Title: Texas Lien and Tax Search Checklist: A Detailed Overview Keywords: Texas lien search, tax search, lien and tax search checklist, types of Texas lien and tax search checklists Introduction: A comprehensive understanding of Texas lien and tax search is crucial, whether you are involved in real estate transactions, property purchases, or debt recovery. Texas lien and tax searches enable individuals and businesses to obtain accurate information on property liens and taxes that may affect their investments. In this article, we will delve into the details of the Texas Lien and Tax Search Checklist, exploring its importance and discussing different types of checklists available. I. The Importance of Texas Lien and Tax Search Checklist: Performing a thorough lien and tax search in Texas is crucial for various reasons: 1. Identifying Liens: A lien search helps identify any existing liens on a property, such as mortgage liens, judgment liens, or mechanic's liens. This information is vital for assessing the property's market value and to ensure clear title transfer during real estate transactions. 2. Uncovering Tax Obligations: A tax search allows individuals to determine if any unpaid property taxes or tax liens exist against a property. Failure to address these prior to purchasing a property may result in the buyer assuming the unpaid tax obligations. 3. Minimizing Financial Risks: By conducting a lien and tax search, individuals can avoid unforeseen financial liabilities and potential legal disputes, safeguarding their investment and financial stability. II. Texas Lien and Tax Search Checklist: When performing a Texas lien and tax search, it is vital to follow a systematic checklist to ensure a comprehensive and accurate assessment. Different types of Texas Lien and Tax Search Checklists include: 1. Property Lien Search Checklist: — Identify the correct county where the property is located. Texas has 254 counties, and each has its own public records for property liens. — Determine the preferred method for accessing public records, such as online platforms, county clerk offices, or using third-party title search companies. — Compile the necessary property information, including the property owner's name, address or legal description, and any additional details required by the chosen search method. — Perform a thorough search for all possible forms of liens, including mortgage liens, judgment liens, federal tax liens, state tax liens, mechanic's liens, and HOA liens, among others. 2. Property Tax Search Checklist: — Gather property-specific details, such as property address, owner's name, and appraisal district number. — Access the appropriate local taxing authority's website or contact their office to obtain accurate records regarding property tax obligations. — Verify the existence of any unpaid property taxes or tax liens against the property. — Review the tax payment history, including any penalties, exemptions, or abatement to have a holistic understanding of the financial obligations associated with the property. Conclusion: Conducting a Texas lien and tax search using a comprehensive checklist is paramount for property buyers, investors, and individuals involved in real estate transactions. The Texas Lien and Tax Search Checklist enables individuals to uncover liens, assess tax obligations, and mitigate potential financial risks. By following the prescribed checklist, individuals can protect their investments and make informed decisions when dealing with properties in Texas.

