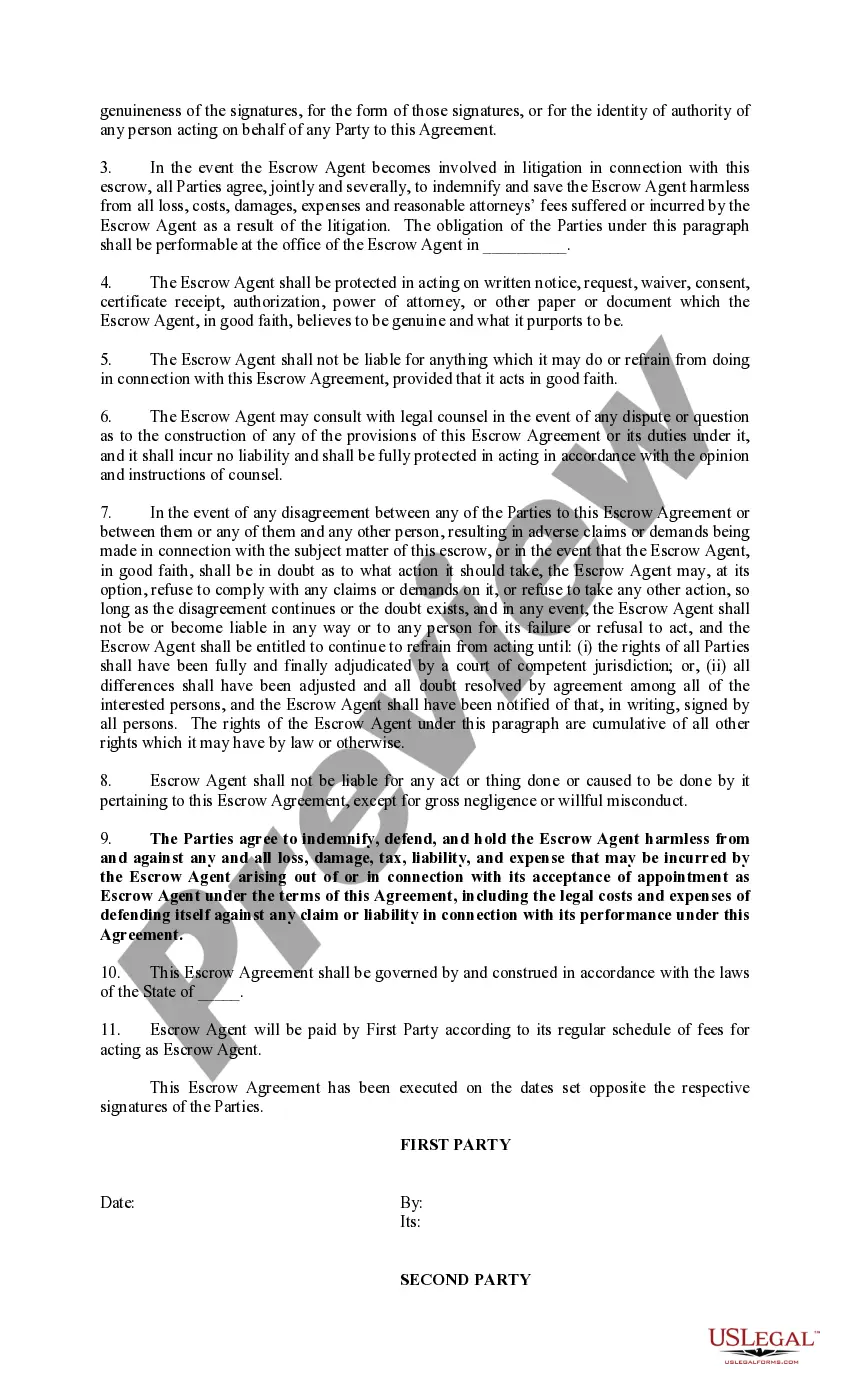

The Texas Exhibit to Operating Agreement Escrow Agreement is a legal document that complements the operating agreement of a company or organization in the state of Texas. This agreement specifically focuses on the escrow arrangement between the parties involved. The purpose of this agreement is to outline the terms and conditions under which funds or assets, often referred to as "BS crowed property," will be held in trust by a third-party escrow agent until certain specified conditions are met. It serves as a safeguard to ensure the smooth conduct of business transactions and protect the interests of the parties involved. The Texas Exhibit to Operating Agreement Escrow Agreement typically includes several key components: 1. Parties: It identifies the involved parties, including the company or organization (represented by its members or owners) and the designated escrow agent. 2. Es crowed Property: This section explicitly describes the nature, type, and value of the property or assets that will be placed into escrow. It may involve cash, stocks, bonds, securities, or any other valuable assets agreed upon by the parties. 3. Escrow Period: The agreement specifies the duration for which the funds or property will remain in escrow. This period can vary depending on the purpose and complexity of the transaction. 4. Conditions for Release: The Texas Exhibit to Operating Agreement Escrow Agreement defines the conditions that must be met for the BS crowed property to be released. These conditions are typically established based on milestones, achievements, or specific events predetermined in the operating agreement. 5. Disbursement Instructions: This section outlines how the escrow agent should handle the disbursed funds or assets once the conditions for release have been met. It may include instructions for distributing funds to specific parties or transferring ownership of assets. 6. Escrow Fees and Expenses: The agreement specifies the fees to be paid to the escrow agent for their services. These fees may include upfront charges, transaction fees, or a percentage of the BS crowed property's value. Additionally, any expenses incurred during the escrow process are also addressed. There can be different types of Texas Exhibit to Operating Agreement Escrow Agreements, tailored to specific business needs or transactions. For example: 1. Purchase and Sale Transaction Escrow Agreement: This type of agreement is commonly used when a company or organization is selling or acquiring assets, such as real estate, intellectual property, or business divisions. 2. Merger and Acquisition Escrow Agreement: In cases where companies are merging or acquiring one another, this agreement ensures the proper handling and protection of funds or assets during the transitional period. 