Texas Dependent Administrator General Information Form

Description

How to fill out Texas Dependent Administrator General Information Form?

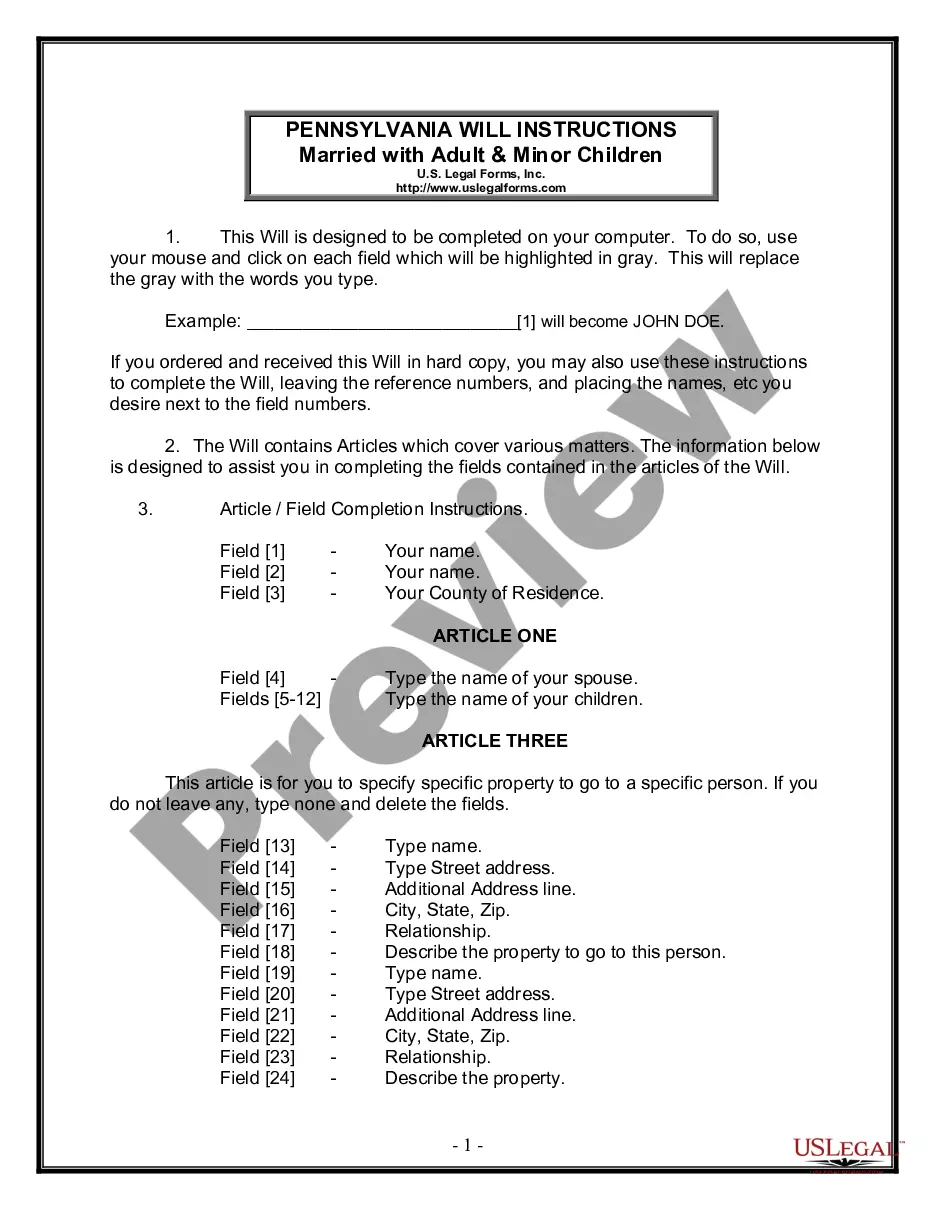

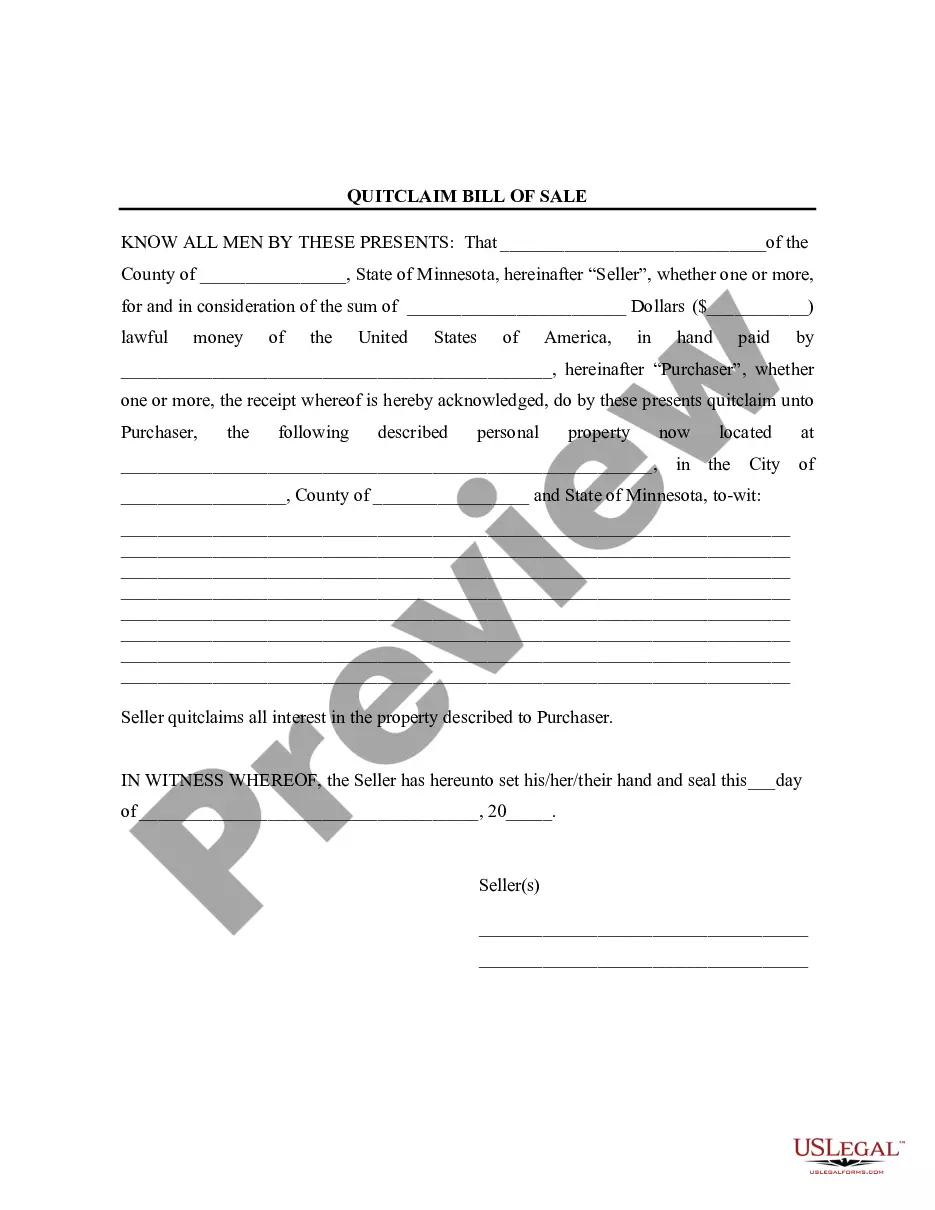

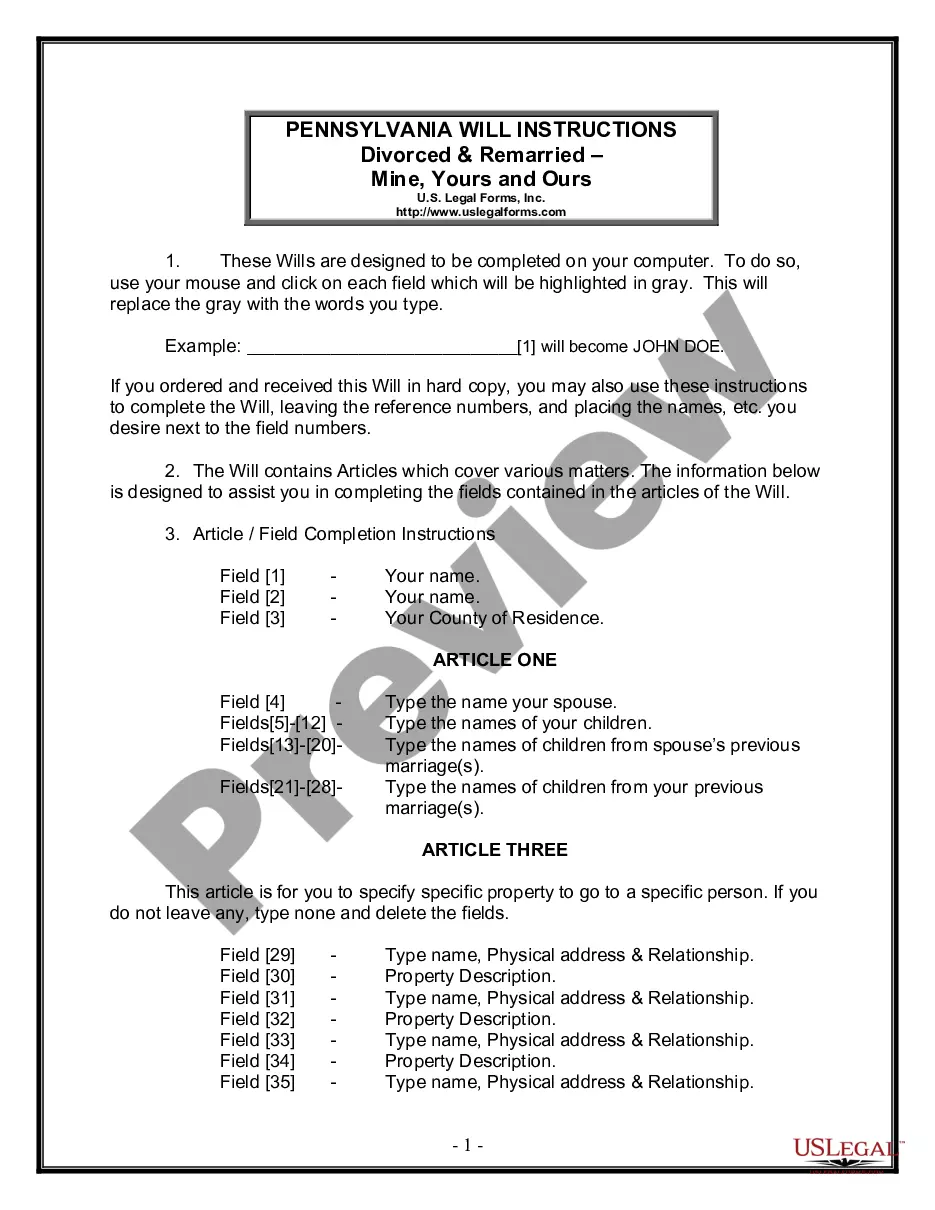

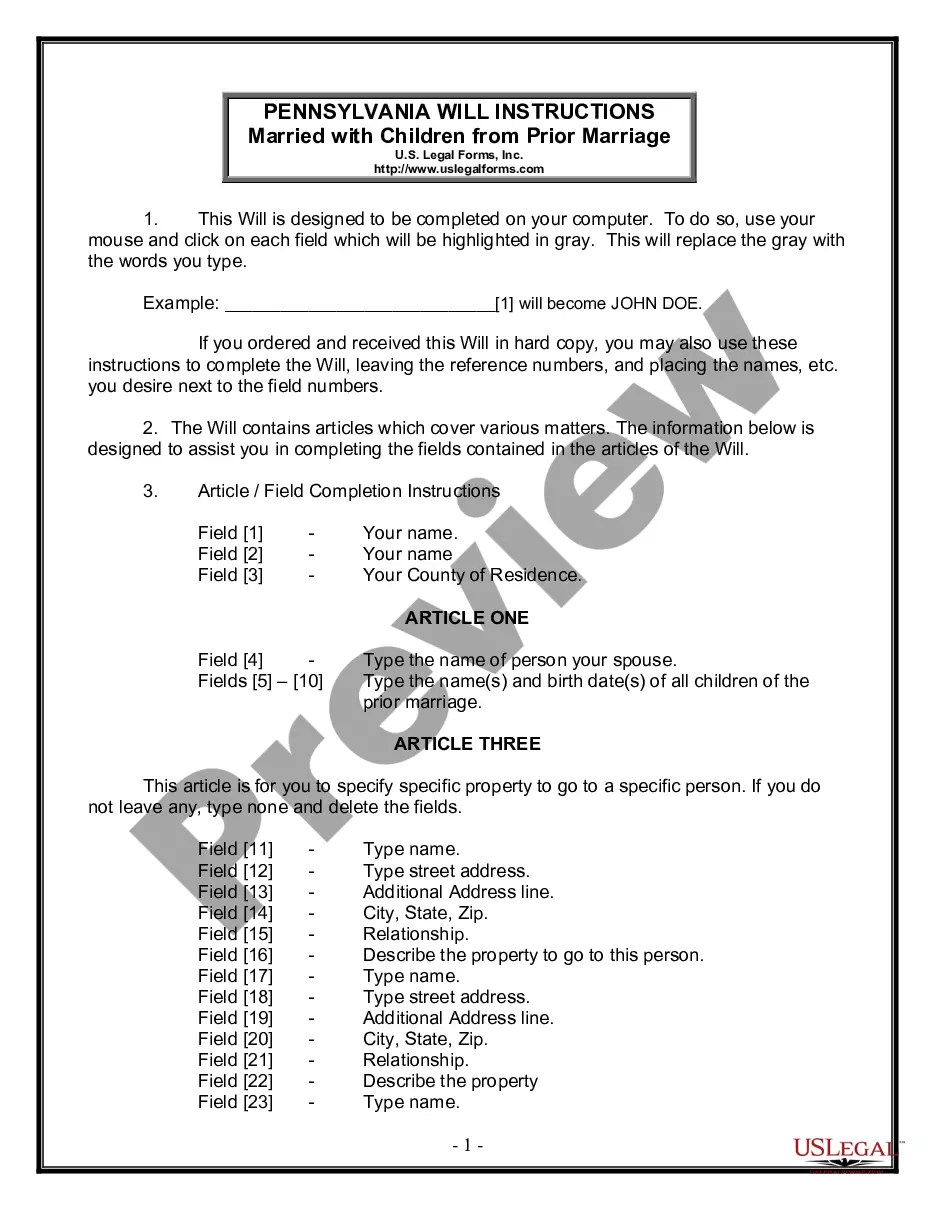

How much time and resources do you often spend on composing official documentation? There’s a better way to get such forms than hiring legal specialists or wasting hours searching the web for an appropriate blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Texas Dependent Administrator General Information Form(updated for 1/1/2014).

To get and prepare an appropriate Texas Dependent Administrator General Information Form(updated for 1/1/2014) blank, follow these simple instructions:

