Texas Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

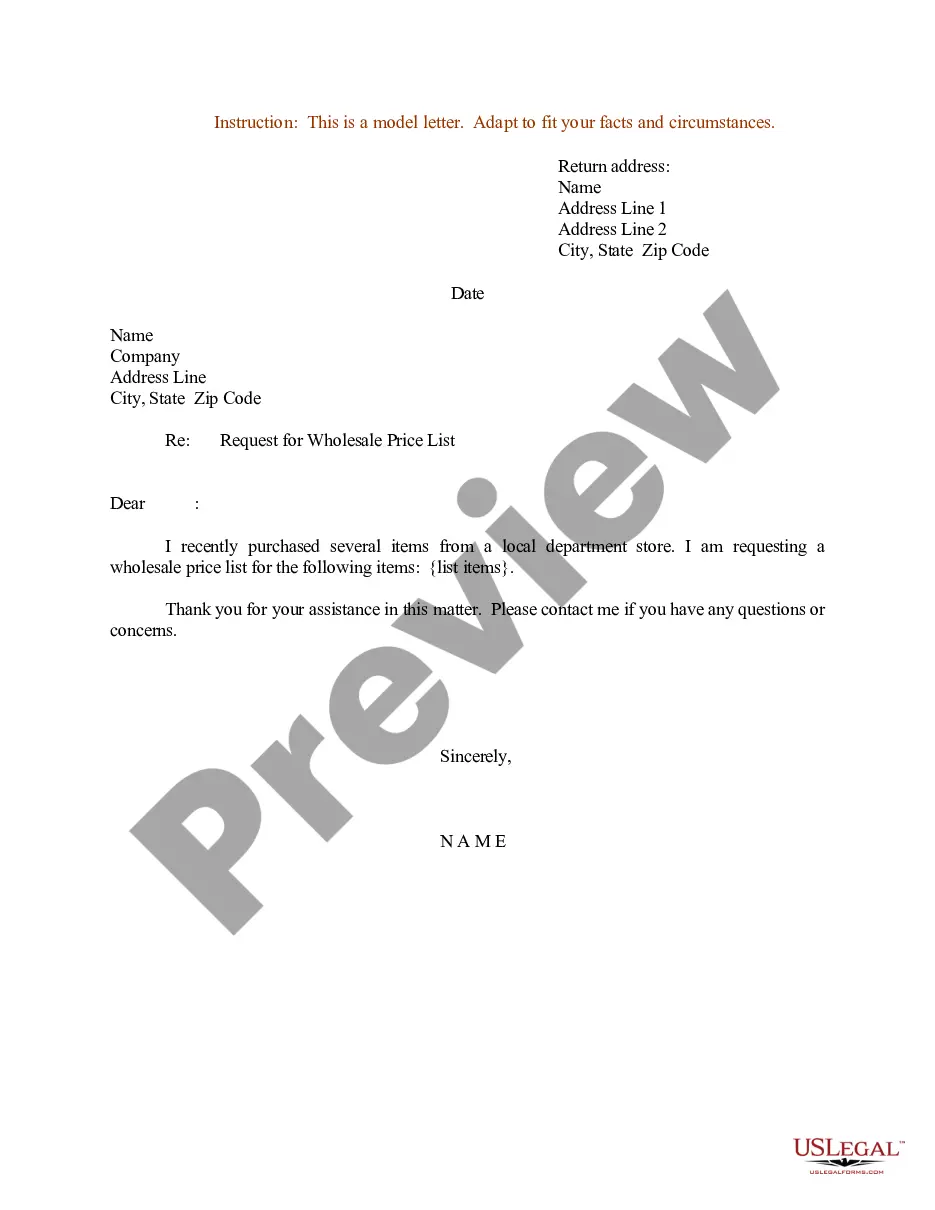

How to fill out Texas Self-Employed Independent Contractor Pyrotechnician Service Contract?

If you need to complete, obtain, or print legitimate document layouts, use US Legal Forms, the biggest collection of legitimate forms, that can be found on the web. Use the site`s simple and easy convenient search to obtain the paperwork you want. A variety of layouts for business and person uses are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the Texas Self-Employed Independent Contractor Pyrotechnician Service Contract in a number of clicks.

In case you are previously a US Legal Forms consumer, log in in your account and click on the Acquire option to obtain the Texas Self-Employed Independent Contractor Pyrotechnician Service Contract. You can also gain access to forms you previously delivered electronically from the My Forms tab of your respective account.

