A Texas Research Agreement — Self-Employed Independent Contractor is a legal contract that outlines the terms and conditions between a researcher and a hiring entity in the state of Texas. This agreement is specifically designed for independent contractors who are self-employed and engaged in research activities. Keywords: Texas Research Agreement, Self-Employed, Independent Contractor, Research Activities, Terms and Conditions, Hiring Entity. This agreement serves as a crucial document to establish a clear understanding between the researcher and the hiring entity regarding the scope of the research, rights and responsibilities of both parties, compensation, and confidentiality. The agreement ensures that the researcher's work is protected, and it addresses important legal aspects. Within the category of Texas Research Agreement — Self-Employed Independent Contractors, there can be different types based on various research fields and requirements. Some of these specific types may include: 1. Scientific Research Agreement: This type of research agreement is applicable when the self-employed contractor is engaged in scientific research, conducting experiments, analyzing data, and drawing conclusions. 2. Medical Research Agreement: In the case of medical researchers who are self-employed, this specific agreement caters to the unique aspects of their field. It may include provisions for clinical trials, patient privacy, and compliance with medical ethics. 3. Market Research Agreement: This type of agreement is relevant for self-employed contractors who specialize in market research, conducting surveys, analyzing consumer behavior, and providing insights to businesses. 4. Technology Research Agreement: When the research activities involve technology-related fields such as software development, artificial intelligence, or innovation research, this specific agreement can be utilized to define the researcher's responsibilities and protect intellectual property. 5. Academic Research Agreement: This agreement type is suitable for self-employed independent contractors engaged in academic research, such as professors, scholars, or postgraduate students. In conclusion, a Texas Research Agreement — Self-Employed Independent Contractor is an essential legal document that outlines the terms and conditions between a researcher and a hiring entity. It ensures clear communication, protects the rights of both parties, and establishes expectations for various research fields such as scientific, medical, market, technology, and academic research.