- Look through the form content to ensure it meets your state regulations. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t meet your requirements, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Texas Dependent Administrator General Information Form(updated for 1/1/2014). Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Texas Dependent Administrator General Information Form(updated for 1/1/2014) on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most reliable web solutions. Sign up for us now!

Form popularity

FAQ

Do Letters of Testamentary expire in Texas? Letters Testamentary do not come with an official expiration date. However, institutions and officials may require that the document be dated within the last 60 days before transferring any assets.

When someone dies without a Will in Texas, the default provision in the law requires that the estate be subject to a ?Dependent Probate Administration.? In this type of administration, the court-appointed administrator needs the court's supervision and authority to conduct any action in the probate process.

Can an administrator of an estate be a beneficiary? Yes. In fact, it's common for an administrator to be the beneficiary of an estate. For example, the administrator is often the deceased's next of kin, like a spouse or an adult child, who is also often a beneficiary.

Texas law provides that, when this happens, the Will is treated as if it did not exist, and the estate passes by intestate (without a Will) succession. This means that children by a prior marriage take the deceased spouse's one-half of any community property.

When someone dies without a Will in Texas, the default provision in the law requires that the estate be subject to a ?Dependent Probate Administration.? In this type of administration, the court-appointed administrator needs the court's supervision and authority to conduct any action in the probate process.

The difference is the way in which they have been appointed. An Executor is nominated within the Will of a deceased person. If there is no Will, an Administrator is appointed by a Court to manage or administer a decedent's estate.

What is a dependent administration? A dependent administrator means that the administrator of the estate is dependent upon the Court's supervision and authority to conduct any action in the probate process. This is ultimately a more costly and timely process.

Texas estates are settled in two ways. In a dependent administration, the executor or representative must get court approval for most actions and report regularly to the probate judge. In an independent administration, the executor/representative is given more authority and autonomy to carry out his or her duties.