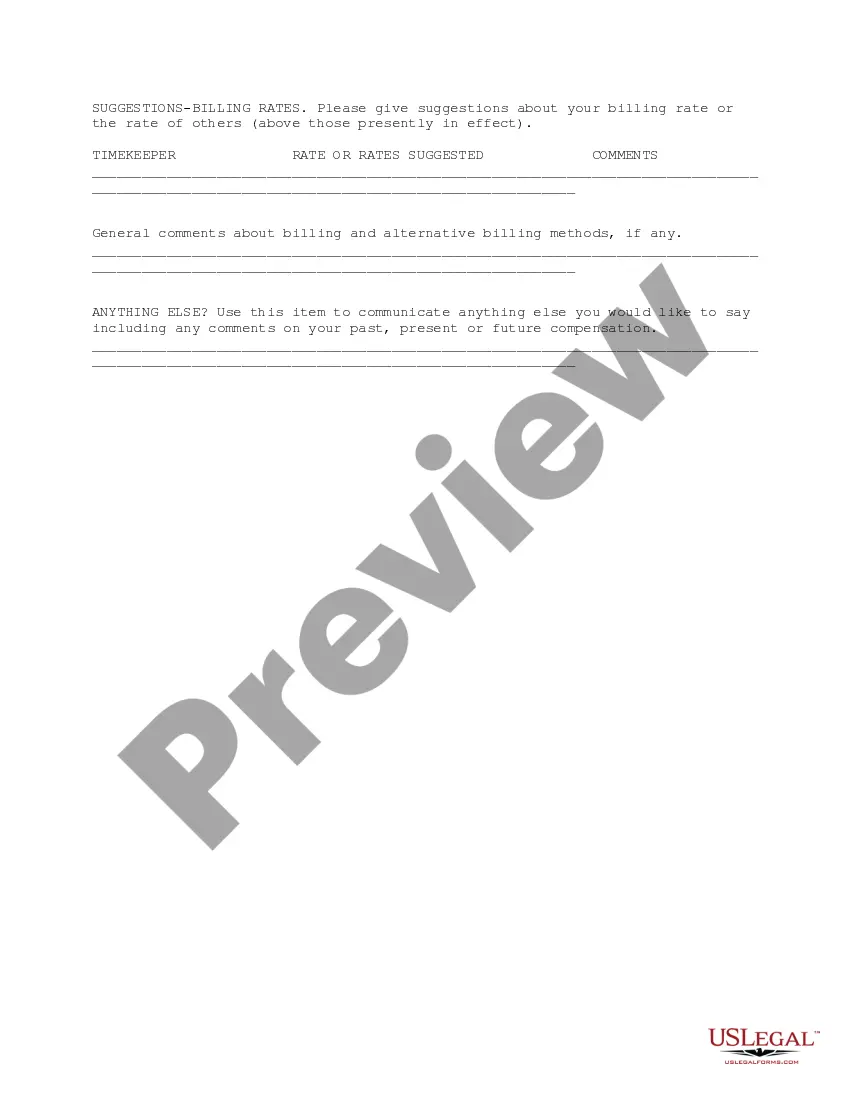

This form assures that the compensation committee considers all relevant information when deciding the allocation of compensation. It provides an opportunity for each lawyer to list unique accomplishements, involvement with associates and management committees, national practice groups participation, recruiting, and an area for comments.

Texas Compensation Committee Information Form

Description

How to fill out Compensation Committee Information Form?

You may spend several hours on-line searching for the legitimate papers template that suits the federal and state specifications you require. US Legal Forms gives a huge number of legitimate kinds that are reviewed by experts. You can actually obtain or produce the Texas Compensation Committee Information Form from your services.

If you currently have a US Legal Forms account, it is possible to log in and then click the Obtain key. Following that, it is possible to complete, modify, produce, or indicator the Texas Compensation Committee Information Form. Every single legitimate papers template you purchase is the one you have for a long time. To obtain an additional copy of any bought kind, proceed to the My Forms tab and then click the related key.

If you work with the US Legal Forms website for the first time, adhere to the simple instructions under:

- Very first, be sure that you have chosen the correct papers template to the area/area of your liking. Look at the kind explanation to ensure you have picked out the right kind. If offered, make use of the Review key to search throughout the papers template at the same time.

- In order to find an additional version from the kind, make use of the Look for area to discover the template that fits your needs and specifications.

- Upon having located the template you want, click Purchase now to proceed.

- Select the rates prepare you want, key in your qualifications, and register for a merchant account on US Legal Forms.

- Full the transaction. You may use your Visa or Mastercard or PayPal account to cover the legitimate kind.

- Select the file format from the papers and obtain it in your device.

- Make changes in your papers if necessary. You may complete, modify and indicator and produce Texas Compensation Committee Information Form.

Obtain and produce a huge number of papers themes making use of the US Legal Forms site, which provides the largest variety of legitimate kinds. Use skilled and status-certain themes to deal with your company or individual demands.

Form popularity

FAQ

For the 2023 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...

There is no minimum tax requirement under the franchise tax provisions. An entity that calculates an amount of tax due that is less than $1,000 or that has annualized total revenue less than or equal to $1,180,000 is not required to pay any tax. (See 3 Page 4 note for tiered partnership exception.)

The wage and cash compensation deduction for each 12-month period are as follows: $400,000 per person for reports originally due in 2022 and 2023. $390,000 per person for reports originally due in 2020 and 2021.

Tax Rates, Thresholds and Deduction Limits ItemAmountNo Tax Due Threshold$1,030,000Tax Rate (retail or wholesale)0.5%Tax Rate (other than retail or wholesale)1.0%Compensation Deduction Limit$330,0002 more rows

Reports and Payments For franchise tax reports originally due?The no tax due threshold is?on or after Jan. 1, 2022, and before Jan. 1, 2024$1,230,000on or after Jan. 1, 2020, and before Jan. 1, 2022$1,180,000on or after Jan. 1, 2018, and before Jan. 1, 2020$1,130,0005 more rows

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

The Texas franchise tax calculation is based on margin, which can be calculated using one of the following methods: Total revenue times 70% Total revenue minus cost of goods sold (COGS) Total revenue minus compensation. Total revenue minus $1M.

Wages List (Form C-4) includes the employee names, Social Security numbers and wage amounts paid in the quarter. TWC Rules 815.107 and 815.109 require all employers to report wages and pay unemployment taxes electronically.