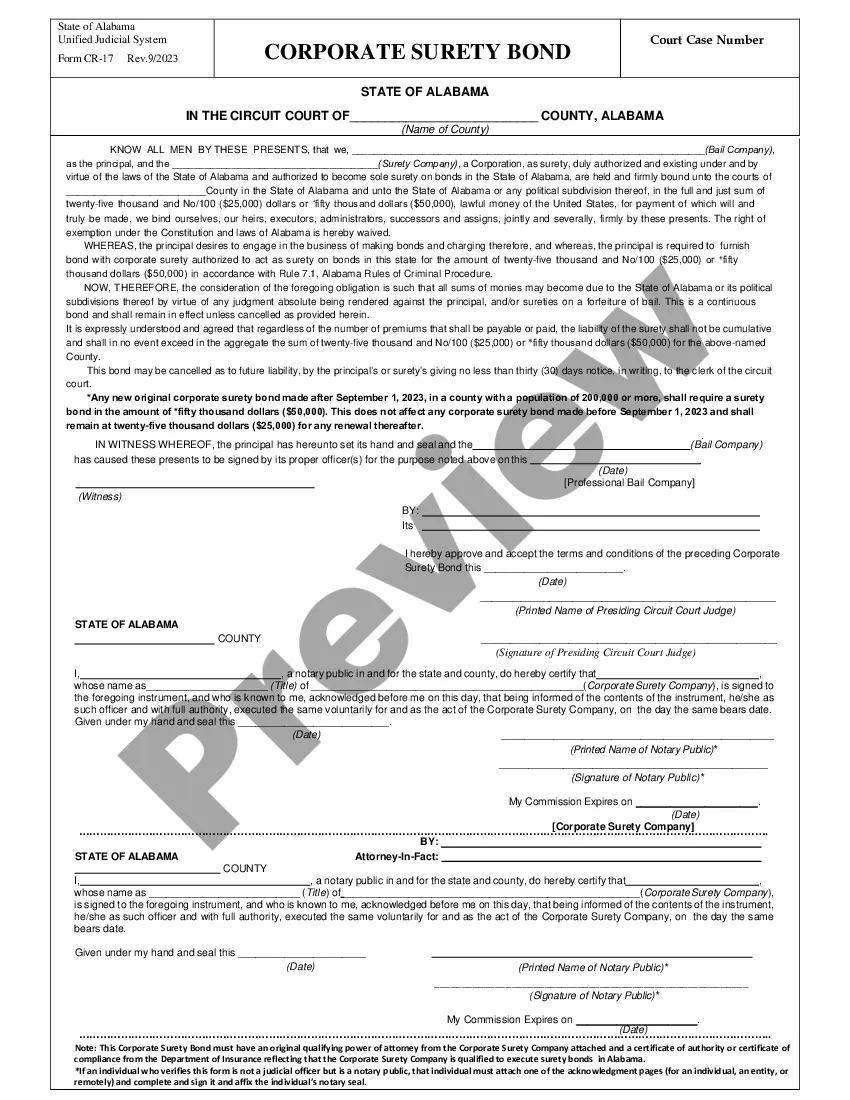

Texas Research Agreement - Self-Employed Independent Contractor

Description

How to fill out Research Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the biggest libraries of legal forms in the States - gives a wide range of legal papers templates you may download or print. Utilizing the website, you can find a huge number of forms for enterprise and personal reasons, categorized by types, claims, or keywords and phrases.You will find the newest types of forms such as the Texas Research Agreement - Self-Employed Independent Contractor in seconds.

If you have a monthly subscription, log in and download Texas Research Agreement - Self-Employed Independent Contractor from your US Legal Forms catalogue. The Down load key can look on every single kind you perspective. You have access to all previously delivered electronically forms within the My Forms tab of the profile.

If you want to use US Legal Forms the first time, here are straightforward directions to get you began:

- Be sure you have picked out the correct kind to your city/region. Go through the Preview key to check the form`s articles. See the kind description to ensure that you have selected the correct kind.

- In case the kind does not match your requirements, make use of the Research field on top of the display to get the one which does.

- In case you are content with the shape, affirm your selection by visiting the Purchase now key. Then, select the rates plan you prefer and provide your references to register for the profile.

- Method the purchase. Make use of bank card or PayPal profile to complete the purchase.

- Pick the format and download the shape on the gadget.

- Make modifications. Fill out, revise and print and sign the delivered electronically Texas Research Agreement - Self-Employed Independent Contractor.

Every design you put into your account lacks an expiration particular date and it is your own permanently. So, if you wish to download or print an additional backup, just proceed to the My Forms section and then click about the kind you require.

Get access to the Texas Research Agreement - Self-Employed Independent Contractor with US Legal Forms, the most substantial catalogue of legal papers templates. Use a huge number of specialist and condition-certain templates that satisfy your organization or personal demands and requirements.

Form popularity

FAQ

Independent contractors in Texas, and those who hire them, often wonder whether independent contractors can be bound by a non-compete agreement under Texas Law. The answer is yes. In Texas, there is no prohibition against binding an independent contractor to a non-compete agreement.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Even if you remain classified as a contractor, a non-compete clause may not be enforceable. Independent contractors are expected to be experts in their chosen field and are likely working for multiple companies at once. If one company attempts to enforce a non-compete clause, your ability to find work may be affected.

The answer is: A non-compete agreement IS enforceable in Texas if it is supported by valid consideration, and is reasonable in time, geographic scope, and activities to be restrained. A Texas employer can utilize a non compete agreement to protect company goodwill and confidential information.

There must first, in every instance, be a separate enforceable agreement beyond the noncompete restriction itself. In other words, a standalone noncompete procured in return for a sum of money or other compensation is simply void as against Texas public policy. That is a naked restraint that will not be enforced.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

In its most recent case on the subject, the Texas Supreme Court ruled, that in certain circumstances, non-compete agreements are enforceable. As a result, although an employee may lose her job, the employer with a non-compete agreement will prevent her from walking across the street to work for a competitor.