Texas Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor

Description

How to fill out Texas Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor?

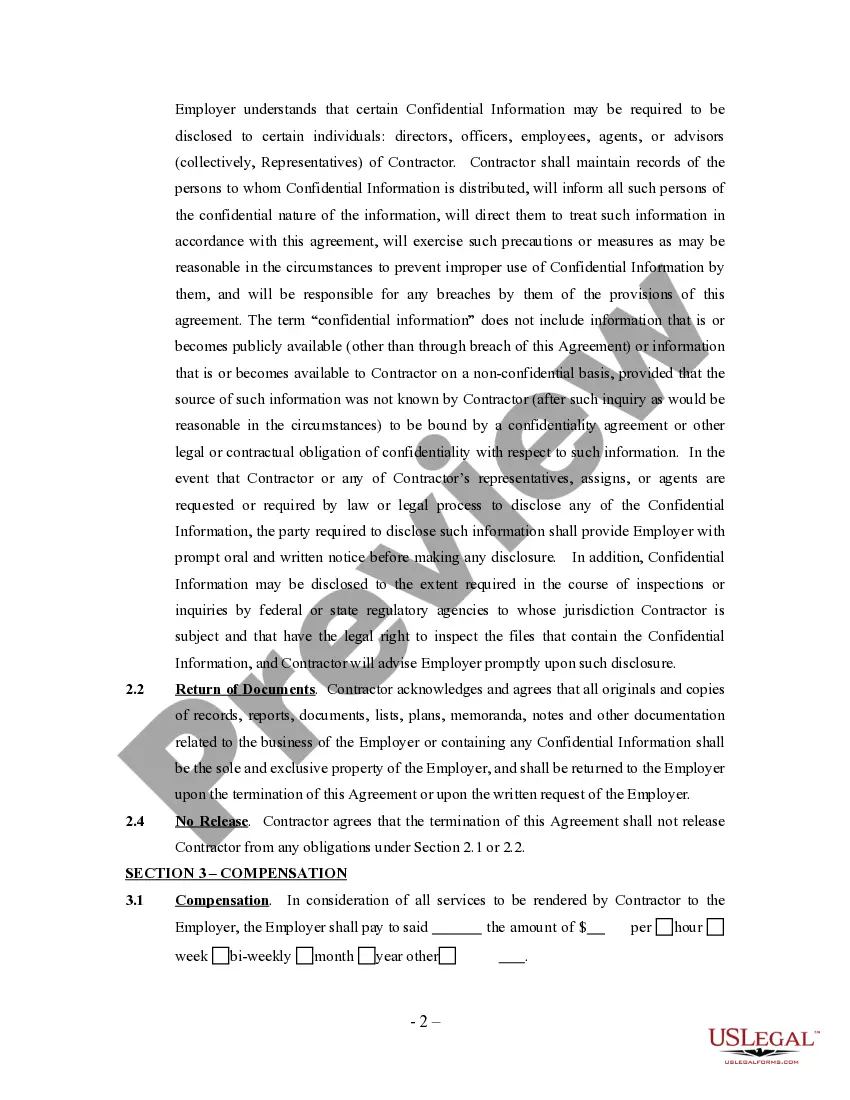

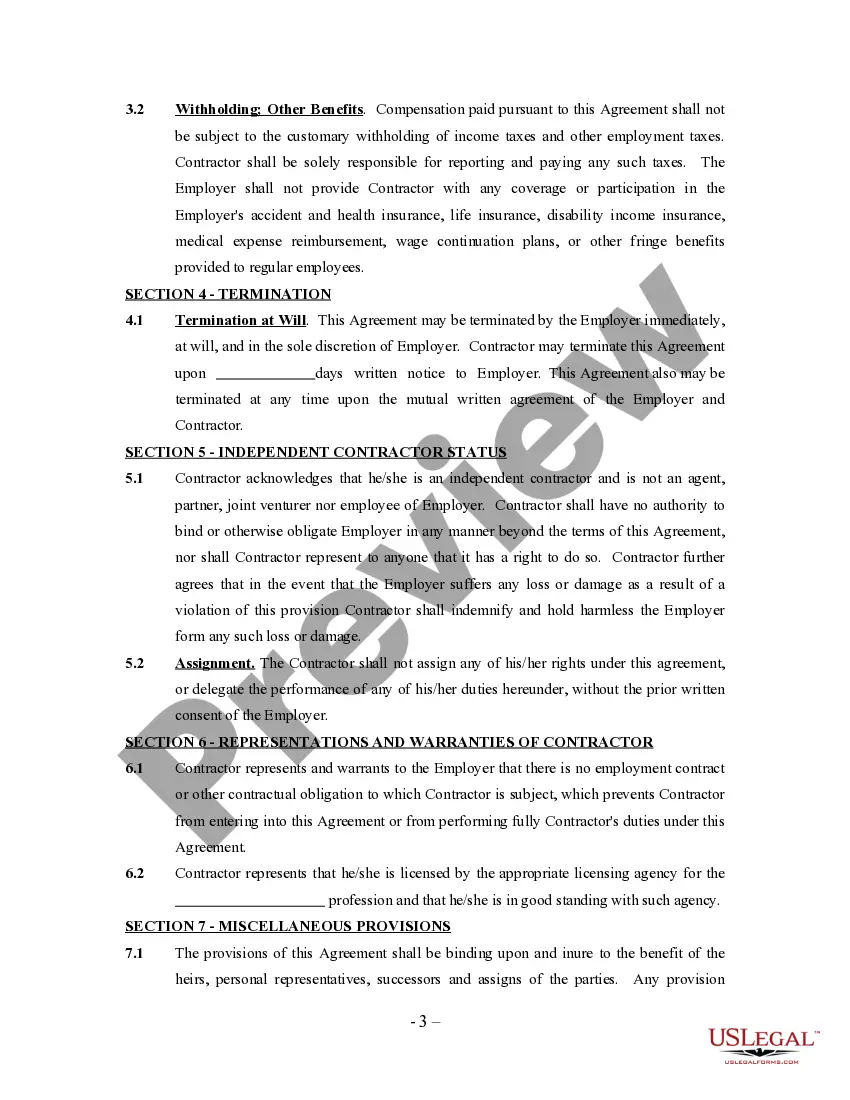

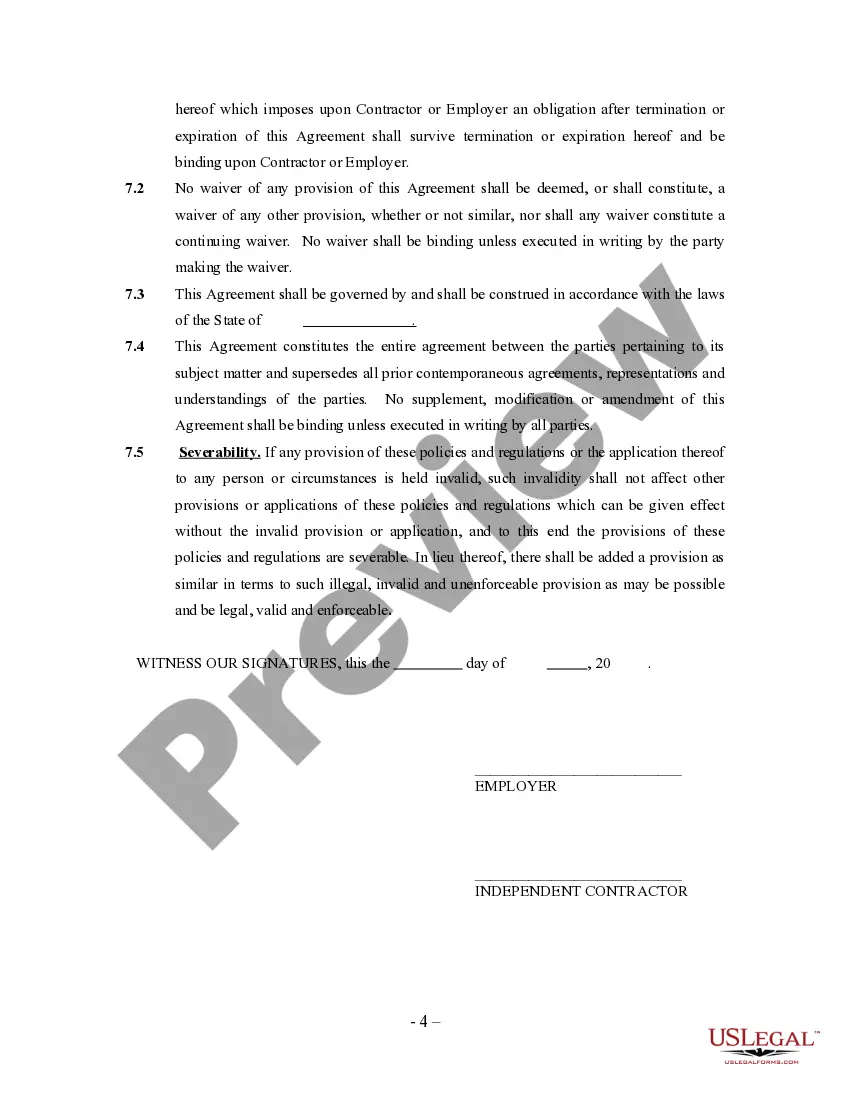

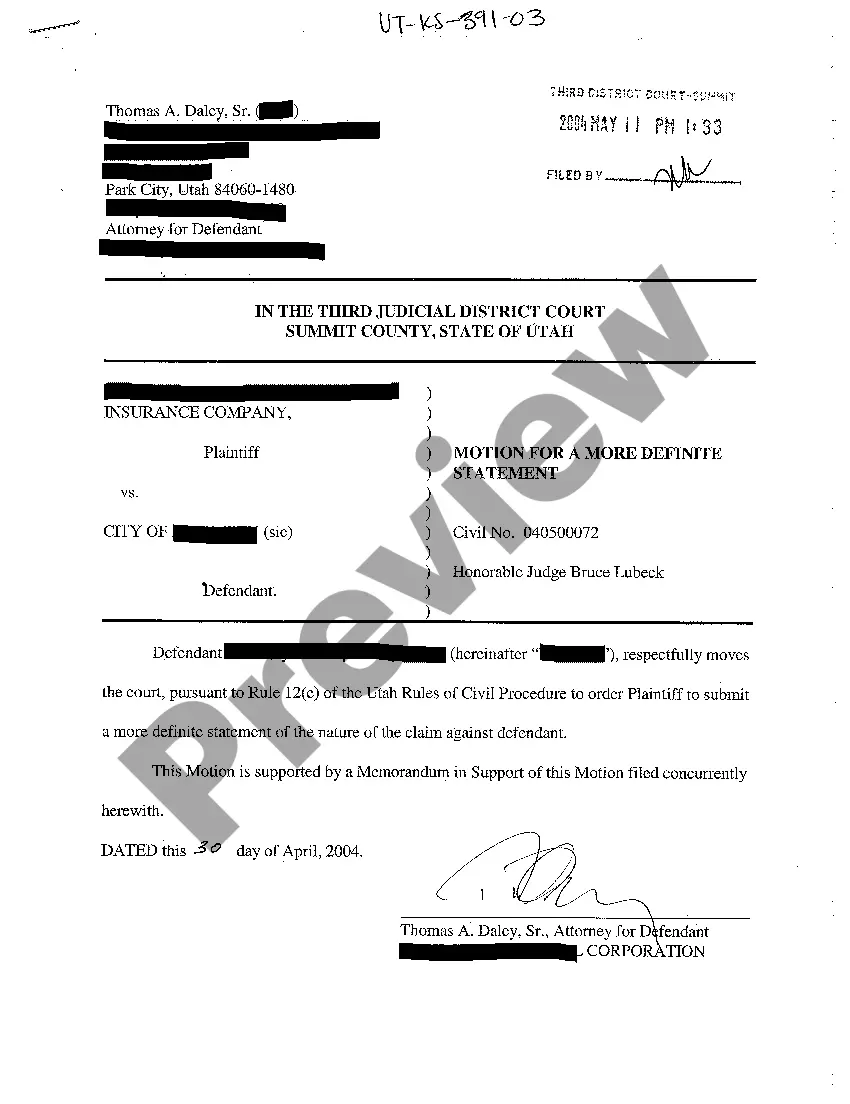

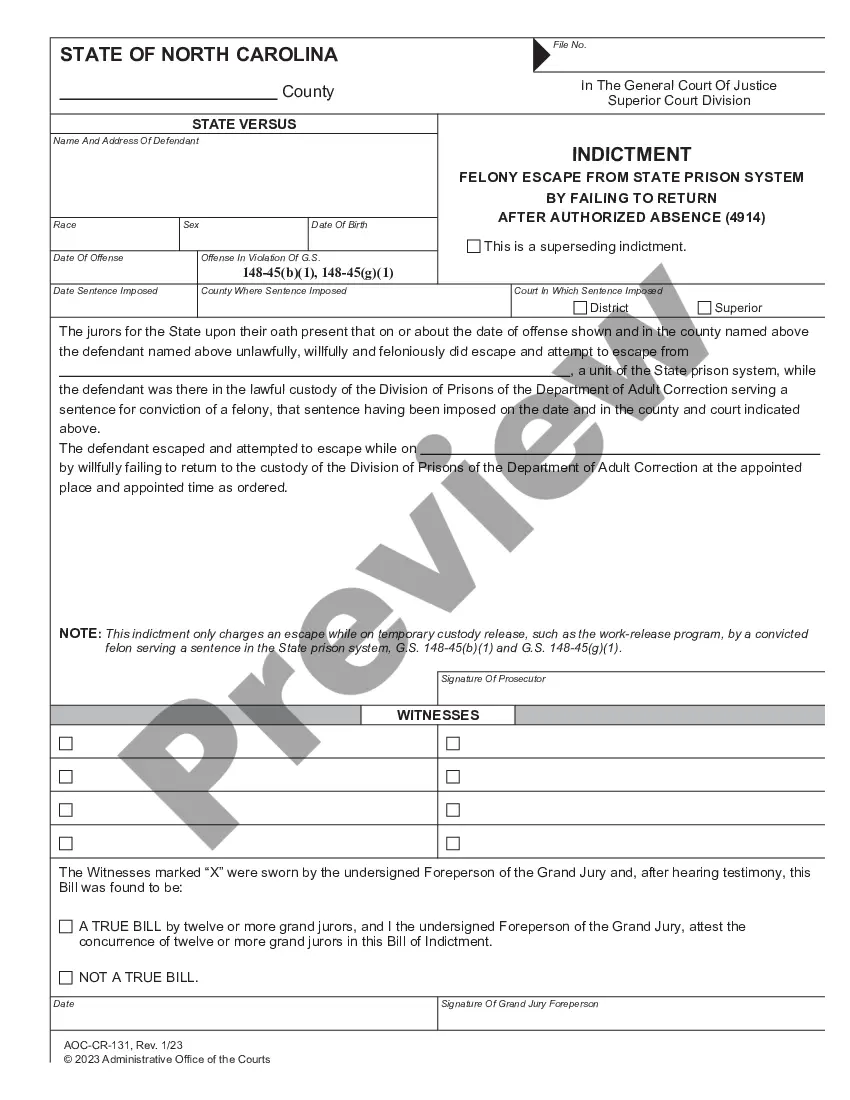

Have you been in a position the place you require paperwork for either company or personal reasons nearly every working day? There are tons of legitimate papers layouts available on the net, but finding kinds you can depend on isn`t easy. US Legal Forms delivers 1000s of type layouts, such as the Texas Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor, which are composed in order to meet federal and state needs.

When you are previously knowledgeable about US Legal Forms internet site and also have a free account, basically log in. Next, you may acquire the Texas Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor web template.