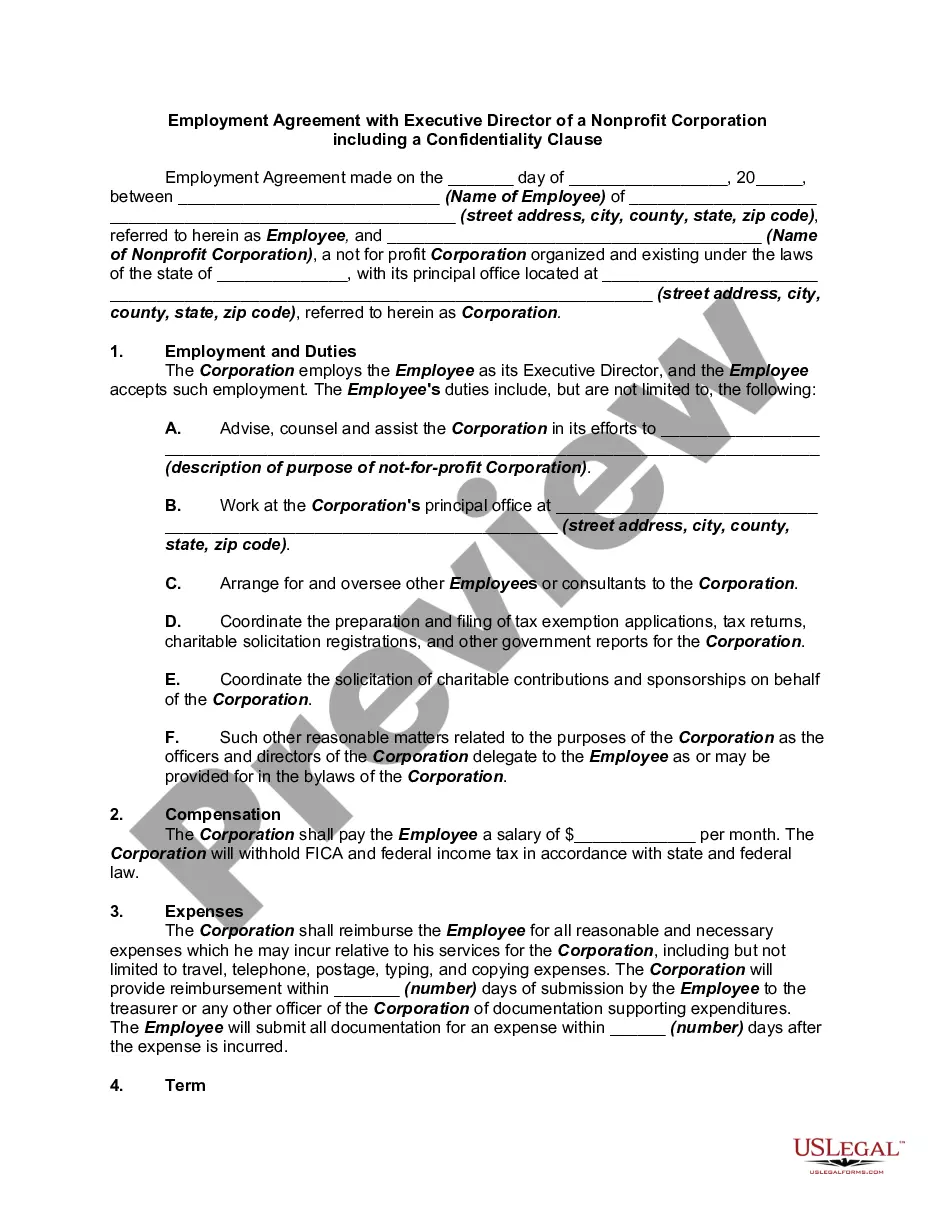

Texas Lien and Tax Search Checklist

Description

How to fill out Texas Lien And Tax Search Checklist?

You can commit hours on the web searching for the legal document template that suits the federal and state specifications you want. US Legal Forms supplies thousands of legal types that are examined by professionals. You can actually download or printing the Texas Lien and Tax Search Checklist from your assistance.

If you already possess a US Legal Forms account, you are able to log in and click on the Download switch. Next, you are able to complete, edit, printing, or sign the Texas Lien and Tax Search Checklist. Each legal document template you get is the one you have forever. To acquire one more duplicate of the purchased kind, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms site for the first time, keep to the easy directions beneath:

- Initially, be sure that you have chosen the correct document template for that county/town of your choice. Read the kind information to make sure you have chosen the right kind. If offered, utilize the Review switch to appear from the document template as well.

- If you would like locate one more version in the kind, utilize the Lookup field to discover the template that meets your needs and specifications.

- When you have identified the template you want, click Purchase now to proceed.

- Choose the costs prepare you want, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal account to purchase the legal kind.

- Choose the file format in the document and download it to the product.

- Make adjustments to the document if needed. You can complete, edit and sign and printing Texas Lien and Tax Search Checklist.

Download and printing thousands of document web templates utilizing the US Legal Forms web site, which provides the biggest selection of legal types. Use specialist and condition-distinct web templates to handle your company or specific demands.