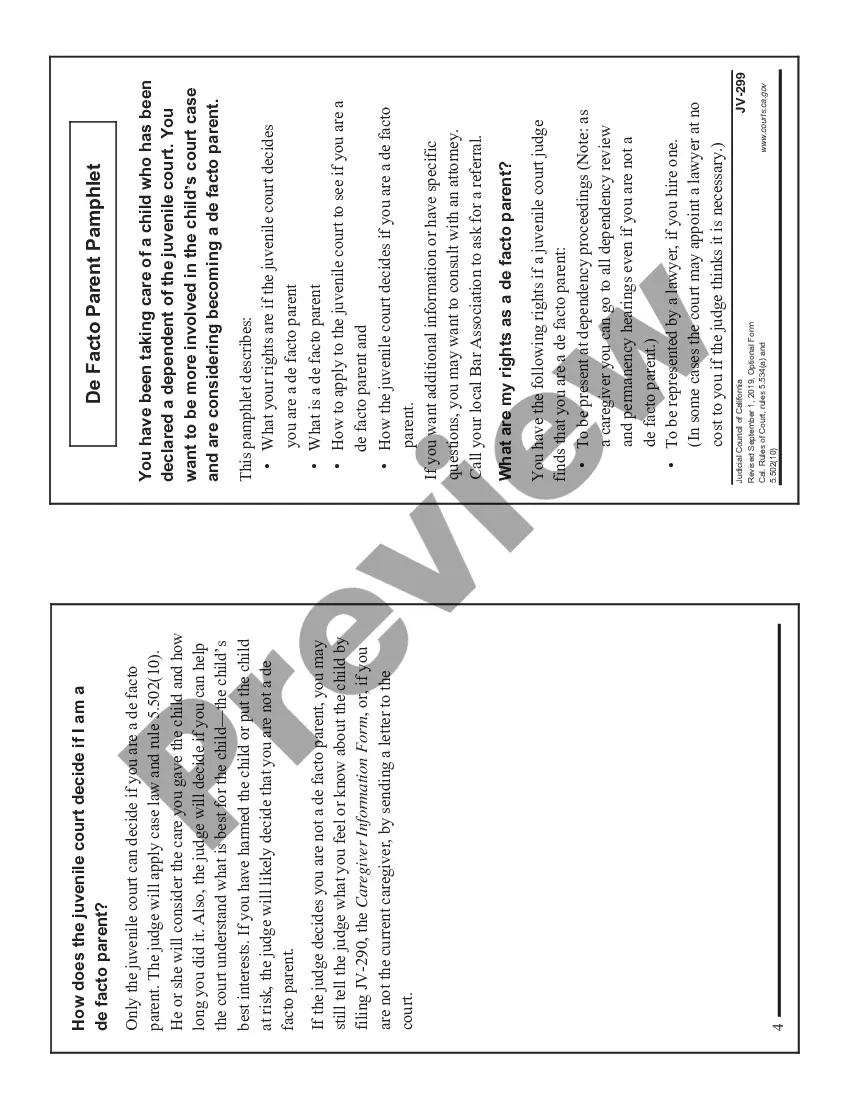

If you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the appropriate metropolis/land.

- Step 2. Utilize the Review choice to examine the form`s articles. Do not neglect to read the description.

- Step 3. In case you are unhappy together with the form, use the Research field on top of the screen to find other models of the legitimate form design.

- Step 4. Once you have found the shape you want, select the Acquire now option. Pick the costs plan you like and add your credentials to register for the account.

- Step 5. Method the purchase. You may use your bank card or PayPal account to complete the purchase.

- Step 6. Choose the formatting of the legitimate form and obtain it on your system.

- Step 7. Comprehensive, revise and print or signal the Texas Self-Employed Independent Contractor Pyrotechnician Service Contract.

Every single legitimate document design you get is your own property for a long time. You might have acces to every single form you delivered electronically in your acccount. Select the My Forms segment and decide on a form to print or obtain yet again.

Remain competitive and obtain, and print the Texas Self-Employed Independent Contractor Pyrotechnician Service Contract with US Legal Forms. There are thousands of specialist and express-distinct forms you can utilize for the business or person demands.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

A third way of approaching this problem is called the "ABC" test, which is used by almost two thirds of the states (not including Texas) in determining whether workers are employees or independent contractors for state unemployment tax purposes.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

The ABC test is a legal test used by many states in employment-related laws, such as for workers' compensation or unemployment compensation, to determine whether a worker is an employee or independent contractor.