3. Investor or Shareholder Escrow Agreement: This agreement type is often used to hold shareholder investments, ensuring compliance with specific conditions before releasing funds to the company. The specifics of each type of Texas Exhibit to Operating Agreement Escrow Agreement may differ depending on the industry, transaction size, and individual circumstances. It is always advised to consult with legal professionals to customize the agreement to meet the needs of the specific business situation.

Texas Exhibit to Operating Agreement Escrow Agreement

Description

How to fill out Texas Exhibit To Operating Agreement Escrow Agreement?

You are able to invest hours online attempting to find the legal record format that meets the federal and state demands you want. US Legal Forms provides a large number of legal types that happen to be examined by pros. You can easily down load or print out the Texas Exhibit to Operating Agreement Escrow Agreement from the service.

If you currently have a US Legal Forms bank account, it is possible to log in and click on the Download key. Following that, it is possible to comprehensive, revise, print out, or sign the Texas Exhibit to Operating Agreement Escrow Agreement. Each and every legal record format you get is the one you have permanently. To acquire another backup for any purchased develop, proceed to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms internet site the very first time, adhere to the straightforward guidelines beneath:

- Very first, make certain you have chosen the proper record format for that region/town of your choosing. Read the develop information to make sure you have selected the proper develop. If accessible, make use of the Review key to search throughout the record format as well.

- In order to discover another version in the develop, make use of the Research area to find the format that meets your requirements and demands.

- After you have located the format you need, just click Buy now to carry on.

- Pick the prices prepare you need, key in your qualifications, and register for your account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal bank account to pay for the legal develop.

- Pick the file format in the record and down load it to the system.

- Make changes to the record if necessary. You are able to comprehensive, revise and sign and print out Texas Exhibit to Operating Agreement Escrow Agreement.

Download and print out a large number of record layouts using the US Legal Forms website, which provides the largest variety of legal types. Use expert and state-certain layouts to tackle your company or specific needs.