Texas Agreement Designating Agent to Lease Mineral Interests

Description

How to fill out Agreement Designating Agent To Lease Mineral Interests?

You are able to spend several hours on the Internet attempting to find the authorized papers web template which fits the state and federal needs you will need. US Legal Forms offers a large number of authorized types which are examined by experts. It is simple to down load or print the Texas Agreement Designating Agent to Lease Mineral Interests from my service.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Down load button. Following that, it is possible to complete, change, print, or sign the Texas Agreement Designating Agent to Lease Mineral Interests. Each and every authorized papers web template you acquire is your own property forever. To acquire yet another version associated with a acquired kind, check out the My Forms tab and click on the corresponding button.

If you use the US Legal Forms website for the first time, keep to the easy directions listed below:

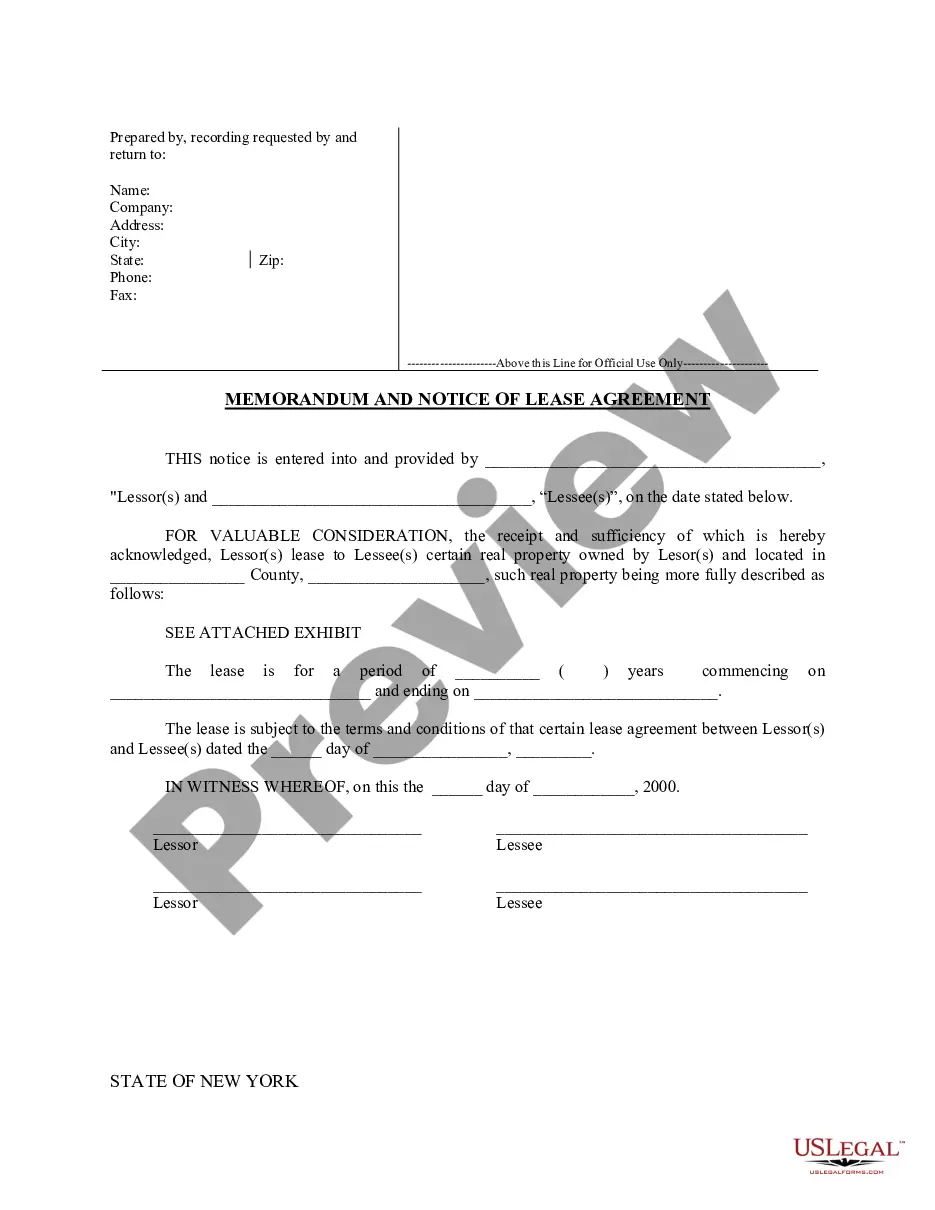

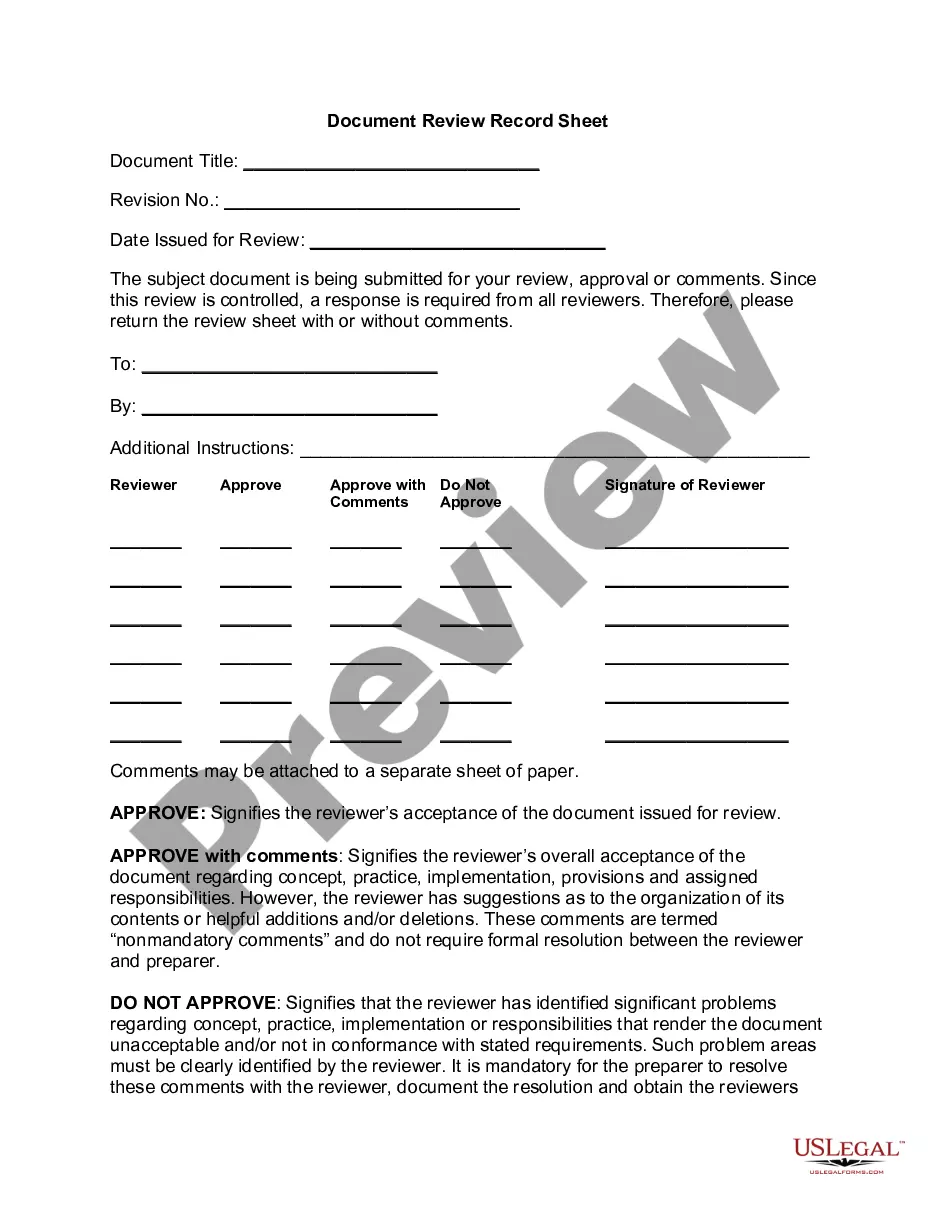

- First, ensure that you have chosen the correct papers web template for that county/town of your liking. See the kind description to ensure you have picked out the right kind. If available, make use of the Review button to look with the papers web template also.

- If you want to get yet another version in the kind, make use of the Research discipline to obtain the web template that meets your needs and needs.

- Once you have located the web template you would like, simply click Purchase now to carry on.

- Find the prices prepare you would like, type your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal bank account to cover the authorized kind.

- Find the structure in the papers and down load it to your device.

- Make adjustments to your papers if necessary. You are able to complete, change and sign and print Texas Agreement Designating Agent to Lease Mineral Interests.

Down load and print a large number of papers web templates utilizing the US Legal Forms website, that offers the most important selection of authorized types. Use professional and state-certain web templates to take on your business or personal needs.

Form popularity

FAQ

The best way to sell mineral rights in Texas is to use a qualified broker. A good broker will do two things: They will get your property in front of thousands of mineral rights buyers. They will guide you through the process to ensure you don't get taken advantage of. Sell Mineral Rights in Texas - Free Guide to Mineral Rights Value texasmineralgroup.com texasmineralgroup.com

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property. Minerals, Oil And Gas Ownership Rights Disputes Lawyer,Texas ondafamilylaw.com ? assets ? business ? oil-... ondafamilylaw.com ? assets ? business ? oil-...

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage. Why Sell Your Mineral Rights - 6 Factors to Consider pheasantenergy.com ? why-sell-mineral-rights pheasantenergy.com ? why-sell-mineral-rights

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

A mineral right is a real property interest and can be conveyed independently of the surface estate. mineral rights | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? mineral_rights cornell.edu ? wex ? mineral_rights

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.