New!A Guide for the Texas Independent Administrator with Will Annexed(updated 9/5/2017)

Description

How to fill out New!A Guide For The Texas Independent Administrator With Will Annexed(updated 9/5/2017)?

If you’re looking for a way to appropriately prepare the New!A Guide for the Texas Independent Administrator with Will Annexed(updated 9/5/2017) without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of paperwork you find on our online service is created in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use New!A Guide for the Texas Independent Administrator with Will Annexed(updated 9/5/2017):

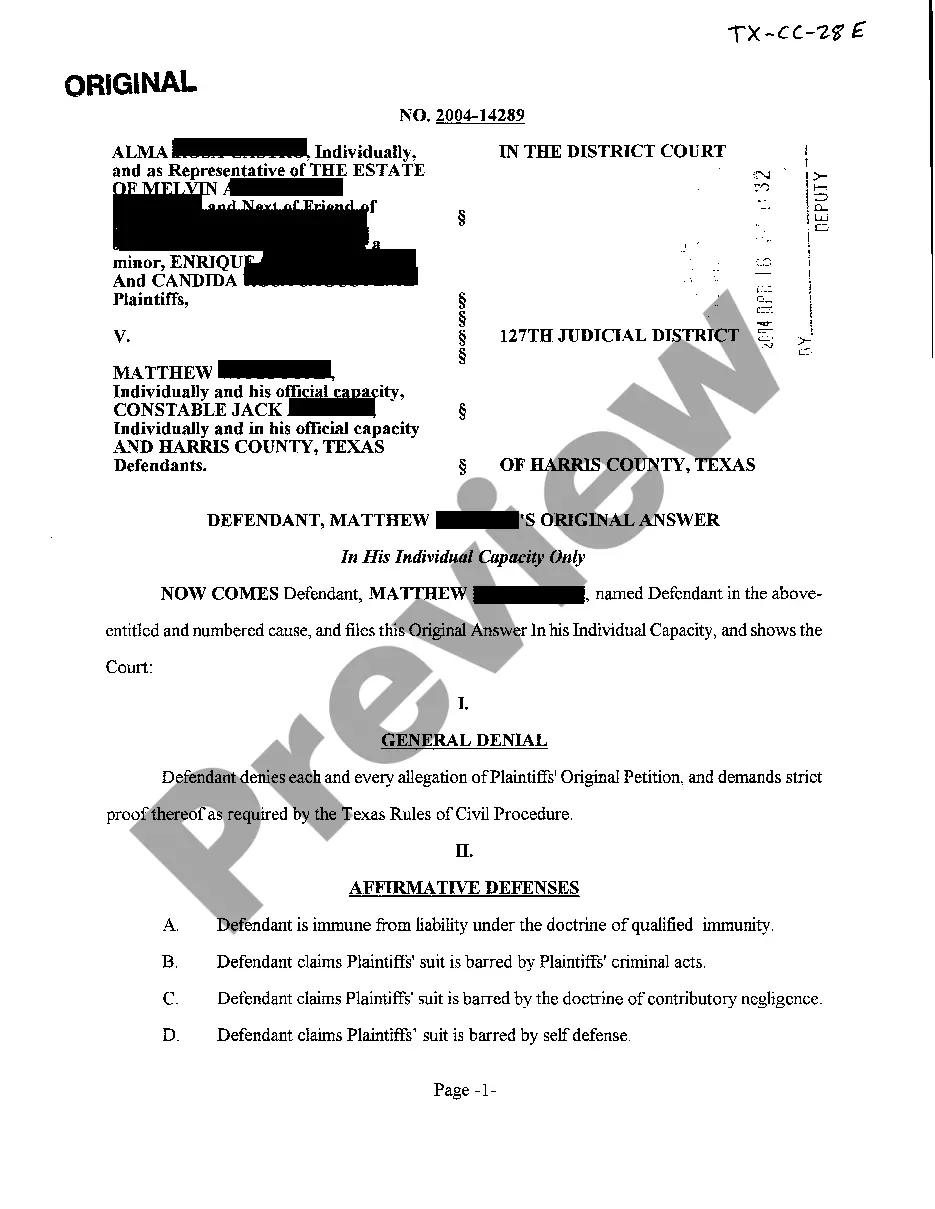

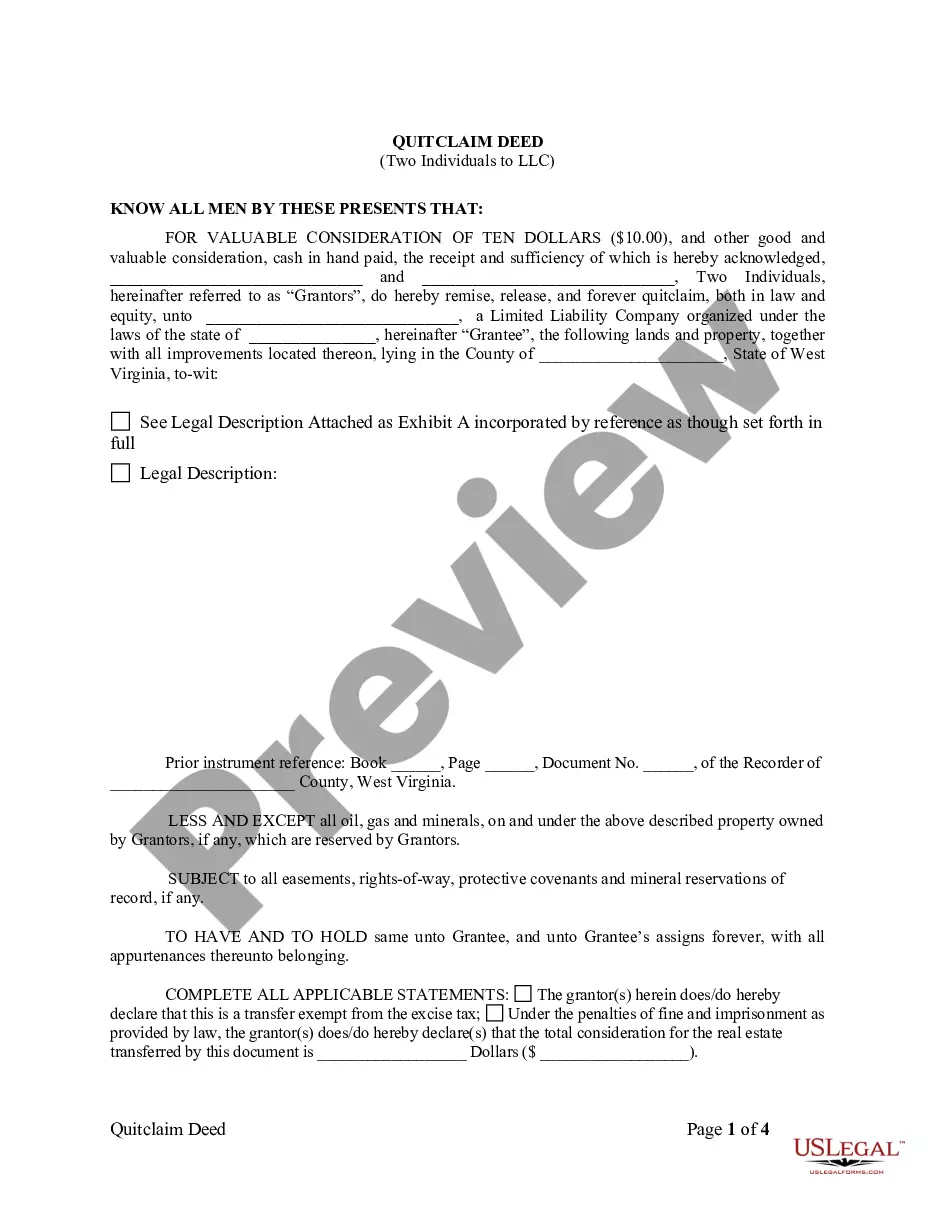

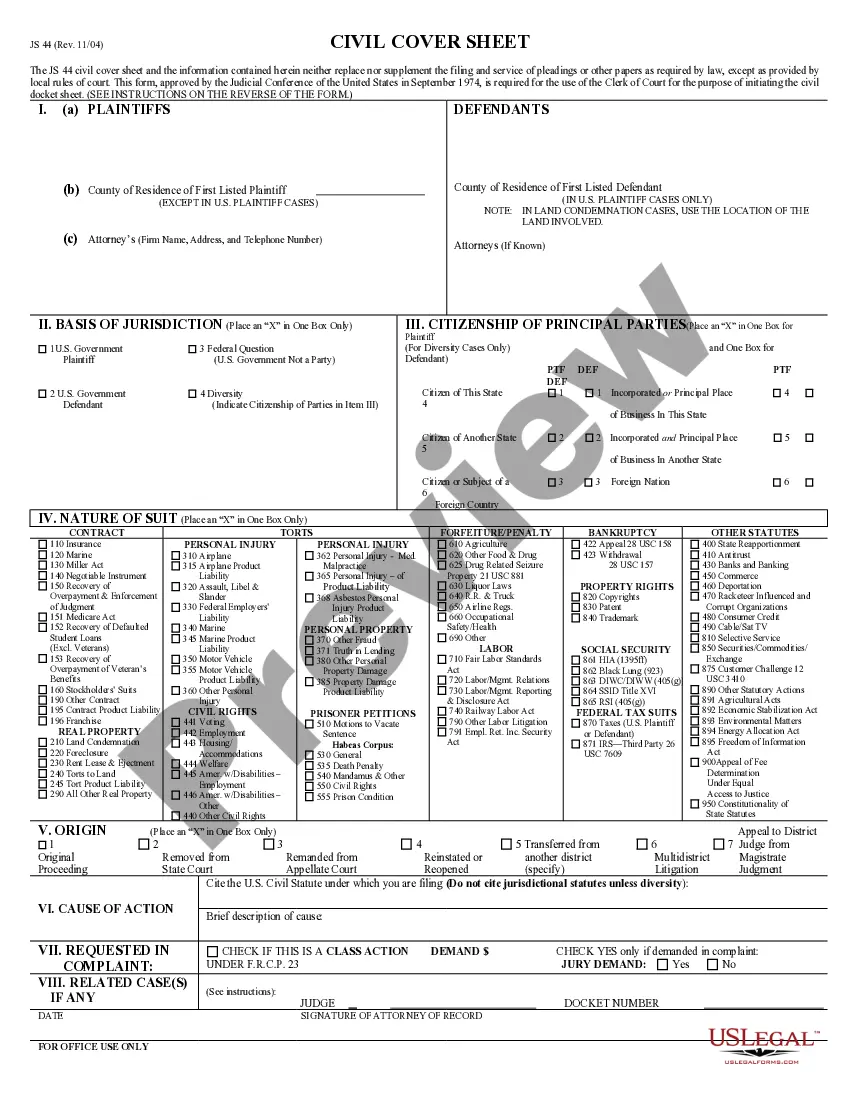

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the dropdown to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your New!A Guide for the Texas Independent Administrator with Will Annexed(updated 