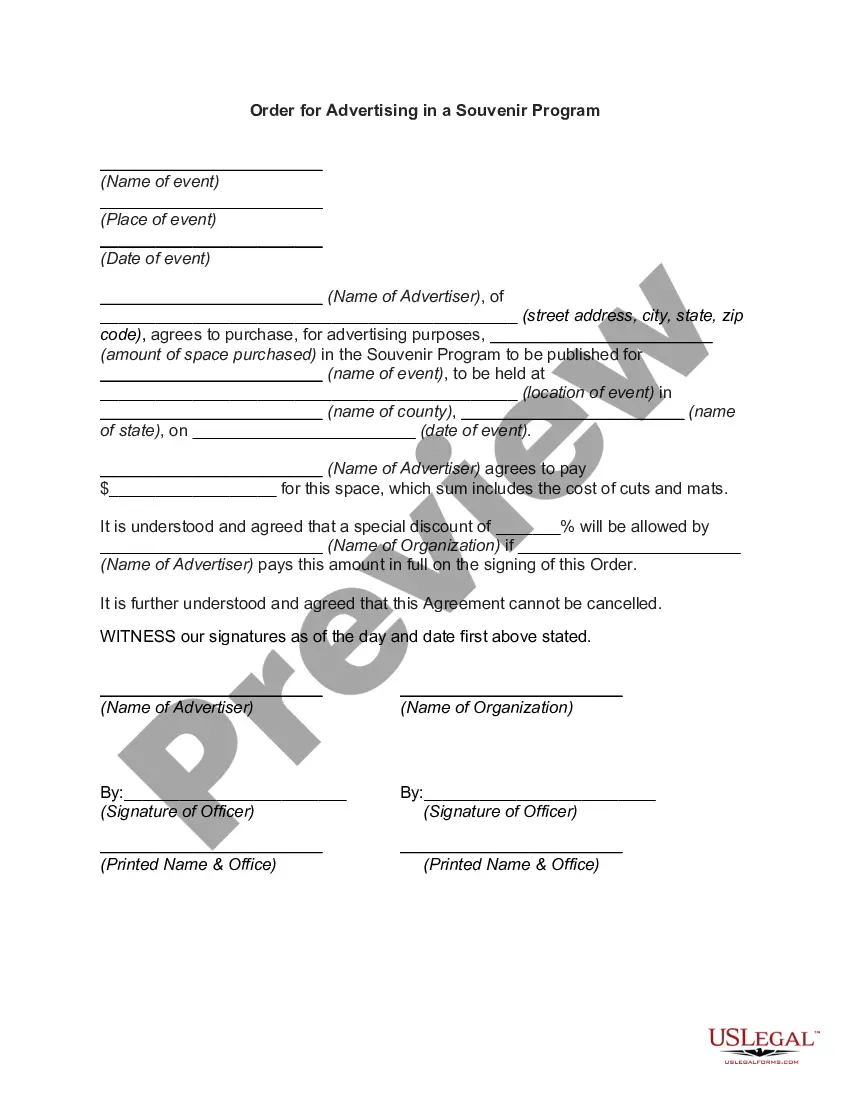

A Conversion of Reserved Overriding Royalty Interest to Working Interest form. The assignee shall be entitled to recover, out of the total proceeds derived from the sale of oil and gas produced from each well drilled and completed as a well capable of producing oil or gas in paying quantities on the Land, the total cost of drilling, completing, and equipping such well together with the cost of operating such well until the time of such recovery.

Texas Conversion of Reserved Overriding Royalty Interest to Working Interest

Description

How to fill out Conversion Of Reserved Overriding Royalty Interest To Working Interest?

Finding the right authorized document design could be a have a problem. Obviously, there are a lot of templates available on the net, but how will you obtain the authorized develop you will need? Take advantage of the US Legal Forms site. The service delivers thousands of templates, like the Texas Conversion of Reserved Overriding Royalty Interest to Working Interest, that can be used for enterprise and personal requirements. All the varieties are checked out by specialists and satisfy federal and state requirements.

Should you be currently registered, log in for your account and then click the Acquire button to find the Texas Conversion of Reserved Overriding Royalty Interest to Working Interest. Make use of account to look through the authorized varieties you might have purchased previously. Check out the My Forms tab of your account and get an additional backup of your document you will need.

Should you be a new consumer of US Legal Forms, listed here are straightforward guidelines for you to follow:

- Very first, be sure you have chosen the correct develop to your area/county. It is possible to look through the shape utilizing the Preview button and look at the shape information to make sure it is the right one for you.

- When the develop fails to satisfy your expectations, utilize the Seach industry to discover the correct develop.

- When you are sure that the shape is suitable, click on the Purchase now button to find the develop.

- Pick the rates strategy you need and enter the needed info. Build your account and pay for the order using your PayPal account or bank card.

- Choose the file structure and down load the authorized document design for your product.

- Complete, modify and print out and sign the attained Texas Conversion of Reserved Overriding Royalty Interest to Working Interest.

US Legal Forms is the largest catalogue of authorized varieties for which you can find different document templates. Take advantage of the company to down load skillfully-manufactured papers that follow status requirements.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

Fixed NPRI ? royalty of an exact, calculable quantity, eg ? 1/16th of oil & gas produced. Floating NPRI ? any description including ?of ? royalty? which would be multiplying the interest by the royalty, eg ? 1/16th of the royalty of oil & gas produced.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...