Texas Specialty Services Contact - Self-Employed

Description

How to fill out Texas Specialty Services Contact - Self-Employed?

If you have to complete, obtain, or printing lawful papers web templates, use US Legal Forms, the largest collection of lawful varieties, which can be found on the web. Use the site`s basic and handy look for to obtain the papers you will need. Different web templates for organization and person reasons are sorted by categories and states, or search phrases. Use US Legal Forms to obtain the Texas Specialty Services Contact - Self-Employed in just a few mouse clicks.

If you are presently a US Legal Forms buyer, log in in your profile and click the Acquire option to have the Texas Specialty Services Contact - Self-Employed. Also you can access varieties you in the past acquired inside the My Forms tab of the profile.

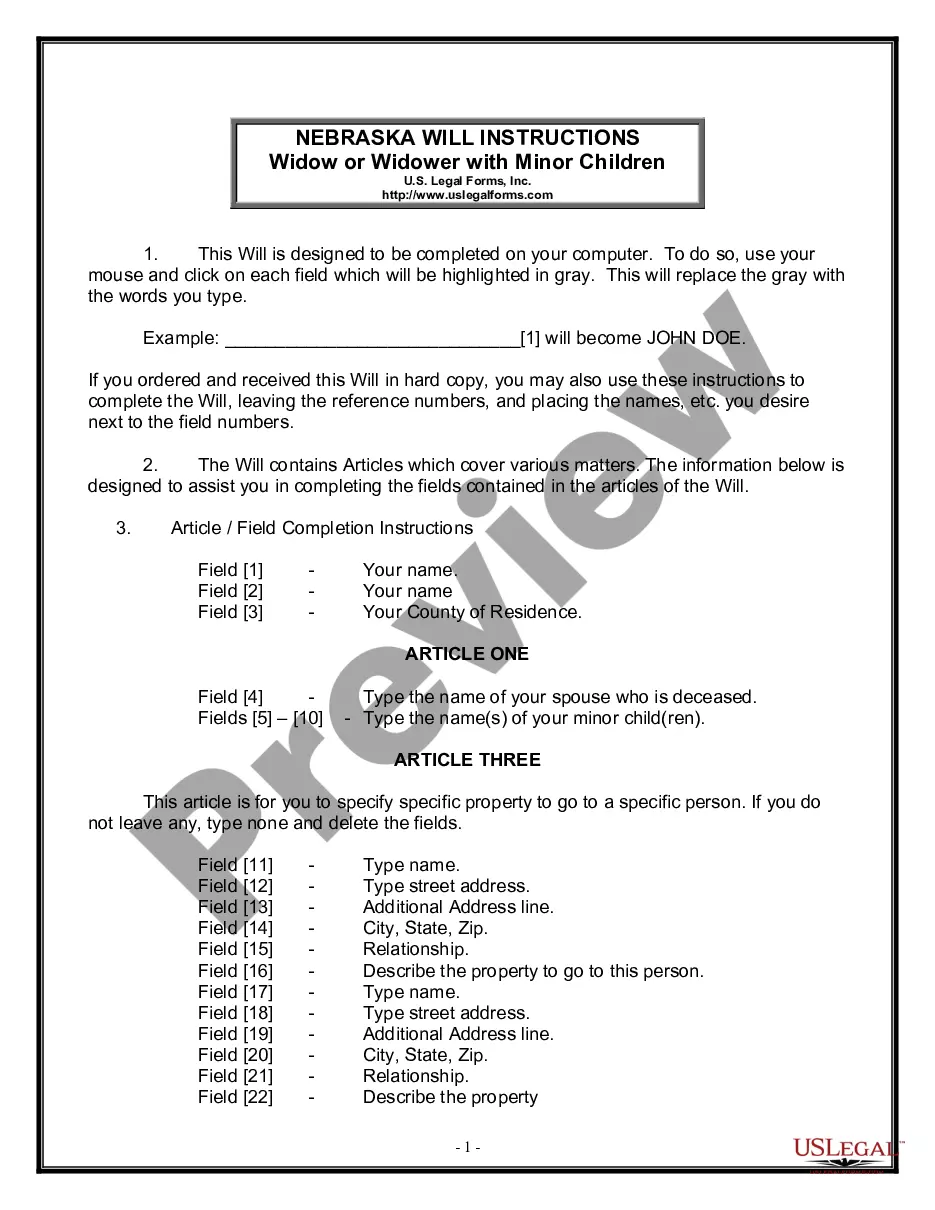

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that right metropolis/land.

- Step 2. Utilize the Preview method to look through the form`s content material. Don`t forget about to read through the description.

- Step 3. If you are unsatisfied together with the form, use the Look for field towards the top of the monitor to get other versions from the lawful form web template.

- Step 4. When you have discovered the form you will need, click the Buy now option. Opt for the pricing program you choose and include your references to register to have an profile.

- Step 5. Process the purchase. You can use your credit card or PayPal profile to accomplish the purchase.

- Step 6. Pick the file format from the lawful form and obtain it on your own system.

- Step 7. Full, revise and printing or signal the Texas Specialty Services Contact - Self-Employed.

Every single lawful papers web template you acquire is your own forever. You might have acces to each and every form you acquired within your acccount. Click the My Forms portion and pick a form to printing or obtain yet again.

Be competitive and obtain, and printing the Texas Specialty Services Contact - Self-Employed with US Legal Forms. There are millions of skilled and express-specific varieties you may use to your organization or person needs.

Form popularity

FAQ

Generally, felony probation requirements in Texas require defendants to:Attend their regularly scheduled meetings with their probation officers on time, every time.Maintain a job in a reliable and lawful occupation.Not break any laws.Not ingest alcohol, illicit drugs or other controlled substances.More items...?

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

How to Prove Income When Self-Employed Versus as an EmployeeT-4 slips.Pay stubs.A copy of your federal income tax return.A proof of income statement, called an Option C print, from the CRA.

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

Yes, you can be self-employed while on probation, but you will need to show some sort of income statements or tax statements.

Documents that could be used to prove self-employment include, but are not limited to: business licenses, tax returns, business receipts or invoices, signed affidavits verifying self-employment, contracts or agreements, or bank statements from a business account that show self-employment.

Self-employment: means the customer solely owns, manages, and operates a business and is not considered an employee of another person, business, or organization; exists when the service or product is actively marketed to other potential customers; and.

Wage and Tax Statement for Self Employed (1099). These forms prove your wages and taxes as a self employed individual. It's one of the most reliable proofs of income you can produce since it is a legal document. Profit and Loss Statement or Ledger Documentation.

If you are an independent contractor, a gig worker, or are self-employed in Texas, and you are out of work due to COVID-19, you may qualify for unemployment benefits through Pandemic Unemployment Assistance (PUA).