Texas Third Party Debt Collector Surety Bond

Description

How to fill out Texas Third Party Debt Collector Surety Bond?

If you’re searching for a way to properly prepare the Texas Third Party Debt Collector Surety Bond without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business scenario. Every piece of documentation you find on our online service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Texas Third Party Debt Collector Surety Bond:

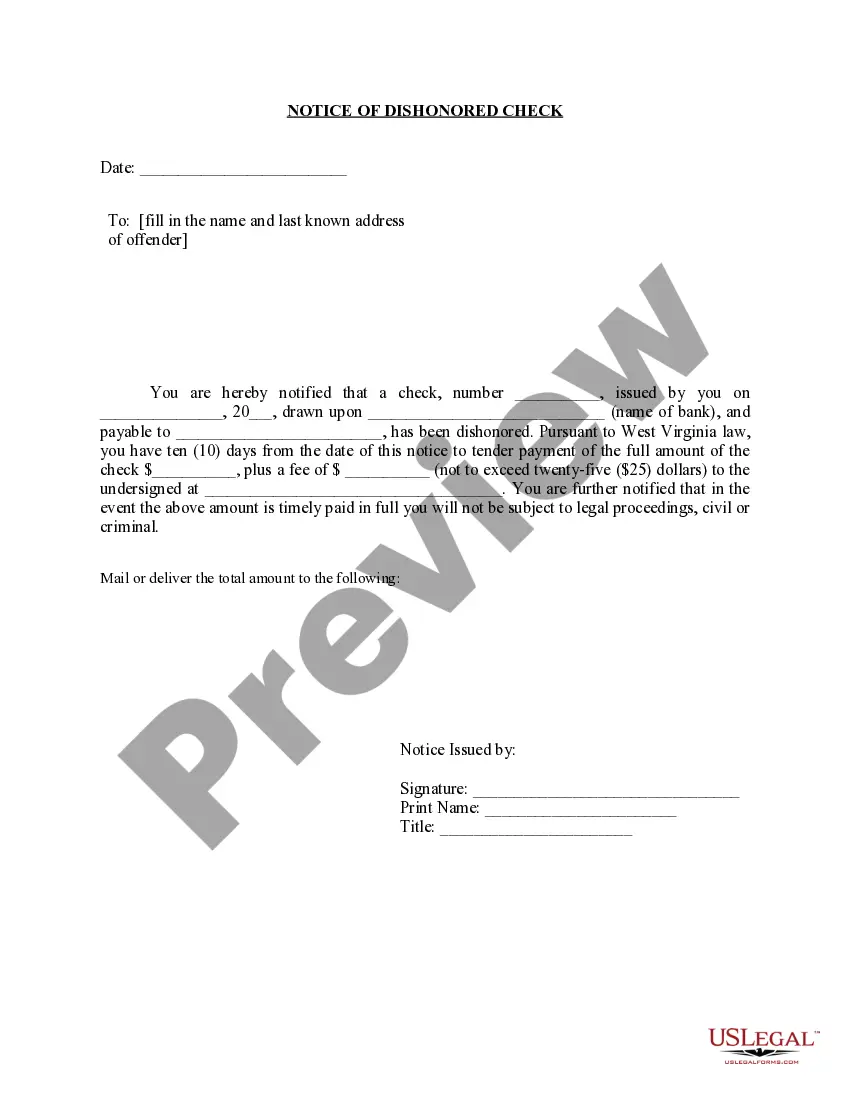

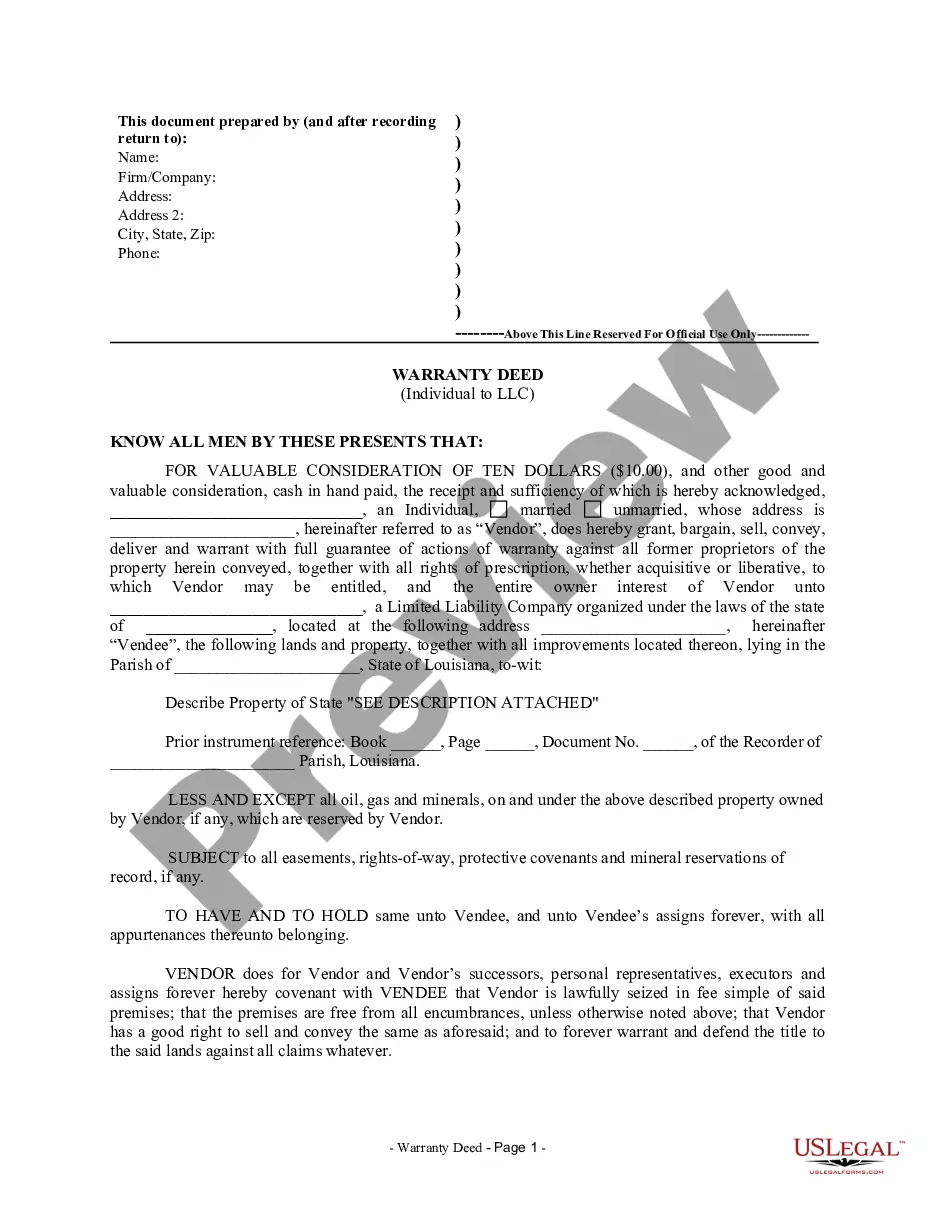

- Ensure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Texas Third Party Debt Collector Surety Bond and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Texas and Federal Law The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

If you are sued and can't pay, the creditor can get a judgment in court against you for the money you owe, plus interest. Being ?judgment proof? means that your property and income can't be seized by creditors, because it is ?exempt? by law from the creditor's claims.

Texas and Federal Law New rules from the federal Consumer Financial Protection Bureau prevent debt collectors from suing or threatening to sue over time-barred debts.

Background. Texas statute 392.101 requires all third party debt collectors operating in the state to file a $10,000 surety bond with the Secretary of State. The Texas legislature enacted the bonding requirement to ensure that debt collectors engage in ethical business practices.

Although the unpaid debt will go on your credit report and cause a negative impact to your score, the good news is that it won't last forever. Debt after 7 years, unpaid credit card debt falls off of credit reports. The debt doesn't vanish completely, but it'll no longer impact your credit score.

If you're dealing with a third-party debt collector, there are five things you can do to handle the situation. Be smart about how you communicate. Debt collectors will continue to contact you until a debt is paid.Get information on the debt.Get it in writing.Try settling or negotiating.

(a) A creditor may contract for, charge, and receive from an obligor interest or time price differential. (b) The maximum rate or amount of interest is 10 percent a year except as otherwise provided by law. A greater rate of interest than 10 percent a year is usurious unless otherwise provided by law.

Texas does not license collection agencies, but third-party debt collectors must file a $10,000 surety bond with the Texas secretary of state in order to operate legally within the state.