Texas Administrative Order Regarding Applications to Probate a Will More Than Four Years after the Testator's Death(updated 1/1/2014)

Description

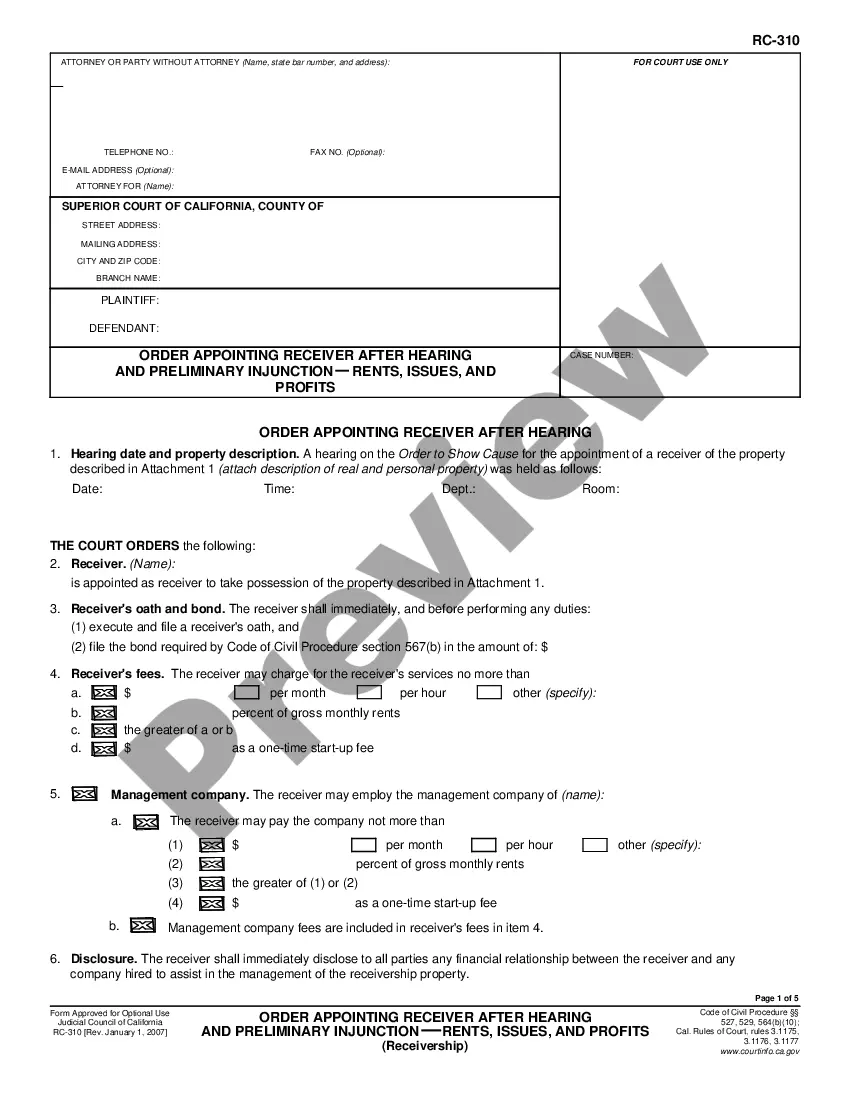

How to fill out Texas Administrative Order Regarding Applications To Probate A Will More Than Four Years After The Testator's Death(updated 1/1/2014)?

How much time and resources do you often spend on composing official paperwork? There’s a greater opportunity to get such forms than hiring legal experts or spending hours browsing the web for an appropriate blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Texas Administrative Order Regarding Applications to Probate a Will More Than Four Years after the Testator's Death(updated 1/1/2014).

To get and complete a suitable Texas Administrative Order Regarding Applications to Probate a Will More Than Four Years after the Testator's Death(updated 1/1/2014) blank, adhere to these simple steps:

- Examine the form content to make sure it meets your state laws. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t satisfy your needs, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Texas Administrative Order Regarding Applications to Probate a Will More Than Four Years after the Testator's Death(updated 1/1/2014). Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally secure for that.

- Download your Texas Administrative Order Regarding Applications to Probate a Will More Than Four Years after the Testator's Death(updated 1/1/2014) on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

Ing to Texas Probate Code Section 93, an interested party can legally dispute a will's validity by filing a formal lawsuit. Under the code, an individual only has 2 years to contest a will.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

In Texas, the executor of the estate must file for probate within four years from the testator's death. Texas probate law is very strict about this statute of limitations. In certain circumstances, there may be alternatives for wills that have expired.

Texas law provides that, when this happens, the Will is treated as if it did not exist, and the estate passes by intestate (without a Will) succession. This means that children by a prior marriage take the deceased spouse's one-half of any community property.

There is no general requirement that all wills go through probate in Texas. However, if the decedent dies and leaves a will, you can only implement its provisions through probate.

This can pose a special problem because Texas law generally requires a Will to be probated within 4 years of the date of the decedent's death. If more than 4 years have passed, the applicant for probate must convince the court he or she had good cause for not presenting the Will within that time.

After the 4-year anniversary of a person's death, if another person pays value, in good faith, without knowledge of the existence of a will, for a property from the decedent's heirs, then they will hold superior title against any devisee under any will that is subsequently offered for probate.? (Texas Estates Code: Sec