demands.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.