This form is used when the owners adopt, ratify, and confirm the Lease in all of its terms and provisions, and lease, demise, and let to the Lessee named in the Lease, all of the owner's interest in the Lands as fully and completely as if each of the undersigned had originally been named as a lessor in the Lease and had executed, acknowledged, and delivered the Lease to the Lessee.

Texas Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights

Description

How to fill out Ratification And Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights?

Have you been within a place that you need to have papers for sometimes company or person uses just about every working day? There are tons of legitimate papers templates available online, but finding types you can rely on is not effortless. US Legal Forms delivers a huge number of form templates, just like the Texas Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights, which can be composed in order to meet federal and state needs.

Should you be previously informed about US Legal Forms website and have a free account, just log in. Following that, you may download the Texas Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights web template.

If you do not offer an profile and want to start using US Legal Forms, adopt these measures:

- Obtain the form you require and make sure it is for the proper city/state.

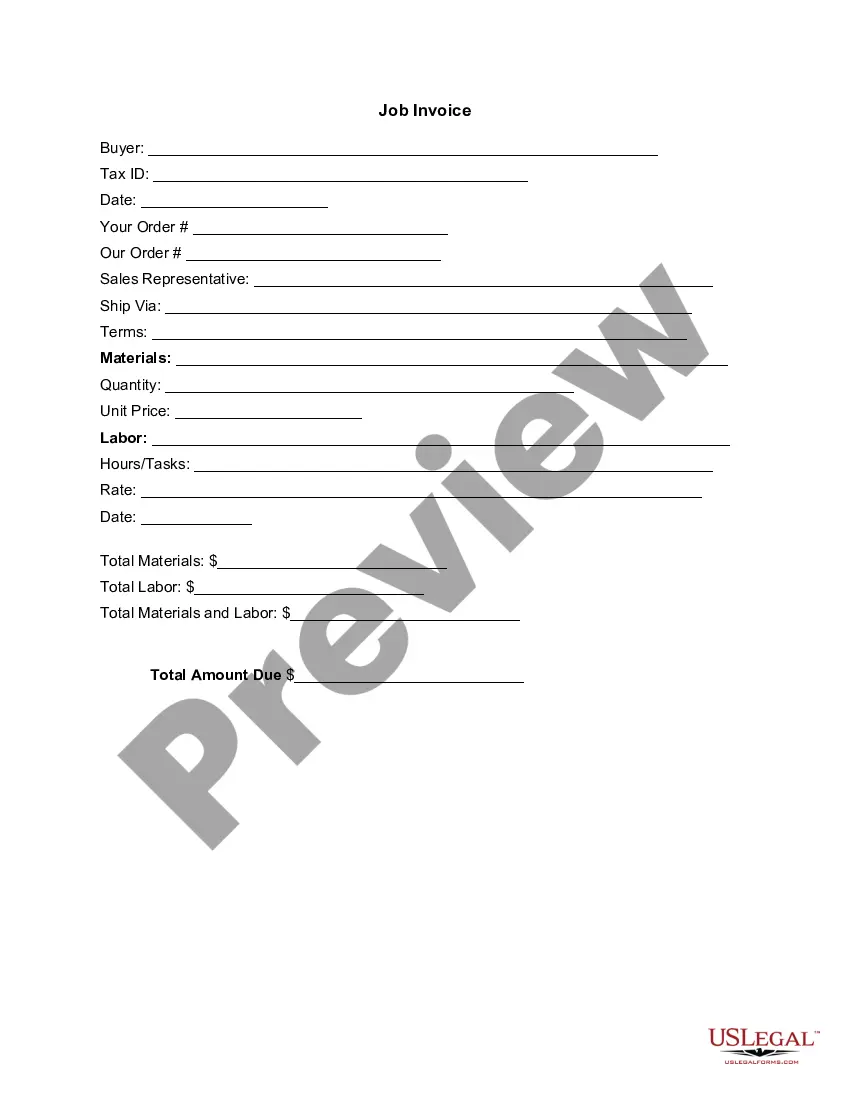

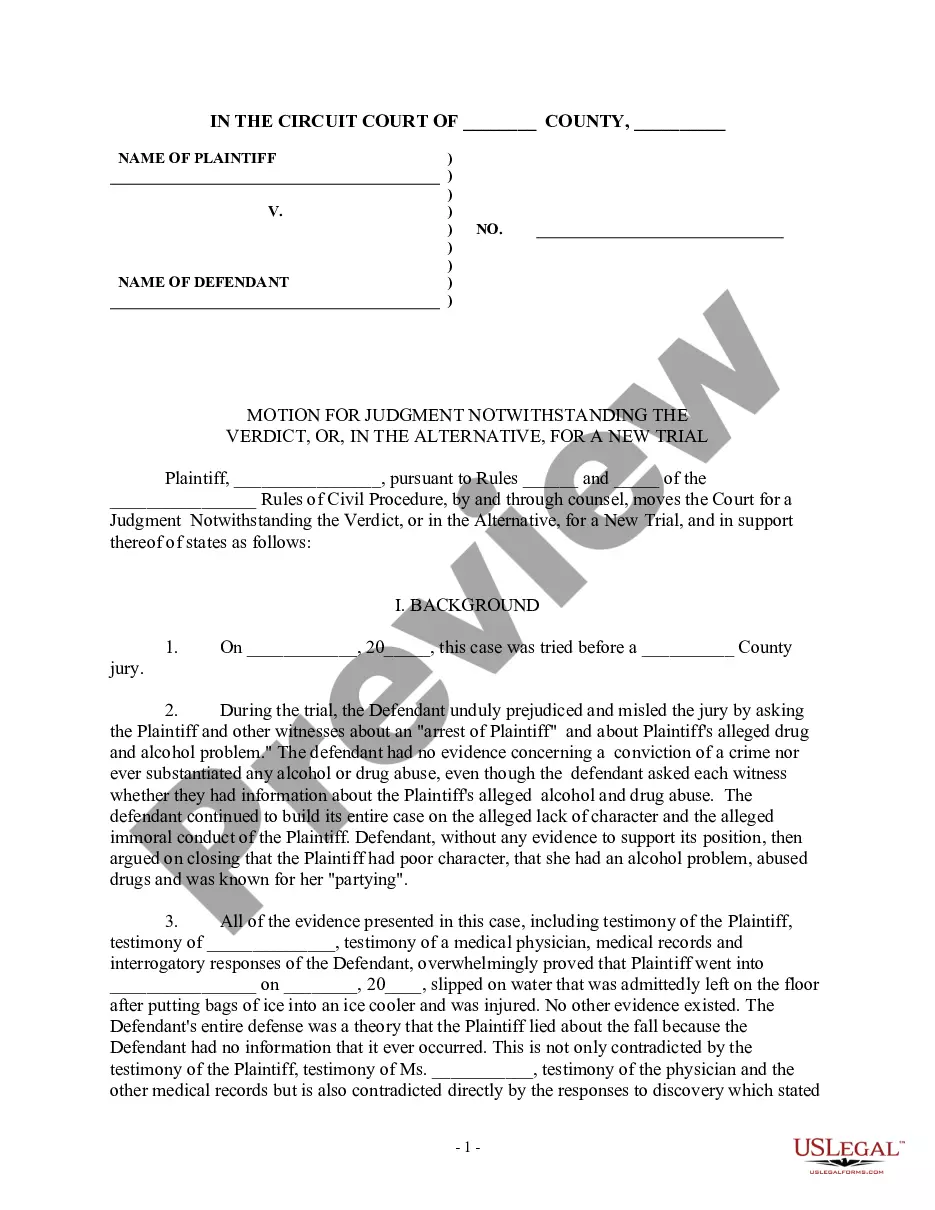

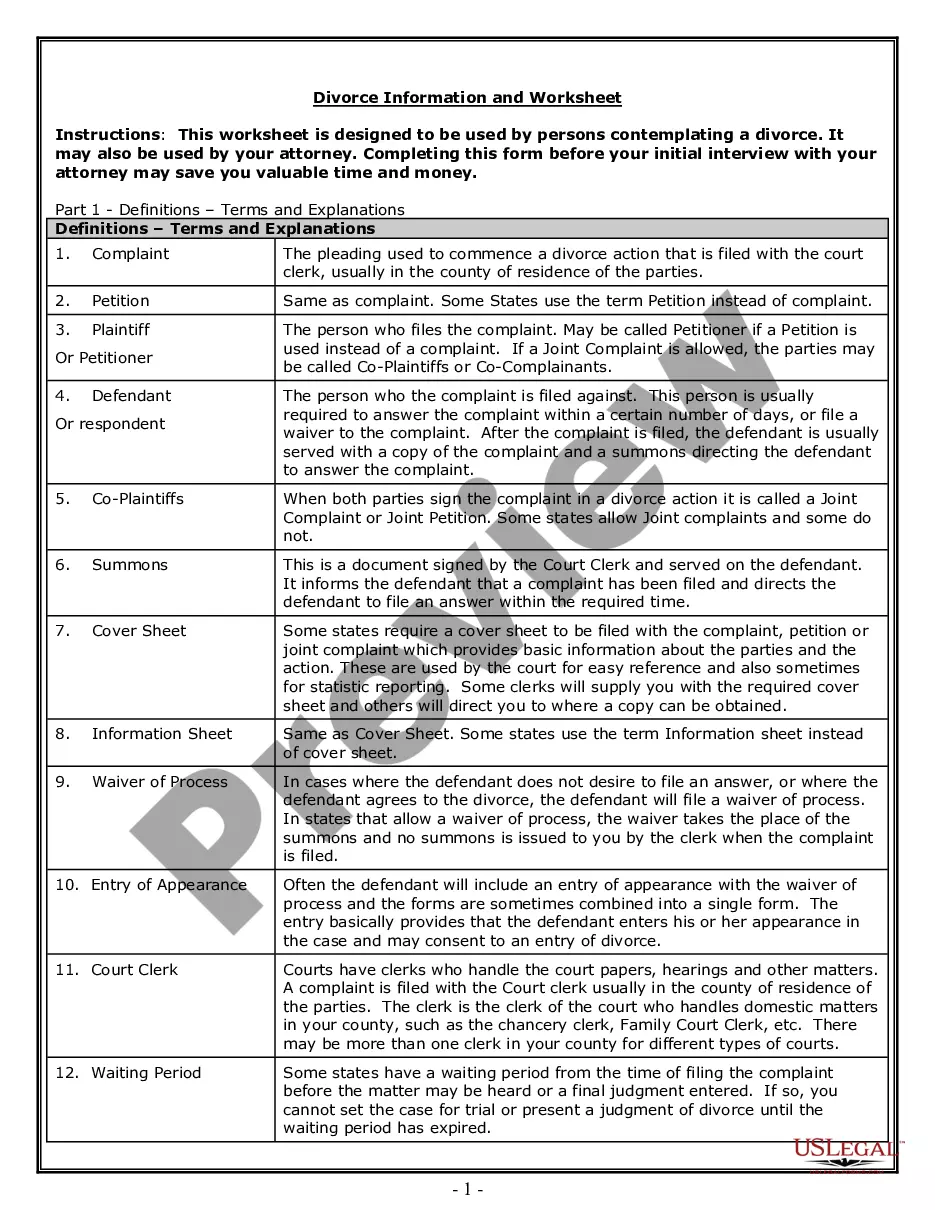

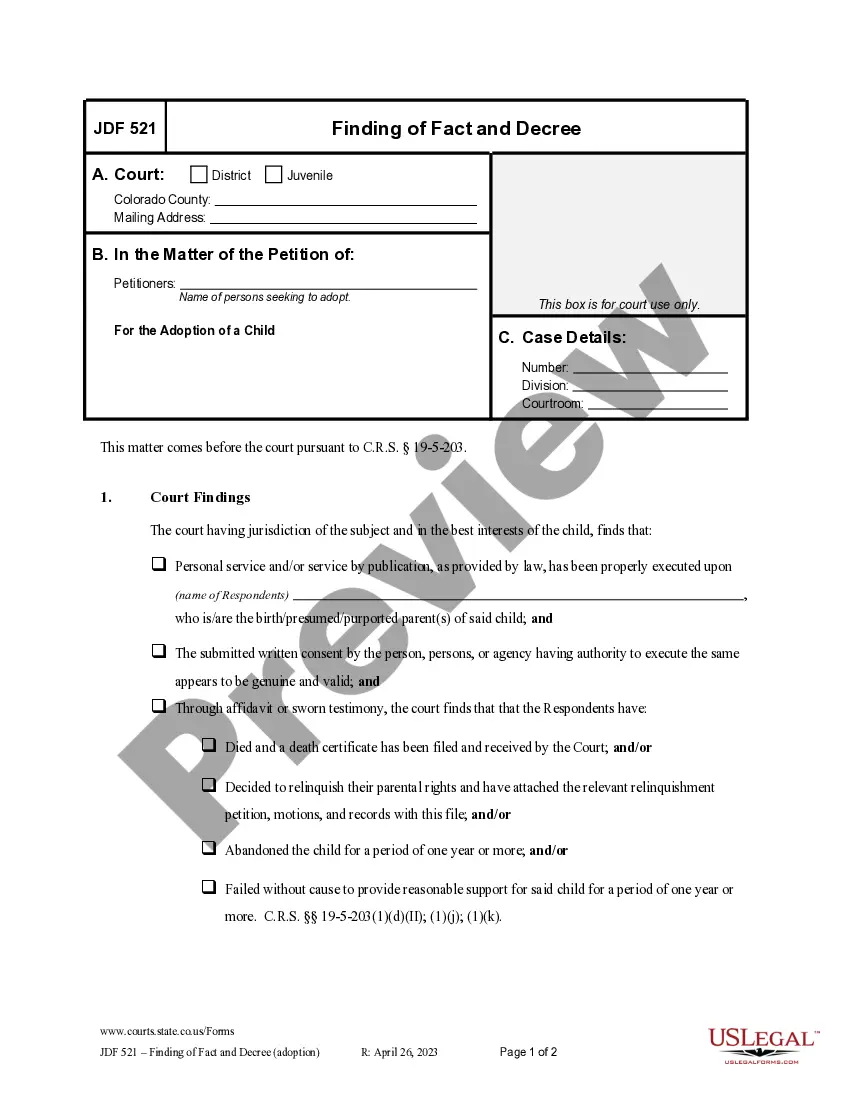

- Use the Review switch to check the shape.

- Browse the information to actually have chosen the proper form.

- When the form is not what you are seeking, utilize the Look for discipline to get the form that meets your needs and needs.

- Whenever you obtain the proper form, click on Purchase now.

- Pick the costs plan you would like, submit the specified details to produce your bank account, and pay for an order using your PayPal or bank card.

- Decide on a practical data file formatting and download your version.

Find each of the papers templates you may have bought in the My Forms food list. You can get a extra version of Texas Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights anytime, if possible. Just select the needed form to download or produce the papers web template.

Use US Legal Forms, by far the most substantial collection of legitimate forms, to save lots of time and avoid faults. The services delivers skillfully made legitimate papers templates that you can use for an array of uses. Produce a free account on US Legal Forms and initiate creating your way of life a little easier.