Texas Moving Services Contract - Self-Employed

Description

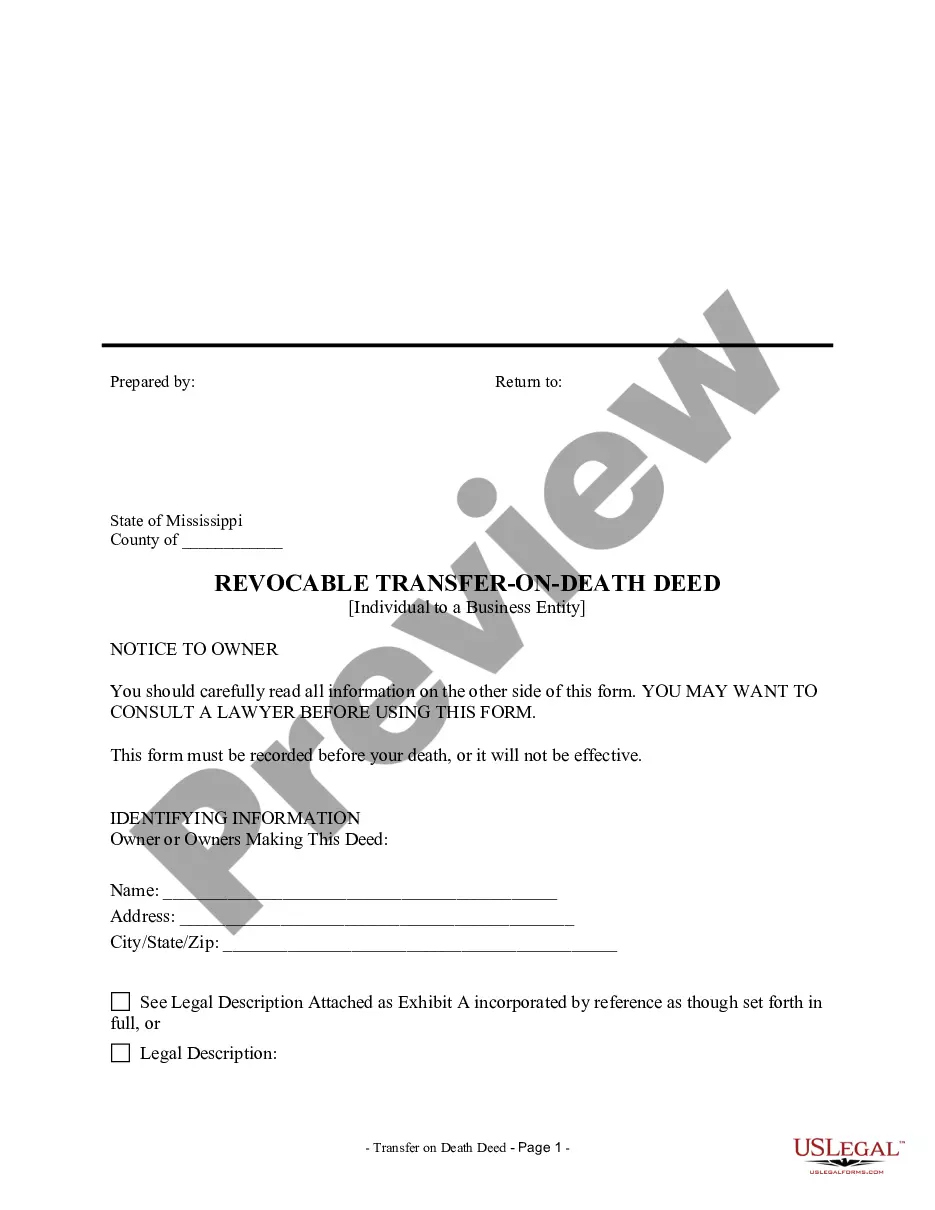

How to fill out Texas Moving Services Contract - Self-Employed?

You can spend hrs on the web looking for the lawful record design that suits the state and federal requirements you need. US Legal Forms gives a huge number of lawful types which are reviewed by professionals. It is possible to acquire or produce the Texas Moving Services Contract - Self-Employed from the service.

If you have a US Legal Forms account, you can log in and then click the Obtain option. Afterward, you can complete, revise, produce, or indicator the Texas Moving Services Contract - Self-Employed. Every single lawful record design you acquire is your own permanently. To get one more version for any bought kind, visit the My Forms tab and then click the related option.

If you use the US Legal Forms site for the first time, adhere to the straightforward directions under:

- Initially, make certain you have chosen the proper record design for that county/metropolis of your liking. Browse the kind outline to ensure you have picked out the proper kind. If accessible, take advantage of the Review option to search through the record design at the same time.

- If you would like locate one more version from the kind, take advantage of the Look for field to find the design that meets your requirements and requirements.

- Once you have identified the design you desire, click Get now to carry on.

- Select the pricing plan you desire, type your qualifications, and register for your account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the lawful kind.

- Select the formatting from the record and acquire it for your system.

- Make changes for your record if needed. You can complete, revise and indicator and produce Texas Moving Services Contract - Self-Employed.

Obtain and produce a huge number of record layouts while using US Legal Forms site, that offers the most important assortment of lawful types. Use professional and express-specific layouts to tackle your business or specific needs.

Form popularity

FAQ

(C) A contract that includes maintenance and repair or restoration will be taxable in total if the charges for repairs and/or restoration services exceed 5.0% of the total charges and are not separately identified to the customer in the contract or billing.

Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

(C) A contract that includes maintenance and repair or restoration will be taxable in total if the charges for repairs and/or restoration services exceed 5.0% of the total charges and are not separately identified to the customer in the contract or billing.

Taxable ServicesAmusement Services.Cable Television Services and Bundled Cable Services.Credit Reporting Services.Data Processing Services.Debt Collection Services.Information Services.Insurance Services.Internet Access Services.More items...

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The charges for transportation or delivery, both before and after the sale, are taxable even if stated separately from the sales price of a taxable item. These charges are considered to be services or expenses connected to the sale.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.