Texas Exhibit D to Operating Agreement Insurance — Form 1 is a legal document commonly used in the state of Texas to outline the specific insurance requirements and provisions that must be included in an operating agreement. This agreement serves as a crucial component in outlining the rules and regulations governing the operations and management of a company. The purpose of the Texas Exhibit D to Operating Agreement Insurance — Form 1 is to ensure that all parties involved in the business are adequately protected against potential risks and liabilities. This includes the company itself, its members, managers, and any other individuals involved in the business. By clearly identifying the insurance requirements and provisions, this exhibit helps in mitigating any potential disputes or issues that may arise in the future. There are different types of Texas Exhibit D to Operating Agreement Insurance — Form 1 that can be tailored to the specific needs of the company or business. These may include provisions for general liability insurance, property insurance, workers' compensation insurance, professional liability insurance, and any other additional coverage that may be required based on the nature of the business operations. The general liability insurance clause in Texas Exhibit D to Operating Agreement Insurance — Form 1 provides coverage against claims of bodily injury, property damage, or any other third-party claims arising out of the company's operations. This coverage safeguards the company and its members from potential lawsuits and financial losses due to accidents or incidents that may occur during the course of business activities. The property insurance clause ensures that the company's physical assets, such as buildings, equipment, and inventory, are adequately covered against risks such as fire, theft, or natural disasters. This coverage helps in protecting the company's investment and ensures that any potential damages or losses are mitigated. Workers' compensation insurance is another crucial component included in the Texas Exhibit D to Operating Agreement Insurance — Form 1. This coverage is mandatory in many states, including Texas, and provides benefits to employees who are injured or become ill due to their work. It helps in covering medical expenses, lost wages, and rehabilitation costs, thereby providing financial support to affected employees and avoiding potential legal disputes. Professional liability insurance, also known as errors and omissions insurance, is often required for businesses that provide professional services. This coverage protects the company and its members in case of any claims of negligence, errors, or omissions in the delivery of professional services. It helps in covering legal defense costs and potential damages arising from such claims. In conclusion, Texas Exhibit D to Operating Agreement Insurance — Form 1 is a significant document for businesses operating in Texas. By clearly outlining the insurance requirements and provisions, it helps in ensuring that all parties involved are adequately protected against potential risks and liabilities. The specific types of insurance coverage included in this exhibit may vary depending on the nature of the business, but commonly include general liability insurance, property insurance, workers' compensation insurance, and professional liability insurance.

