A Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is a legal agreement that relates to the ownership and transfer of mineral rights in the state of Texas. This type of assignment specifically pertains to non-producing leases and includes the reservation of the rights to pool. In the context of mineral rights, an overriding royalty interest refers to a share of the profits obtained from the production of minerals, which is separate from the ownership of the actual minerals themselves. This means that the holder of an overriding royalty interest is entitled to a percentage of the revenue generated from the production of minerals on a specific lease. When it comes to the Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool), there may be different variations or types with specific provisions tailored to different situations. Some possible variations may include: 1. Texas Assignment of Overriding Royalty Interest on Non-Producing Lease: This type of assignment deals specifically with non-producing leases, where no active extraction of minerals is taking place at the time of the assignment. The assignment establishes the percentage of overriding royalty interest assigned to the assignee and outlines the specific terms and conditions of the agreement. 2. Texas Assignment of Overriding Royalty Interest on Single Lease: This type of assignment targets a single lease, where the overriding royalty interest is associated with a particular lease specifically identified in the assignment. It may include details regarding the lease's location, legal description, and any additional terms specific to that lease. 3. Texas Assignment of Overriding Royalty Interest that Reserves Right to Pool: This specific type of assignment not only transfers the overriding royalty interest but also reserves the right to pool the leased minerals. Pooling refers to the combining of multiple contiguous lease tracts to facilitate more efficient extraction and production of minerals. This provision allows the assignee to participate in pooled operations and receive royalties from the production. In summary, a Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is a legally binding document that transfers ownership of a non-producing overriding royalty interest associated with a single lease, while also reserving the right to pool the leased minerals if necessary. Different variations of this assignment may exist, tailored to specific scenarios and including relevant provisions and conditions.

Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

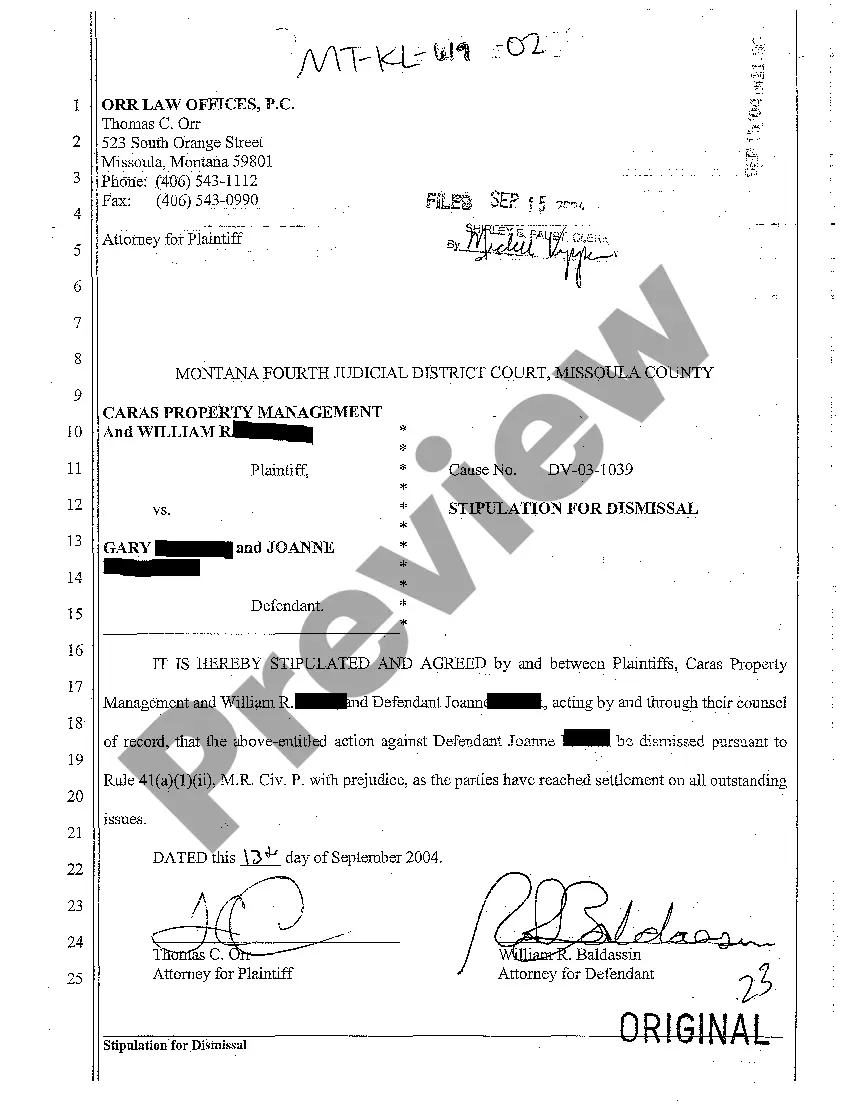

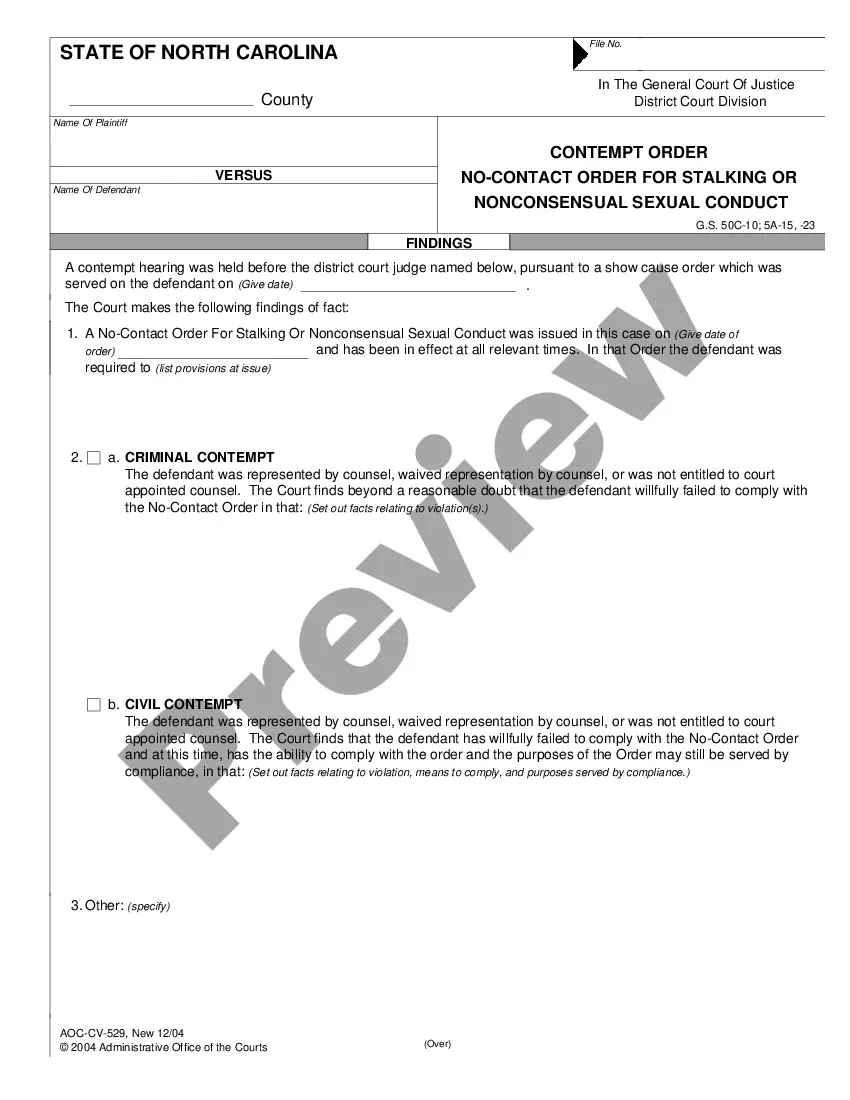

How to fill out Texas Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

US Legal Forms - among the most significant libraries of legal types in America - offers a variety of legal record themes it is possible to download or print. Using the web site, you can find a large number of types for company and personal uses, sorted by groups, suggests, or key phrases.You will find the newest models of types such as the Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) within minutes.

If you currently have a monthly subscription, log in and download Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) from the US Legal Forms collection. The Obtain key will appear on each kind you look at. You have accessibility to all earlier acquired types from the My Forms tab of your own account.

If you would like use US Legal Forms for the first time, listed below are straightforward instructions to get you started out:

- Be sure to have chosen the best kind for your personal town/area. Go through the Review key to check the form`s articles. Read the kind information to actually have selected the proper kind.

- If the kind does not match your demands, take advantage of the Lookup discipline near the top of the display screen to find the the one that does.

- In case you are pleased with the form, affirm your selection by clicking on the Acquire now key. Then, pick the pricing strategy you want and provide your qualifications to register for an account.

- Approach the deal. Utilize your Visa or Mastercard or PayPal account to complete the deal.

- Select the format and download the form in your gadget.

- Make alterations. Fill up, revise and print and sign the acquired Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

Every web template you put into your account does not have an expiration date and it is the one you have for a long time. So, if you would like download or print another duplicate, just proceed to the My Forms area and click on in the kind you require.

Get access to the Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) with US Legal Forms, probably the most comprehensive collection of legal record themes. Use a large number of professional and state-certain themes that fulfill your organization or personal requirements and demands.

Form popularity

FAQ

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.