9/5/2017) and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Most estates in Texas must undergo probate administration proceedings. However, some estates may be exempt from probate procedures, depending on how the assets in question are owned. In some cases, estates may also qualify for simplified probate proceedings.

An estate may be exempt from the probate process in certain circumstances. Under Texas Estates Code, Title 2, Chapter 205, an estate need not pass through the probate process if there is no will and the total value of the estate (not counting any homestead real estate owned by the Decedent) is $75,000 or less.

Primary tabs. Administrator with will annexed refers to a person appointed by a court to fill the role of an executor of a will when an executor is unspecified or unavailable. The administrator takes on all the legal responsibilities and powers of an executor in administering the will.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

Formal Probate in Texas Formal probate proceedings are likely required if the estate (the amount of property the deceased person left behind) is less than $75,000, not counting certain types of exempt property.

It is necessary to probate a Will when the estate includes assets titled in the decedent's name. The Texas Estates Code specifically says that Will is not effective to prove title to or the right to possession of any property disposed of by the Will until the Will is admitted to probate.

The Non-Probate Asset Bank Accounts. Investment Accounts. Retirement Accounts (IRAs & Pension Plans) Life Insurance Policies. Annuity Contracts. Real Estate. Vehicles.

Texas law provides that, when this happens, the Will is treated as if it did not exist, and the estate passes by intestate (without a Will) succession. This means that children by a prior marriage take the deceased spouse's one-half of any community property.