Texas Self-Employed Seasonal Picker Services Contract

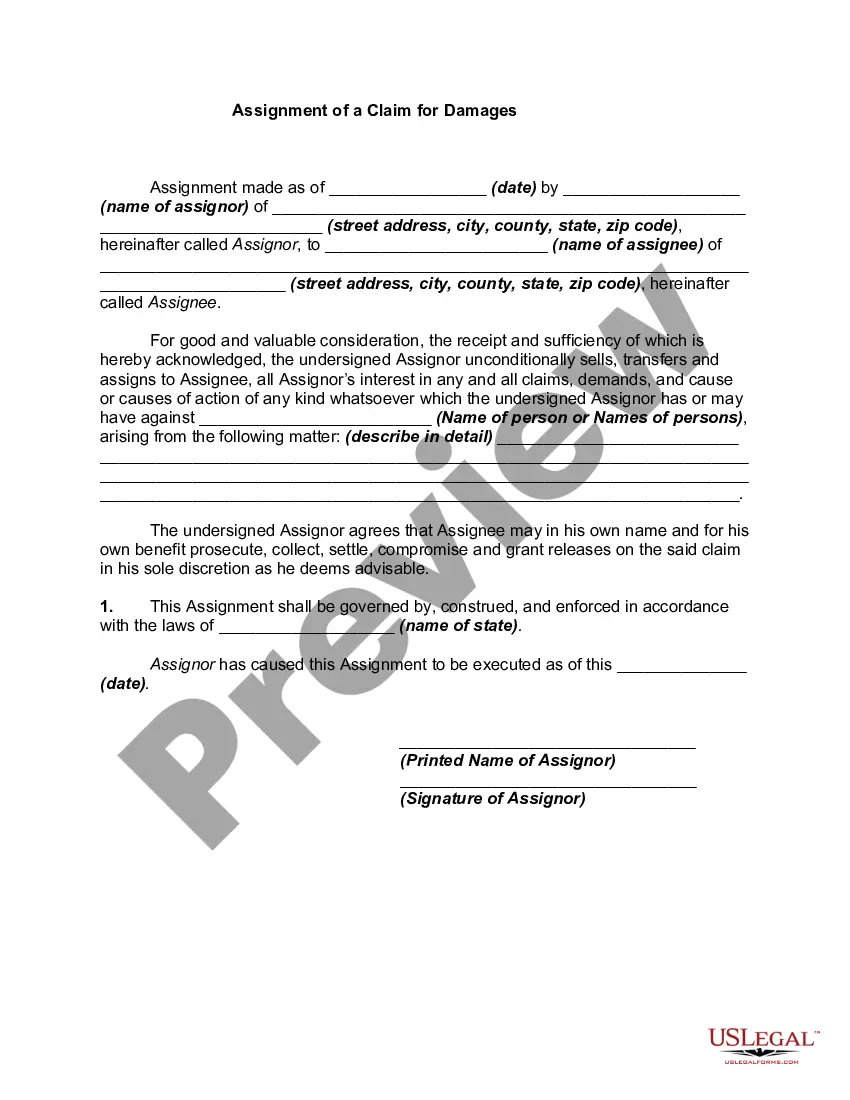

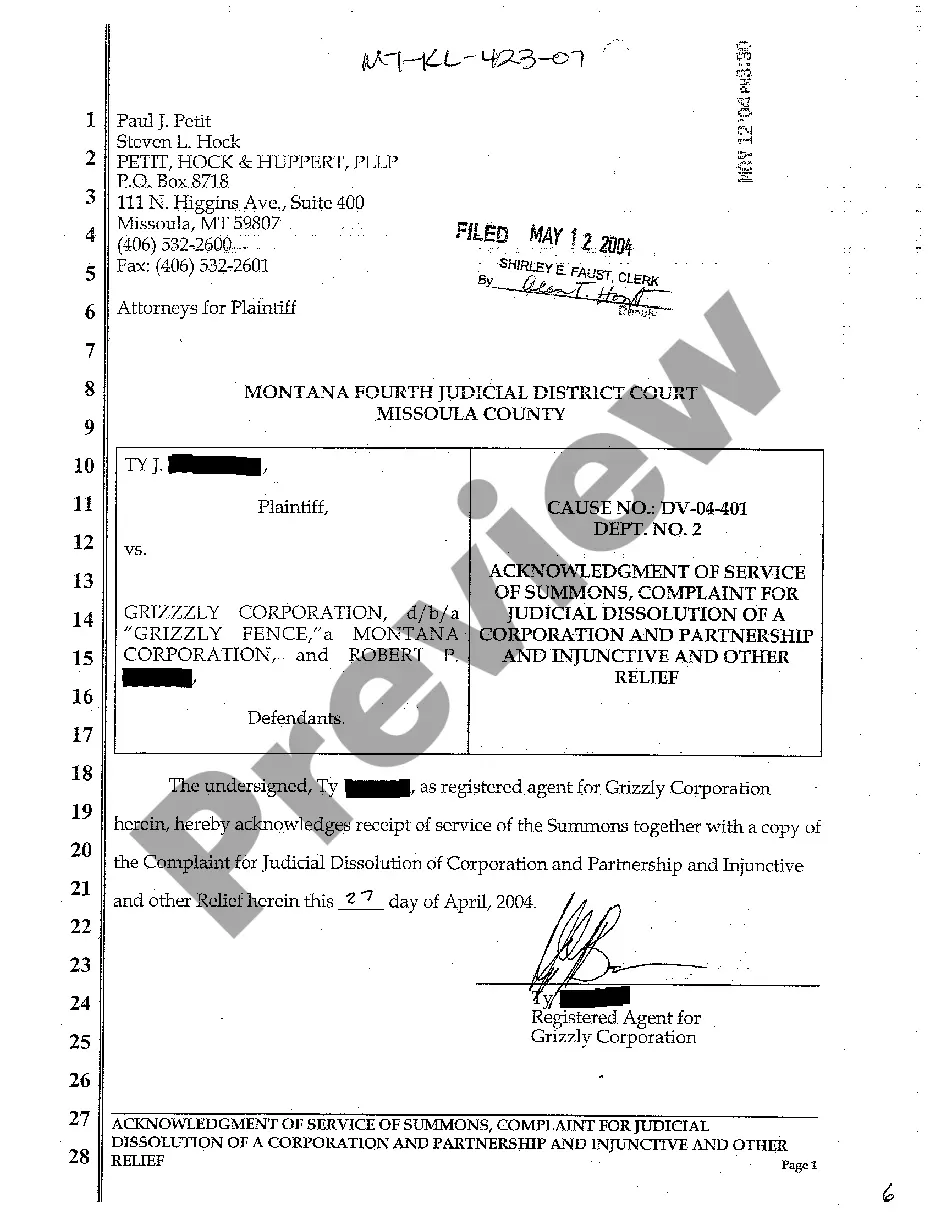

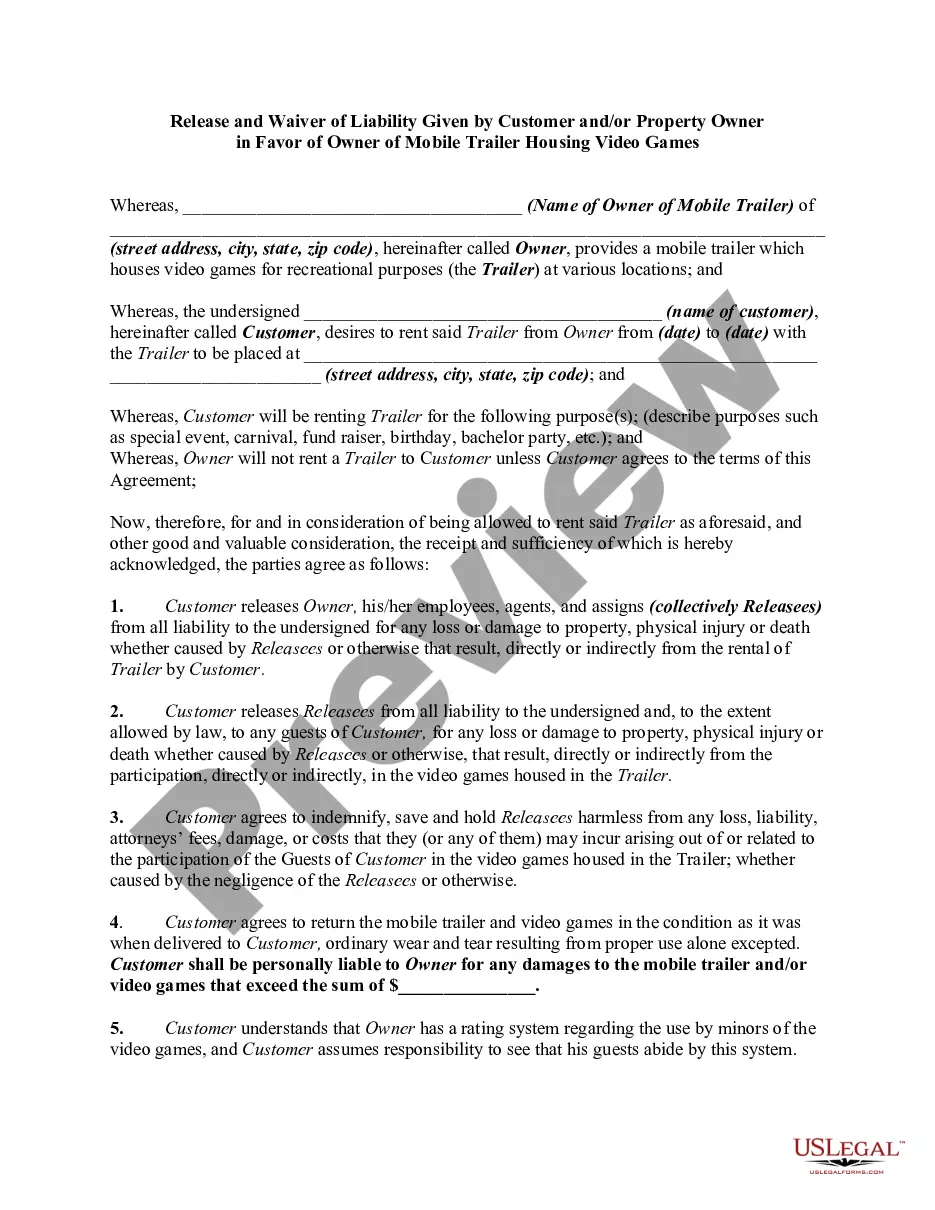

Description

How to fill out Texas Self-Employed Seasonal Picker Services Contract?

If you need to total, obtain, or print out legal document templates, use US Legal Forms, the largest selection of legal varieties, which can be found online. Take advantage of the site`s easy and convenient search to find the paperwork you require. Numerous templates for enterprise and specific uses are sorted by groups and claims, or search phrases. Use US Legal Forms to find the Texas Self-Employed Seasonal Picker Services Contract in just a number of clicks.

Should you be already a US Legal Forms consumer, log in for your profile and then click the Obtain button to find the Texas Self-Employed Seasonal Picker Services Contract. You may also gain access to varieties you formerly acquired within the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for that correct area/land.

- Step 2. Make use of the Preview method to examine the form`s information. Don`t forget about to read the outline.

- Step 3. Should you be not satisfied with the develop, use the Search field near the top of the monitor to find other variations of your legal develop template.

- Step 4. Once you have identified the form you require, select the Get now button. Select the costs strategy you choose and add your accreditations to register for an profile.

- Step 5. Approach the transaction. You can use your bank card or PayPal profile to complete the transaction.

- Step 6. Select the structure of your legal develop and obtain it on your own product.

- Step 7. Complete, modify and print out or indication the Texas Self-Employed Seasonal Picker Services Contract.

Every legal document template you buy is your own forever. You may have acces to every single develop you acquired inside your acccount. Click on the My Forms area and decide on a develop to print out or obtain once again.

Contend and obtain, and print out the Texas Self-Employed Seasonal Picker Services Contract with US Legal Forms. There are many specialist and condition-particular varieties you can use for the enterprise or specific requires.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

If you are an independent contractor, a gig worker, or are self-employed in Texas, and you are out of work due to COVID-19, you may qualify for unemployment benefits through Pandemic Unemployment Assistance (PUA).

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.