Texas Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

Are you currently in a placement that you will need files for either organization or person functions virtually every day? There are a variety of lawful document templates available online, but locating versions you can trust isn`t simple. US Legal Forms delivers a huge number of form templates, such as the Texas Deed and Assignment from Trustee to Trust Beneficiaries, that are composed to meet state and federal needs.

Should you be previously familiar with US Legal Forms website and have a merchant account, merely log in. Next, you may download the Texas Deed and Assignment from Trustee to Trust Beneficiaries web template.

Unless you offer an account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and ensure it is for that correct town/state.

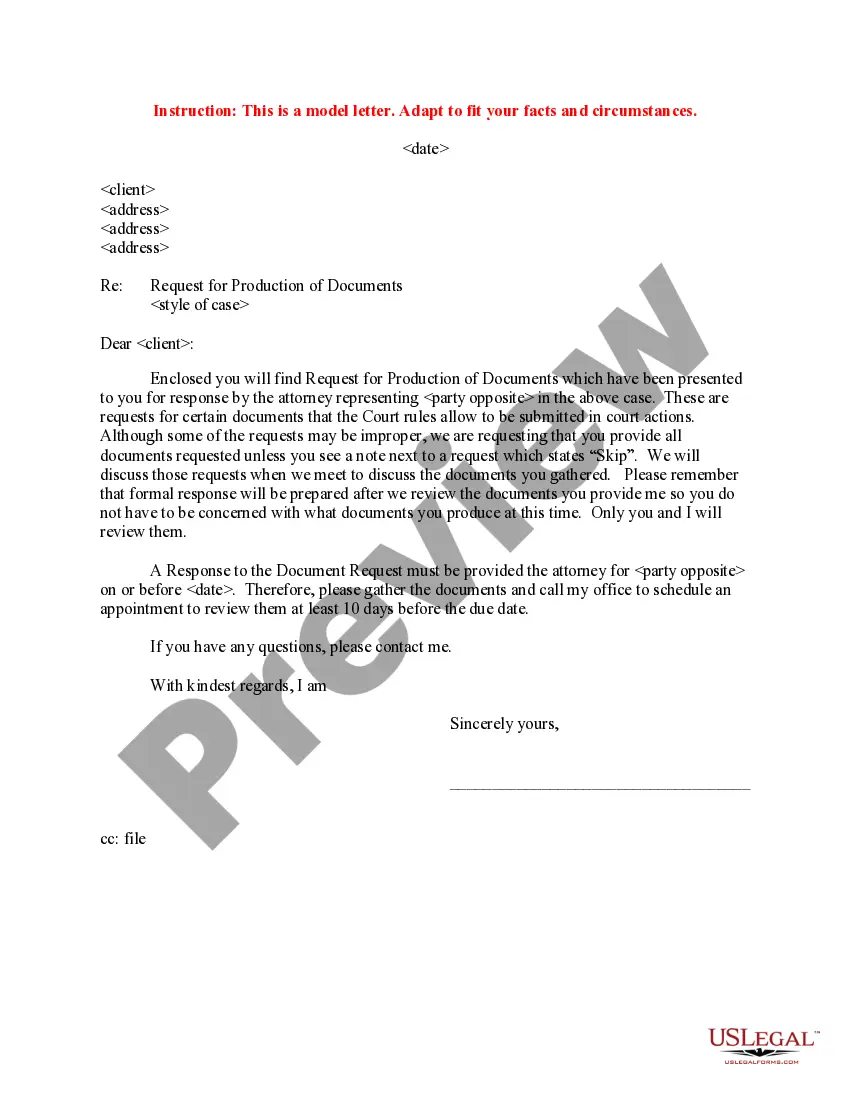

- Utilize the Preview key to review the form.

- See the explanation to ensure that you have selected the right form.

- If the form isn`t what you`re looking for, make use of the Search discipline to discover the form that suits you and needs.

- If you find the correct form, simply click Buy now.

- Select the prices strategy you want, submit the desired details to generate your bank account, and buy the transaction using your PayPal or credit card.

- Pick a hassle-free document file format and download your version.

Locate all of the document templates you have bought in the My Forms food selection. You can aquire a extra version of Texas Deed and Assignment from Trustee to Trust Beneficiaries at any time, if needed. Just click on the needed form to download or print out the document web template.

Use US Legal Forms, the most considerable assortment of lawful types, in order to save time as well as avoid mistakes. The assistance delivers expertly made lawful document templates that you can use for a range of functions. Make a merchant account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

The fiduciary duties of trustees refer to the duties owed when managing a trust by a trustee to the beneficiary. Like other fiduciary relationships, trustees have fiduciary duties of care, loyalty, and good faith. As a result, the trustee must manage the trust in a reasonable manner and avoid self-dealing.

What Are the Duties of Trustees in Texas? Document Management (Record Keeping) A trustee should keep records of everything they do in their role as trustee. ... Accounting. ... Asset Distribution. ... Trustee Meetings. ... File and Pay Taxes. ... Asset and Property Management. ... Breach of Trust. ... Misappropriation of Trust Funds.

But, they need to choose a person to be a trust's trustee and are unsure if a designated beneficiary can legally also be a trustee. Legally, yes, a trustee can also be a beneficiary. However, while a beneficiary can be a trustee, there are a few rules they must adhere to.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

However, a trustee cannot withdraw money from a trust on their behalf. It must be done on behalf of the trust. Essentially, this means the investments they make with the funds in a trust must benefit the trust and the beneficiaries. If a trustee uses trust funds for their benefit it is a breach of their fiduciary duty.

You have the right to seek accountings, file suit, complain and inquire about distributions. Texas Prop. Code Ann. § 111.004 defines an interested person as ?a trustee, beneficiary, or any other person having an interest in or a claim against the trust or any person who is affected by the administration of the trust.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

A trustee may be responsible for administering, managing, and distributing trust assets. A trustee has a fiduciary responsibility to conduct their duties in a way that adheres to the rules of the trust and benefits the beneficiaries of the trust. A trustee must typically be at least 18 years of age and of sound mind.