Texas Clauses Relating to Initial Capital contributions

Description

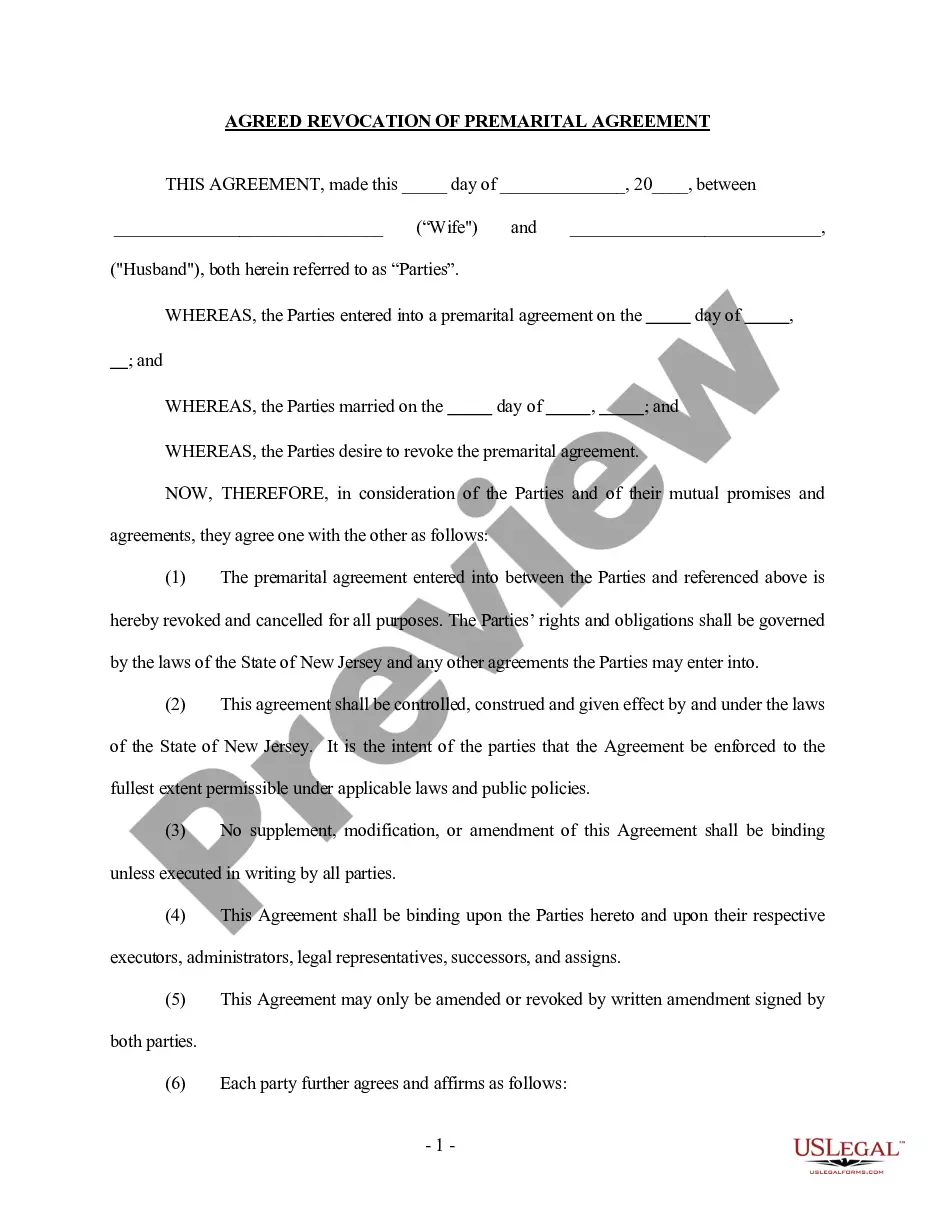

How to fill out Clauses Relating To Initial Capital Contributions?

If you have to comprehensive, down load, or print out legitimate papers layouts, use US Legal Forms, the largest selection of legitimate forms, which can be found on-line. Make use of the site`s simple and easy practical research to get the files you need. Numerous layouts for business and personal uses are categorized by categories and says, or keywords and phrases. Use US Legal Forms to get the Texas Clauses Relating to Initial Capital contributions with a few clicks.

If you are presently a US Legal Forms buyer, log in to your profile and click the Down load key to have the Texas Clauses Relating to Initial Capital contributions. You may also gain access to forms you previously acquired from the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your appropriate metropolis/country.

- Step 2. Take advantage of the Review option to look over the form`s content. Don`t neglect to learn the description.

- Step 3. If you are not happy using the develop, utilize the Research field at the top of the display to discover other versions from the legitimate develop design.

- Step 4. After you have identified the shape you need, select the Purchase now key. Opt for the costs plan you choose and add your references to register to have an profile.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal profile to finish the transaction.

- Step 6. Pick the structure from the legitimate develop and down load it in your system.

- Step 7. Complete, revise and print out or sign the Texas Clauses Relating to Initial Capital contributions.

Each and every legitimate papers design you buy is the one you have eternally. You might have acces to each and every develop you acquired within your acccount. Select the My Forms segment and choose a develop to print out or down load again.

Contend and down load, and print out the Texas Clauses Relating to Initial Capital contributions with US Legal Forms. There are millions of skilled and state-specific forms you may use for the business or personal requirements.

Form popularity

FAQ

The most common capital contribution is cash, but you can also contribute property, such as office space, vehicles, and equipment. It's also possible to contribute services to an LLC.

What Is Contributed Capital? Contributed capital, also known as paid-in capital, is the cash and other assets that shareholders have given a company in exchange for stock. Investors make capital contributions when a company issues equity shares based on a price that shareholders are willing to pay for them.

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

This clause should be used when one member contributed real property to the joint venture in exchange for membership interests and another member has contributed capital. The capitalized terms and section references used in this clause should be conformed to the relevant joint venture operating agreement.

The IRS permits tax free capital contributions of non-cash assets as long as the value of the asset equals the value of the equity received in exchanged. If the value of the asset is less than the value of the equity received, the excess amount may be a taxable gain.

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

Example of Contributed Capital For example, a company issues 5,000 $1 par value shares to investors. The investors pay $10 a share, so the company raises $50,000 in equity capital. As a result, the company records $5,000 to the common stock account and $45,000 to the paid-in capital in excess of par.

This clause should be used when one member contributed real property to the joint venture in exchange for membership interests and another member has contributed capital. The capitalized terms and section references used in this clause should be conformed to the relevant joint venture operating agreement.