Unless you provide an bank account and need to begin using US Legal Forms, adopt these measures:

- Discover the type you need and ensure it is for your correct metropolis/county.

- Take advantage of the Review button to analyze the shape.

- Browse the outline to ensure that you have chosen the right type.

- When the type isn`t what you are searching for, use the Search area to discover the type that fits your needs and needs.

- Once you find the correct type, simply click Get now.

- Opt for the prices program you want, submit the necessary details to create your bank account, and buy the transaction using your PayPal or charge card.

- Choose a practical paper format and acquire your copy.

Find each of the papers layouts you might have bought in the My Forms food list. You can aquire a extra copy of Texas Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor at any time, if required. Just go through the required type to acquire or produce the papers web template.

Use US Legal Forms, the most comprehensive selection of legitimate forms, in order to save time and avoid errors. The services delivers appropriately made legitimate papers layouts that can be used for an array of reasons. Produce a free account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

The differences are actually pretty simple to understand once they are explained. They can be summed up in two sentences: Copyeditors catch all the mistakes the author missed. Proofreaders catch all the mistakes the copyeditor missed.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

Ability to work independently. Ability to meet deadlines. Exceptional time management skills. Excellent Google search skills.

Creators are considered to be independent contractors; if you had actually read the Partner Programme Agreement rather than simply clicking that you agreed and understood it while placing your digital signature, you would have clearly seen this.

As long as the freelance writer or editor makes less than 35 content submissions a year, they can still be labeled an independent contractor.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

If you have always wanted to work from home and have an incredible attention to detail, online proofreading jobs may be the perfect fit. You can work for a company (usually as an independent contractor), or run your own freelance gig using one of the many freelance marketplaces.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

To reach a customer service representative, please call us at 888-833-8385.

In professional publishing, copy editing is the act of improving what an author writes. Proofreading, on the other hand, is a safety net that ensures that the author and copy editor didn't miss anything. These are two different jobs with the same goal: making a piece of writing as readable and error-free as possible.