Texas Exhibit D to Operating Agreement Insurance - Form 1

Description

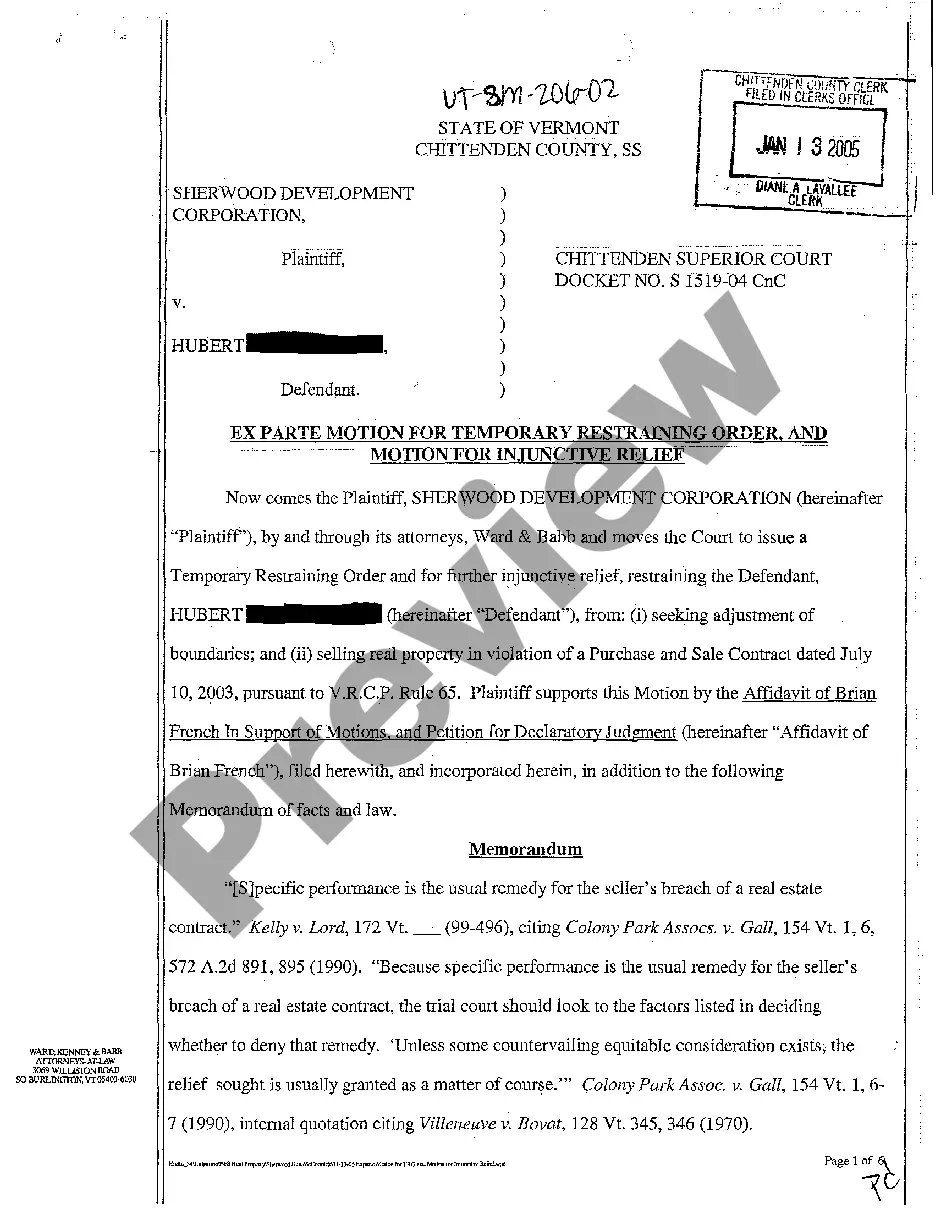

How to fill out Texas Exhibit D To Operating Agreement Insurance - Form 1?

Choosing the best legitimate record template can be quite a battle. Naturally, there are a variety of templates available on the Internet, but how do you obtain the legitimate form you need? Utilize the US Legal Forms web site. The service offers thousands of templates, such as the Texas Exhibit D to Operating Agreement Insurance - Form 1, which can be used for company and private needs. Each of the kinds are checked by pros and meet up with state and federal needs.

In case you are already authorized, log in to your accounts and then click the Obtain option to find the Texas Exhibit D to Operating Agreement Insurance - Form 1. Use your accounts to look from the legitimate kinds you may have acquired earlier. Visit the My Forms tab of your own accounts and get an additional copy of your record you need.

In case you are a whole new consumer of US Legal Forms, listed below are basic directions so that you can follow:

- Initial, ensure you have selected the right form for your town/county. You are able to look over the form utilizing the Preview option and read the form explanation to ensure it is the right one for you.

- If the form is not going to meet up with your preferences, make use of the Seach industry to find the appropriate form.

- Once you are certain that the form is proper, click the Get now option to find the form.

- Choose the pricing prepare you want and enter in the needed info. Make your accounts and pay for an order using your PayPal accounts or credit card.

- Pick the document structure and download the legitimate record template to your gadget.

- Full, modify and printing and signal the acquired Texas Exhibit D to Operating Agreement Insurance - Form 1.

US Legal Forms is the biggest catalogue of legitimate kinds for which you will find a variety of record templates. Utilize the company to download professionally-manufactured documents that follow express needs.

Form popularity

FAQ

Procedural Rule P-24 provides guidelines for title companies to use when negotiating the portion of the title premium to be paid to another title company for: (1) furnishing title evidence and/or (2) examining title and/or (3) closing the transaction.

Generally speaking, the seller pays for their own title policy to ensure that the buyer receives a good and marketable title with no encumbrance or defects; while the lender will require the buyer to purchase a lender's title insurance to protect its interest in the property.

How to Write an Operating Agreement Download the operating agreement form from the Texas Secretary of State website and enter your company name. Enter the document's effective date. Enter the state of location and the full name and business address of the owner(s).

Procedural Rule P-35 is titled Prohibition Against Guaranties, Affirmations, Indemnifications and Certifications.